How Feasible Is Sugar Reduction In Beverages?

Less or no sugar is still an enigma that the beverage industry has partially solved. Despite the increasing use of artificial or natural sugar alternatives, there remains a wide gap in achieving the WHO mandate of less than 5% sugar in energy intake per person. In the US, the sugar intake from soft drinks dropped by 7.7% per person from 2014-22, while in Europe, UNESDA’s members reported a 28.6% added sugar reduction since 2000 in soft drinks.

Four classes of sugar alternatives are currently being used for this purpose: sweet fibers, bulk sweeteners, natural non-nutritive sweeteners, and artificial non-nutritive sweeteners. Of these, bulk sweeteners already hold supremacy in both confectionary and beverage categories. Along with maltitol and sorbitol, erythritol also shares the stage, especially in indulgent drinks. Its specialties include keto-friendliness, lower calories, and sugar-mimicking taste.

Conversely, artificial and natural non-nutritive sweeteners have been the key to reducing sugar and calorie content in beverages requiring intense sweetness. However, these features have proved insufficient in replacing sugars completely or reducing the added sugar content in beverages to the required level. Sugar isn’t just a sweetener but also plays a key role in the mouth’s feeling and the pleasant aftertaste associated with sweet beverages. The substitutes may reiterate the sweetness of sugar, but the astringent aftertaste and changed mouthfeel are a challenge that reduces the appeal of the drinks in question.

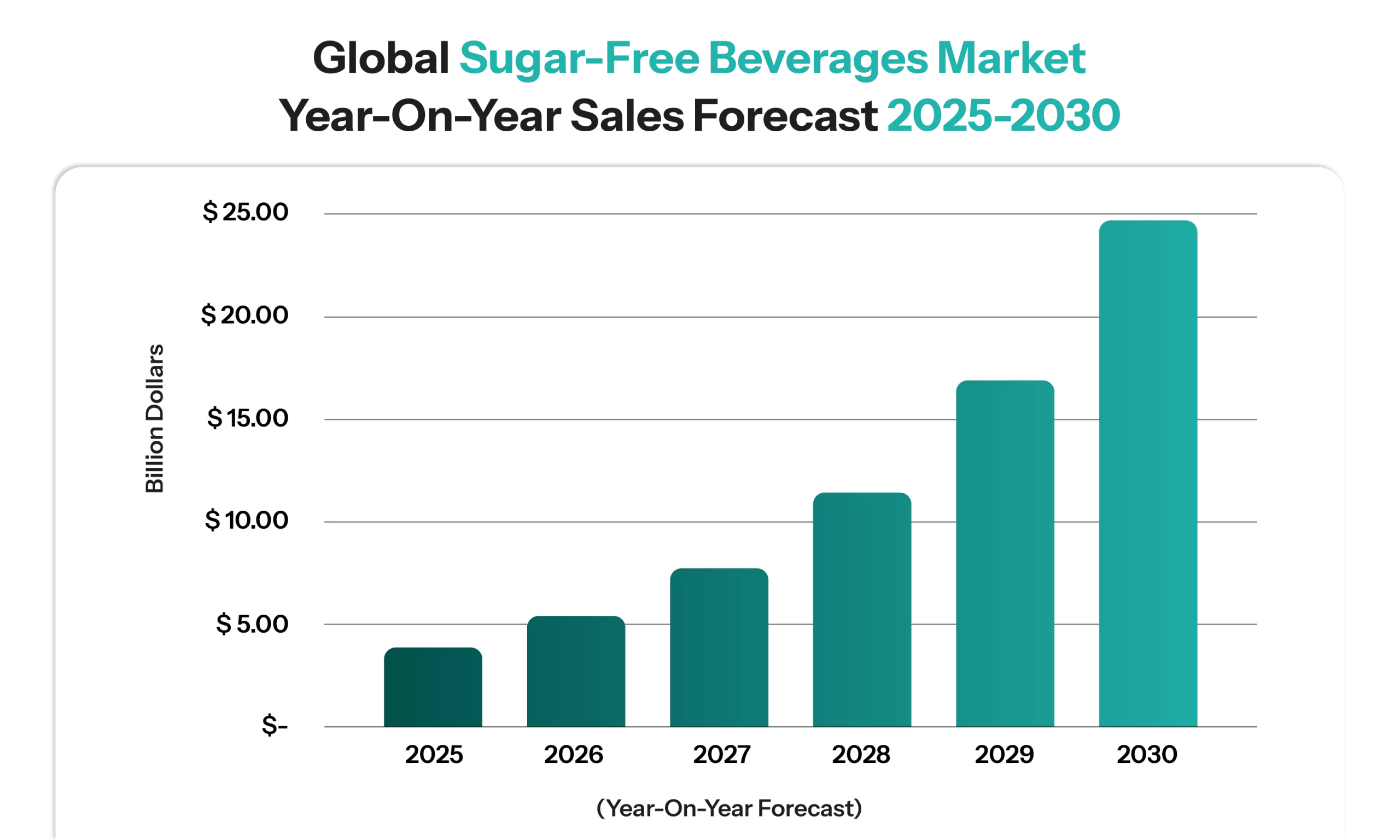

Adopting a less sweet profile is a complication that needs to be balanced with taste and mouthfeel. Even if consumers are willing to purchase low—or zero-sugar drinks, their taste profile remains conditioned to the oversweetness they have been used to. Therefore, there is a substantial chance of sales reduction, stagnation, or loss of a competitive edge. Globally, the sugar-free beverages market is estimated to swell to $24.46 Billion by the end of this decade at an implied CAGR of 46.94%.

Is There a Solution?

A plausible solution is to work on the flavor and customize it to changing consumer expectations worldwide. Moving away from sweetness opens up a window for introducing complex flavor profiles that could be sour and sweet or savory and sweet at the same time. The rising acceptance of innovative drinks like kombucha, kvass, tepache, and kefir in the U.S. and Europe affirms this change in consumers’ perception. It also opens up the opportunity to improve the nutritional profile of these drinks through the introduction of functional ingredients in related beverage categories. Ginger is already leading the tide in this context in Latin America and the U.S.

Novel technologies and sweetening systems are also being employed for this purpose. For instance, Nestle developed an intrinsic technology to convert intrinsic sugar into prebiotic fibers reducing sugar content by 50% without compromising taste. Similarly, Givaudan developed sweetness-enhancing ingredients that impart perceptive sweetness without eliminating the need for added or artificial sweeteners in food products and beverages. The firm was able to reduce sugar content by 50% across its beverage categories.

Final Word

Our analysis estimates that sugar reduction in beverages will be a gradual process aided by further research and innovation. More research is needed to understand the relationship between the new class of alternative sweeteners and their long-term effects on health. As the effects of these new sweeteners on gut and heart health become clearer, their categorization will be more organized along the scales of benefits and effectiveness. Sugar reduction is one of the key beverage industry trends that will keep shaping ingredient technologies, customization, and marketing strategies in the coming years. The market lead will come to those who embrace these changes while aligning sugar reduction to particular geographies, product categories, and consumer expectations.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.