Toyota’s recent unveiling of hydrogen combustion engine vehicles stirred several debates regarding the future of EVs and whether hydrogen vehicles can be considered a viable successor to Fuel Cell Vehicles (FCEVs) and Battery Electric Vehicles (BEVs). As EVs are rapidly replacing traditional ICE-based vehicles, the queries on its further expansion and advanced alternatives are knocking on the doors of automakers and research facilities.

The technological advancements in using hydrogen vehicles answer several bottlenecks impeding the growth of the EV market, further pushing the viability of hydrogen as future fuel. Nevertheless, in the present scenario, sustainable vehicles seem divided into two zones with hydrogen combustion engines in one corner. At the same time, FCEVs and BEVs occupy each other. This close rivalry calls for critical scrutiny to assess how deep the waters around each are and if hydrogen will replace the EV battery sector for good. Let’s dive in to get a better idea.

- Energy Density: Energy density carries enormous weight in deciding the future appeal and application of the contenders mentioned above in the race for sustainable transport options. Figuratively, lithium-ion batteries still take the lead over the other two for yielding 100-300 Wh/kg on a gravimetric and volumetric basis. Hydrogen combustion engines stand lowest with 120-142 MJ/kg and 8-10 MJ/L for compressed and liquid hydrogen, respectively. A hydrogen fuel cell stands somewhere in between the two. The energy density of lithium-ion batteries is proving to be an obstacle in their application in the aviation industry. Hydrogen vehicles, on the other hand, offer an extended range with much less weight and eliminate the need for heavier brakes, higher torque, and more structural weight. Therefore, it is inevitable that green hydrogen will have a place in the application where lithium batteries don’t: trains, marine, heavy long-haul vehicles, and trucks are a few notable names from that list.

- Efficiency: Despite technological advancements, hydrogen fuel cells and combustion engines still stand far below their EV counterparts in terms of efficiency. Figuratively, the tank-to-wheel efficiency of BEVs stands between 75-85 percent and at 50 percent for FCEVs. H2-ICEs stand at the back of the line with 40-45 percent efficiency. The gap becomes wider for well-to-wheel efficacy, where FCEVs come down to 35 percent while H2-ICE stands at a mere 30 percent. It is to be noted that these are approximate figures that may move up and down based on driving patterns, sources of renewable energy, and loads.

- Safety in Hydrogen Vehicles: There is wide skepticism about the safety of hydrogen ICEs and FCEVs due to a lack of knowledge and awareness. While significant concerns revolve around the highly flammable nature of hydrogen, some points have also been raised about the explosive nature of this gas. It must be understood that NASA has long used hydrogen combustion to launch rockets and astronauts in space, which implies that considerable success has been achieved in safely handling hydrogen. More importantly, if there is a leakage or fault with the fuel cell, quick dissipation in the air is more likely owing to a superlight attribute of hydrogen. The customary ignition engines catch fire due to slower leakage and heavier gasoline and diesel molecular weight. Thus, the chances of accidents and fire are as low as that of traditional BEVs and ICEs.

- Cost Of Ownership: Several factors contribute to this aspect of clean technologies, but upfront capital costs and fuel consumption play a decisive role for end-users and vehicle makers. In this respect, H2-ICEs can stand taller than others due to simple combustion and lesser exhaust treatment requirements than traditional ICEs. The BEVs take a backseat here owing to the expensive rare earth metal inclusion that drives the cost globally. However, further R&D is required in this direction as the total numbers change with driving routes, vehicle dimensions, total weight, powertrain efficiency, and how different nationalities will regulate the ownership costs for these vehicles.

- Range and Refueling Requirements for Hydrogen Vehicles: Hydrogen vehicles stand shoulder-to-shoulder with typical gasoline-powered engines, which means one can expect a 300-400 miles range from a single hydrogen tank. On the other hand, FCEVs carry an edge on this front as they can easily stretch this range up to 500 miles under specific configurations. BEVs come last in this context, with 100-300 miles at a full charge. As for refueling, hydrogen vehicles carry an edge over battery vehicles as the latter needs more time to recharge while the former can be refueled with fresh hydrogen within a few minutes.

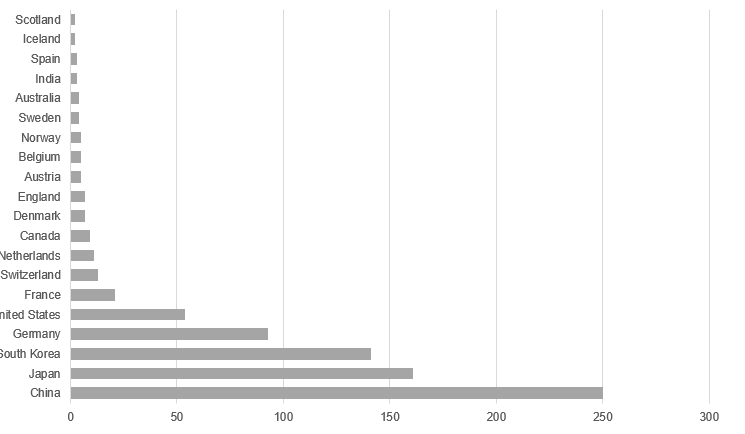

- Infrastructure availability: Concerning infrastructure, BEVs have the top slot as maximum investments and progress have come their way in the last few decades. Currently, California, Texas, and Florida in the USA have the most extensive network of BEV charging stations, closely followed by Europe and China. For FCEVs and HICE, the infrastructure development has been somewhat limited. The highest expansion has been witnessed in California and Japan. Statistically, hydrogen refueling stations are available in 37 nations around the world, among which Columbia, Israel, and Cyprus are the latest additions. Europe has 254 hydrogen stations, of which 105 are in Germany, 44 in France, and the rest in the UK and Netherlands. In Asia, the stations are limited to China, South Korea, and Japan, with a staggering 455 stations. 814 hydrogen stations were registered globally at the end of 2022; the number is expected to exceed 1000 by the end of 2023.

- Investments: The much-pronounced difference in global investment in hydrogen and battery vehicles can be accredited to these two concepts’ familiarity and technological evolution. The IEA estimates the global investments for BEVs to cross $300 billion by 2025. For FCEVs, global investments are estimated to touch $13.6 billion by 2032. HICE stands at the end, but it is rapidly picking up the trends as auto giants like Tesla, Toyota, and others are taking the reins in their hands. In 2021, Cummins received a hefty grant of $4.5 million from the U.S. government for developing hydrogen fuel cell powertrains for heavy-duty trucks. The efforts in this project will potentially be used to further research in HICE for the same purpose.

- Technological Forecast: The evolution of HICE, BEVs, and FCEVs largely depends on present R&D capabilities to overcome the technological barriers associated with each. Concerning BEVs, there is an imminent need to find alternatives to lithium, for its high cost and limited availability can easily bring the BEVs to a dead end in the near future. Then there is the question of increasing battery life, vehicle autonomy, and range and reducing charging time, depreciation costs, and vehicle costs. FCEVs and HICE, on the other hand, researchers need to dwell deeper to find platinum replacements and improve operating temperatures, energy density, and hydrogen tanks’ weight. The same applies to HICE and the urgency to deal with nitrogen oxide emissions to meet sustainability goals aptly. Several automotive giants and research facilities like Tesla, Toyota, BMW, Argonne National Laboratory in the USA, National Renewable Energy Laboratory, and Hydrogen Technology & Energy Corporation (HTEC) Canada are working towards these goals.

- Major Upcoming Launches (in each category): An exhaustive list of launches is slated in each category in the coming years. With respect to BEVs, many top-end and new makers are in line, including Bentley, Audi, Alfa Romeo, Acura, Honda, and several others. Bentley plans to replace five of its top models with fully electric powertrains by 2025. Even the FCEV segment is buzzing with announcements of new launches from several global leaders like BMW, Honda, Hyundai, Kia, Toyota, Range Rover, and Ineos. With respect to HICEs, MAN Truck & Bus plans to bring forth a hydrogen-powered demo fleet in 2024 along with Kenworth, which also plans to launch a hydrogen-powered heavy-duty truck by the end of this year.

Conclusion

Both electric and hydrogen vehicle technologies have pros and cons, and it will be too soon to judge the success and failure of any as much depends on R&D efforts, success, market dynamics, usage patterns, vehicle types, and regulatory support from governments across the globe. Much will also depend on intended use, driving range requirements, and cost of ownership. However, both hydrogen and electric vehicles will play a key role in transitioning to sustainable, clean transportation in the future.

How Can We Help? (Our Services)

To stay afloat amid major paradigm shifts, every business needs to identify scalable opportunities through innovation, value creation, and a strategic road map to these goals. With over a decade of experience, Stellarix has supported hundreds of clients in achieving these goals with a comprehensive 360-degree horizon scan, current and future landscape visualization, and extensive market research.