According to a recent Neilsen survey, approx. 73% of global consumers are ready to play their part and modify their consumption behavior and pattern to restore the lost balance of the environment. It stands true for every market, including the beverage industry. However, a tightrope constantly twisting in pressures of tough competition and low margins leaves little to no room for compromising on the prevalent resource and carbon-intensive manufacturing practices.

The beverage industry is a significant consumer of natural resources; e.g., the water footprint for a one-liter soda can ranges between 170-310 liters, while the alcoholic beverage industry scored 4.8 out of 10 on the drinks industry sustainability Index 2020. However, these are just a few small segments of this multi-layered intricate problem. Several other challenges require more profound research, development, and technical solutions. This blog is an effort to shed light on some of the most specific challenges impeding the path to greener beverage processing operations and some plausible solutions.

Challenge 1: Ingredients Sustainability

A significant part of the beverage industry relies on fruits and plant derivatives, most of which are sourced from distant places. This creates gaps on several fronts, including nutritional profile, shelf-life, transportation emissions, and the overall carbon footprint of manufacturing operations. Every step between farms to bottle adds to the producers’ and consumers’ carbon footprint while putting a huge question mark on the overall value delivered by the final product. Also, the hazardous impact of preservatives, emulsifiers, acidity regulators, and water used in the process further puts a question mark on the quality and valuation of these drinks.

A simple solution to this challenge is to focus on local procurement of ingredients. Preferably, these ingredients should be produced from organic farming practices. Also, there is an imminent need to narrow down the water footprint of the manufacturing operations, which includes better wastewater treatment and recycling methodologies.

Challenge 2: Low Carbonation Efficiency

The carbonation process is responsible for the fizz in soft drinks, sparkling wine, and beers. The rising energy costs are forcing manufacturers to either reduce or cease production of CO2. Earlier, CO2 was obtained as a by-product from fertilizer production, but as the process becomes more and more scarce, the amounts of CO2 also run low. Its scarcity is a serious factor because CO2 is also a barrier between beverages and oxygen, thus keeping microbial infections and oxidative enzymatic reactions at bay. Lack of CO2 can easily result in premature spoilage, discoloration, and stale taste of drinks.

Several sustainable alternatives can be implemented to counter this scarcity. For example, carbonation sensation enhancers like porphyran, sitosterol, menthyl acetate, etc., can give users a carbonation sensation without including CO2 in the drinks. Similarly, agents like glycerol citrate, fatty acid ester, and propylene glycol alginate can improve beverages’ carbonation retention efficiency. This can reduce carbonation loss to a considerable extent.

It is also high time to begin the implementation of foam retention and better solubilization apparatus in the beverage industries. Lastly, as a natural air constituent, nitrogen generators can easily generate it. Beverage manufacturers could also expand CO2 production from anaerobic digestion. The anaerobic digestion industry annually provides 90,000 tonnes of bio-CO2 in Europe and the UK. The industry specialists are optimistic. They believe this capacity can be increased to meet the current CO2 demand in the food and beverage industry. There is also much scope in carbon capture technologies that can be used dually as a source of CO2 for the F&B industry and reduce the carbon footprint of industries.

Challenge 3: Energy Intensive Refrigeration Processes

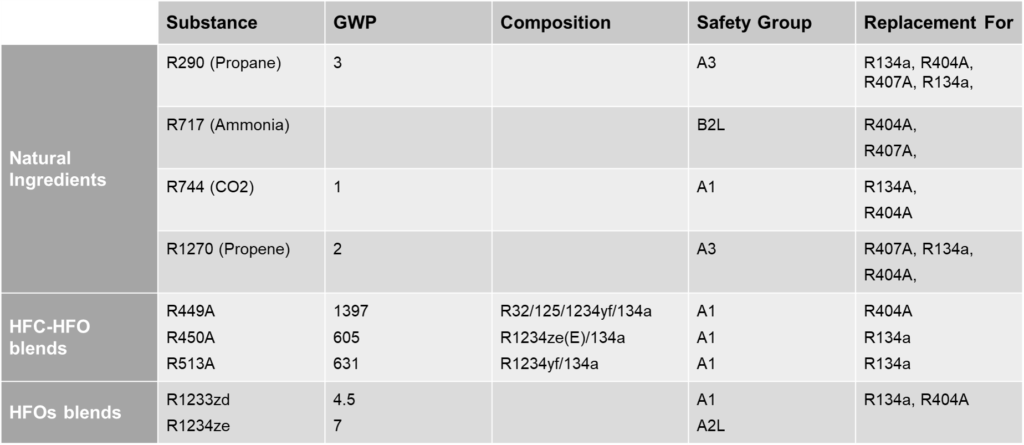

Cooling or refrigeration processes account for 20% of GHG emissions from the global beverage industry. As more and more companies commit to Net Zero emissions, the rate of exploration of sustainable cooling alternatives grows exponentially. There’s much buzz about natural refrigerants, HFCs with lower GWP, hydrofluroolefins (HFOs), and some HFC-HFO blends. CO2 cascade systems score high as an HFC substitute for large refrigeration systems like those used in supermarkets or factor flows. Additionally, process synchronized cooling has brought a paradigm shift in the beverage industry, making it way more efficient, eco-friendly, and economical for manufacturers at all levels. Innovations like magnetocaloric refrigerators, solid-state refrigerants, Enviro-cool multi refrigerators, sound-assisted, and bio-robot refrigerators will also play a key role in defining the future of the sustainable refrigeration market.

Table Summarizing Natural Alternatives To Industrial Refrigerants

Challenge 4: High Risk Of Non-Acidic Beverage Contamination

Yeast is one of the dominant microbes in fruit-based and non-alcoholic beverages. The microbial development can easily produce secondary metabolites, including carbon dioxide, polluting substances, and spoilage. Other than yeast, viruses, bacteria, protozoa, and molds act as partners in crime. Several solutions have emerged as sustainable solutions for this problem. These include hot water immersion, surface waxes, irradiation through UV, and a specific focus on equipment cleanliness. On the innovation front, completely automatic systems with aseptic process systems will offer continuous sterility analysis. It will play a key role in reducing Scope 2 emissions, food wastage, and the environmental impact of beverage processing units.

Challenge 5: Supply Chain Loopholes

Several predictable and non-predictable factors expose the beverage industry’s supply chain. These factors include clogged ports, lack of CO2, resin shortage for plastic bottles, shipping delays, war, etc. The global beverage industry faces the consequences as China slowly reduces its aluminum production. Also, the trucking and shipping issues have disturbed the frequency, quantity, and quality of drinks delivered to end users. Overall, it widens the environmental footprint of the beverage industry as spoilage, delay in delivery, and demand-supply imbalance mean higher emissions of GHGs in the environment. It indicates the need for better investment and installation of digital solutions. These solutions bring the required agility and flexibility to the entire supply chain. Multi-level optimization can help reduce scope three emissions to a great extent. It involves sustainable technology, vehicles, raw material sources, recovery mechanisms, and partners.

Challenge 6: High Use Of Non-biodegradable Packaging

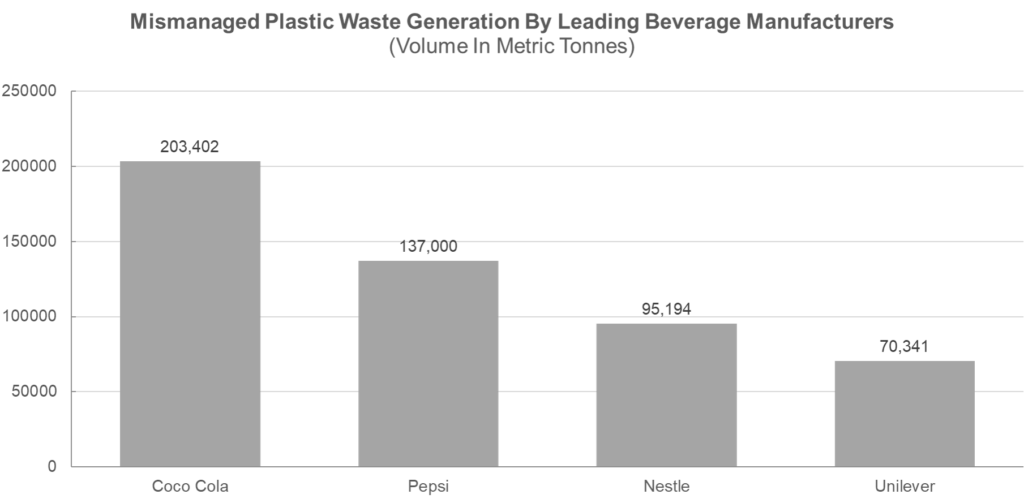

The beverage industry is still striving to ensure a healthy, circular plastic economy. This is one of the major impediments in its path to a greener future. It is one of the biggest consumers of single-use plastic bottles that only add to littering in kerbsides, waterways, landfills, etc. The virgin plastic used in the process is highly porous. This leads to the leakage of CO2 over time and significantly reduces the carbonation shelf life of drinks. Further, recycled plastic exacerbates the rate of carbonation loss due to structural defects expanding the carbon footprint of beverage companies.

Mismanaged Plastic Waste Generation By Leading Beverage Manufacturers

Last Words

The beverage industry came through the pandemic relatively stronger financially than its counterparts. Research shows that the industry stakeholders are willing to move ahead in this direction and want to shift from a begrudging pattern to a result-oriented modus operandi. They seek better strategic, technological, and transformational solutions to help them become sustainability leaders without losing their edge and profit figures in the beverage market.