Aircraft’s engine thrust, wing lift, and horsepower come from jet fuel. Aviation fuel represents about 30% of total flying costs and makes for the #1 cost for airlines. In 2022, total jet fuel (derived from crude oil) consumption amounted to 73 billion gallons. The harmful carbon emissions by the aviation industry were close to 5600 million tons in 2022. The surging cost of jet fuel and calamitous calefaction drive the aviation industry to reconsider its sustainable fuel strategy. Additionally, it is prompting the industry to explore ways to offset CO2 emissions from the global fleet.

Expansive Aviation Industry

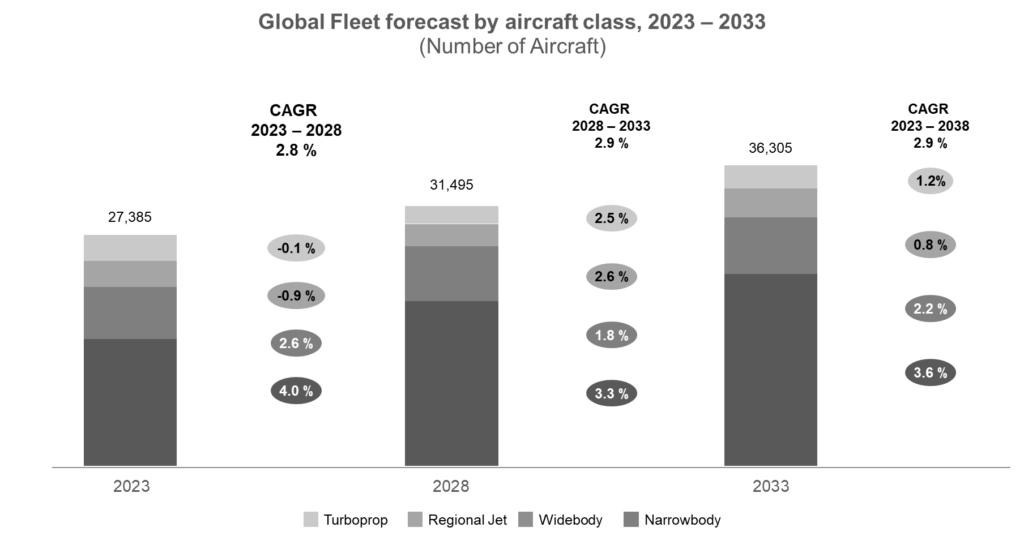

In recent years, the airline industry has grown at a supersonic speed. Air travel has become busier than ever for passenger service, cargo, and the military. Additionally, airfare has become more expensive. The growth projections are robust, with the global fleet reaching 36,000 aircraft by 2033, the air freight market value projected to be USD 175.24 billion by 2028, and the military aviation market to reach USD 74.44 billion by 2028. Over 100,000 flights take off daily (2023), increasing to 200,000 by 2030.

Figure 1: Global fleet forecast by aircraft class, 2023-2033

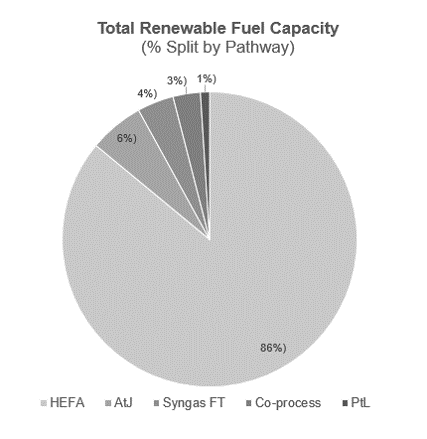

We can only imagine the extent of global dimming and global warming the aviation industry will be landing into without serious pitching of global SAF production. Current SAF production was 300 million liters (2022), at only 0.1-0.2% of the worldwide aviation fuel supply. According to the International Air Transport Association (IATA), 450 billion liters of Sustainable Aviation Fuel will be required annually by 2050 to meet the aviation industry’s net-zero carbon dioxide (CO2) emissions target. Meeting the net-zero target set by ICAO (International Civil Aviation Organization) will require a definitive approach. In the coming years, a manifold build-up of the Sustainable Aviation Fuel (SAF) production pipeline will be necessary.

Understanding Biofuel, Renewable Jet Fuel or SAF

Sustainable Aviation Fuel (SAF), also called renewable jet fuel, is made from non-petroleum feedstock. Biodiesel production involves the production of lipids, cetane, hydrocarbons, biofuel additives, cellulose, camelina, synthesis gas (syngas), and transesterification.

SAF feedstock is classified as 1st generation, 2nd generation, 3rd generation feedstock, and e-fuels. SAF’s 1st generation feedstock comprises food-grade oils and fats like canola, rapeseed oil, palm oil & derivatives, corn, soyabean oil, and sunflower oil. SAF 2nd Generation feedstock includes waste fats, oils, and greases (FOGs) like used cooking oil, inedible animal fat & tallow, trap grease, and fatty acid distillates.

3rd Generation SAF feedstock includes CO-rich industrial waste gases and algae biomass. E-fuels in the aviation industry are feedstock produced by renewable (solar or wind power) sources like e-kerosene.

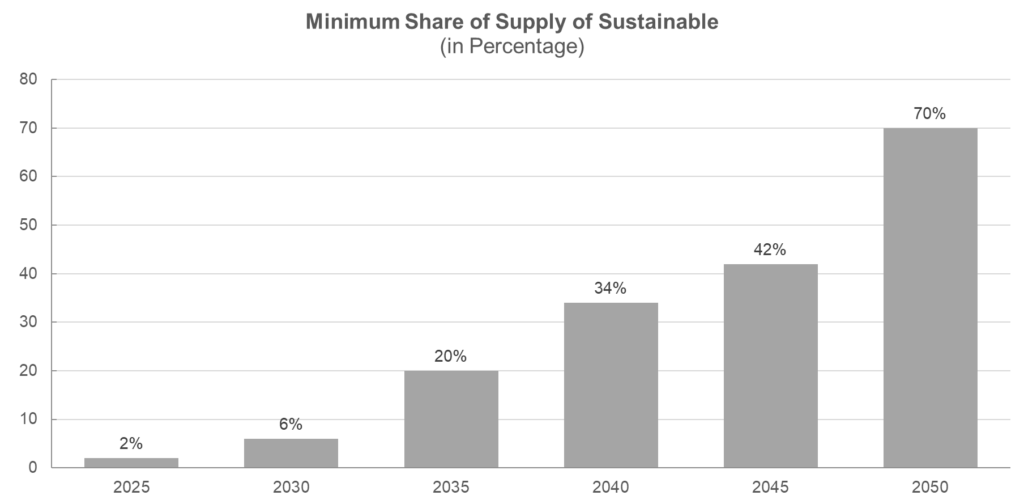

Sustainable Aviation Fuel is produced via various pathways, such as the certified Hydroprocessed Esters and Fatty Acids (HEFA), alcohol-to-jet (AtJ), and Fischer-Tropsch (FT). The HEFA pathway called the HVO (Hydrotreated Vegetable Oil) process, refines waste oils, animal fats, and waste oils into sustainable aviation fuel (SAF) through hydrogenation.

HEFA is currently the most common SAF production method, clocking 86% SAF production, according to IATA data. There is a great need for government incentives, such as tax relief, tax exemptions, and policy support, to develop new SAF production pathways where RD&D is currently being carried out.

One of the biggest challenges in achieving long-term SAF production targets is to find the best possible and continual SAF fuel feedstock sources that give high SAF yields. The current cost of SAF to jet fuel is double and sometimes 4-5 times, making it one surmountable barrier to achieving a carbon-neutral goal (2050) for aviation.

Figure 2: 9 Total Renewable SAF fuel capacity: % Split by Pathway

Key SAF Production Locations & SAF Companies

To reach levels of net-zero carbon emissions by 2050, ICAO estimates a possible $4 Trillion investment needed in renewable aviation fuel. Shell PLC, Neste Oyi, Aematics Inc., SkyNRG, LanzaTech Inc., Gevo Inc., AV Fuel Corporation, Aematics Inc., Fulcrum BioEnergy Inc., Velocys Inc., Red Rock Biofuels and World Energy are carrying out primary SAF production.

BP p.l.c. has created a special SAF division named Air BP to create specialized renewable fuel from its plant in Lingen, Germany. Honeywell UOP and Oriental Energy have jointly established another SAF plant in Maoming, China.

Another British Petroleum SAF operation is coming at Kwinana, Western Australia. JGC Group, in partnership with REVO International Inc. and Cosmo Oil Co, Ltd, has announced that it is building its supply chain and SAF production domestically.

Indaba Renewables Fuels is developing a new refinery to produce SAF fuel from 100% waste oil products in alliance with Haldor Topsoe. Moreover, Suria Capital Holdings Berhad and Vandelay Ventures Sdn Bhd will develop the Sabah Maju Jaya Renewable Energy Industrial Complex (SAF diesel) at Sapangar Bay, Malaysia. TotalEnergies has started SAF production in France at their refinery in Grandpuits, which will be their essential zero-crude manufacturing site.

According to IATA findings, over 85 clean aviation fuel producers have announced this. They have revealed over 130 scalable renewable fuel projects across 30 countries. Stainable Aviation Fuel (SAF) is championing the aviation sector toward becoming more sustainable and environmentally responsible by 2030 and beyond.

Government Acts and Legislations for SAF

The International Civil Aviation Organization (ICAO) aims to provide critical SAF estimates and solid SAF projections. These include factors such as feedstock cost, fuel yield, total capital investment (TCI), facility scale, and Minimum Selling Price (MSP). ICAO also aims to disseminate significant trends for SAF production cost and processing technologies/feedstock comparisons.

The United States has issued SAF blenders tax credit legislation. The bill provides a $1.25 credit per gallon of SAF sold (qualified fuel mixture). This credit is applicable if the SAF demonstrates a 50% reduction in lifecycle greenhouse gases (GHG) compared to conventional jet fuel. In addition, at the beginning of 2025, SAF will be raised to $1.75 per gallon under the new Clean Fuel Production Credit (CFPC) Act. Illinois approves the SAF tax credit of $1.50 per gallon of SAF used by aircraft in the state.

Japan has enacted the aim for the Act for Sky and will achieve aviation carbon neutrality by 2050. The country is establishing a complete supply chain for domestic SAF production. Also, India plans to use 1% sustainable aviation fuel by 2025 and increase it to 4-5% as more biofuels become available. The United Kingdom has also implemented the Jet Zero strategy and a 10% SAF fuel mandate of total crude jet fuel consumption by 2030.

Other Important Endeavors

France’s endeavor for SAF has led to rolling out €300 million for pilot/demonstrator construction or engineering studies. The EU regulations announcement of “Fit-for-55” is a significant step. It aims to reduce the EU’s greenhouse gas emissions by at least 55% by 2030. Also, countries like Singapore, Brazil, UAE, and China are making other critical progress toward targeting a more sustainable aviation future.

Sustainability in aviation is undoubtedly far-reaching. However, it heavily relies on strong incentives from states/governments to establish pioneer plants and refineries for Sustainable Aviation Fuel (SAF). Incentivizing and investing are necessary for various institutes and organizations to continue their research on the present Sustainable Aviation Fuel feedstock. Furthermore, they require support to explore new feedstock options.

Figure 3: Minimum share of supply of sustainable aviation fuels (in %)

Final Thoughts

Aviation has made personal, business, and freight trips exceedingly quick yet so CO2 loaded. New Sustainable Aviation Fuel producers will require close support and knowledge to get SAF technical certification. Industry leaders, policy stakeholders, and researchers also play a crucial role. They need to engage on all Sustainable Aviation Fuel (SAF) topics. Additionally, they should work towards developing viable commercial SAF frameworks. Moreover, there is excellent optimism around SAF’s prospect of becoming the best alternative to jet fuel. Furthermore, as SAF production matures and becomes more established across countries, we can see more blue skies and greener pastures by 2050.