India: An Emerging Bright Spot for the Petrochemical Industry

The petrochemical industry has been an essential aspect in the context of the Indian economy, and it has also served as a backbone for several other industries, including textiles and automotive, in the country. Notably, India has risen in recent years, capitalizing on the petrochemical landscape, aiding the increasing requirement for petrochemical products while supporting manufacturing capabilities.

Also, India’s role has become vital following the emergence of petrochemicals, as the world is adopting innovative and sustainable practices. This blog explores why India is considered an emerging bright spot for the petrochemical industry and how it is positioned to become a key player in the years to come.

Market Size and Projections

The Indian Chemicals and Petrochemicals sector is witnessing significant growth and is slated to reach $300 billion by the end of 2025. This rise is substantial compared to the market size of $220 billion in 2024. Interestingly, as per predictions, 2040 might see the petrochemicals industry reach $1 trillion, minimizing reliance on imports while expanding cost competitiveness.

Role in the Indian Economy

The chemical industry is pivotal for India’s growth, contributing to approximately 6% of the economy while providing vacancies for more than 5 million people. Moreover, it accounts for 3% of global chemicals, making it the second-largest exporter of agrochemicals and chemical dyes.

India’s Growing Demand for Petrochemical Products

India, with a population of over 1.4 billion, is one of the fastest-growing major economies in the world. As urbanization continues rapidly, there is an increasing demand for petrochemical products. The country’s growing middle class is driving up the consumption of plastics, textiles, automotive parts, and consumer goods, most of which rely on petrochemical derivatives.

- Plastic Products: The plastic industry is one of the largest consumers of petrochemicals. With plastic being an essential part of packaging, construction, and electronics, India’s expanding manufacturing and retail sectors are increasing the demand for plastic products.

- Automotive and Electronics: The demand for petrochemical products is increasing following the growth of the electronics and automotive industries. As smartphone and vehicle production is rising, the usage of petrochemical goods like adhesives, composites, synthetic rubbers, and coatings is increasing.

- Textiles and Clothing: The textile industry, another major consumer of petrochemicals, continues to thrive in India. Synthetic fibers, such as polyester derived from petrochemicals, are increasingly replacing natural fibers due to their cost-effectiveness and versatility.

Government Initiatives and Infrastructure Development

The Indian government has been instrumental in the growth of the petrochemical industry as it has developed several policy reforms and initiatives, creating a reliable environment for investment and development in the sector. A few key measures include:

- Petroleum, Chemicals, and Petrochemicals Investment Regions (PCPIRs): The development of PCPIRs is a key policy to accelerate growth within the industry. Under the latest PCPIR Policy 2020-35, a joint investment of ₹10 lakh crore (approximately USD 142 billion) is aimed at by 2025.

- Plastic Parks and Textile Parks: They aim to offer a supportive ecosystem for the industry, promoting research and development and attracting investment.

- 100% Foreign Direct Investment (FDI): The government is allowing 100% FDI through automatic routes, making it simpler for foreign investors to invest in the sector.

- Strategic Location and Resources: India’s strategic location, coupled with the availability of cheap resources, provides a favorable environment for global oil companies to invest in the petroleum sector.

- Favorable Government Policies: Tax concessions on petrochemical products like

- Make in India: This has attracted global players and spurred the development of petrochemical infrastructure.

- Atmanirbhar Bharat (Self-Reliant India): The concept of a self-sufficient or reliant India is especially crucial for the petrochemical sector, which has traditionally depended on imports for raw materials.

- National Petrochemical Policy: The government set out the policy in 2020 to make India a number one hub in the petrochemical market. The policy targets petrochemical capacity expansion while encouraging investments in downstream industries and improving efficiency across the supply chain.

Domestic Production and Increasing Investment

India’s domestic petrochemical production capacity has been on the rise, fueled by investments from both Indian companies and multinational corporations. State-owned companies such as Indian Oil Corporation (IOC) and Reliance Industries are leading the charge, investing in large-scale refineries and petrochemical complexes.

Reliance Industries, one of the biggest conglomerates globally, has made significant strides in the petrochemical sector. The brand is a key manufacturer of PTA (purified terephthalic acid), polyethylene, and polypropylene. These are important materials in manufacturing plastics, textiles, and packaging products. Reliance’s refining and petrochemical integration has aided in maintaining a robust presence in the global market while contributing significantly to India’s economic growth.

Several foreign players are investing in India and collaborating with Indian manufacturers and producers, considering the potential market. Companies like ExxonMobil, Aramco, and Shell have put their money into joint ventures in the country, boosting their capacity to meet export and domestic requirements.

Export Potential and Global Market Positioning

India’s position as an exporter of petrochemical products is strengthening, driven by its growing production capacity and competitive pricing. Countries in Southeast Asia, Africa, and Europe are importing petrochemical products from India, particularly plastics, fertilizers, and chemicals.

- Plastic Exports: India is emerging as a global exporter of plastics and polymer products. The growing demand for packaging materials in international markets has led to a surge in India’s plastic exports, making it one of the world’s leading exporters of plastic products.

- Petrochemical Feedstock: India has become a leading petrochemical feedstock exporter globally by supplying materials like aromatics, ethylene, and propylene, following the growing network of integrated petrochemical complexes and refineries.

- Strategic Geographical Location: India’s strategic location makes it easy to access vital global markets, particularly in the Middle East and Southeast Asia. Additionally, the proximity to key shipping routes improves export logistics, solidifying its role in the worldwide petrochemical trade.

Top Petrochemical Companies in India

- Reliance Industries Limited (RIL): The largest private-sector company in India and a global leader in the petrochemical sector, operating one of the world’s largest refining and petrochemical complexes in Jamnagar, Gujarat. RIL produces polymers, polyester, fiber, chemicals, and fuels.

- Indian Oil Corporation Limited (IOCL): India’s largest commercial enterprise, with diversified petrochemical facilities producing polymers and chemicals. IOCL produces polymers, glycols, elastomers, and chemical intermediates.

- GAIL (India) Limited: A top natural gas company in India with a significant presence in petrochemical production. It operates India’s largest gas-based petrochemical plant and produces polyethylene and polypropylene.

- Hindustan Petroleum Corporation Limited (HPCL): A major state-owned oil and gas company with significant petrochemical operations that produce polymers and industrial chemicals.

- Bharat Petroleum Corporation Limited (BPCL): A leading state-owned oil and gas company with growing petrochemical operations, producing various chemicals and polymers.

- ONGC Petro Additions Limited (OPaL): A joint venture promoted by ONGC, GAIL, and GSPC. It operates one of the biggest integrated petrochemical complexes in India and produces polyethylene, polypropylene, and butadiene.

- Haldia Petrochemicals Limited (HPL): One of the largest petrochemical companies in Eastern India, operating a world-class complex producing polymers and chemicals. HPL produces polyethylene, polypropylene, and butadiene.

- Chennai Petroleum Corporation Limited (CPCL): A major player in the petrochemical industry, produces various petrochemical products.

- Mangalore Refinery and Petrochemicals Limited (MRPL): A subsidiary of ONGC, operating an integrated refinery and petrochemical complex in Mangalore. It produces polymers and chemicals.

- Essar Oil and Gas Exploration and Production Limited (EOGEPL): Part of the Essar Group, which is involved in the exploration, production, and refining of petroleum and petrochemical products. It produces polymers, chemicals, and fuels.

- Kothari Petrochemicals Ltd: Part of the HC Kothari group, a top producer of polybutenes.

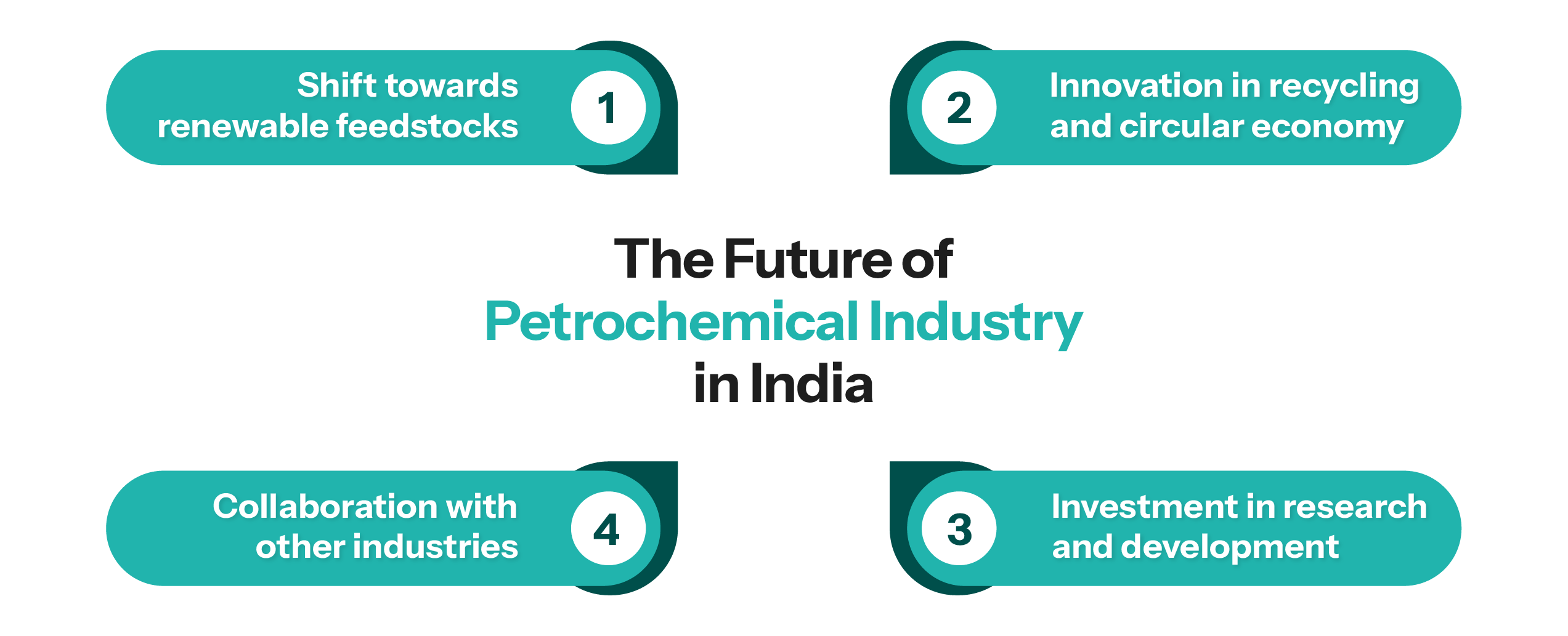

Sustainable Practices and Innovation

As the world moves toward more sustainable practices, the petrochemical industry faces insurmountable pressure to minimize its environmental impact. India is responding to this problem by identifying innovative technologies that promote sustainability in petrochemical production.

- Recycling and Circular Economy: India is at the forefront of developing recycling technologies, precisely in plastics, to offer actively developing recycling technologies, particularly in plastics, to address the growing problem of plastic waste. The country is also moving towards a circular economy model, where waste materials are repurposed into valuable products.

- Alternative Feedstocks: There is a growing focus on identifying alternative feedstocks like biomass and renewable energy to reduce the carbon footprint of petrochemical processes. Indian organizations are investing substantially in research and development in these areas.

- Green Petrochemicals: The demand for bio-based and sustainable petrochemical products is growing. Indian petrochemical manufacturers are looking into producing biopolymers, biofuels, and other eco-friendly chemicals to cater to the global demand for green products.

Challenges and the Road Ahead

The petrochemical industry is growing rapidly; however, to continue the chariot unopposed, challenges need to be addressed:

- Environmental Concerns: Petrochemical production raises questions about the environmental impact it may have. Thus, the Indian petrochemical industry must solve the issue by inculcating sustainable practices using technological advancements.

- Dependence on Imported Feedstocks: India has to depend on imports of some raw materials and feedstocks like lubricating oils, crude petroleum, heating oil, petrol, diesel fuel, and jet fuel, despite rising domestic production.

- Addressing this dependency will be crucial to reducing costs and improving the competitiveness of Indian petrochemical products.

- Market Volatility: The petrochemical industry is vulnerable to repeated price changes or fluctuations following global crude and oil instability, impacting margins and costs.

Conclusion

The petrochemical industry substantially contributes to India’s GDP, with the nation building its manufacturing capacities, investing in innovation, and enhancing infrastructure. Modern initiatives are helping to cement its presence in the global petrochemical industry, which is driven by the expansion of production capability and a growing domestic market.

Additionally, favorable investments, policies, and improved supply chains by the Indian government are pushing petrochemical growth in the nation. Moreover, by targeting sustainability for the future, the Indian petrochemical industry is also adopting eco-friendly practices.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.