Finance for Future: AI and ML in FinTech Industry

The advancement of artificial intelligence (AI) and machine learning (ML) in the Fintech industry has received a lot of publicity. It happened owing to the ability to work with large amounts of data and several automation opportunities. It includes fields like insurance, banking, and wealth management. Factors like threat prevention, demand for personalized user experience on mobile devices, preventive analysis, faster transactions on the go, high security, etc., are driving the adoption of AI and ML. Further, the growing ecosystem of startups is creating more use cases and opportunities for AI-based services.

Artificial Intelligence in the Fintech Market

In 2023, the fintech sector’s artificial intelligence (AI) market was valued at approximately 42.83 billion U.S. dollars. Fast forward to 2024, this figure escalated to 44.08 billion U.S. dollars. Projections suggest a steady growth trajectory with a compound annual growth rate (CAGR) of 2.91 percent, poised to surpass the 50 billion U.S. dollar mark by 2029.

Benefits of AI-ML in Fintech

The Fintech industry is experiencing a rise in machine-learning applications that process large amounts of data sets and provide analytical capabilities. It is a cost-effective solution to process data in real-time, derive patterns for decision-making, and learn to make complex predictions.

Artificial Intelligence in Fintech

AI and ML offer some opportunities for the financial industry, such as process automation, sales productivity, forecasting, an anti-money laundering system, compliance, personalized user experience, and customized banking.

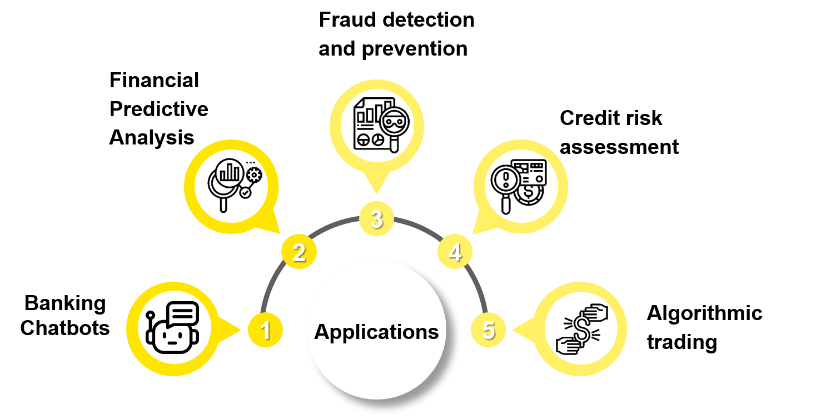

Applications of AI and ML in Fintech

Banking Chatbots

AI-powered chatbots have become popular in the financial sector. Interestingly, they are incorporated with Natural Language Processing (NLP) to engage and interact with customers 24/7. Moreover, they enhance online conversations to provide client-friendly personalized experiences. Chatbots can respond to customers’ inquiries and help them through their account details. They can also help open new accounts and direct complaints to the relevant customer service unit. Another advantage of chatbots is that they provide investment and wealth management assistance.

The AI-driven chatbot also offers opportunities to automate the customer support process. For example, Bank of America has its chatbot Erica that offers balance sheets, past transactions, investment portfolio details, etc., to customers without inconvenience. It also provides invoices for payment transactions and detects fraud or suspicious activity. Furthermore, it asks users some questions and evaluates their responses for security.

AI and ML can automate diverse processes within the FinTech sector, resulting in cost reduction and enhanced efficiency. ML algorithms can automate customer support, asset management, and sales forecasting, enabling companies to allocate their resources to more intricate tasks.

Process Automation

AI and ML have the potential to streamline various operations in the FinTech industry, leading to reduced costs and heightened operational efficiency. Functions such as customer support, asset management, and sales forecasting can be automated through the utilization of ML algorithms, allowing organizations to reallocate their resources to more complex and strategic endeavors.

Financial Predictive Analysis

Predictive Analytics in the Fintech industry enables client analysis, risk management, and customer experience management. Also, it aids in product and channel strategy, risk and capital modeling, sales, and channel performance, etc. With its Data Mining techniques, predictive analytics for financial businesses uses complex SaaS platforms to analyze borrowers’ history, calculate credit scores, and prevent high-risk operations. With the help of Machine Learning, predictive analysis can collect and process big data related to the customer, find patterns in the history of their behavior, predict their future actions, and deploy customized, prescriptive solutions unique to each customer. Predictive analytics in financial services directly impacts marketing strategy, sales promotion, profit generation, and optimizing resources. Financial predictive analytics thus offers opportunities, such as calculating credit scores, preventing bad loans, improving sales, optimizing resource use, and enhancing operational efficiency.

Efficient Loan Underwriting

Machine Learning (ML) can be a pivot in bolstering the efficiency of loan underwriting processes within the FinTech sector, thus reducing financial risks. By meticulously scrutinizing a borrower’s credit history, income, and other relevant factors, ML algorithms can significantly improve and streamline the loan underwriting process, resulting in more accurate assessments.

Fraud Detection and Prevention

Fraudulent activities are on the rise in the Fintech industry. To avoid such activities, we need an anti-fraud system that can continuously learn from incidents of fraud and use the output in the monitoring and detecting process. Many sectors of the industry, such as banking and insurance, are using AI-based solutions to reduce and prevent financial losses. AI is the most promising future technology for Fintech as it includes algorithms that perform big data analysis and use machine learning to find correlations between user behaviors and fraudulent activities. Machine learning models that include both supervised and unsupervised techniques can easily detect any abnormal or suspicious activities in real time.

Credit Risk Assessment

Credit risk assessment in the Fintech industry adopts artificial intelligence techniques to differentiate. Moreover, it manages the process of client profiling based on customer risk profiles. AI is used to determine the creditworthiness of the facility borrower. It does that by harnessing data to predict the probability of default. It helps improve the accuracy of credit decisions rather than just calculating the credit score based on banking history. Also, it maximizes the rejection of high-risk customers, minimizing the rejection of deserving customers.

Thus, artificial intelligence is used to decrease the credit losses of financial institutions by integrating self-assessment features for credit eligibility. Financial institutes offer customized products and services to clients based on their credit scores. Notably, AI also helps Fintech companies distribute a certain amount of online loans to their clients. It does that by profiling clients based on risk profiles. Thus, using the AI system in finance, mainly in the banking sector, offers an opportunity to find out which customers are at high risk and which ones are creditworthy despite an average credit score.

Algorithmic Trading

Algorithmic trading is about making trade decisions using self-learning algorithms and machine learning without human intervention. Machine learning algorithms learn by iteratively processing training data, identifying patterns in historical market data, and using real-time market scenarios to make sell-and-buy decisions. Using pattern recognition technology, the artificial intelligence algorithm can provide recommendations related to absolute return investment stocks. Further, trading using AI offers opportunities like improved accuracy, increased trading speed, accurate trading decisions, and predictions of the market. Moreover, it provides deep market analysis based on big data, which is mainly essential for large financial firms.

Personalization and Data Analysis

Fintech mobile app development firms can employ AI and ML to analyze customer data, such as financial history, spending patterns, and other relevant details, to gain a deeper understanding of their needs and preferences. This data-driven approach enables the customization of financial products and services while developing fintech applications, enhancing client satisfaction and involvement. By leveraging AI, personalized investment portfolios can be recommended based on a customer’s risk tolerance, investment goals, and existing portfolio.

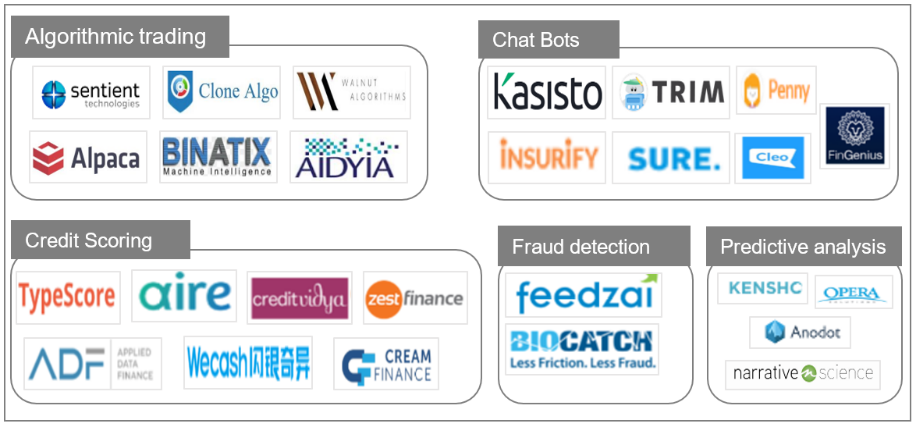

Prominent Startups

Artificial intelligence (AI) is transforming the way people interact with money by streamlining and optimizing processes ranging from credit decisions to quantitative trading and financial risk management. The Fintech industry is largely driven by startups offering personalized services and solutions. A few of the prominent startups in the industry are:

- Anodot‘s business monitoring platform uses machine learning to constantly analyze and correlate every business parameter and provide alerts to clients of revenue leaks, cost spikes, and user experience issues.

- Aire uses machine learning to provide personalized credit scores to users to apply for loans and credit cards. The scores are based on multiple factors, including credit history, including financial maturity, career, and lifestyle.

- Kasisto leads the financial industry with conversational AI technology (KAI) and an intelligent KAI-powered virtual assistant solution that quickly responds to customers’ banking questions and provides investment recommendations.

- Clone Algo develops AI trading systems for financial markets using a range of algorithms combined with timing technology and risk management systems.

- Feedzai provides banks, merchants, and companies with AI tools to manage payments online and fight financial fraud.

Conclusion

Artificial Intelligence (AI) will continue to be a significant force in the Fintech business. Its application expands across a wider array of sectors. Fintech organizations will benefit from new use cases. Moreover, the revenue-generating potential is due to AI, machine learning, and big data analytics. For example, data from users’ OTT subscriptions, movie and event ticket transactions, and social media activity can be integrated to provide suggestions for new subscriptions and movie ticket offers. Furthermore, AI-enabled analytics solutions can assist banks and merchants in gaining insights into client spending patterns. It provides services such as location-specific discounts and rewards, micro-financing, and other similar services.

Moreover, the motivation to increase AI in each sector will be driven by the financial service organization’s investment in upskilling its workforce. According to industry statistics, only 49% of organizations currently have training initiatives for their employees to better understand AI. There is an increasing need in the industry for upskilling and the identification of new monetization opportunities.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.