Digitalization, especially with AI & ML, has revolutionized the banking and financial services industry, and it will continue to do so in the future. Fintech companies are leveraging digital technologies to create innovative products and services such as mobile payments, peer-to-peer lending, and cryptocurrency. With the continued advancement of digital technologies, Fintech companies will be able to provide better access to financial services, more efficient and secure financial transactions, and improved customer experiences.

Emerging markets have played a significant role in revolutionizing the industry. With the increased adoption of mobile phones and associated mobile wallets, digital banking, and advanced payment system acceptance have pushed the market penetration

Alan Kay, an A.M. Turing Award laureate, once said, “The best way to predict the future is to invent it.” But be it innovation or invention, they last as long as they serve the needs of the hour. In the same lieu, this blog highlights some unique technologies that will restructure opportunities, strategies, and disruptions in the fintech industry over 2023 and beyond.

Figure 1: Fintech Industry Trends

- New POS Integrations supporting the Buy Now Pay Later (BNPL) trend: Buy Now Pay Later, or BNPL, has been around for years, but it has been highly criticized as an unhealthy practice that may develop unhealthy spending habits among consumers. However, this concept was widely accepted during the pandemic, becoming a preferred choice for retaining eCommerce customers. The trend is expected to expand in 2023. It will happen along with new POS integrations, loyalty perks, and online checkout features in eCommerce platforms across the globe.

- Embedded digital fingerprinting and credit scoring: Banking institutions, investors, and lenders are now deploying AI-driven credit scoring and digital fingerprinting methods to reduce margins of error, accelerate the loan approval process, and analyze potential loan applications in a better way. Digital fingerprinting works through an extensive key customer and user database that can be used to create reports. Moreover, detailed profiles of customers. The data goes down to every detail, such as ISP, location, cell phone carrier, etc. The smart credit scoring system includes additional data like IP analysis, income, spending potential analysis, geodata, social media information, and more. Lenders and banks can easily use it to determine a user’s or applicant’s credibility.

- Regtech compliance: Regulatory technology, or regtech, is a specialized technology that ensures private and public financial institutions’ compliance with the latest regulations. Increasing regulatory pressures are compelling businesses to spend more to meet convoluting regulations. The growing list of regulations related to cryptocurrencies, data, risk, compliance, and financial services is attracting more and more global players into this domain. For instance, IBM developed a cognitive fraud prevention solution to win Financial Crime Product of the Year, and other giants like Deloitte Touche, ACTICO GmbH, Ascent Technologies Inc, Chainalysis, Broadridge Financial Solutions, and several others are developing similar solutions.

- Digital Immune Systems (DIS): Digital Immune Systems provide a fault-tolerant operating environment that prevents complete system failure and returns to normal mode without delay, reducing the risk of business interruption. Apart from that, DIS helps maintain consumers’ trust in the responsiveness and reliability of transactions. DIS will grow in importance as more businesses put their money into digital investments to better connect with their customers. A Gartner survey predicts that by 2025, companies relying on digital immunity will boost their respective end-user satisfaction by 80%.

- Web 3.0 And Metaverse: The rise of Web 3.0 and the Metaverse was triggered by the emergence of AI, ML, and Blockchain technology. These sophisticated technologies bred the idea of decentralized finance (DeFi), which is now getting a foothold in the fintech market. According to a recent forecast, the Web 3.0 Blockchain market evaluation will reach USD 6,187.3 million by 2023. This figure is also expected to expand at a CAGR of 44.6% from 2023 to 2030. As more and more fintech applications wave through the World Wide Web, the internet’s infrastructure will be rebuilt, making it a safer, more accessible, and more efficient haven for business activities. It will allow regulators, businesses, and individuals to work and collaborate in a more open space online. Further, recent patent filing trends indicate authenticating transactions in extended reality spaces using different “virtual” biometric identifiers, enabling seamless transactions for users.

- AI Trust, Risk, and Security Management (AI TRiSM): AI TRiSM provides tools that simplify AI models’ interpretation and regulate their usage as confidential, sustainable, trustworthy, and fair solutions. Gartner predicts that, by 2026, business models focused on AI transparency, trust, and security will register an approximately 50% improvement in user acceptance, adoption, and business goals. They also predict that in 2028, AI-driven machines will constitute 40% of global economic productivity and 20% of the workforce. It’s safe to assume that AI model deployment figures will show a positive trend in 2023.

- AR (Accounts Receivable) Automation to Support Cash Flow Management: As automation digs deeper into the finance sector, it is helping companies move away from manual accounting practices and streamline their businesses more efficiently. More and more CFOs are now adopting automated AR processes, and the trend is bound to go up as organizations enter remote and hybrid work modes.

- Predictive Analysis to Support Critical Financial Decisions: Data-based predictive analysis plays a pivotal role in understanding market dynamics, customer creditworthiness, and revenue forecasting. The information extracted from such studies helps companies make informed decisions. As decision-making moves from intuition to logic, data-based predictive analysis takes center stage in every business domain, including finance.

- Embedded Finance: Embedded finance refers to integrating financial tools with nonfinancial institutions’ offerings. The embedded finance ecosystem ranges from investment to credit, banking, payment processing, and insurance. The search for the term “embedded finance” has grown by 488% since 2018, which means positive growth will be witnessed further in 2023. As more companies decode the significance of improved user experience, trust, and distribution, the rage for embedded finance will soar globally.

- Fintech Solutions for Environmental, Social, and Corporate Governance (ESG): With the growing pressures of climate change and net zero targets, the ESG niche has overflowed with massive investment influxes in the last few years. A Bloomberg analysis estimates that global ESG funds will surpass the $53 trillion figure by 2025, constituting more than 1/3 of total assets under management (AUM). The emergence of ESG bred another niche called “ESG-focused fintech solutions” that caters explicitly to organizations in this domain. These solutions employ distributed ledger technology to provide traceability and fund allocation capability based on pre-determined outcomes or criteria. Automated reporting systems or auditors can then verify (through IoT) whether the fund distribution conforms to the relevant ESG requirements. The diversity of these solutions, numbers, and categories will proliferate as ESG assets and mandates increase in the coming years.

- UPI 2.0 and Digital Rupee: UPI or Unified Payments Interface and e-Rupee are innovations from India that are making their way into countries worldwide. UPI works on a highly secured platform that promises reliable end-to-end security and complete data protection. The National Payments Corporation of India (NPCI) recently launched UPI 2.0 this year with several new features like support from all major banks, an overdraft facility, a one-time mandate, signed intent, QR code payments, and invoices. The digital Rupee is a virtual iteration of physical money. It can be withdrawn and placed in a digital wallet as we do with real cash in the real world. However, unlike UPI, eRupi is handled by RBI and does not entail any individual owner. UPI is already an accepted mode of payment in Singapore, and soon it will be available in the UAE, Bhutan, France, Nepal, and several other nations.

Fintech Industry: Conclusion

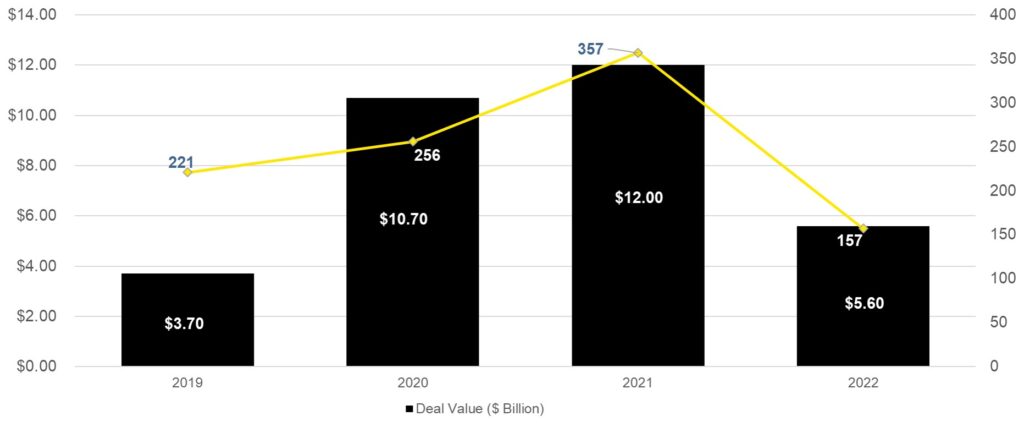

With worldwide Fear, Uncertainty, and Doubt prevailing globally, the Fintech sector might be bearing the brunt for the coming few months. Valuations are going down, access to capital markets is restricted, and enormous pressure to sustain profitability and margins exists. The 2022 “Crypto Winter” will not end soon and will significantly impact developments in 2023. However, as history has witnessed, recession times are the best times for unique and game-changing innovations. Additionally, the growth of the gig economy and the increased focus on financial inclusion will also create opportunities for fintech companies to expand their offerings and reach new customers. Despite the troughs, investments crested in fintech industry and tech, and in 2023, we may witness some noteworthy M&A resulting in market consolidation.