Agribusiness

Nurturing innovation to feed a growing world.

Facilitating Sustainable Agriculture, Food Security, and Smart Farming Practices

The increased demand for biocontrols and biopesticides, adoption of integrated pest management, and use of plant growth regulators (PGRs) are driving the future of the agrochemicals business. Digital technologies and innovation also support the transformation, with industry leaders collaborating with technology developers to optimize chemical usage.

Indoor and urban farming have opened a plethora of opportunities. However, the industry strives to overcome regulatory and sustainability pressures, evolving market dynamics, and currency risks. These trends demand agriculture consulting expertise that can guide innovations enhancing farming reliability and sustainability to ensure global food security.

Industry Trends

Agribusiness Trends

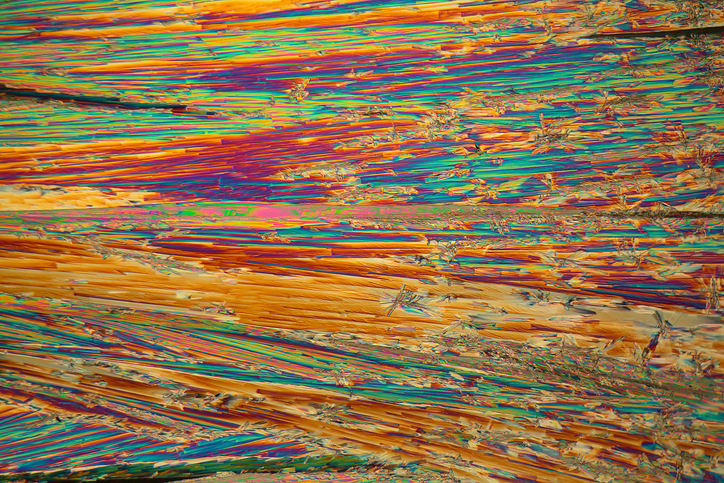

Semiochemicals

Biologicals

Smart Fertilizers

Digitalization

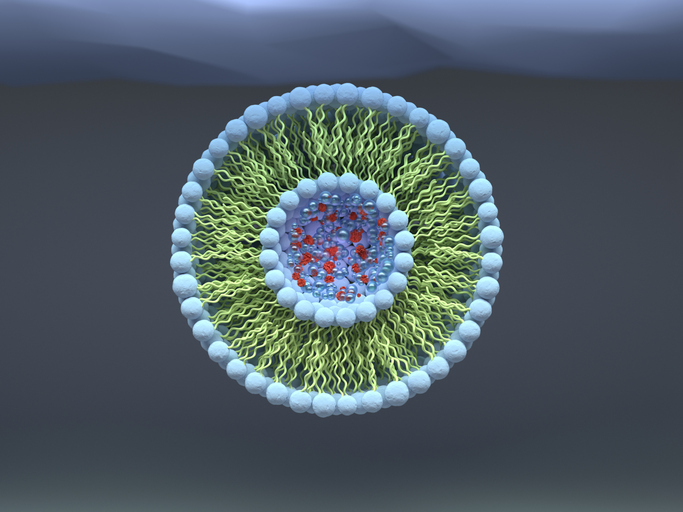

Nanotechnology

Integrated Pest Management

Non-Edible Oil Sources

Semiochemicals

The semiochemicals market is experiencing a significant transformation due to changing consumer preferences, technological advancements, and rising pressures for sustainable agricultural practices. It is expected to reach a US $16 billion valuation by 2032.

Innovations in delivery systems and formulations of semiochemicals will increase their applications in organic farming and pest control. Advancements in precision agriculture and growing regulatory support will also increase the appeal and acceptance of semiochemicals across markets.

How Can We Help You?

The transformation of chemical and materials industry in the coming years will be guided by agility to digitalize, sustainable sourcing, and ability to optimize resource utilization. The market lead will be shaped by success in application and opportunity mapping and innovation in decarbonization efforts. It implies an imminent need for experienced and resourceful counselling that could provide strategic guidance for adaptation, innovation, and harnessing the full potential of opportunities presented along the way. We have worked with almost all subsectors of this industry ranging from petrochemicals to additives, paints, coatings, agrochemicals, and biochemicals. We are well-equipped with experience and skills to reimagine operations from sourcing to upcycling to accommodate the changing dynamics of global chemical business.

ExploreAlignment with emerging sustainability standards and changing client preferences demands Research and development (R&D) prowess in the chemicals and materials industry. At Stellarix, our R&D and innovation strategy is meticulously crafted to navigate the dynamic realm of chemicals and materials. Focusing on market analysis, emerging technologies, and regulatory landscapes, our strategy promotes competitiveness and sustainable growth.

We thrive on collaboration and partnerships, engaging with research institutions and industry allies. A customer-centric approach tailors products to market demands, agile R&D processes ensure adaptability and data analytics enhances decision-making. We prioritize intellectual property management, practice sustainable supply chain integration, and excel in market entry and commercialization. Our risk management, continuous improvement, and global perspective ensure strategic alignment with international trends.

ExploreWe specialize in crafting dynamic business and market strategies for the chemicals and materials industry. Our holistic approach considers market dynamics, competition, tech trends, and customer needs. From market research to target markets, we guide you in identifying trends, developing tailored products, and optimizing your portfolio. We emphasize a clear value proposition, ensuring your unique offerings stand out.

Stellarix excels in innovation, technology adoption, and optimization of distribution channels. We help with pricing strategies and brand positioning and integrate sustainability and corporate responsibility seamlessly. Customer relationship management is a forte, and we explore global expansion opportunities. Our risk management expertise covers market fluctuations, supply chain disruptions, and regulatory changes. We guide strategic opportunities and due diligence in mergers and acquisitions (M&A). Establishing monitoring and adaptation mechanisms with defined KPIs, we adapt your strategy for continued success. Choose Stellarix to navigate the chemicals and materials industry strategically.

ExploreWe prioritize a robust chemical and materials sustainability strategy, aligning environmental, social, and economic factors for long-term success. Our approach involves key elements, including life cycle assessments, responsible raw material sourcing, and green chemistry practices to minimize environmental impact. We focus on waste reduction, water efficiency, and product innovation for sustainability. Carbon footprint reduction and adherence to certifications and standards are priorities.

Continuous improvement is embedded, ensuring regular assessments and seeking opportunities for enhancement. Choose Stellarix for a sustainable future in the chemical and materials industry.

ExploreCollaboration and partnerships drive innovation and boost competitiveness in the dynamic chemicals and materials industry. Our concise guide for co-manufacturing (co-man) and partner identification aligns with business goals in the chemicals and materials industry, emphasizing clear collaboration objectives. We identify partners with complementary technologies through a thorough assessment of organizational capabilities, market analyses, and technology assessment. Stellarix advocates engagement in industry networks and conferences to expand partnership horizons.

To ensure reliable collaborations, we focus on supplier and customer relationships, regulatory subordination, financial stability, and cultural compatibility. Our guidance covers risk assessments, legal considerations, and due diligence for flexible and scalable partnerships.

ExploreWith Stellarix, you can navigate the complexities of startup scouting and acquisition strategies specific to the chemical and materials industry. Our strategic support and guidance are helping companies bridge the gap between their business objectives and performance improvement. Our tailored insights based on extensive research and analytics have helped several key industry players in identifying emerging technologies and potential partners to stay ahead of the curve.

ExploreOur Experience

Technology Landscape – Biodegradable Capsule Suspension

A renowned C&M industry client engaged Stellairx to assess the global technology landscape for bio-based encapsulation to determine potential market opportunities and reinforce its market position. The insights provided by our chemical consulting team helped the client devise a strategic roadmap for future collaboration and market entry, thereby enhancing business resilience. Client Background: A global […]

Player Landscape – High Performance Polymers (HPP)

A leading player in the polymer segment sought a comprehensive overview of the high-performance polymers market to strengthen their strategic position. The strategic intelligence provided by our team allowed them to: Client Background: Our client is a leading player in the polymeric segment and wanted to explore the current landscape of high-performance polymers and their […]

Textile Value Chain Analysis– Assessing the Scale of Regenerated Cellulosic Fibers

A textile industry player sought to analyze the entire textile value chain to identify emerging technology trends, strategic entry points, and collaboration opportunities across each segment. The comprehensive market intelligence from Stellarix guided the organization’s partnership, investment, and innovation strategies, enabling long-term growth and competitive advantage. Client Background: The manmade cellulose fibers, commonly known as […]

Client Queries Addressed

Q1. What are the key market trends and customer needs that agrochemical companies should focus on to strengthen their competitive position?

Q2. How can agrochemical companies leverage innovation and R&D to develop new products and solutions that meet evolving market demands?

Q3. What strategies can be employed to strengthen supply chain management and ensure the availability and quality of agrochemical products?

Q4. How can companies improve their sustainability practices to align with regulatory requirements and consumer expectations, and how will this impact their market position?

Q5. What are the best practices for forming strategic partnerships or collaborations within the industry to drive growth and expand market reach?

Q1. What are the potential cost savings or efficiency gains from investing in new technology, and how can these be quantified and compared to the investment required?

Q2. How can agrochemical companies prioritize technology investments to align with their business strategy and market positioning?

Q3. What financial models or strategies can be used to spread the investment costs of new technology while maintaining competitive pricing and profitability?

Q4. How can companies assess new technologies' ROI to ensure they deliver value and do not adversely impact their pricing strategy?

Q1. What key sustainable practices can agrochemical companies adopt to reduce environmental impact and align with regulatory requirements?

Q2. How can agrochemical companies quantify and demonstrate the environmental and economic benefits of sustainable practices to stakeholders and customers?

Q3. What strategies can effectively market and communicate the adoption of sustainable practices to enhance brand value and appeal to environmentally conscious consumers?

Q4. How can companies leverage partnerships, certifications, or industry standards to bolster their sustainability credentials and differentiate themselves in the market?

Q1. What digital tools and data analytics platforms are most effective for enhancing product development processes in the agrochemical industry?

Q2. How can companies harness the power of data analytics to tailor marketing strategies and better target their customer segments?

Q3. What are the best practices for integrating customer feedback and data into product development cycles to ensure alignment with market needs and preferences?

Q4. How can digital tools be leveraged to improve customer engagement and support, and what metrics should be used to measure their effectiveness?

Insights

See All

Blogs

Blogs

Articles

Articles