2023 concluded with COP 28 showing the world the present worth and discrepancies of its 2050 Net Zero plan and efforts. An IEA report suggests that to zero its CO2 emissions by 2050, the energy sector needs to raise its target bars while improving the pace and intensity of its efforts. These requisites are further backed by the record-level surge in demand for fossil fuels and non-renewable energy sources projected for this year. This, however, doesn’t mean any stagnation in renewables growth and adoption. But there remains a scope for stronger and more genuine efforts. For a clearer understanding, here’s a summarized global energy industry outlook for each segment:

Renewable Energy

As the first half of 2023 indicated, the clean energy investments reached new peaks, registering record growth. The trend also continued in the second half and will continue in 2024. As Europe takes lessons from the recent energy crisis, governments across the West push harder for renewable energy deployment. Globally, solar and wind energy consumption will ascend on charts rising by approx. 10-11% on a year-on-year basis. These growth numbers will still face a stark challenge from supply chain disruptions, lower auction prices, rising mining commodities prices, and financial burdens.

Global Energy Industry: Hydrogen Capacity

As more and more nations rush to increase their hydrogen production capacity, infrastructure expansion will be a common sight worldwide. But the catch is that most of this hydrogen is produced through fossil fuel reformation methods, making it grey hydrogen. Most countries lack electrolysis capacity, which complicates the production process of green clean hydrogen. It is a mineral and metal-intensive task that places hydrogen in close competition with other renewable energy technologies and total renewable output economics.

Other than short electrolysis capacity, high capital requisites, unaffordable production expenses, and uncertainty about offtake contracts after project commissioning restrain growth in this domain. Moderate growth can be expected in 2024 owing to low-cost renewable energy production supporting policies introduced by governments in China, Australia, and the US. This is evident by the rising number of green hydrogen projects reaching the Final Investment Decision (FID) in all these nations.

Global Energy Industry: Nuclear Power

Last week, the World Economic Forum included the outlook from the IAEA director general about the significance of nuclear energy in the clean energy mix in the near future. It implies the rising share of nuclear energy in global energy output, and the total numbers ought to go up from 5GW in 2023. The major driving factors for this resurgence include the Ukraine crisis, natural gas shortage, and increasing inclination towards renewable energy independence. This year, the Asia-Pacific region is expected to be the leading growth driver in this domain, followed by Europe.

CCUS

Despite CCUS’s higher significance in decarbonization, less activity has been noted in this area in the last few years. As governments and private players are pushed hard to increase activity in this respect, strong uptake in CCUS strategies is expected this year. Denmark, the US, the UK, and others will be the nation’s leading licensing in this niche in 2024.

Oil and Gas

After a slump in 2023, the demand for fossil fuels, especially oil and gas, is rebounding in 2024. Reports from associations suggest increasing consumption in growing economies, colder weather, and rising unrest in the Middle East will push global demand for oil and gas. The charge for oil supply is to be taken by the United States, Brazil, China, and Guyana. Figuratively, the global gas demand will go up by 2.5%, while for oil, the numbers will go up by 1.2-2.25 million barrels per day.

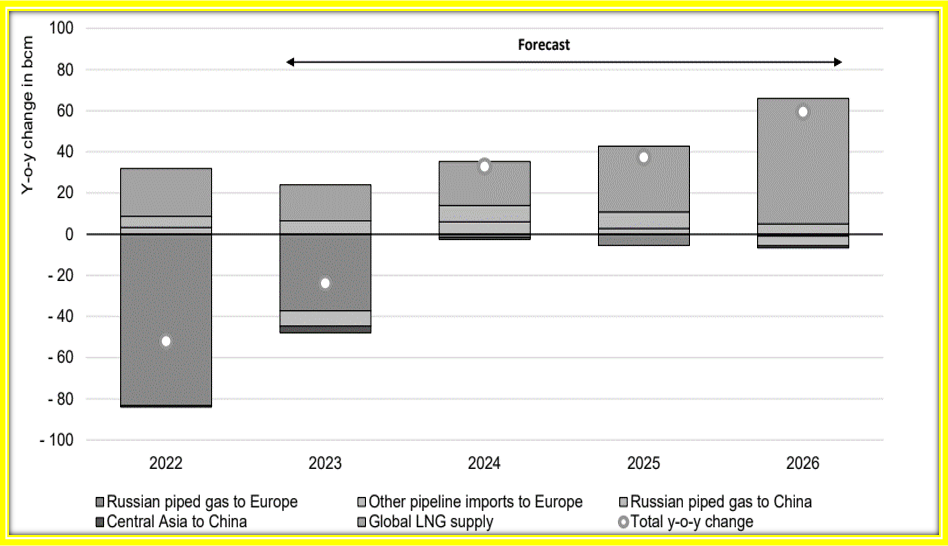

Image: Year-On-Year Change In Global Gas Trade And LNG Supply 2019-2024

Conclusion

The resurging demand for oil, gas, and other fossil fuels poses a challenge to emissions reduction efforts. Climate change, rising heat, and geopolitical tensions further fuel this fire that must be contained without delay. In all, there is a dire need for more serious national, industrial, and technological efforts to meet the 2030 targets set by developed and developing economies.

Is There More?

Yes, there will be much more to the energy industry’s development and progress in 2024. Below, we have covered the key developments, insights, and expected movements in the renewable and non-renewable energy sectors.