Figure 1: Automotive Industry Future Trends

Know About Automotive Industry

Technological and economic activities in the automotive industry (auto sector outlook) have long been a bellwether for several business verticals. As we approach 2023, the market is teetering between challenging and promising indicators. The automotive industry sets noteworthy benchmarks in technology, revenues, and sustainable goals. It stands out among other sectors in this regard. How? Here’s a synopsis:

- Increasing investments in hydrogen fuel cell development: The disrupted supply chains, high demand for metals, super-expensive charging infrastructure, and rising prices of electric batteries have compelled automakers to look beyond the temporary “hope” presented by EVs. Global automakers, including Volkswagen, BMW, Toyota, and Hyundai, are aggressively working on developing hydrogen fuel cells, and the trend is bound to increase in 2023 and years beyond that.

- Robotaxis services will join the online world: Automated vehicles are now ready for small-scale commercial deployment, and we will see several cases in the coming year. The California Public Utilities Commission granted Cruise a “driverless deployment permit” for commercial operations. This landmark decision sets an encouraging example for similar deployments in various other regions. 2023 brings exciting new developments. This includes expanded robotaxis, commercial deployment of driverless heavy autonomous vehicles, and increased adoption of Level 3 vehicles with LiDAR in Europe.

Auto Sector Outlook: EV Sales and Infrastructure

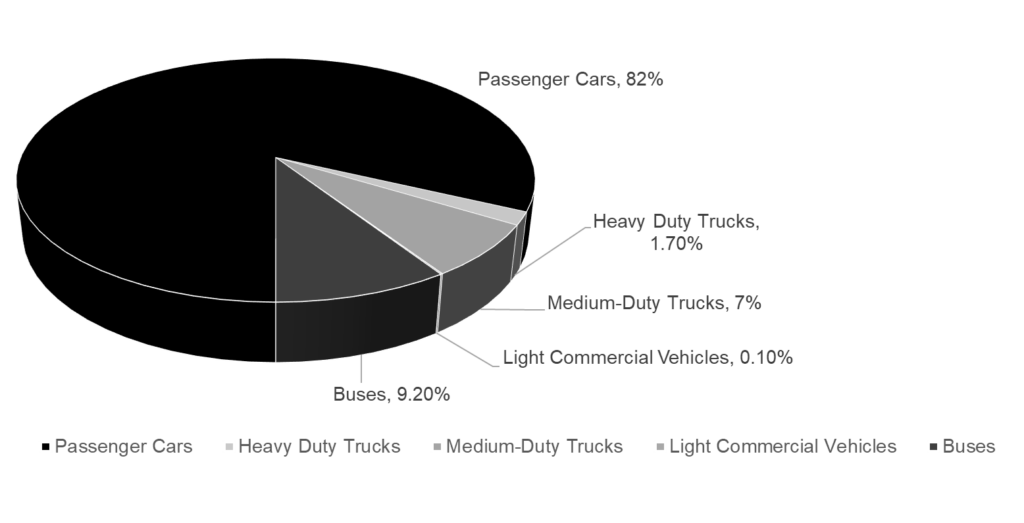

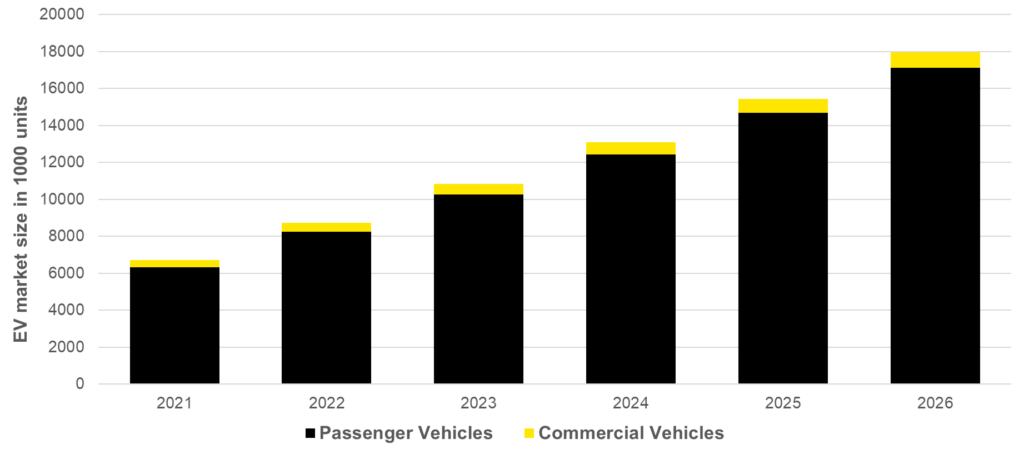

- Electric Vehicle sales gain momentum: EVs have been around for quite some time now, and experts predict that the sales figures will further shoot up in 2023 due to rising fuel prices and climate change pressures. A long series of EV launches is waiting to join the mainstream automotive market, and the prices are due to fall with rising competition and the availability of choices. By the end of this year, statisticians project the sale of approximately 7.1 million EVs, with an estimated total sales figure surpassing 8.6 million units in 2023. A summary of the global EV sales forecast from 2021-2026 is as follows:

- Expansion of EV charging infrastructure: We can’t talk about proliferating EV sales figures without mentioning the expansion of its charging infrastructure. Governments worldwide have some serious plans in development to address the EV charging station requirements in 2023. For example, in China, the government aims to deploy charging stations on all highways by the end of 2023. Aside from the government, automakers are also attempting to address this issue with battery-swapping solutions. For instance, Nio, an EV start-up, plans to upgrade its proprietary battery swap stations next year to make room for batteries with varying voltages and other brands. However, charging will remain a big issue in 2023, as there is a dire need for battery standards regulations, which complicate the task of installing proper charging points and swapping stations.

Auto Sector Outlook: Expansion into Automotive Industry

- Increased adoption of Adaptive AI: Artificial intelligence is penetrating deeper and deeper into detail-intensive processes in the automotive sector. Adaptive AI surpasses traditional AI systems by reviewing and revising its code to accommodate real-time changes in its surroundings. These changes may not have been present or anticipated during its initial development. Integrating adaptive AI in detail-intensive automotive processes will help automakers adapt to industry disruptions and changes more quickly and efficiently.

- Evolution of Vehicle to Everything (V2X) technologies: The autonomous vehicle ecosystem relies on connectivity at various levels. Figuratively, when a car is making its way into the real world, it is also forging a path in the virtual world by releasing real-time data through various channels. Technologies known as “Vehicle-to-Everything” (V2X) enable the creation of this virtual ecosystem. It uses a series of connectivity protocols and advanced telematics to enable communication between vehicles and other connected elements like a similar vehicle, smart traffic lights, “smart city” infrastructure, railroad crossings, blind corners, etc. V2X technologies are still in their evolving stage. Still, in a fully functional state, they will allow all elements of a connected ecosystem (on or near-road entities) to communicate their trajectory or position every second in real time. Since all these systems are still in their development stage, we can anticipate extensive discussions and analysis in this domain. This growth is expected to continue in 2023 and beyond.

Software-Defined Vehicles:

The industry coined this phrase to represent the paradigm shift from electromechanical-based products to software-based, upgradeable mobility solutions. Simply put, the vehicle design and framework are no longer defined by hardware but by software. Tesla pioneered this domain when it built vehicular firmware around a computer network. As more and more companies join the suite, the concept of vehicles may shift from machines on wheels to high-performance computers (HPC) on wheels in the coming years. The automotive software market’s worth is estimated to double by 2030 compared to the last decade5. Connected assistance systems like connected parking, navigation, V2P, and V2N have the potential to save driving hours, prevent accidents, and reduce material damage. Their value exceeds the current and projected market worth in this domain.

- Automakers will need to adapt to the increasing complexity of vehicles: The increasing lines of code in automotive software will keep complicating matters for automakers across the globe in 2023 and beyond. Currently, the number of lines in car codes exceeds 100 million, compelling automakers to become software companies. The increasing level of autonomy in vehicles will result in an upward trend in these code lines. As a result, automakers and OEMs will need to recruit more software engineers. In addition, mechanical engineers adapt to the evolving dynamics of the market.

Ownership and Issue

- Change in the traditional car ownership model: The private car ownership model has been a global practice for almost a quarter of this century and the last century. However, the rising fuel prices, idle time in driveways, improved public transport infrastructure, parking hassles during peak hours, maintenance costs, and sky-high insurance premiums give many future car owners second thoughts. When asked, 48% of future car owners agreed they wouldn’t mind giving up their cars. This was in exchange for the availability of alternative mobility solutions.

- Automotive supply chains will remain an issue: The effect of supply chain disruptions was mitigated by the muted demand for vehicles. However, in 2023, global automotive production will experience the full impact of this gap. The low supply of semiconductors poses a challenge in the assembly of vehicles, EV batteries, and other automotive accessories. Additionally, the escalating geopolitical situation between Taiwan and China adds further complications. Moreover, acquiring metals such as steel, cobalt, nickel, etc., also presents difficulties in production. In this case, local sourcing, mining strategies, and new regulations might be of little help.

Auto Sector Outlook: Summary

Persistent supply-chain disruptions, inflationary pressures, and rising geopolitical complications will greatly shadow this market’s growth and development figures. Every industry, including the automotive sector, must address the pressing issue of sporadic climate change at its core. It is about time we realize the hoax of “electric cars” and how small their role will be in constricting carbon footprints, ethical conundrums, and clean energy drives. It will be a mixed bag of goodies, where some pros will outweigh the cons and vice versa.