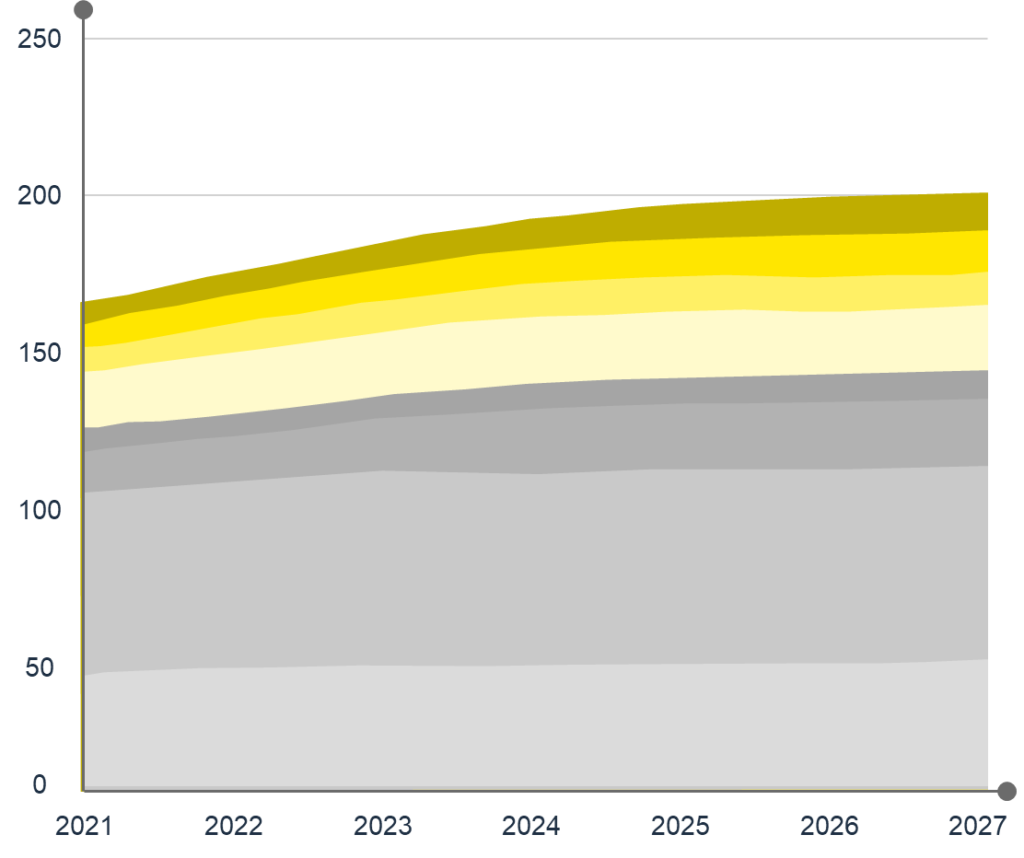

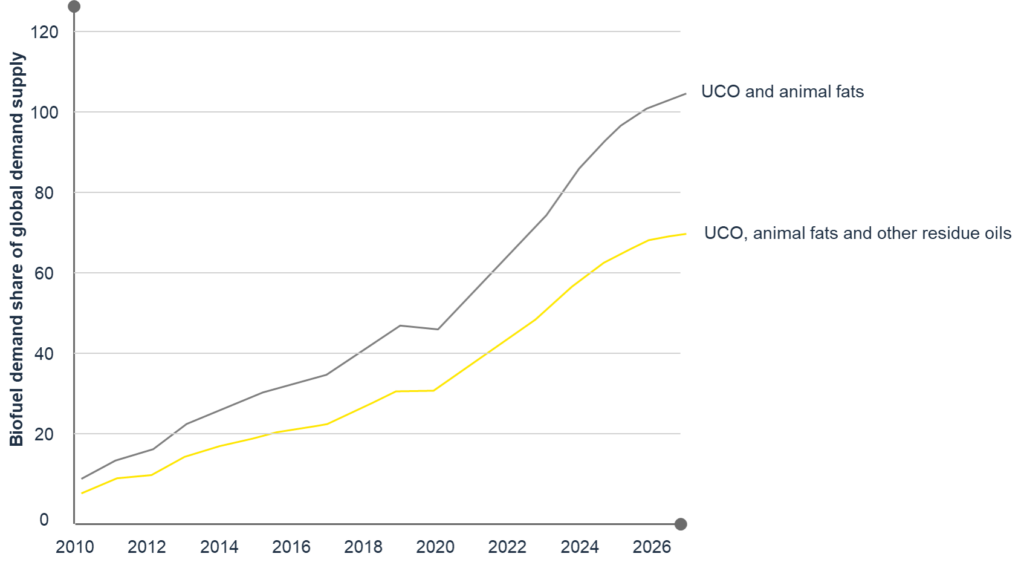

According to the latest IEA report, the biojet and biofuel industry is headed toward a deep feedstock supply crunch till 2027. If the producers stick to their old patterns without finding sustainable alternative sources of biofuels, the problem will become huge. The report suggests a spike in demand for fats, residue oils, wastes, and vegetable oils by 56%. It will figuratively rise to 79 million tonnes. The demand for feedstock alternatives like residue and waste-based biofuel is exceptionally high. It helps manufacturers meet the tightening emission regulations and feedstock policy objectives.

However, overconsumption of this feedstock creates a big vacuum for livestock feed supply, pushing food prices up directly and indirectly. Also, the problem is rooted deeper in the appropriation of agricultural land in feedstock production with increased fertilizers and pesticide usage that disturbs the long-term sustainability and organic food production goals. This precarious scenario calls for better feedstock alternatives and regulatory support. Moreover, identification of unsustainable and fraudulent waste supplies. The Global Bioenergy Partnership report estimates that biofuels will meet approx. 27% of global transportation fuel demand by 2050 mandates the need for strong acknowledgment and resolution of these challenges.

Biggest Challenges in Feedstock Alternative

- First Generation Feedstock: The first generation feedstock comprises the most abundantly available raw materials, including starch-based and sugar-based feedstock, potato, wheat, barley, sugarcane, and sugar beet plants. The pandemic, followed by the Russia-Ukraine crisis, has disturbed supply chains and grain distribution across the globe. Russia and Ukraine are the world’s first and fifth-largest wheat producers. Europe’s ongoing conflict and energy crisis have intensified food inflation and threatened food supplies. It has happened especially in Asia, Africa, and South America. This adds extra pressure on the US and Europe to produce more land to meet this looming demand. Moreover, the stress of offering less land to biofuel feedstock mounts. As food takes priority over fuel for more than half of the world, the Western governments have pressure to shift to second-generation feedstock and curtain the grain shortage.

- Second Generation (2G) Feedstock: The second-generation feedstock has been developed to combat first-generation feedstock’s food vs. energy dynamic. It comprises lignocellulose or carbohydrate biomass, a potent substitute for first-generation counterparts. However, the issue lies in the complications related to logistics, production costs, and complexity compared to their predecessors. International Renewable Energy Agency (IRENA) report states that second-generation feedstock’s production cost is 2-3 times higher than that of first-generation biofuels. The capital costs, land use conflicts, infrastructure limitations, and transportation are obstacles to successfully deploying and implementing these biofuels. Cellulosic ethanol production involves complex processes, such as biomass pretreatment, enzymatic hydrolysis, and fermentation. Developing efficient and cost-effective technologies for each step remains a significant challenge. Achieving high conversion rates and optimizing the enzymatic processes to break down the complex lignocellulosic structure of biomass efficiently is a technological hurdle that needs to be overcome. Ensuring a reliable and sustainable biomass feedstock supply for second-generation ethanol production is critical. Obtaining a consistent and economically viable feedstock supply can be challenging due to factors like seasonal variations, geographical constraints, and competition with other uses such as animal feed and bioenergy. The bulky biomass feedstocks’ collection, transportation, and storage can also pose logistical challenges. The public’s perception and acceptance of second-generation ethanol can impact its market adoption. Concerns about land use change, food security, water consumption, and potential environmental impacts must be addressed effectively through education and awareness campaigns. Demonstrating sustainability and positive environmental benefits of this alternative feedstocks-based ethanol can help build public trust and acceptance.

- Third-Generation Feedstock: The third-generation feedstock comes from algal biomass and waste oil. It neutralizes all the challenges of the first two-generation biofuels but comes with problems. IEA reports that the production costs of algae-based biofuels are approx. $7 per liter. The first gen biofuels cost more than $0.5 – $1.5. Then there is the issue of scaling up production and huge water and nutritional requirements that may involve negative environmental repercussions in the long run. For instance, the US Department of Energy states that algae cultivation may range between 1000- 2000 gallons of water for every 1000-2000 gallon fuel production. Lastly, a National Renewable Energy Laboratory report states that large-scale algae cultivation for biofuel production may lead to nutrient pollution and habitat destruction. Therefore, through utmost care and responsibility, the path to implementation can take place.

The Solution in Feedstock

- Better Technology Deployment: Technological stagnation is a subtextual demand concerning second and third-generation biofuel production. In the current scenario where the world struggles to feed all mouths while keeping air, water, and land clean and clear, dwelling a little deeper to find technological solutions is crucial. Waste animal fats and used cooking oil offer many non-food crop feedstocks for renewable biofuels. Therefore, better technical backup can upscale and economize non-food-based biofuel production. For example, biomass-based Fischer-Tropsch and cellulosic ethanol-based technologies can employ alternative feedstocks for biofuels to yield low-carbon biofuels for commuting and transportation.

- Innovation: Several production modus operands have upscaled the production of biofuels on a commercial level. However, a big innovation gap exists in converting grass or wood-based biomass into liquid biofuels. Thermochemical processes like bio-FT synthesis, rapid pyrolysis, and hydrothermal gasification can help fill this gap. Moreover, sustainable upgrading of this production methodology.

- Supporting Infrastructure: Do you know it is more economical to trap the carbon dioxide produced by second-generation biofuel production processes than first-generation and conventional fuel production processes? Several biofuel production pathways, such as ethanol fermentation, lead to carbon dioxide emissions. Since the CO2 produced in the process is pure, the cost of purification can be skipped significantly. Thus, reducing the cost of CO2 capture as a whole. Several biofuel plants worldwide successfully capture carbon, pushing the total figure to 2.21 MtCO2 annually. However, to meet the 2030 Net Zero Scenario, they must scale this figure by 50 times. That can happen by filling the vast gap with better infrastructure deployment and development.

Conclusion

The future of biofuel depends very much on alternative feedstocks for biofuels, as they enable the sustainable utilization of biomass, reduce competition with food, and offer lower carbon emissions. Better initiatives and efforts on multiple fronts can combat these predicaments. Governments and markets need to work hand-in-hand to understand the depth of these challenges and support new infrastructure and tech development. Simultaneous efforts can help cover the supply chain gaps and rising food crises. The world needs more programs like the Sustainable Aviation Grand Challenge Roadmap, which is currently active in the United States. Similarly, Germany dedicates huge investments and resources to improve yields from resides and wastes in Europe. Canada’s Clean Fuels Fund focuses on supply chain development for alternative fuels. Such initiatives are teamed with policies focused on emission reduction that promise incentives to biofuel producers to neutralize the emissions issue related to their production processes.