Future of Cleaning Products: The Sustainability Shift to Ingredient & Format

Emerging Green Cleaning in 2026 and Beyond

From being a strategic competency to a mainstream trend, sustainable value chain operations are currently experiencing a significant shift in the cleaning products manufacturing in the US and worldwide. A confluence of new regulatory regimes, rising consumer demand for transparency, and technological advancements in green chemistry drives this shift toward environmentally friendly cleaning products. Additionally, stringent regulations surrounding microplastics are adding to this shift.

About 23% of US adults prefer household cleaning products with plant-based ingredients. Meanwhile, 51% of UK adults support eco-friendly efforts by investing in eco-friendly dishwashers or home care products, while 93% of consumers in the APAC region look for cleaning products with gentle ingredients. These statistics clearly indicate a prominent trend toward sustainable cleaning, requiring businesses to adopt sustainable innovation and use green ingredients and formats.

In this context, the blog specifically discusses ingredient and format innovations, along with regulatory complexities, shaping the future of sustainability in the cleaning products industry.

Next-Gen Ingredients: Is Your Cleaning Products Portfolio Ahead of the Curve?

With the production of bio-based surfactants through enzymatic processes and advanced fermentation techniques, manufacturers are well-positioned to make a swift transition. So, companies that focus on carbon-responsible and similar innovative ingredients gain branding and supply chain advantages. These developments utilize non-food biomass, such as sugarcane bagasse, along with C1 gases like methane and captured CO₂, ultimately creating a strong foundation for circular chemistry.

The “Waste-to-surfactant” pathway is a groundbreaking development that achieves yields of up to 95% using room-temperature NaOH treatment of pulp mill waste. The resulting glucoisosaccharinic acid (GISA) amides, purified through foam fractionation, exhibit high stability, strong foaming properties, and structural similarity to high-end commercial or traditional surfactants.

This pathway helps CPG companies by eliminating sourcing and regulatory risks associated with petrochemicals while enabling the development of cost-effective ingredients for sustainable, high-quality formulations.

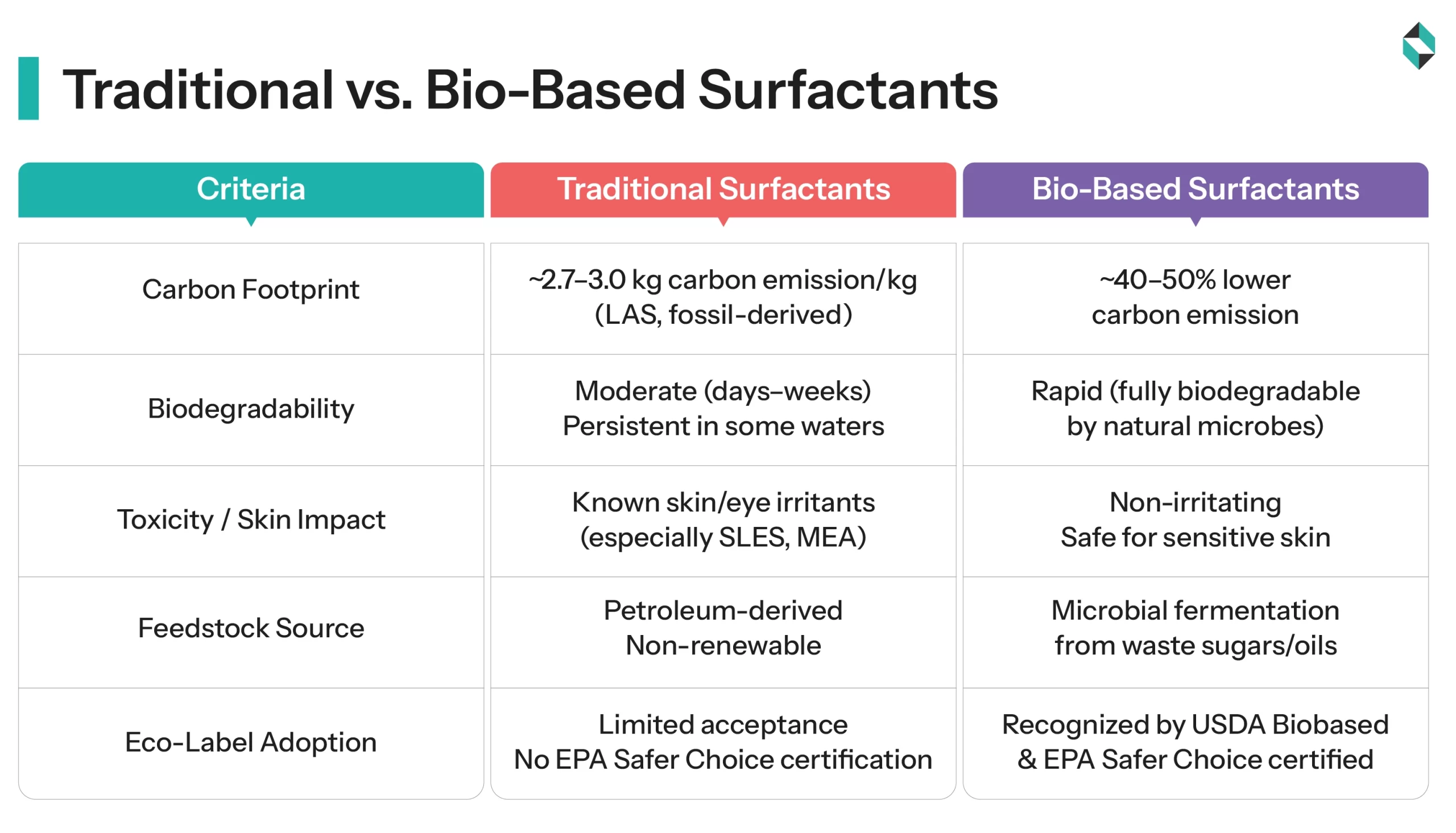

Apart from this, microbial biosurfactants, especially Rhamnolipids, are gaining traction. Rhamnolipids are replacing traditional surfactants such as SLES (Sodium Laureth Sulfate), MEA (Monoethanolamine), and LAS (Linear Alkylbenzene Sulfonate). Rhamnolipids possess superior biodegradability, high cleaning efficiency, emulsification, and foaming properties, which collectively help reduce the carbon footprint. This multifaceted nature of Rhamnolipids helps businesses develop high-performance formulations.

However, fermentation-based Rhamnolipid production faces challenges related to scalability, cost, and purification. Therefore, it is beneficial to identify and partner with suitable suppliers that invest in advanced purification and scale to gain a competitive edge in the market.

Connect with our CPG consulting experts to identify and collaborate with suitable suppliers through our strategic partner scouting services.

Moreover, cleaning products with “microbially derived surfactant” offer the benefits of enhanced customer trust, which is why industry players using these ingredients seek certification from the Environmental Protection Agency (EPA) Safer Choice program.

Are You Ready to Switch to Dissolvable, Waterless Alternatives from Traditional Pods?

Apart from ingredient-related challenges and new trends, cleaning product manufacturers face pressing issues of water and plastic logistics costs. High water use associated with traditional detergent formats necessitates the demand for sustainable alternatives.

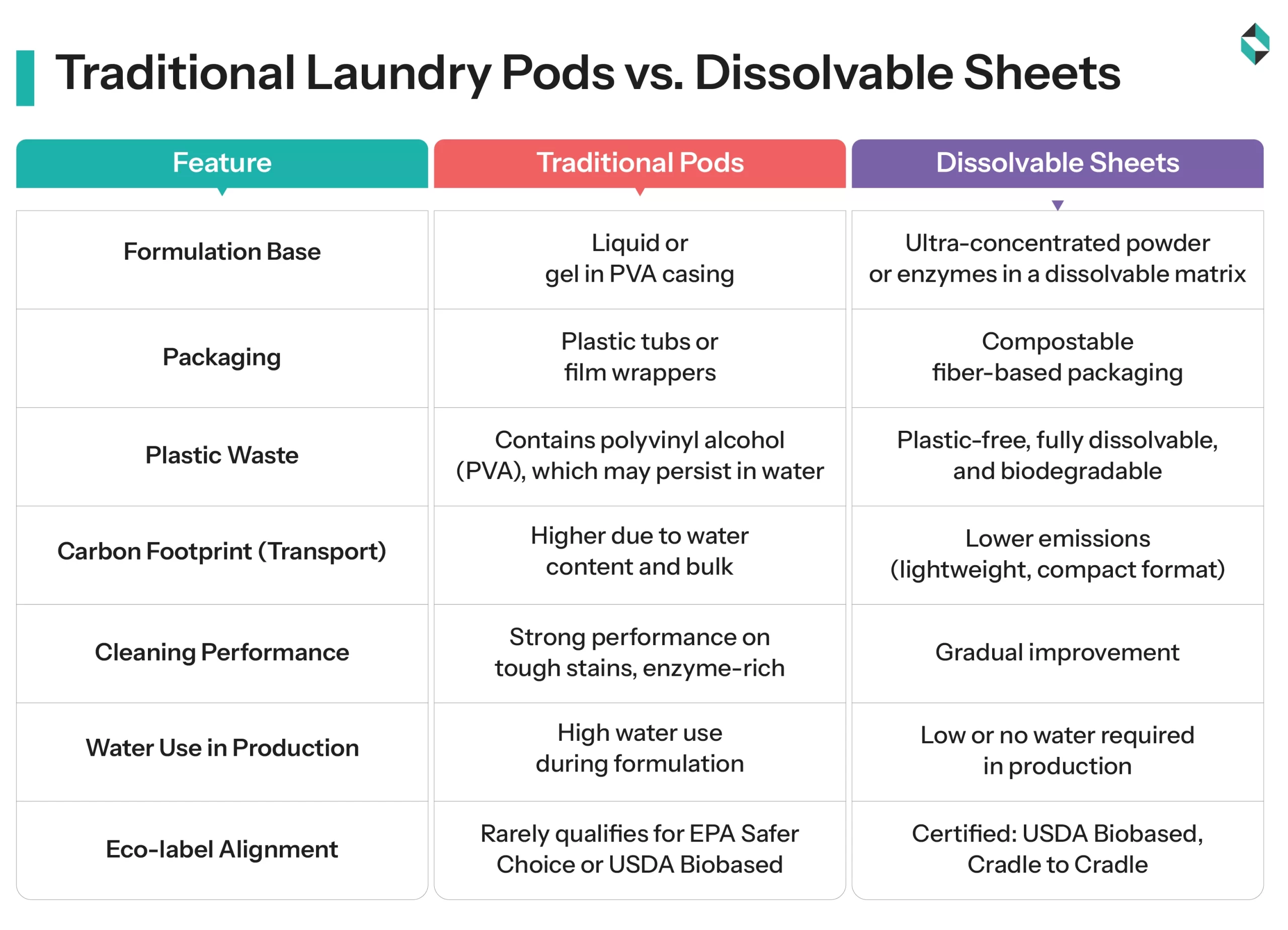

Here, the emergence of ultra-concentrated, waterless cleaning formats, comprising dissolvable sheets, pods, and tablets, marks a remarkable shift in household cleaning. Hence, companies leveraging these innovative formats accomplish sustainability goals while strengthening their branding and attracting an environmentally conscious customer base.

These formats offer notable advantages to businesses, such as reducing plastic packaging, lowering carbon emissions, and reducing shipping weight. These benefits are achieved through at-home dilution using reusable bottles.

Dissolvable laundry sheets have become a useful innovation, serving as a future-proof format for cleaning product brands aiming for sustainability benefits and staying competitive in the market. Unilever’s Dirt is Good (Persil), Earth Breeze, and Tru Earth are helping promote the adoption of compact, eco-friendly laundry sheets, emphasizing a sustainability-first message.

Further, with advances in materials science, a transition is happening from polyvinyl alcohol (PVA) to bio-based, fully biodegradable matrices made of new polymers and plant cellulose. Cleaning product manufacturers that adopt such future-ready formats benefit from higher surfactant loading and more effective enzyme delivery, thereby enhancing cleaning performance while maintaining stability across various conditions.

However, common challenges, such as perceptions of performance and consumer skepticism about the effectiveness of dissolvable laundry sheets compared to liquid detergents, persist. Additionally, issues like shelf-life, formulation stability, and price parity still need to be addressed.

Therefore, for cleaning product companies, opportunities lie in minimizing the credibility gap through substantial R&D investments and by leveraging expert R&D consulting services that match the performance of liquid detergents while enhancing the sustainability benefits of dissolvable formats.

Regulatory and Policy Challenges for Companies Transitioning to Green Cleaning

- The cleaning products industry operates within strict federal and state regulations, primarily regarding microplastics and PFAS (per- and polyfluoroalkyl substances).

- EPA’s progressive efforts in California to expand bans on microplastics are impacting scrubbing powders, laundry capsules, and encapsulates.

- PFAS, used in degreasers and stain repellents, are facing federal phase-outs.

- The lack of a clear definition for what qualifies as eco-friendly, bio-based, or non-toxic remains a major barrier for cleaning industry players, raising concerns about greenwashing.

Strategic Implications for Cleaning Products Businesses

- Invest in R&D focused on ingredient innovation, such as biosurfactants (Rhamnolipids), to improve cost-effectiveness and scalability.

- Shift to laundry sheets integrated with advanced binder systems, promoting biodegradable formats.

- Focus on green chemistry and natural abrasives while remaining proactive on microplastics regulation.

- Ensure operations rooted in authentic ecolabels, ensuring robust life‑cycle assessments.

Final Words

For cleaning product firms, the shift to sustainability is more than just a reformulation challenge; it is a strategic risk that involves supply chains, regulatory compliance, and brand or customer trust. Both agility in response and accelerated innovation will be pivotal in gaining a market edge amidst intense competition. But the biggest impeding force is the regionally diverse and complex regulatory framework. That is where strategic insight becomes central.

Stellarix helps companies navigate the evolving regulatory frameworks while aligning with consumer perception and sustainability demands. We are assisting several market incumbents and new players in turning these challenges into a competitive advantage.

Partner with Stellarix to create a future-ready portfolio that aligns with changing market, regulatory, and consumer perspectives.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.