Reimagining the Future of Cardiac Valves

The convergence of biotechnology, materials science, AI in designing, implantation planning, monitoring, decentralization, 3D Bioprinting, and regenerative medicine is reshaping the structural heart landscape. This perspective explores various scenarios that could alter the technological and adoption landscape of structural heart devices over the next 10 years.

The human heart has four valves: the Aortic, Mitral, Tricuspid, and Pulmonary Valves. Among them, the Aortic valve requires maximum replacement or repair.

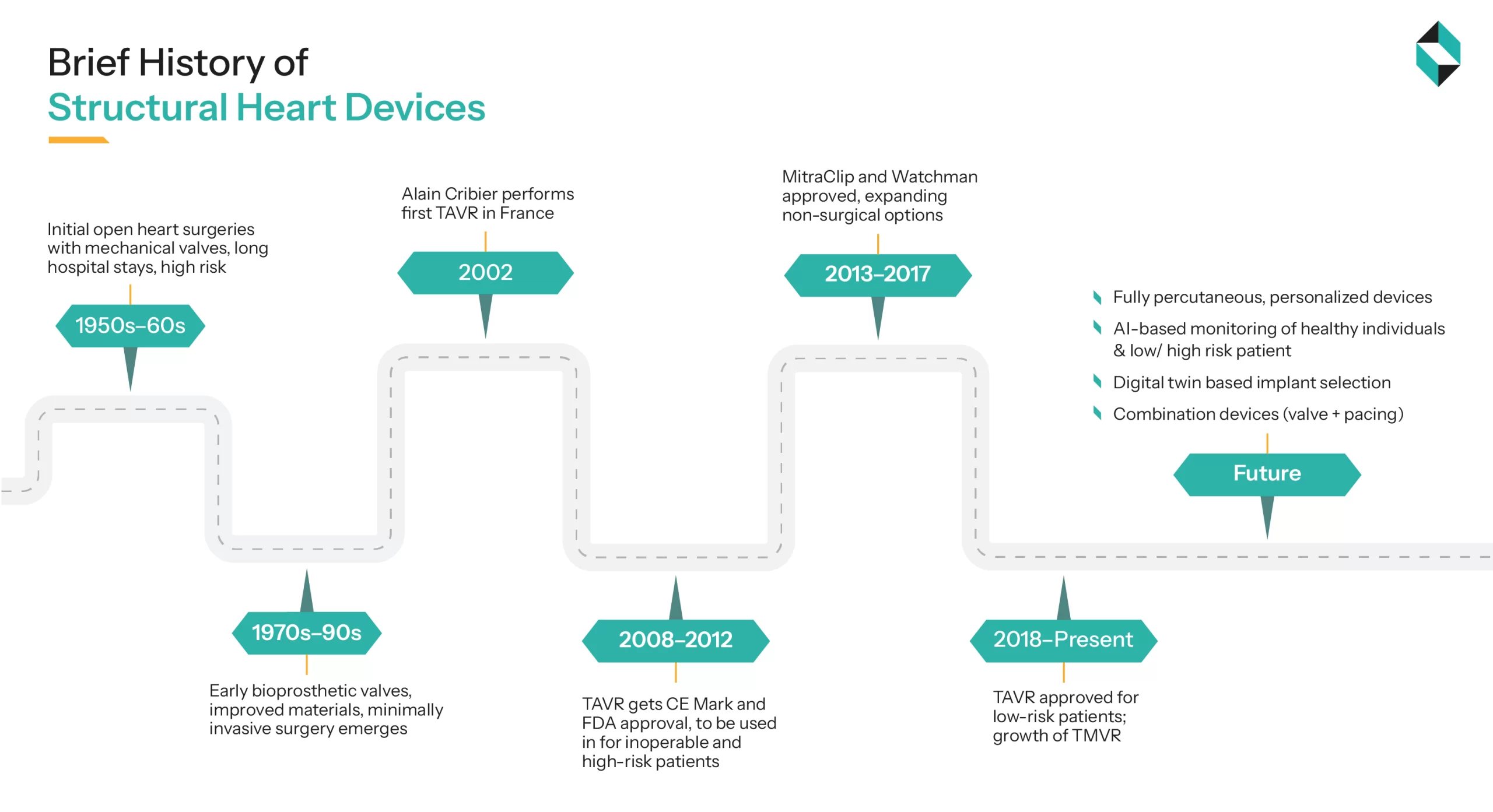

Initial structural heart devices were large caged ball valves designed and implanted in 1960 by Dr Dwight Harken. Around the 1980s, the bileaflet prosthesis mechanical valve was introduced by St. Jude Medical (SJM). However, all valves till the 2000s were implanted with open heart surgeries, had extended hospital stays, and a high risk of operative mortality around 15% to 20% (PMC).

With technological advancements in materials science, biotechnology, and surgical processes, in April 2002, the first successful aortic valve replacement was performed using a transcatheter procedure by the team of Dr. Alain Cribier. The Procedure was called Trans-catheter Aortic valve Implantation or replacement (TAVI or TAVR), and it was officially approved in 2011 by the US-FDA for high-risk patients (Richard A. DeWall et.al). Approval of MitraClip by Abbott Vascular (in 2013) and Watchman by Boston Scientific (in 2015) has expanded the less-surgical options and changed the approach from valve replacement to valve repair. Around 2018, TAVI procedures were approved for low-risk patients, and the growth of Transcatheter mitral valve replacement (TMVR) and repair (TMVR)

Market Entry Barriers

Significant market entry barriers for a new player include:

- Stringent long-phase clinical evidence & trials, and high regulatory burden

- Trust of physicians and patients

- Hospital contract lock-in

- High manufacturing, sterilization, storage, & logistics standards

- Competitive IP landscapes

Investors expect safety trial data and regulatory clearances, as well as early adoption data, to gauge commercial potential.

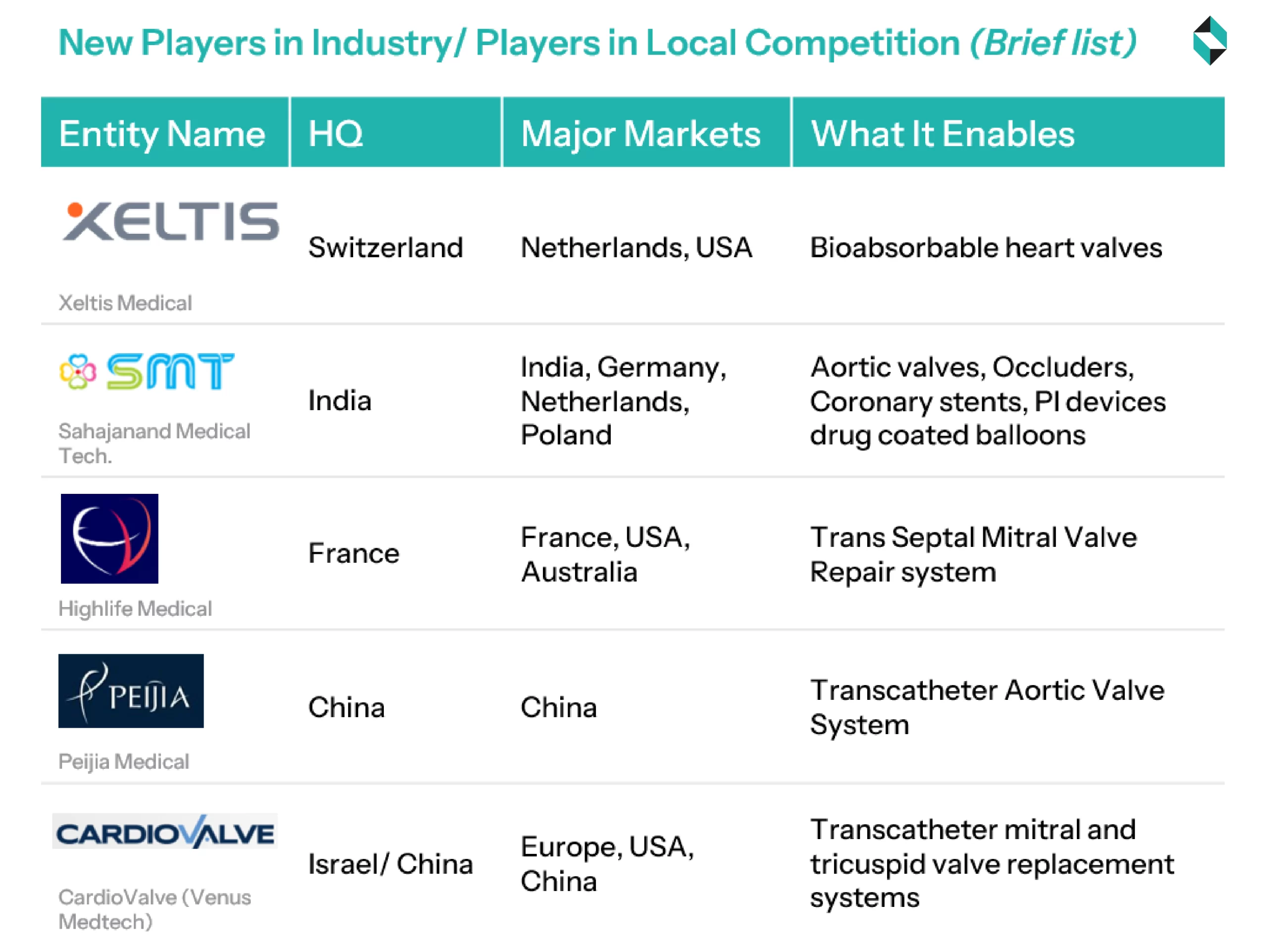

Startups and New Entrants in the Domain

To overcome the entry barriers, new entrants are taking the route of niche indications (such as pediatric, redo procedures), novel mechanisms (e.g., bioabsorbable, soft robotic), or researching to improve procedural efficiency and workflows (such as digital twin, drug coating, & implantation/ explantation systems)

Actionable themes that leaders are expected to follow

1) Expand Treatable Population: In the next 5 years, companies in prosthetic valve replacement and repair will continue to explore new markets for their existing or slightly modified offerings. Companies will continue to invest in research, regulatory approvals, and marketing efforts towards expanding the scope of repair devices to cover medium and early-risk patients

2) Expanding to New Markets and Care Centers: Both large companies and new entrants will intensify their marketing and sales efforts to capture emerging and underserved economies in Asia, Africa, and Latin America. This will be achieved through long-term procurement contracts with Governments and hospitals.

Along with the hospitals, this action will create business opportunities for the downstream players involved in medical device logistics, storage, operating room training, and maintenance.

3) Simplify Procedures: Expanding to new geographies and hospitals would not yield expected results until the implant selection, workflow, transcatheter visualization, and post-operative care procedures are simplified.

Though this would require intense research efforts and are expected to be driven by large players (like Medtronic, Abbott Vascular, and Edward Lifesciences etc.), along with the big players, nice players, new entrants, and startups will play a Greater Role in simplifying the procedure, and expanding the benefits to the needy patients and geographies.

4) Make Repairs Durable: To support the value-based care model and align with Payers’ expectations, larger players like Medtronic, Abbott Vascular, Boston Scientific, etc., will continue to pursue incremental innovation around improving tissue interaction, reducing stress points, minimizing leakages, and implementing self-healing or re-coaptive technology.

5) Differentiate Digitally: Given the high market barriers, not all companies and new entrants will be able to compete directly in researching, developing, and commercializing cardiac valves and repair devices.

Instead, many will seek to create value and capture part of the revenue in the workflow and patient journey by embedding digital solutions across the cardiac valve repair or replacement journey.

This includes tools for target selection, decision support for choosing between repair and replacement, AI-driven assistance during the procedure (e.g., visualization, navigation, and automation support), and post-implantation, non-invasive and at-home monitoring of the valve and patient’s health status.

In the next decade, it is expected that advancements in cardiac valves will be seen in the following three horizons

- Horizon 1: Platform Maturation & Expanded Indications

- Horizon 2: New Modalities, Advanced Imaging, and Personalization

- Horizon 3: Frontier Science, Fully Integrated Valve Repair Ecosystems, or Perhaps no valve

Each horizon will witness the entry of new players into the market, the exit of existing practices and technologies, the expansion of intervention into new patients and markets, and the development of new business models.

The following article in the series will discuss several high-impact shifts that may reshape the structural valve market and their impact on technology developers, hospitals/healthcare providers, payors/payviders, and patients.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.