The Business Case of Weight Reduction in High-performance Polymers

The global high-performance polymer market (HPPs) is moving at an unprecedented pace, with a market valuation of $38.23 billion in 2024. The mounting pressures threatening to separate leaders from stragglers stem from a trifecta of challenges spanning regulatory, economic, and technological factors. Now, the agility to capture value through the quick integration of lightweighting solutions will be the differentiating factor for the industry stakeholders. Before moving on to the implications of these difficulties, it is prudent to understand the need for weight reduction in high-performance polymers and the relevant challenges a bit closely.

Weight Reduction: The Strategic Differentiator

The density of high-performance polymers is between 1.2 g/cm3 and 1.5g/cm3, compared to other widely used metals like aluminum. Therefore, for the aerospace and automotive industries, it translates into enhanced fuel efficiency, higher design flexibility, and lower emissions. Hence, the implications of it being a strategic cost, a product innovation, and a compliance enabler are correct. Other factors making a strong case for it are summarized as follows:

| Core Driver | Key Metric | Quantitative Mandate | Most Affected Sector |

| Regulatory | U.S. CAFE Standards set economy targets for fleet average fuel consumption | Aiming for 54.5 mpg by the end of 2025 | Automotive |

| Regulatory | The EU requires emission reduction for new vans and cars | 100% reduction in the next ten years | Automotive |

| Regulatory | CO2 reduction target per passenger-kilometer for air travel | 75% reduction aimed by 2050 | Aerospace |

| Regulatory | ICAO’s ambition for net-zero carbon emissions | Net-zero by 2050 | Aerospace |

| Regulatory | Integration of advanced composites in next-gen aircraft. | 53% in Airbus A350 for 25% fuel gain | Aerospace |

| Regulatory | The EU’s Green Deal and REACH are speeding the shift to sustainable polymers. | NA | Cross-industries |

| Market Demand | Reducing the average BEV weight in comparison to its ICE counterpart. | 37% heavier than ICE counterparts | Automotive |

| Market Demand | Extending EV range by reducing its mass | 10% mass reduction = 13.7% increment in range | Automotive |

| Market Demand | Lightweight polymers yield lower operational costs and emissions, as per IATA analysis | ~20% improved fuel efficiency over an aircraft’s life span | Aerospace |

| Market Demand | Rising pressures for the use of lighter, recyclable packaging materials in beverages, food, and e-commerce. | NA | Consumer Goods |

| Competitive Pressures | Higher investments in HPPs by the chemical industry leaders | More than 85% | Cross-industry |

| Economic Imperative | Direct correlation between fuel burn and CO2 emissions | 3.16 kg CO2 emitted per kg of fuel burned | Aerospace |

| Economic Imperative | Battery systems’ mass addition to EVs reduces their efficiency and range | Adds 300 to 700 kilograms of mass | Automotive |

Understanding the Strategic Urgency Behind HPPs’ Weight Reduction

There are three time-sensitive windows that present a compelling case for chemical industry participants to prioritize HPPs’ weight reduction:

Loss of Initial Stage Partnerships

Both aerospace and automotive manufacturers’ design cycles extend from 5-7 years, which includes the establishment of procurement relationships early on and their persistence throughout the product lifecycle. Companies missing on the current design cycle face the danger of systemic exclusion from the next-generation platforms. With most automotive OEMs explicitly specifying material requirements for 2028-2032 vehicle launches, the opportunity window needs to be nailed in a few quarters only.

Calcifying Competitive Positioning

The HPPs segment is ripe for a first-mover’s advantage in the above-mentioned application areas. Agile establishment of technical credibility, application expertise, and having reference customers will be pivotal in reinforcing the market position. As BASF, Victrex, and Solvay are already setting the benchmark, the window for market edge is already narrowing.

Leveling with Rapid Technological Evolution

Organizations need to level with the speed of material innovation. From nanotechnology integration to additive manufacturing, all emerging developments are shaping next-gen materials requirements and standards. Waiting for market clarity for investment decisions paves the path for losing a competitive edge to already favored incumbent solutions.

How is the Chemical Industry Aligning with this Requirement?

The strategic maneuvers by chemical industry participants signal a fundamental restructuring of this landscape. The responses are clustered around four basic vectors:

Accelerated M&A featuring Portfolio Optimization and Consolidation

The HPPs segment is attracting premium valuations due to exceptionally high growth expectations in aerospace lightweighting and automotive electrification. Though substantial M&A activity in other industries also signals investors’ confidence in this emerging segment. The best example is the recent acquisition of Spectrum Plastics Group by DuPont, valued at $1.75 billion. It exemplifies the growing focus on medical-grade polymers and the belief in their growth trajectories.

Similarly, competition is being fueled by Middle Eastern strategic buyers who are making strategic acquisitions. ADNOC recently finalized $16.5 billion acquisition of Covestro. Together, they are set to establish a formidable platform for specialty chemicals, improving access to competitively priced infrastructure and feedstocks. Also, the acquisition of Nova Chemicals for $13.4 billion underlines the sustained Middle East’s position in downstream chemical value chains.

Lastly, fluoropolymers and fluorochemicals are also becoming the center of M&A activity, especially in the context of semiconductor and aerospace applications.

Moving Beyond Conventional Material Supply Chains

A number of partnerships in the material science landscape aim to meet the consumer demand to move beyond polymer specifications. The highlighting developments include Cellforce Group’s and BASF’s joint venture. The partnership centers on securing the European supply chain, developing sustainable cell technology, and reducing logistics costs.

Also, BASF’s joint venture with the Chinese company Shanshan aims to serve the world’s largest EV market.

Similarly, Syensqo has established multiple partnerships spread across the value chain from component manufacturing to material development. Most of these partnerships reinforce material suppliers amidst critical aerospace supply chains with qualification cycles ranging from 3-5 years and promising multi-year revenue opportunities.

Capacity Expansion in High-Growth Regions

Leading manufacturers are showing confidence in long-term demand trajectories and investing in capacity. Solvay’s $85 million collective investment in expanding PEEK production capacity is a prime example. It now owns facilities in Georgia and India, with a global resin production capacity exceeding 2,500 metric tons. It also commissioned thermoplastic composite manufacturing in South Carolina, focusing on the production of unidirectional composite tape from PEEK, PPS, and PVDF polymers. The primary objective here is to assist automotive, aerospace, and energy consumers seeking lightweight components in meeting their environmental responsibilities.

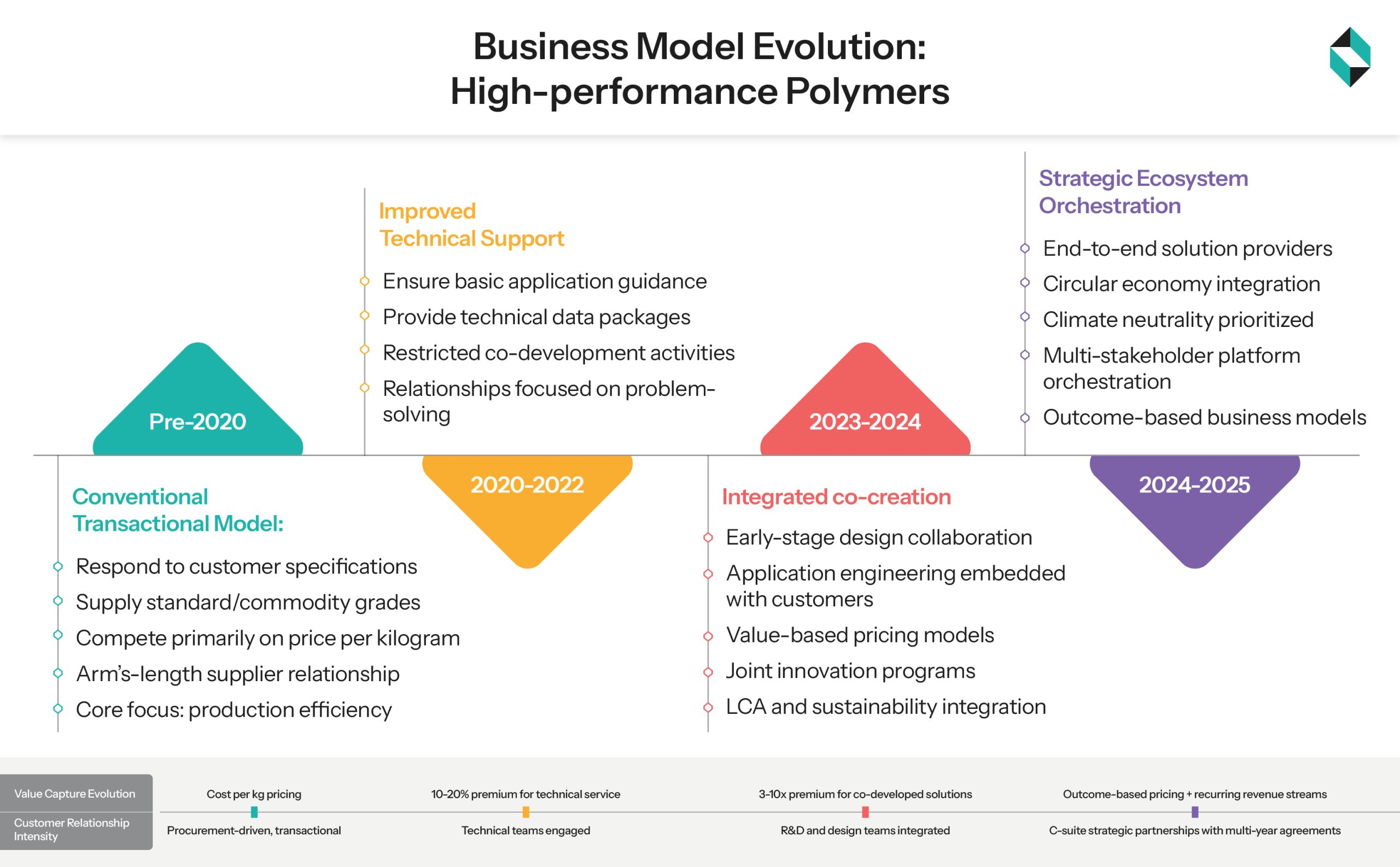

Transforming Business Models from Transactions to Co-creation Engines

The engagement levels between polymer manufacturers and customers are evolving through integrated partnerships where material science is defining product designs right from conception. The best example is again set by BASF with its e-motor development program. Its co-creation partnerships span design expertise, material selection, ultrasim simulations, and much more. The USP of this new model lies in Covestro’s stated vision of achieving complete circularity across all polymer segments. They explicitly plan to neutralize their Scope 1 & 2 emissions by 2035 and Scope 3 emissions by 2050.

Is that all?

The sustainability imperative of HPPs is compelling OEMs to acknowledge that customer adoption for lightweight polymers goes beyond material availability. As they restructure their distribution frameworks with a specific focus on technical capability and application support, strategic partnerships answer several key questions related to scaling customer adoption. Covestro’s distribution partnership with PolySource to secure its polycarbonate portfolio sets a benchmark for the course to be followed in this context.

All in all, these strategic responses demonstrate the growing acknowledgement among chemical industry leaders of the distinct competitive edge offered by HPPs and how it requires fundamentally different capabilities than commodity chemical production.

High Performance Polymers Market Segmentation

The global high-performance polymers market stood at $38.23 billion in 2024 and is expected to reach $65.2 billion by 2035 at a CAGR of 4.98%. However, the growth will not be evenly structured across the landscape. For now, the highest demand for lightweighting solutions is driven by the automotive and aerospace segments. Fluoropolymers currently hold ~30% of this market, and their dominance will persist due to their low friction, high thermal stability, and lightweight properties. But the most substantial growth is to be witnessed in liquid crystal polymers due to 5G deployment and IoT expansion. Most importantly, this segment intersects lightweighting with specific performance requisites and promises premium growth opportunities.

In our recent engagements, we conducted an in-depth player landscape analysis of the high-performance polymers sector, helping clients navigate evolving market shifts.

The Bottomline

The growing pressures and emerging opportunities present industry participants with a rapidly narrowing window. While the long-term growth trajectory of lightweighting is inevitable, the next 2 years will be decisive in segmenting value creators from marginalized players. From a strategic to financial perspective, lightweighting presents an early commitment that promises to yield lasting advantage.

Even from a technical perspective, the capabilities requisites are paving the way for natural partnerships. But the biggest question is, how prepared is your organization to leverage this growth opportunity?

Stellarix’s chemical consulting team is helping market players capitalize on decisive shifts in this industry. Our actionable intelligence and strategic blueprints are helping companies:

- Identify the most ROI-promising applications for their polymer portfolios

- Quantify the true value generation capabilities through lightweighting

- Navigate the evolving market, customer, and regulatory pressures across promising geographies

- Develop a balanced circularity strategy that caters to both investors and customer demands

Looking to move from strategic response to market leadership? Schedule a consultation today.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.