Trump’s Pharma Tariffs: Risks, Impact & Strategy

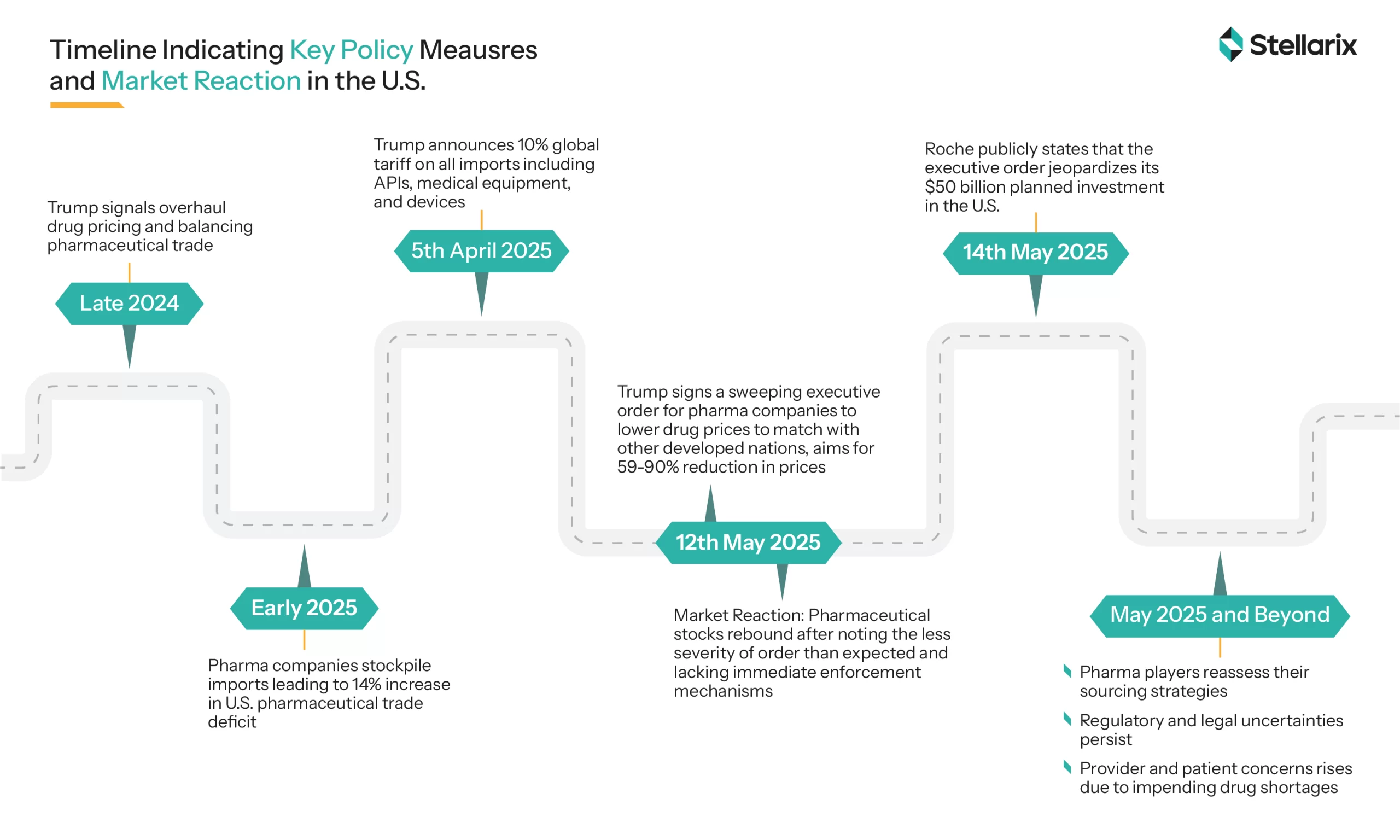

This is not a recent development; it started with the end of Trump’s first term. During the last quarter, executive orders were issued to cut down the costs of medicines. However, the federal court dismissed the motion, citing that this motion didn’t involve public opinion. The Biden administration also attempted it with the IRA when Medicare started negotiating prices for the first time.

Now, with the newly announced tariffs on pharmaceuticals, there is a big debate about their impact on the pharmaceutical industry and what kind of disruptions it will bring to the ecosystem.

In this write-up, we will explore the reasons, the effect, and what strategic course could help companies navigate the complexities of this development.

Story Behind Surging US Tariffs on Pharmaceuticals

Unlike other nations, the US healthcare system is a maze of multilayered frameworks. It comprises insurance, hospitals, employer subsidies, and publicly funded insurance plans for the elderly (Medicare) and lower-income citizens (Medicaid). It is a decentralized system where officials cannot negotiate blanket prices for particular drugs, and they have no authority to deny overpriced products.

A comparison made in 2021 with Canadian, Australian, and European nations revealed that US prescription drugs are two to four times costlier than their international counterparts.

Furthermore, the US lobby group PhRMA (Pharmaceutical Research and Manufacturers of America) asserts that the US healthcare system is the only one in the world that allows insurers, hospitals, and pharmacy benefit managers (PBMs) to take away 50% of every dollar spent on medicines. Most of this 50% is earned by intermediaries, who raise prices to an exorbitant level for consumers.

How the New Tariff Scheme Works and Will it Hurt Big Pharma Companies?

Under the new initiative, the health secretary, Robert Kennedy, has been given directives to convey the price targets to the pharmaceutical industry and initiate official dialogue for price reduction from current levels. In the event that negotiations stall, the health secretary has the authority to implement a drug pricing model similar to the “most favored nation” approach, thereby bringing US prices to a level comparable to the lowest prices paid by wealthy nations worldwide. It is said that prices will be reduced by 59-90% after that.

This move is more substantial because it includes Medicare, Medicaid, and private medical insurance in the scheme. The word is also around that this reduction will also be applied to GLP-1 drugs like Ozempic and Wegovy, but confirmation on that is still awaited.

For all its worth, it is a welcome move for patients with access to lower-priced drugs now. Nevertheless, as for hurting, big pharma companies could face up to a 10% drop in profits. The worst US hits include Pfizer and Bristol Myers Squibb while Europe’s Novo Nordisk and AstraZeneca would also take the blow.

Global Impact of US Tariffs on Pharmaceuticals

Although the US tariffs have a drastic impact on all global industries, the revival of taxes on pharmaceutical companies stands out as it is said to be the strongest lobby. Still, the Trump administration is in no mood to subsidize foreign healthcare. Here is a summary of all that the tariff on pharmaceuticals entails:

Manufacturing Disruptions and Supply Chain Descripencies

- Approx. 70% of APIs (active pharmaceutical ingredients) used in the US pharmaceutical industry are imported. The 10% baseline tariff on all imports and 25% duties on smaller nations, such as Ireland, endanger the import model. Ireland is home to crucial drugs like GLP-1 medications, and it exported $127 billion in pharmaceuticals to the US last year, which helped generate $91.5 billion in revenue. Pre-tariff stockpiling led to a 14% trade deficit for the US by the first quarter of 2025, as major players like Johnson & Johnson and Pfizer rushed to avoid impending duties.

- The tariffs are also placing an additional strain on manufacturing systems. For instance, misclassifying goods under the Harmonized Tariff Schedule indicates penalties exceeding approx. 25% of total shipment values for pharma players.

- Lastly, the claims that with this move, the government aims to bring production back to the US stand strongly contradicted by the fact that shifting production to the United States will need a minimum of 3-5 years, leading to short-term shortages. Further, the tariffs on raw materials like steel will additionally inflate upfront costs for domestic drug manufacturing.

Financial and Strategic Impact

- The cost escalations are anticipated to be huge, which may lead some leading market players into an economic crisis. For instance, Johnson & Johnson estimates a tariff expense of $400 million in 2025. For small firms, it means an existential crisis straight away. Similarly, companies like Eli Lily have paused their R&D initiatives to adjust costs, which implies its long-term effect on innovation.

- The announcement also impacted the stock markets and initially brought a steep fall in pharma stock. Though the numbers are picking up, analysts still fear wide skepticism among investors.

- The projects Novo Nordisk, Pfizer, and Lily announced to align with Trump’s ‘America First’ movement are still years away from completion, meaning the domestic manufacturing pledges might be stranded due to high costs.

Patients and End-Users

- Despite Trump’s claims of a 59-90% reduction in drug prices and alignment with lower international pricing benchmarks, market experts find these figures unrealistic and with several legal barriers.

- On the other hand, lower list prices could help more than 75% of Americans who struggle for drug access regularly.

- Additionally, tariff-driven costs may be passed on to patients if drugmakers decide to raise prices domestically or abroad.

- The stockpiling of essentials by pharma companies might smooth the supply chain. Still, in the long run, it may disrupt market access to biologics and generics that heavily rely on imported APIs.

Policy and Legal Complexities

- The implementation guidelines of the executive order still lack clarity, and there is a valid chance that courts may block this move completely, just like in 2020. Also, the 90-day tariff freeze provides temporary solutions but may negatively impact long-term plans.

- Pharma lobbyists strongly feel that these tariffs will slow down innovation, and there are already other policies like IRA in place to address excessive drug prices.

- Lastly, Section 232 investigations into drug imports’ implications on national security indicate escalated trade tensions in the near future.

Strategic Roadmap: How Pharma Can Navigate the Tariff Turmoil

Supply Chain Resilience and Diversification

Manufacturers must work to reduce their over-reliance on China and seek new partnerships with other API suppliers located in Latin America, Eastern Europe, and Southeast Asia. Long-term contracts and joint collaborations with existing suppliers could also help in quality assurance and prioritizing access during market shortages.

Investment in Domestic Manufacturing

Companies must work to accelerate U.S.-based generic and API-based drug manufacturing. The government must extend federal grants and state-level tax benefits for companies pursuing domestic pharma projects.

Logistics and Inventory Optimization

Buffer stockpiling of APIs for the next 6-12 months will help maintain production levels of high-risk drugs. For instance, Moderna has already stockpiled mRNA vaccine components for the next year. For time-sensitive biologics, using air freights and finding nearshoring packaging alternatives will help in optimizing logistics.

Policy Advocacy and Regulatory Compliance

Collaborations with leading lobbies like PhRMA will secure temporary exemptions for essential medicines like pediatric cancer drugs or tariff waivers for essential components. Also, it is high time to integrate AI-based regtech compliance tools to track evolving regulatory frameworks and prevent penalties.

Contract Renegotiation

Shift agreements with stakeholders who can share tariff-based costs will ensure margin stability.

The Bottomline

While the tariffs are being publicized as a tool to help common people, the legal ambiguity and procedural loopholes in their implementation reflect ambiguity. Moreover, the pharmaceutical lobby is a strong pillar of the US administration, which implies they will push back strongly or find more ways to offset the rising costs that the patients may have to bear in some way in the near future. For companies, it is a multi-challenge prong that they may turn into opportunities with strategic portfolio diversification, investment in domestic capabilities, and better engagement with policymakers. As the tariff framework evolves, strategic capabilities and thinking will distinguish resilient players from unprepared ones.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.