Medical Devices Industry: Emerging Commercialization

The prolific digital transformation has made doctors’ tasks twofold: to improve health outcomes & to be mindful of patients’ perceptions of care. Moreover, connected medical devices (MD) ease monitoring and managing patient health vitals at home and improve long-term non-acute care.

As per UN statistics, chronic and non-communicable diseases (NCD) cause 75% of worldwide deaths (2022) and will claim 86% of all 90 million mortalities annually by 2050. Moreover, using AI-based medical devices and continuously monitoring health unfailingly can alleviate the substantial economic burden of lifestyle diseases. In addition, artificial implants, 3D imaging, MD as software, and improved/new MD are argumentatively changing the face of the present healthcare system.

Defining Medical Devices & Approval Bodies

Medical devices are instruments and equipment for specific medical purposes such as disease or condition diagnosis, cure, prevention, treatment, monitoring, palliation, and rehabilitation. The FDA explains an MD as an apparatus, machine, contrivance, implant, or in-vitro diagnostics (IVD) intended to manage healthcare and affect the structure or function of the body of a man or animal. MD differs from medicinal products in that they do not require or involve any chemical action within or outside the body to achieve their primary intended purpose.

Development, production, and commercialization of MD are critical per the risk-based classification system:

- Class I, which poses low individual/public risk

- Class II, which poses a moderate individual/public risk

- Class III & Class IV, where IV poses a high risk of serious health consequences to the individual and public life in case of medical device malfunction

The design control and clearance of all regulatory requirements are crucial in launching any medical device. Various bodies approve medical equipment according to its country of origin. In the US, the Food, Drug, and Cosmetic Act regulates medical devices; in the European Union (EU), they must comply with the EU Medical Devices Regulations and carry the CE marking.

The Ministry of Health, Labor, and Welfare (MHLW) regulates medical devices in Japan, while the Therapeutic Goods Administration (TGA) oversees medical device regulations in Australia. The National Medical Product Administration (NMPA) in China regulates medical devices. In Israel, it is the Israeli Ministry of Health’s medical device regulation unit (AMAR) and the Central Drugs Standard Control Organization (CDSCO) in India that regulate medical devices.

Introducing New Medical Devices In The Market

The global medical device market is projected to reach $471.80 billion by the end of 2023 and grow at a CAGR of 5.26% from 2023 to 2028.

As per WHO, around 2 million medical devices are estimated to be available worldwide and categorized into 7000 generic groups. For regulation purposes, one begins with generic device grouping, where Medical OEM groups medical devices (MD) based on similar intended use and technological similarities without looking into special features. It then establishes the devices’ risk range/classification depending on the possible complications from device usage. The development team then deciphers the Medical Device Nomenclature System/Category (UMDNS) and computer codes for the product.

Anyone can undertake the manufacturing of medical devices, whether they are from the medical industry or not. One can build their own medical device if someone has found unique research/findings pertaining to a specific medical problem. End-users of medical equipment who think of substantially improving a particular medical product offering can also manufacture medical instruments. The complete process is divided into stages:

- Initial prototyping

- Setting up the resources/development team, R&D, and technical documentation

- Product development

- Assessment by national or local committees

Finally, after all evaluation, the manufacturer gets an FDA registered label/FDA cleared label/FDA approved label or De Novo application grant for their product. An essential aspect of the commercialization process in the US is to get approval on the ‘reimbursement fee’ for the medical device by payers based on fair market value and resultant healthcare clinical improvement and outcomes. With an increased trend towards outpatient care given in ambulatory service centers (ASCs) and office-based labs (OBL), the US’s Medicare & Medicaid Services (CMS) has added more surgical procedures to the covered procedure list (ASC CPL). Not just this, CMS also plans to phase out its inpatient-only list entirely by 2024.

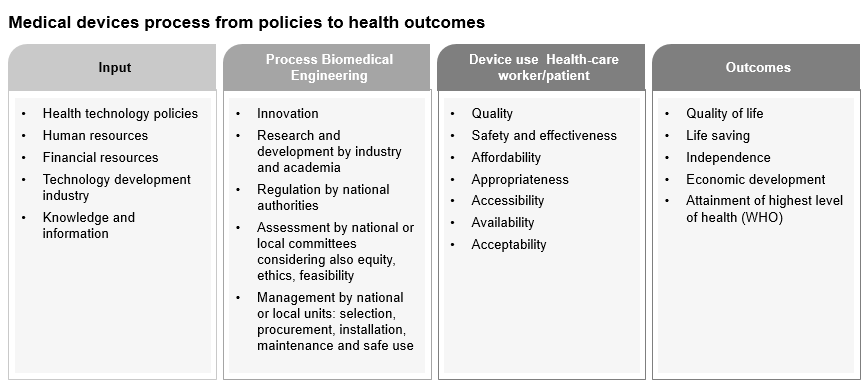

Biomedical Engineers And Dynamic Synthesis

To develop devices, the medical team and biomedical engineers work together to integrate mathematics, engineering, biology, and life sciences principles to develop health devices. After building the medical device, it needs integration at healthcare providers’ clinics or doctors’ clinics, or with end-users. Once the device enters the market, biomedical engineers must work out marketing, contracting, supply chain management, IT integration, service strategy, project management, training, tech management, risk management, and quality/safety management.

After the precursor model plan, technical testing, safety tests, clinical trials/ simulations, and regulatory review, the biomedical engineer becomes confident of the medical device’s biological and technical efficacy. Post-market launch, biomedical engineers conduct pivotal extensive studies of the medical device in question to further confirm its clinical efficacy.

As part of the post-market surveillance, they monitor the long-term effectiveness and safety of the user base’s usage. This increases the manufacturer’s responsibility and provides quality assurance of medical instruments in the market. It is necessary to receive the International Organization for Standardization (ISO) for medical devices.

Trends & Phenomenons Of The Medical Device Industry

The medical device industry is seeing massive traction in AI-infused devices, additive printing, Internet of Medical Things (IoMT), remote patient monitoring (RPM), AR/VR use & clinical automation systems. The path-breakers in the field include the first remote surgery using 5G technology, portable oxygen concentrators (POC), cloud-connected medical devices, and portable DNA sequencing devices. The Medical fraternity and patients benefit greatly from these innovations and developments with each passing day.

MedTech-inspired wearable medical devices with biosensors and fabrics with integrated electrocardiogram (ECG) sensors, such as sports shapewear, electroencephalogram (EEG), and electromyography (EMG) sensors in compressor garments to measure various biopotentials, are now available in the market, made of advanced soft materials.

Emerging medical mobile apps assist doctors in screening and detecting skin lesions and cancers in the general population. 3D-printed dental implants bring CAD/CAM image design creation and surgical guides. The accuracy and precision of 3D-printed surgical guides and implants are enhancing the dentistry profession. AI-based clear assaying of Coronary computed tomography angiography (CCTA) allows physicians to identify atherosclerosis (plaque) build-up in arteries, leading to improved outcomes in heart care.

FDA-Approved Medical Devices

New & Emerging Medical Devices Approved By FDA Till July 2023

- Twenty-three medical products/lab tests have been FDA-approved/cleared by June 2023.

- Abbott Medical built the sensor-based TactiFlex Ablation Catheter, which is approved for use for people with atrial fibrillation episodes lasting less than seven days and where the same is not getting treated with medicine.

- Biotronik Nro. Inc. has received FDA approval for the Prospera Spinal Cord Stimulation (SCS) System for treating intractable low back pain/leg pain. The patient or the provider manages it remotely using a remote control.

Emerging Medical Devices Approved By FDA In 2022

- In 2022, 41 medical devices received ‘cleared’ or ‘approved’ certificates by FDA. One of the products approved was Eversense E3 Continuous Glucose Monitoring System (CGM) developed by Senseonics, Inc. Also, the Eversense E3 system uses a sensor implanted under the skin, which can be worn for over 180 days. The transmitter, worn outside the body, relays real-time blood sugar (glucose) levels to a connected mobile device app every 5 minutes via Bluetooth.

- General Electric Company owned Datex-Ohmeda, Inc. and created the Et Control Medical device as software. Users must use the Et Control software feature with the Aisys CS2 anesthesia system. Et Control helps maintain exhaled oxygen levels and the quantity of suitable anesthetic gas to minimize pain. Further, this helps maintain the anesthesia flow and decreases the providers’ GHG and workload.

New And Emerging Medical Devices Approved By FDA In 2021

- The FDA further regulated 27 new MDs in 2021.

- Delphinus Medical Technologies, Inc. has developed the SoftVue System, an automated whole breast ultrasound system. For patients who show no signs of breast cancer and have dense breast tissue, it aims to detect the possibility.

- ConMed Corporation built ConMed PadPro Multifunction Electrodes (MFEs) and ConMed PadPro. Additionally, a compatible defibrillator attaches the ConMed PadPro’s MFEs, a set of sensors. The electrode measures the electric signal coming from the heart and sends the same to a defibrillator. In case of an irregular heartbeat, the attached defibrillator delivers a shock to restore a normal heartbeat.

- The FDA approved another medical device, the Deep Brain Stimulation (DBS) system. Boston Scientific Corporation designed this system as an additional therapy to reduce tremors or Parkinsonian tremors.

Conclusion

Medical devices have seen extensive utilization, from general-use items like everyday spectacles and band-aids to class III category products such as heart, spine, or shoulder implants. Moreover, medical professionals view artificial intelligence as a valuable addition to MedTech, as it builds instruments that are clinically error-proof. FDA has also set up the Digital Health Centre of Excellence, focusing on gauzing AI/ML Software as a medical device (SaMD) ‘s real-world performance (RWP).

The 3D printing MD market is projected to grow to $5.9 billion by 2030 and Medical AI to USD 35 458.2 million by 2032, as per Stellarix’s analysis. A connected MD can give a timely clarion call for further medical examination, thus assisting in preventing premature mortalities. Additionally, vigorously developed and approved robotic surgeries, wearable tech, and 3D-printed implants will also change the face of healthcare.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.