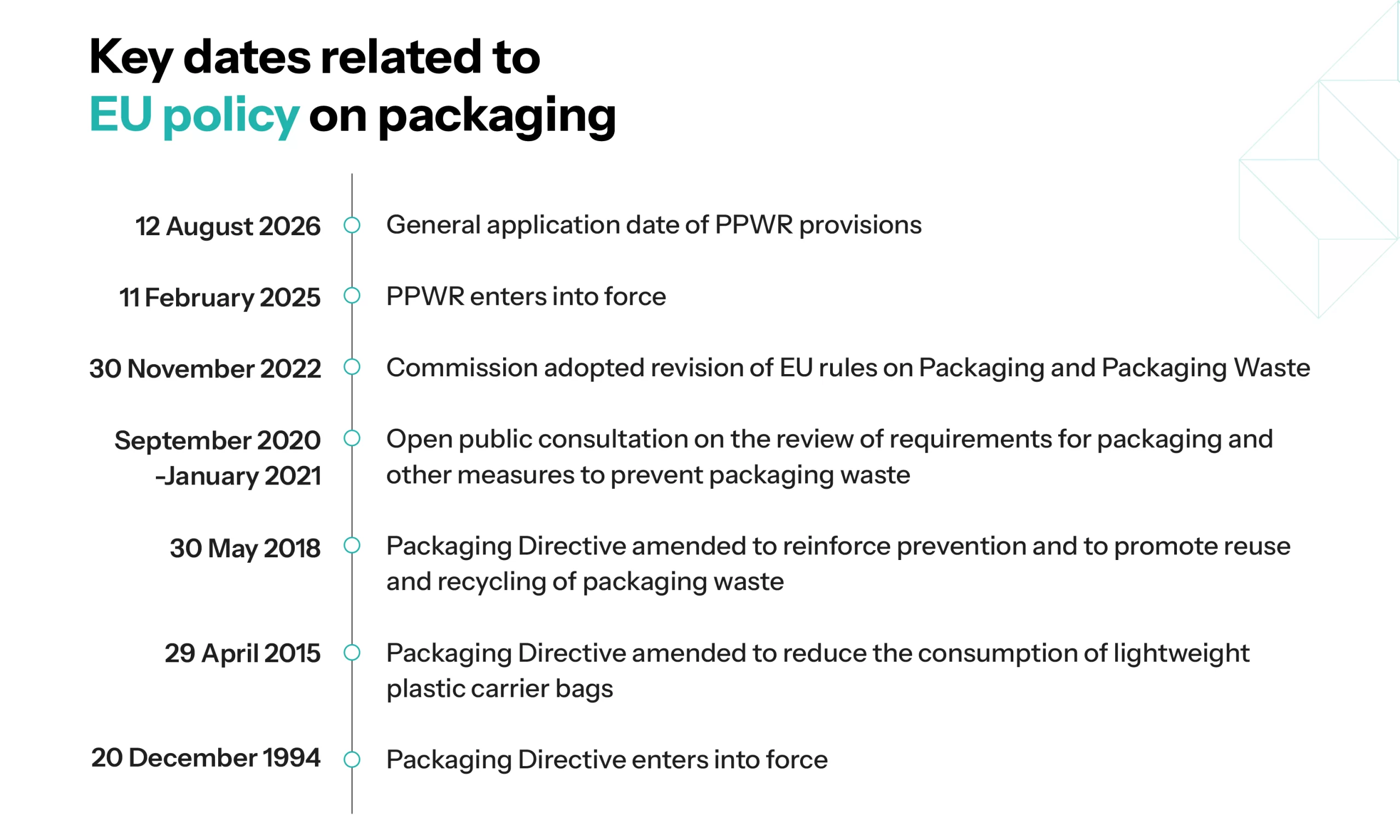

Impact of PPWR Regulations in the Packaging Industry

The packaging industry is witnessing an overhaul with PPWR (packaging and packaging waste regulation, which) is ready to be implemented by 2025-26 across the European Union. It is expected that companies established and operating in the region will face implications, specifically those selling packaged goods, productions, and imports. The aim of the regulation is to diminish the impact the environment is bearing following exposure to packaging. Also, it can empower the reusing and recycling rates to align with different industries, enveloping the EU’s goals for the circular economy.

The blog explores the anticipated or plausible impact that PPWR can cause in 2025-26 and beyond, aiming at areas like market dynamics, compliances, innovation, sustainability, and costs.

Increased Compliance and Reporting Requirements

The year 2025-26 can face heightened regulatory compliances related to waste management, reporting, and packaging design. The areas to be impacted include:

- Extended Producer Responsibility (EPR): Following the implementation, brands or companies will need to be involved in EPR schemes, which may include financial contributions and commitments to the disposal, recycling, and collection of packaging waste. Moreover, startups and established businesses may have to offer detailed data on the type, amount, and recyclability of packaging they invest in the market. In all probability, it may involve exceeded convoluted reporting systems and increased administrative costs.

- Packaging Design Regulations: Businesses and companies may have to redesign their packaging style to meet reuse and recyclability targets. Notably, PPWR mandates that packaging should be designed to minimize waste and use recyclable, reusable, or compostable materials. From 2025-26 onwards, companies will be liable to comply with stringent rules on packaging sizes and material types, requiring changes in production processes.

- Recycling and Recovery Targets: Specific recycling and recovery targets are set to flourish for different types of packaging, including plastics, paper, metals, etc. Moreover, companies may need to provide evidence of meeting these targets through the amount of packaging they recycle or recover. Also, non-compliance may invite increased fees or penalties.

Anticipated Impact of PPWR Regulations

- Increased Costs Packaging Redesign: Companies will need to invest in redesigning packaging to align with the strict PPWR material reduction targets and recyclability. It may see high costs for new packaging materials testing, development, and research.

- Sourcing Sustainable Materials: Businesses or companies may see a rise in procurement costs following the requirement to shift toward bio-based materials, precisely for industries relying on less and cheaper sustainable packaging options.

- Technological Investments: Industries will have to make investments in innovative technologies to improve recycling, enhance packaging circularity, and attain EPR needs, resulting in huge capital expenditures.

- Supply Chain Disruptions: The disruption of the existing supply chain is inevitable following the transition to sustainable packaging materials. Companies are bound to search for new suppliers that can fulfill sustainability standards and adjust production processes to get materials. However, it can lead to delays in supply and hiked costs.

Compliance Complexity

The PPWR introduces a range of complex requirements related to packaging design, waste management, and recycling targets. Companies will need to navigate the intricacies of these obligations, which may vary by country, material type, and packaging category. Managing these obligations, as well as the associated reporting and data collection requirements, will be resource-intensive.

Innovation Pressure

To meet the PPWR’s demanding standards, companies will be under pressure to innovate in packaging design. They will need to find new solutions that meet environmental criteria without compromising product quality, cost-effectiveness, and consumer appeal. The challenge will be balancing sustainability with market demands for convenience, durability, and aesthetic appeal.

Opportunities

1. Enhanced Brand Reputation

- Sustainability as a Differentiator: Businesses and companies that proactively adapt the PPWR and align with its regulations will have an opportunity to expand their brand reputation. Noticeably, consumers are increasingly buying products based on sustainability and businesses that exhibit a commitment to salvage the environment. Thus, companies may attract eco-conscious consumers by following the PPWR way in advance.

- Transparency and Trust: Companies can make fortunes by communicating their alliance for sustainability and alignment with PPWR. It can help them gain the trust of their targeted customers and an opportunity to create a loyal consumer base.

2. Innovation and Differentiation

- The PPWR can trigger packaging innovation. Industries or companies that invest in research and development can offer cutting-edge packaging solutions, including biodegradable plastics, multi-use packaging, and recyclable materials. This can help them stand out in the market and differentiate themselves from the competition.

- Circular Economy Models: Businesses can significantly minimize environmental impact while reducing waste. They have opportunities to explore closed-loop systems, where packaging can be recycled and or reused in-house, reducing waste and minimizing environmental impact.

3. Cost Savings in the Long Term

- Following PPWR can initially be costly for industries. However, in the long term, businesses that invest in more sustainable packaging solutions can save a lot of money. For example, minimizing packaging weight and enhancing recyclability can lower waste disposal costs. Also, using recycled materials could diminish dependency on virgin resources.

- Efficiency Gains: Overall resource efficiency, enhanced recyclability, and waste reduction can be heightened by streamlining packaging, leading to potential cost savings and efficiency gains.

4. New Market Opportunities

- The increasing demand for sustainable products is already opening new markets for companies, and PPWR has catalyzed and made the process swift, enhancing industries’ ability to meet these requirements. Businesses that are willing to offer recyclable, reusable, or made-from-recycled content packaging can appeal to the burgeoning number of eco-conscious consumers.

- The rise of eco-labeled products will also create new opportunities for companies to access premium markets, where sustainability is a key purchasing criterion.

Industry-Specific Impacts

1. Fast-Moving Consumer Goods (FMCG)

- One sector that may have a major impact due to the implementation of PPWR is FMCG because it produces large volumes of packaging. Companies manufacturing or working in the segment will be liable for reducing packaging weight and volume, easing recycled content use, and enhancing packaging recyclability.

- In all likelihood, companies will be required to develop a framework for more sustainable packaging alternatives for products, including cosmetics, personal care items, and household goods, mostly packaged in plastic bottles and containers.

2. E-commerce

- The online market is at an all-time high and growing rapidly worldwide. So, e-commerce companies will have to tighten their focus on making their packaging for delivery more sustainable through optimization. They may have to reduce or diminish dependency on single-use plastics, minimize packaging material, and ensure that packaging material is recyclable.

- Big players in e-commerce will need to find novel ways to balance product protection while ensuring sustainability during delivery. They’ll be required to have eco-friendly packaging and be functional for shipping.

3. Food and Beverage

- The PPWR poses an altogether different challenge for the food and beverage industry, following concerns about shelf life, food safety, and hygiene. Companies will be required to find sustainable packaging solutions that align with the PPWR’s mandates for recycled content while ensuring that the packaging offers product quality and freshness.

- Materials like biodegradable or compostable may find more acceptance in applications as businesses are forced to innovate packaging. Moreover, businesses will need to explore alternative packaging that offers a balance of sustainability and safety.

4. Retail and Consumer Electronics

- Electronics and retailer segments often use plastic packaging. Thus, they will need spring-in innovations to create sustainable packaging to address waste generated by electronic packaging. Moreover, businesses manufacturing or selling retail and consumer electronics will need to reduce the overall, improve recyclability, and packaging footprint, and consider options like minimalistic design and modular packaging.

Impact on Smaller Businesses and SMEs

Due to limited capacity and resources, SMEs (small and medium-sized enterprises) are susceptible to facing peculiar challenges while adapting to PPWR.

- Financial Burden: SMEs may have to deal with significant financial issues, including the initial compliance cost, such as paying for EPR schemes, redesigning packaging, and meeting reporting requirements. This can be a burden, especially for those who do not have enough resources to invest in sustainable packaging solutions.

- Adaptation Support: SMEs that can innovate and assimilate sustainable packaging solutions in the early stages are more likely to benefit from brand differentiation. They can attract environmentally conscious customers who prefer to buy from smaller, responsible brands.

Companies Successfully Adapting to PPWR Regulations

Several companies have already begun adapting to the PPWR regulations and other similar sustainability initiatives. Here are a few examples:

Case Study 1: Unilever

Unilever, a global consumer goods company, has been working towards sustainability for years and has already made significant strides in adapting to packaging regulations like the PPWR. Unilever has also invested in innovative packaging materials, including biodegradable plastics and recycled content.

They have set the following targets:

- Reduce Virgin Plastic Use: 30% by 2026, 40% by 2028, Focus on using recycled plastic, lighter packaging, and alternative materials.

- Ensure 100% Recyclable, Reusable, or Compostable Packaging:

- Rigid plastic: 2030

- Flexible plastic: 2035

- Rigid Plastic (70% of the portfolio by weight): 87% are designed for recycling, with a focus on challenging components (caps, actuators, pumps).

- Flexible Plastics (e.g., sachets): Developing alternative materials and technologies for recycling.

- Use 25% recycled plastic in packaging by 2025.

- Collect and process more plastic packaging than sold by 2025.

- Goals integrated into business group targets and plans.

Case Study 2: Coca-Cola

Coca-Cola has worked extensively to reduce its packaging footprint, aligning its practices with circular economy principles.

Recyclable Packaging: Over 95% of primary consumer packaging is designed for recycling, working to resolve the rest.

- Focus Areas (by 2035): Improve water security in high-risk areas, reduce packaging waste, and decrease emissions.

- Recycled Content Goals: 35-40% recycled material in primary packaging, with 30-35% recycled plastic globally.

- Bottle and Can Collection Goal: Ensure 70-75% of bottles/cans introduced are collected annually.

- Emissions Reduction: Target to reduce Scope 1, 2, and 3 emissions to align with a 1.5°C trajectory by 2035 (from 2019 baseline).

Case Study 3: Nestlé

Nestlé is another major company that has made significant progress in adapting to packaging regulations. It aims to reduce its use of virgin plastics and increase the recyclability of its packaging. Nestlé has also made efforts to collaborate with local governments and other stakeholders to improve recycling infrastructure.

- Reduce Packaging Material Use: Cut virgin plastic by a third by 2025.

- Plastic Packaging Recycling: 83.5% designed for recycling by the end of 2023, aiming for over 95% by 2025, with a commitment to 100%.

- Compliance with Waste Management Laws: Follow EPR & DRS regulations in all countries where applicable.

- EPR Legislation: Active in ~80 countries by 2024, with 45 more pending approval.

These examples show how leading companies are not only meeting PPWR compliance but are also turning sustainability into a business advantage by innovating in packaging design, reducing waste, and creating new opportunities for growth.

Conclusion

The landscape of companies worldwide and various industries are set to reshape, with PPWR being executed in 2025-26. Moreover, challenges will emerge following the introduction of regulation compliance complexity, supply chain management, and, more importantly, cost. However, businesses and brands that adopt the regulations early can see PPWR enacting as a robust driver of cost savings and brand differentiation. They can also position themselves as long-term success and seek new market opportunities in a circular economy.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.