High-Protein Blends & Prebiotic Sodas: Future Trends in Functional Beverages

Functional beverages promise more than just energy and hydration, offering gut health benefits, relaxation, and workout support. This signals a growing shift in consumer demand for health-focused benefits from industry players’ product offerings. The global functional food and beverage segment is valued at more than $281bn with a forecast exceeding half a trillion by 2028.

Gen Z and millennials are significantly contributing to the rise in high-protein blends and prebiotic soda consumption. The functional beverages market spans from energy and sports beverages, prebiotic sodas, and high-protein plant-based options. The question now is how to optimally position your product portfolio to maximize margin and market share while ensuring a competitive edge.

For future-focused companies, the functional category presents an attractive opportunity and catalyzes growth by highlighting products that combine holistic wellness with nutritional effectiveness. This blog explores how high-protein blends and prebiotic sodas are shaping the functional beverages segment, promising trends, challenges, business priorities, and growth opportunities.

What Trends are Reshaping the Business Growth of the Functional Beverage Market?

The US protein market is valued at approximately $116.57 billion, with high-protein beverages gaining popularity in this segment, which is projected to grow annually by 1.9% until 2028.

Further, the rapid growth of prebiotic soda is boosted by PepsiCo’s acquisition of Poppi for $1.95 billion and the launch of Simply Pop by Coca-Cola, underscoring the F&B industry’s focus on gut health. Moreover, the beverage industry players need to capitalize on opportunities and accelerate business growth.

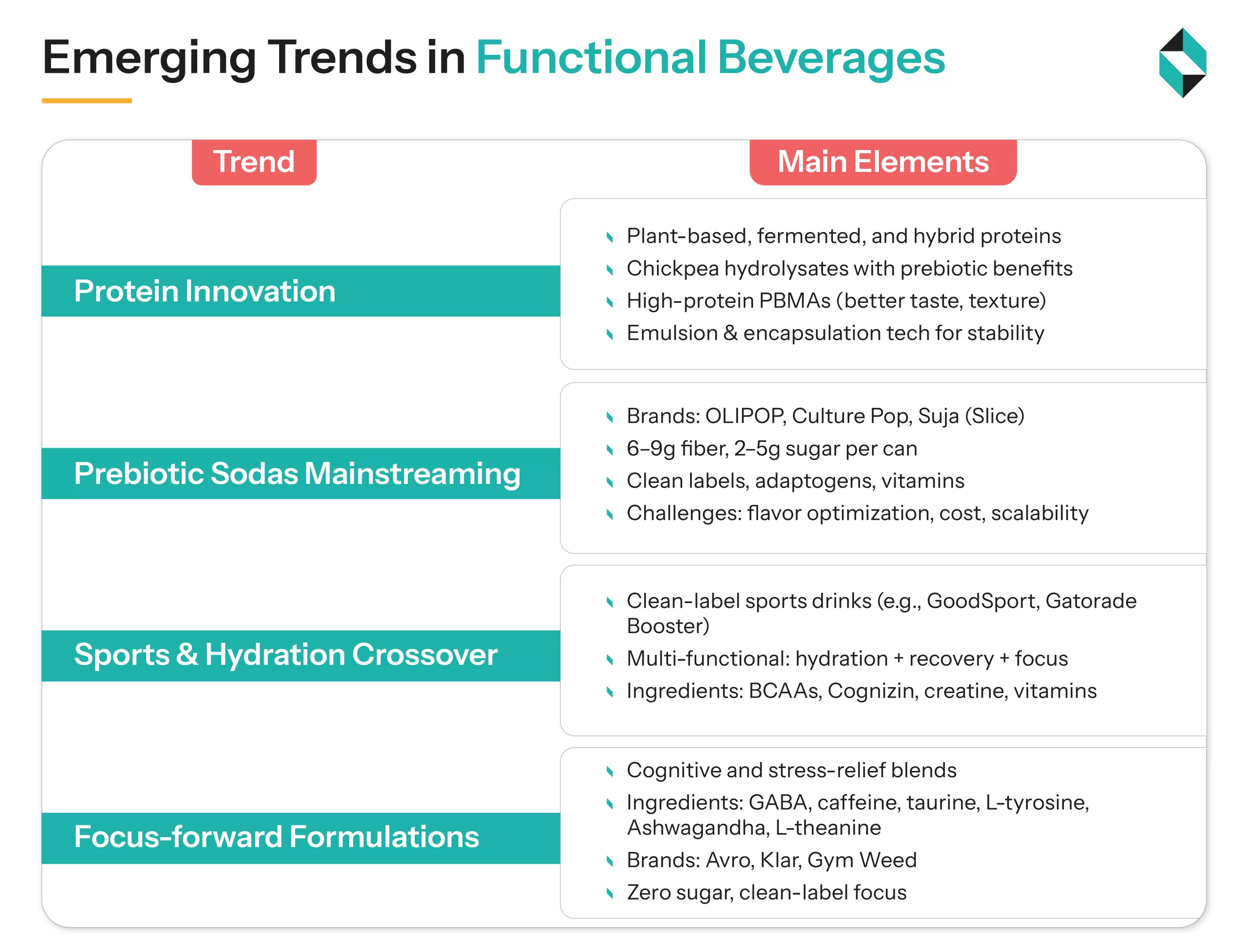

Protein Innovation: Plant-Based, Fermented, and Hybrid

- Leading players are shifting towards protein-infused beverages rather than just soy isolate and whey-based drinks, aiming for a multi-benefit appeal.

- Fermented proteins with improved digestibility and probiotic synergy are becoming a significant part of functional beverages, enhancing consumer adherence.

- Hybrid blends that combine whey with prebiotic fibers and legume proteins, such as chickpea hydrolysates, support gut health. Here, the richness of amino acids and prebiotic functionality allows for cross-category positioning for brands. Furthermore, hybrid blends help businesses reduce formulation costs and adopt a premium pricing strategy.

- Using chickpea protein hydrolysate ingredients offers strategic benefits by meeting clean-label demands, supporting gut health, and reducing the need for additional fortification.

- Therefore, it is essential to invest in emulsion systems and encapsulation to improve ingredient stability and bioavailability. Additionally, these technologies enable R&D teams to develop shelf-stable and effective protein formulations, increasing the utility and benefits of functional beverages, which are major factors in encouraging repeat purchases and securing retail placement.

- Moreover, the sector is advancing with high-protein PBMAs (plant-based milk alternatives) that promise better taste, enhanced nutrition, and improved texture without excessive fortification. These formulations highlight an appealing opportunity to attract health-conscious, flexitarian consumers seeking functional beverages.

Prebiotic Sodas Being Mainstreamed from the Niche

- From niche product to wellness staple, prebiotic sodas offer a strategic opportunity to capitalize on high-margin growth in the carbonated beverage market.

- Brands like OLIPOP and Culture Pop increased the accessibility and appeal of drinks that support gut health, offering 6–9g of fiber per can with minimal sugar (2–5g). Overall, these brands demonstrate a successful approach by attracting high-value demographics.

- These brands focus on clean labels and transparent ingredients, making prebiotic sodas appealing to young consumers while adding functional blends with vitamins, botanicals, and adaptogens.

- Furthermore, Suja, a well-known brand, incorporated the benefits of green juices into a functional offering while launching a Slice soda (reintroduced as a prebiotic sparkling alternative).

- Nonetheless, investments in quality formulation, flavor enhancement, and taste optimization are creating obstacles for further progress and large-scale commercialization of prebiotic soda. These challenges pose formulation and operational difficulties for brands trying to compete.

Crossover with Sports & Hydration Combined Accompanying Clean Label

- With the sports drinks sector forecasted to grow at approximately 5.39% CAGR from 2025 to 2030, F&B players offer functional beverages for sports recovery.

- The trend towards clean labels is also apparent in the sports drink segment, as Chicago-based GoodSport uses 100% naturally sourced ingredients to meet and capitalize on clean-label demand. In addition, the Hydration Booster powder from Gatorade and the focus-forward energy blend exemplify this convergence of cognitive performance and hydration.

- Athletes now require multipurpose drinks that promote hydration and recovery while boosting mental performance.

- Businesses use functional ingredients such as Cognizin, BCAAs, creatine, and vitamin blends to boost mental energy, attention, and focus, capturing market share from the emerging cognitive sports drink segment.

Focus-forward Formulations

- Functional drinks that improve cognitive performance and productivity while enhancing focus are gaining traction amid escalating demand for gut-health beverages.

- Such focus-forward formulations promote mental clarity, aid in stress management, and provide sustained energy for work, exercise, or study.

- Emerging products like Avro Intelligent Hydration utilize GABA in powdered formats to address stress and concentration issues without the typical stimulant crash, paving the way for other brands to develop next-gen formulations.

- Klar Energy and Hydration integrates 150mg of caffeine with taurine, L-tyrosine, and electrolytes, ensuring performance efficacy with a clean-label, zero-sugar formulation. Meanwhile, Gym Weed’s rebrand stresses a hybrid focus-hydration-energy model, appealing to natural performance seekers.

- Ingredients such as adaptogens, Ashwagandha, L-theanine, and nootropics are widely adopted and integrated into functional beverages.

What Challenges are Hindering Innovation in the Functional Beverage Industry?

Regulatory Scrutiny & Risky Health Claims

Legal issues arising from overstated health claims can be a significant concern for you when launching new products in the functional beverages category. For instance, the Advertising Standards Authority banned TRIP’s claims of calmness-inducing effects, pointing out insufficient evidence.

Similarly, Poppi faced a class-action litigation over misleading customers by hyping gut-health advantages of its prebiotic soda. These examples highlight regulatory challenges for F&B players seeking to implement innovation in this space, underscoring the need for effective R&D and strategic measures.

In addition, the diverse global regulations across the EU and the US, along with their different regions, further complicate the landscape for F&B industry players.

High Production Costs vs Price Sensitivity

Businesses encounter obstacles when integrating bioactives such as prebiotics and adaptogens, as well as clean-label components. These integrations require extensive R&D and high-grade sourcing, thereby increasing your production costs.

Further, a lack of proper understanding of microbial interactions in mixed-species fermentations obstructs consistency and optimization in complex beverage fermentation procedures.

Moreover, the presence of large players such as PepsiCo and Coca-Cola exacerbates pricing challenges for new and emerging competitors.

Consumer Skepticism & Sensory Trade-Offs

Functional ingredients such as botanicals and fiber sources negatively affect customer flavor and palate. Thus, curating clean‑label formulations with good taste often requires complex masking tactics and multiple formulation rounds.

You face challenges with prolonged development timelines and increased costs when bringing a product to market due to added complexities in the product development process.

Reportedly, prebiotic sodas’ consumption causes side effects like bloating and nausea due to inulin and other fibers. For instance, OLIPOP ranks high in taste tests but may cause bloating for some consumers. This indicates the need to address potential side effects and alleviate consumer skepticism.

Potential Growth Strategies and Future Business Avenues

| Future Focus Area | Key Highlights | Industry Evidence |

| Innovation & Technology | AI-driven personalization for tailored benefits (energy, focus, digestion) | – AI platforms like NutriGen analyze consumer data to customize functional beverage formulations. – Use of solid-state fermentation to produce plant proteins sustainably. – Strategic partnerships like PepsiCo x Poppi for expanding prebiotic sodas. |

| Consumer-Centric Design | Powdered & concentrated formats for convenience and sustainability | – Launch of shelf-stable powdered functional drinks (e.g., Avro Intelligent Hydration). – High-protein blends targeting Gen Z with chickpea and pea proteins. – Meal-replacement beverages optimized for on-the-go consumers. |

| Sustainability & Compliance | 1. Responsible sourcing & eco-friendly packaging 2. Proactive regulatory alignment 3. Education-led marketing | – Adoption of compostable, biodegradable packaging. – Collaborations with nutrition science startups for regulatory insights. – Campaigns educating consumers on the benefits of prebiotic sodas and gut health. |

- Driving Innovation through Strategic Alliances and Technology: AI-driven personalization for curating functional beverages for distinct needs like boosting energy, focus, productivity, or digestion is the way forward. Concurrently, using solid-state fermentation to develop sustainable ingredients and strategic alliances, as exemplified by Poppi and PepsiCo, offers opportunities to enhance scalability and credibility in high-growth areas.

- Prioritizing Consumer-Centric Design: Develop concentrated and powdered formats that meet both sustainability requirements and customer convenience demands. F&B players can also expand their meal-replacement offering via high-protein blends as part of nutritionally rich functional beverages, and their popularity among youth.

- Future-Proofing with Sustainability and Compliance: Intense focus and investment should be directed towards responsible sourcing and sustainable packaging while remaining proactive with regulatory shifts via collaborating with nutritional science start-ups or firms. There is a scope to promote education-led marketing for converting awareness into habitual usage, particularly in prebiotic sodas.

Final Words

As the space of functional beverages evolves beyond hydration and energy to deliver benefits like mood enhancement, focus, productivity boost, and nutrition, brands must align with consumer expectations. Through sustainable, innovative, and flavor-enhanced offerings, companies can address the complex challenges of protein innovation, including regulatory, cost, and formulation issues, and navigate the territory of prebiotic soda and high-protein blends.

Stellarix assists food & beverage leaders in navigating the crucial juncture of sustainability, regulation, and shifting consumer demands in the functional beverages segment. Harnessing our deep R&D expertise, we guide the strategic development of functional beverages and the launch of prebiotic sodas and high-protein blends—from clean-label formulations to restructured value chains. We guide you in prioritizing and capturing key innovation opportunities and the latest trends. This empowers you to transform market complexity into a resilient, innovative, and future-proof portfolio engineered for sustainable growth.

We have extended a helping hand to 150+ global clients and are currently helping several food and beverage leaders navigate the industry’s changing landscape. To learn more, please get in touch with our team.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.