Green Hydrogen: The Ambition Versus Implementation Conundrum

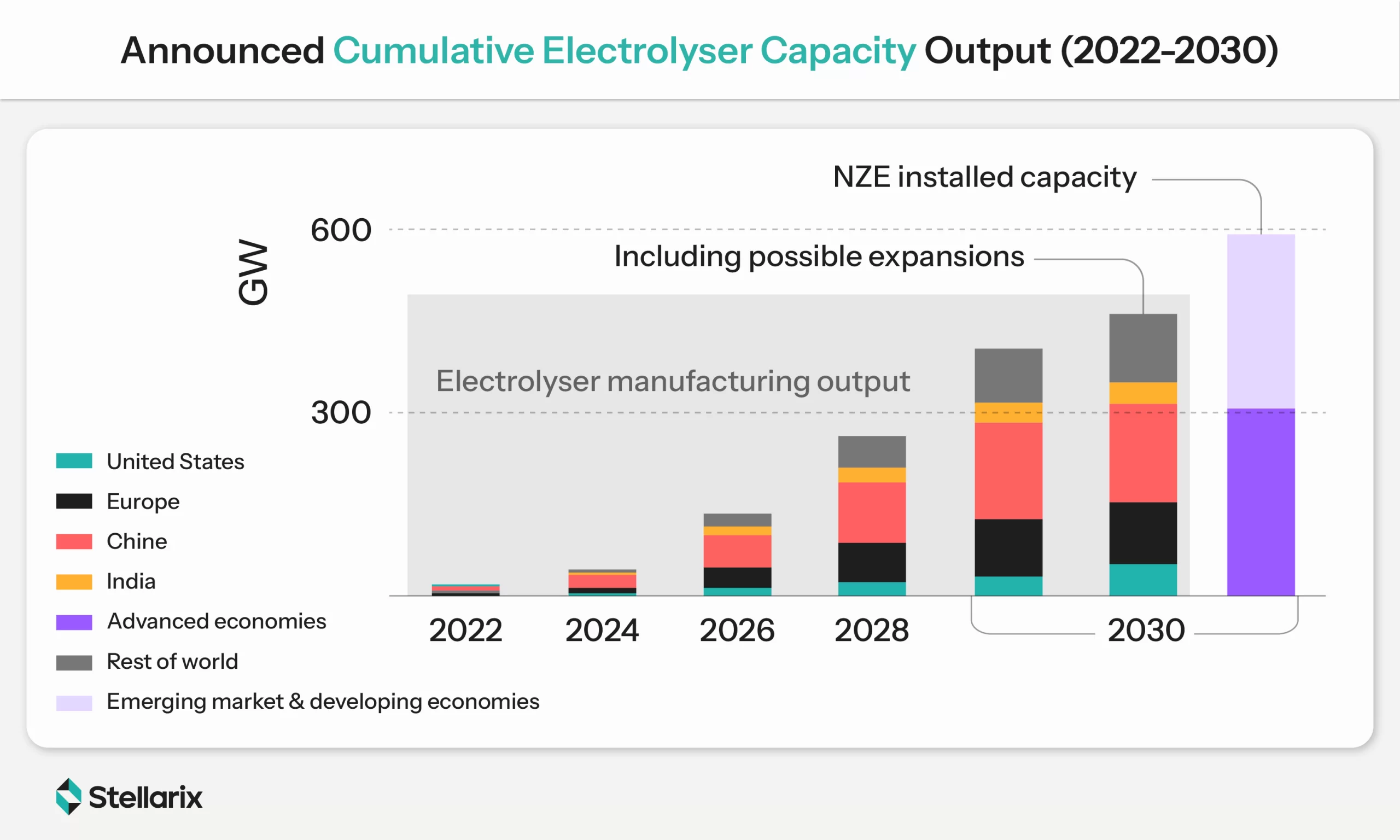

Green hydrogen investments are the major highlight of the growing momentum in the energy industry. The promise of long-term renewable energy storage and electrofuels has made it a cornerstone in this segment. In 2023 alone, approximately $2.8 billion was invested globally in building electrolyzer capabilities, while $700 million was invested in blue hydrogen projects. This increase in electrolysis projects amounted to a 350% increase over the preceding year, implying an increasing inclination toward green hydrogen. Nevertheless, these rising tides are accompanied by complexities rooted in high costs and investment risks, posing a direct threat to the median 1.5℃ ambition of 2030.

There is a need to take a closer look at the kind of implementation gaps that are impeding this progress and what plausible solutions could help resolve these conundrums.

Green Hydrogen Production: The Difference Between Ambition And Realization

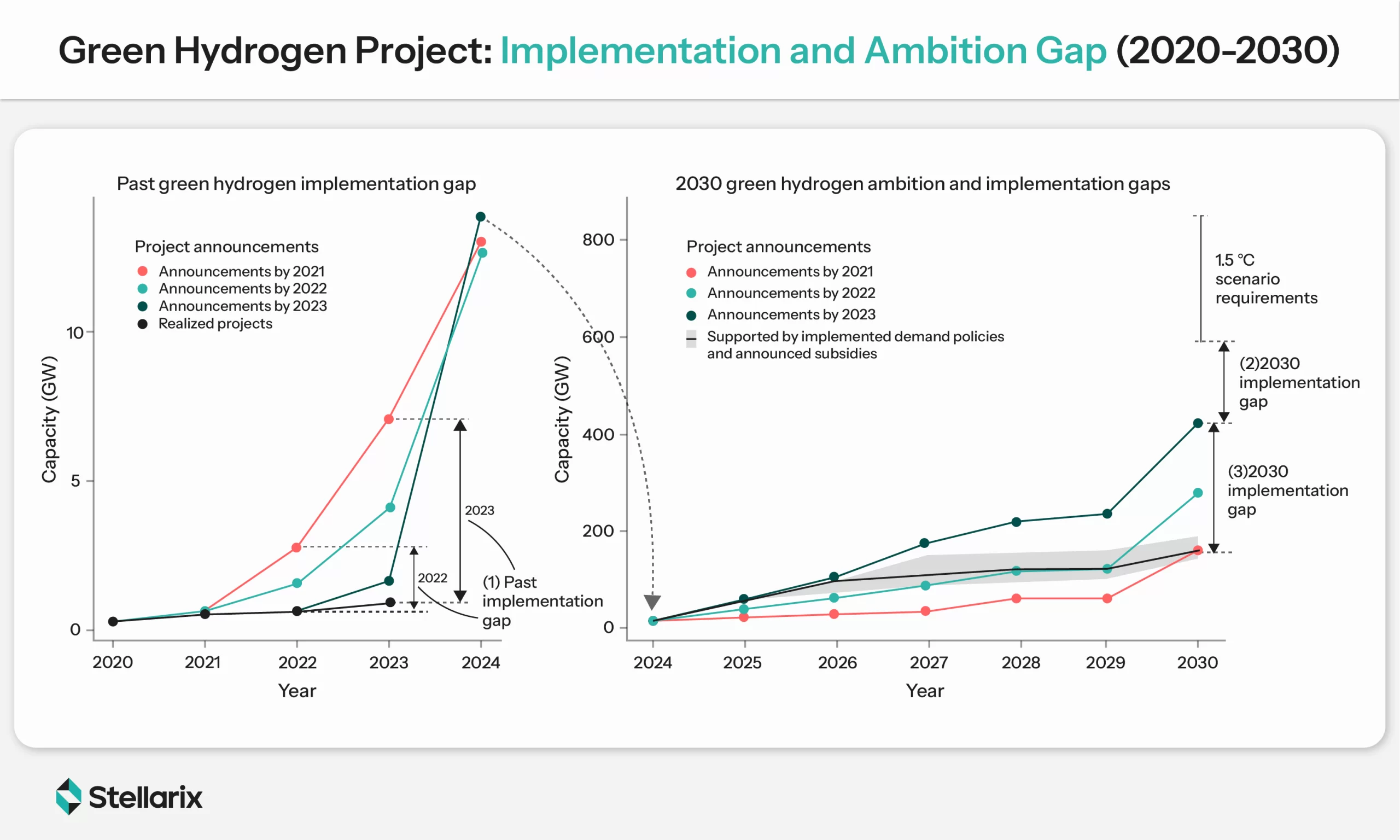

The green hydrogen ambition and implementation gaps have been apparent in the last few years. The developments on these two fronts are moving in opposite directions. Evidently, the difference between prerequisite projects and announced projects to achieve the 1.5℃ scenario in 2030 has narrowed since 2021. However, the future implementation gap for these projects has widened in the same duration.

The number of announcements has grown steadily in the last four years. One key driver behind this development is Europe’s rising inclination towards renewable energy resources. It is closely followed by Australia, Central as well as South America. On the implementation front, only 0.3 W of the announced 4.3 GW was realized for the same duration globally. Apparently, 86% of the projects announced in 2021 were realized on time till 2023, while the rest of the 14% disappeared outright. A similar pattern was followed in 2022 and 2023. Even the projects that secured FIDs either delayed or disappeared. In terms of success, Asia registered maximum success while North America was just, and European projects were below average.

The study that quantified these findings analyzed green hydrogen against its fossil contemporaries across 14 end-use sectors. It concluded that the realization of announced projects would need heavy subsidies and regulatory support for at least a decade. This negates the very goal of bringing the situation under control in the next five years.

Reasons Leading To These Gaps

The Geopolitical Volatility

The geopolitical shifts in the last five years have had a direct impact on the success rate of hydrogen projects. Dating back to 2021-22, COVID-19 resulted in some serious supply chain disruptions, while in 2023, the European energy crisis kicked in, pushing global interest rates sky-high. A recent analysis of 1232 globally announced projects concluded a competitiveness gap that can only be closed with robust political strategy reflecting realistic expectations.

The Cost Factor

In the economic context, green hydrogen projects are 2-3 times costlier than their fossil fuel counterparts. Electricity prices have almost doubled since 2020 in Europe and the US, especially the PPAs. The current cost of hydrogen production ranges between $5.5/kg – $9.5/kg. The costs of electrolyzers are surging due to a steep rise in financial and equipment costs. Though cost is not an issue for highly modular technologies, this is an exceptional case.

While upscale electrolyzer production is a modular process, other components of green hydrogen plants are very complicated and need specific customization. It is estimated that all announced projects would need approximately $1.3 trillion in global subsidies, excluding the carbon price. Therefore, sole reliance on project announcements isn’t a recommended option, especially for policymakers. The framework needs to be structured in a way that it sees through the implementation and end-product realization.

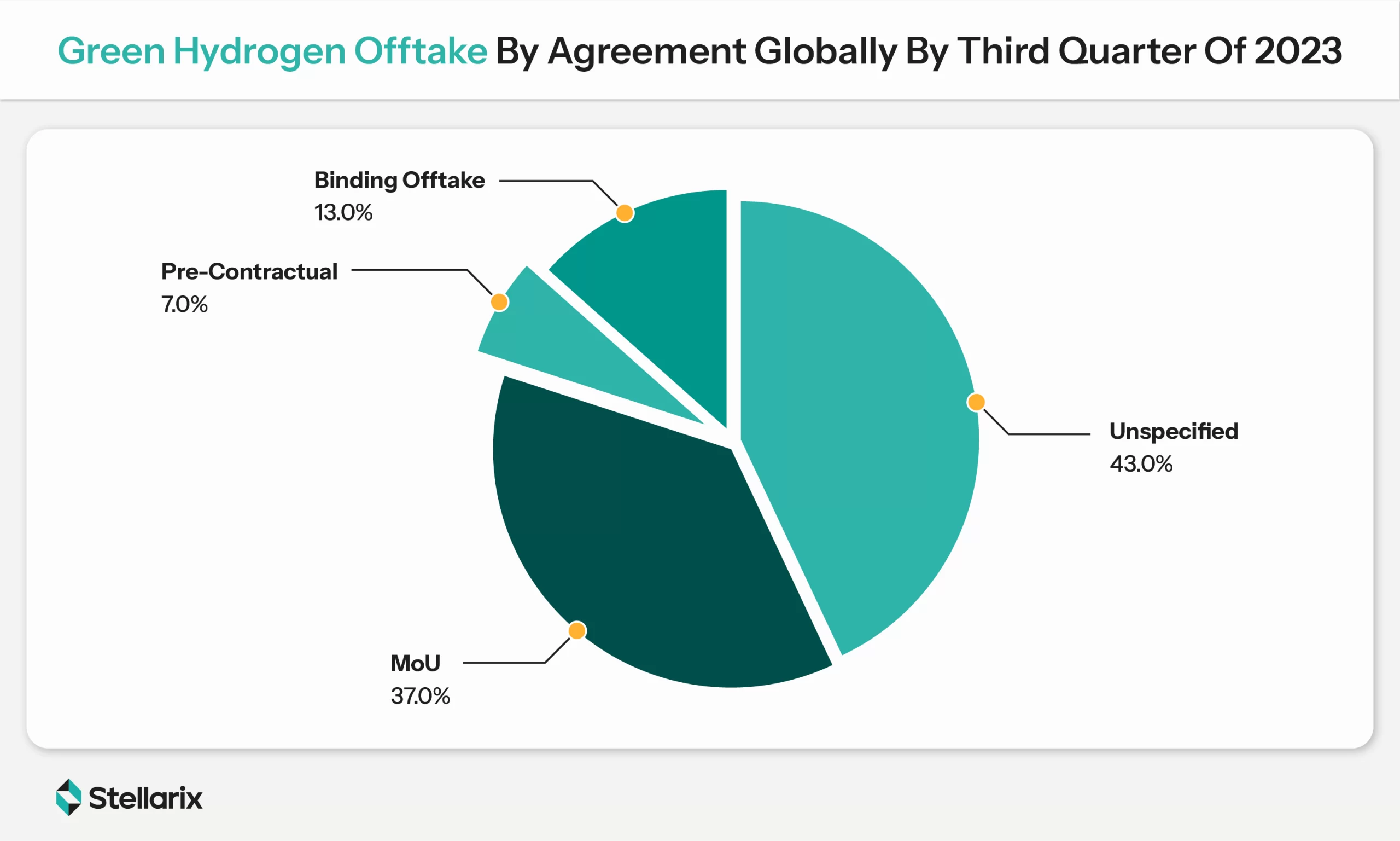

Lack Of Offtake Agreements

This is rooted in a lack of required midstream infrastructure. A substantial portion of funding is currently devoted to hydrogen production, but there are no support mechanisms for midstream infrastructure. A big risk factor for the completion of these projects.

Most off-takers are perplexed about the final results and are finding it hard to move beyond initial negotiations. In return, the rate of projects reaching FIDs is impending, putting developers in a precarious position and slowing down the overall market growth. Till 2023, only 10% of clean hydrogen capacity slated for 2030 had buyers. Out of the total contracted projects, only 13% were binding, 7% were pre-contractual, and the remaining were just MoUs.

Unless due significance is given to the development of midstream infrastructure, hydrogen trade will remain challenged on regional and international levels.

Regulatory Complications

Closing the above-mentioned gaps and reducing risk investments heavily depends on hydrogen-inclined policies and regulations. There is a huge gap in the EU and the US energy framework in this context, it is hampering the growth of the hydrogen market to quite an extent. For instance, the thresholds established by the US, EU, and Canada for hydrogen to be labeled as “clean” only include emissions up to a specific point in production.

Startup Ecosystem Of Green Hydrogen

- Green Hydrogen Systems: A Denmark-based startup, it manufactures flexible hydrogen electrolysers capable of seamless integration with renewable energy sources like solar panels and wind turbines.

- Enapter: A German startup, its focus area includes Anion Exchange Membrane (AEM) electrolysis. Their flexible and scalable electrolyzers are enabling green hydrogen generation for various applications, including industrial and energy operations.

- H2Pro: An Israel-based company, its E-TAC water electrolysis technology is a novel approach that separates hydrogen and oxygen during electrolysis without a sequestration membrane. Its cost-effective nature has hit headlines, garnering funding from bigger players like Bill Gates and Hyundai.

- Heliogen: A U.S.-based startup, it is using high-temperature solar heat for generating green hydrogen at an economical price.

The Way Out

Industry stakeholders, policymakers, and R&D teams need to take a more pragmatic approach. They need to focus more on scale-up challenges, lack of competitiveness, and regulatory gaps that are facilitating these gaps. Also, there is an imminent need to de-risk hydrogen investments with a balanced approach to policy and strategic mix. They also need to accept that the present ambition of 1.5 degrees Celsius by 2030 is an unachievable task in the wake of complex and less standardizable infrastructure; even the policy support assumed for the task may not be enough to accelerate the operations to the required growth rate. Lastly, the short-term policy and subsidy push needs to be extended to a few decades to establish the hydrogen economy without carbon prices or any strong demand scenario.

How Can We Assist?

Our team of energy consultants is helping companies navigate the intricacies of the hydrogen market. Our array of solutions spans:

- Strategic Guidance: Close analysis of market dynamics, project feasibility assessment, and tailored strategies for risk mitigation and better returns

- Simplifying Regulatory Complications: Our renewable consulting team excels in giving guidance on evolving regulatory frameworks and compliance measures

- Partner Scouting: A part of our job is to connect stakeholders, facilitating partnerships between off-takers, investors, startups, and investors for project development.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.