Europe’s Energy Crisis: Assessing the Status Quo

The mayor of a French town recently distributed winter jackets to schoolchildren because the temperature of all public buildings wouldn’t exceed 19 degrees Celsius in the coming months. On the same line, the Belgian government plans to levy a hefty tax on energy companies to create a backup worth $4.6 billion for the anticipated economic crisis. In contrast, the EU energy ministers agreed in the text to cap revenues at €180 per megawatt-hour for electricity producers to cushion citizens and traders from rising energy prices. These are just a few of the endless efforts that European governments are making to stay afloat amidst the looming energy and economic crisis.

Ursula von der Leyen, the European Commission president, has voiced her views on Russia’s role in this crisis. Still, if reports and discussions before February 2022 are noted, Europe was already heading towards a steep energy conundrum. The lessons weren’t learned fast enough from the 2014 Russia-Ukraine crisis, and the pace of investment in renewable energy resources was slow compared to the rising energy demands. The recent war accelerated the series of events that would fall into the EU’s lap within the next few years. So, just blaming the unreliable nature of the Nord Stream 1 pipeline for all this disturbance may not be the best course of action.

How Bad Will Europe’s Winters Be in 2022-23?

The lone wolf dies, but the pack survives”—George R.R. Martin’s description of winter befits the current situation in Europe. However, the pack of nations may still need to fight harder to recover from the economic and political damage caused by this crisis. Currently, the EU’s energy reserve stands at the annual optimal level, quantified at 79bn cu meters. It is enough to meet the annual requirement and marginal additions from Saudi Arabia, the US, and Europe’s alternative sources. However, these reserves will be enough just to survive the normal winters. If the temperatures dip a little lower or higher than usual, the common man may need to choose between keeping the house warm and putting food on the table.

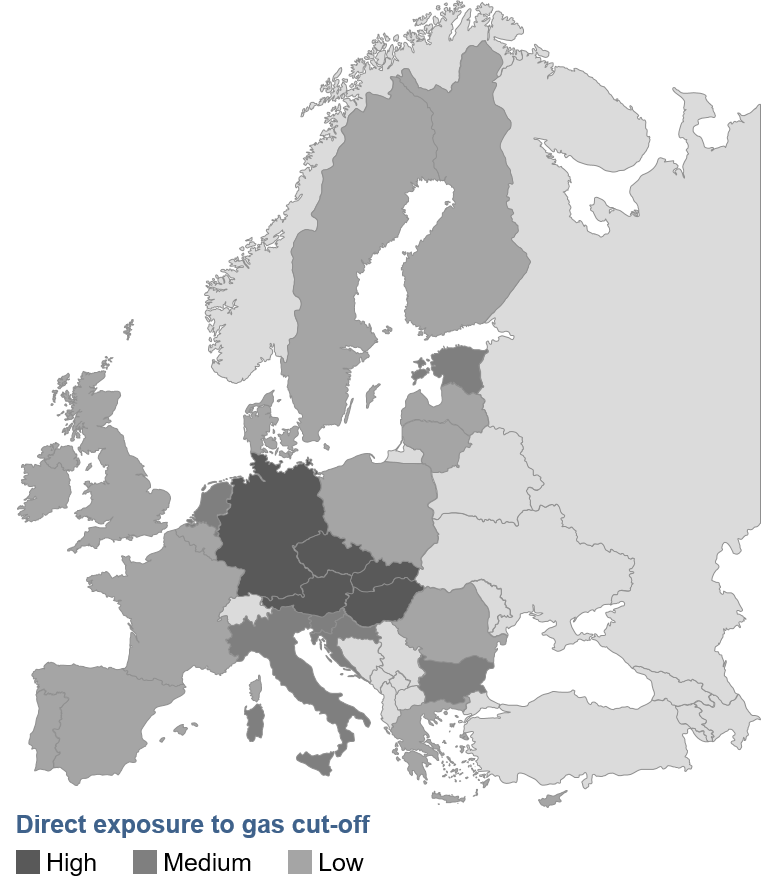

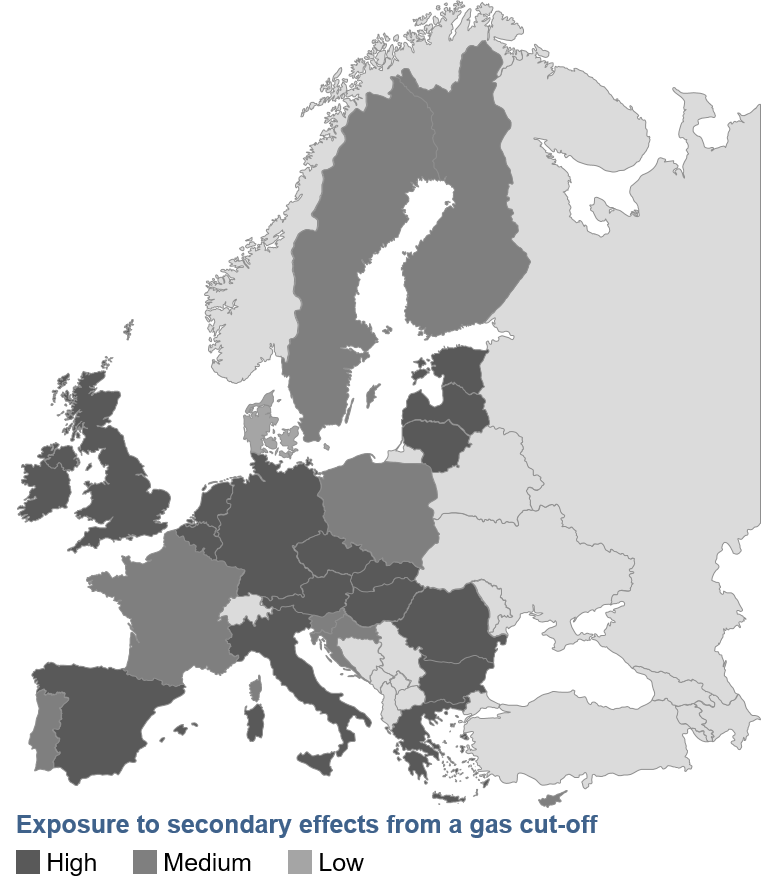

On a national scale, the most vulnerable economies include central European nations—Hungary, Slovakia, and the Czech Republic. These countries had almost a hundred percent reliance on Russia for gas supply to date, and now they are left with just one year’s optimal storage. Given their landlocked geography, super expensive spot market gas prices, and lack of new supply lines, they have a very low scope of diversification for emergencies or future purposes. The industrial sectors of these nations are on the verge of reaching a standstill due to the falling demand for industrial products in Europe, high inflation, and strict gas rationing.

Images Showing Direct (Left) and Indirect (Right) Effects of Low Gas Supplies From Russia On EU Nations

Bigger economies like Austria, Italy, France, and Germany are facing bigger problems on multiple fronts. 30% of Germany’s GDP is derived from its industrial sector, which runs on a tight string due to low optionality and rising market inflation. Though it reduced its reliance on Russian gas to 35% from 55%, energy-intensive sectors like fertilizers, glass, steel, and chemicals will still get a heavy blow due to strict gas rationing. France is heavily dependent on nuclear energy, which is under threat due to low water levels in the river Maine. As reported in September, 56/57 nuclear reactors are offline due to a lack of cooling water. It plans to restart 27 nuclear reactors by the end of this year to combat the energy issue. But that is still a long shot; for now, France is dependent on imports like many others.

Our Key Insights for Energy Industry

Carbon Capture | Self-powering Smart Cities | Smart Grids

Alternative to Li-ion Batteries

Italy has similar speculation about its energy, metallurgy, and mechanical sectors that will become highly vulnerable due to gas shortages. The Baltic States, the UK, Spain, and the rest of Europe are bound to suffer stagnated growth due to high inflation and gas prices. Even if the present energy reserves, a regular winter (which is quite unlikely), and some new supply lines help the continent survive this year, there is still no definite answer to how 62% of total EU energy supplies will be met next year with the dwindling supply lines from Russian pipelines.

What Impact Will It Have On The Global Economy?

The implications of Europe’s energy crisis are bound to spill beyond its borders. It is already pushing up fuel prices globally, making things difficult for developing and underdeveloped nations that are still reeling from the effects of the pandemic. The “Russian Winter” is pushing inflation higher and higher all over the world. Analysis shows that even the slightest rise in the EU’s natural gas prices increases Asia’s and the UK’s vulnerabilities. The table below establishes a close correlation between gas prices in Europe and global commodity markets. It indicates how the changing dynamics of one market affect the other. If the price per barrel increases by $10 in Europe, the price of gas will rise by $9 in the UK and $8 in Asia.

The U.S. doesn’t bear so much brunt as it has turned itself into a net energy exporter in the last six years. Nevertheless, as households and industries try to substitute gas with cost-effective options (coal, gasoline, or oil), it will push the price of crude oil by a few points, creating some pressure on the U.S. The crisis seems to be tipping in Europe, with uncertainty rising over future energy prospects. In essence, what appears like a continental problem at the moment may turn into a full-scale catastrophe in the long run.

Is There Any Solution?

Europe’s high commitment to net-zero emission targets somewhat limited its options to deal with such an unwarranted acute crisis. It strives hard to reduce its dependence on Russia and find alternate supply lines, but that task amounts to building a new Rome. It would be tough to replenish the energy stores in 2023 as they will go vacant this winter. But every story has another side.

Goldman Sachs and Forbes believe that the market is currently overly negative. Despite tight supply lines, gas and oil prices will fall. Germany has decided to keep two of its nuclear sites operational, while France will run its nuclear power lines by the first quarter, and Norway is working to increase its power exports in the near future. The central European nations of Bulgaria, Slovakia, Hungary, and Romania have also pledged to add their additional natural gas supplies to the supply promised by Azerbaijan. Putin, too, has offered to reinstate the supplies through the Nord Stream 2 pipeline; however, the EU has reserved its decision on accepting the offer due to recent events. The recession and inflation are bound to reach a certain peak, but there is no way that countries that survived two world wars wouldn’t find a way out of this powerless tunnel.

Stellarix is committed to smoothing the creased path to future energy transition with comprehensive, integrated energy solutions. You can maintain your hold on your stakeholders, markets, and end-users with proper strategy, innovation, execution, and social solutions. For more, kindly get in touch with us.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.