How China is Reshaping the Future of Solar Energy and Smart Grids?

China’s Dual Push for IP Strategy and Innovation in Solar Energy

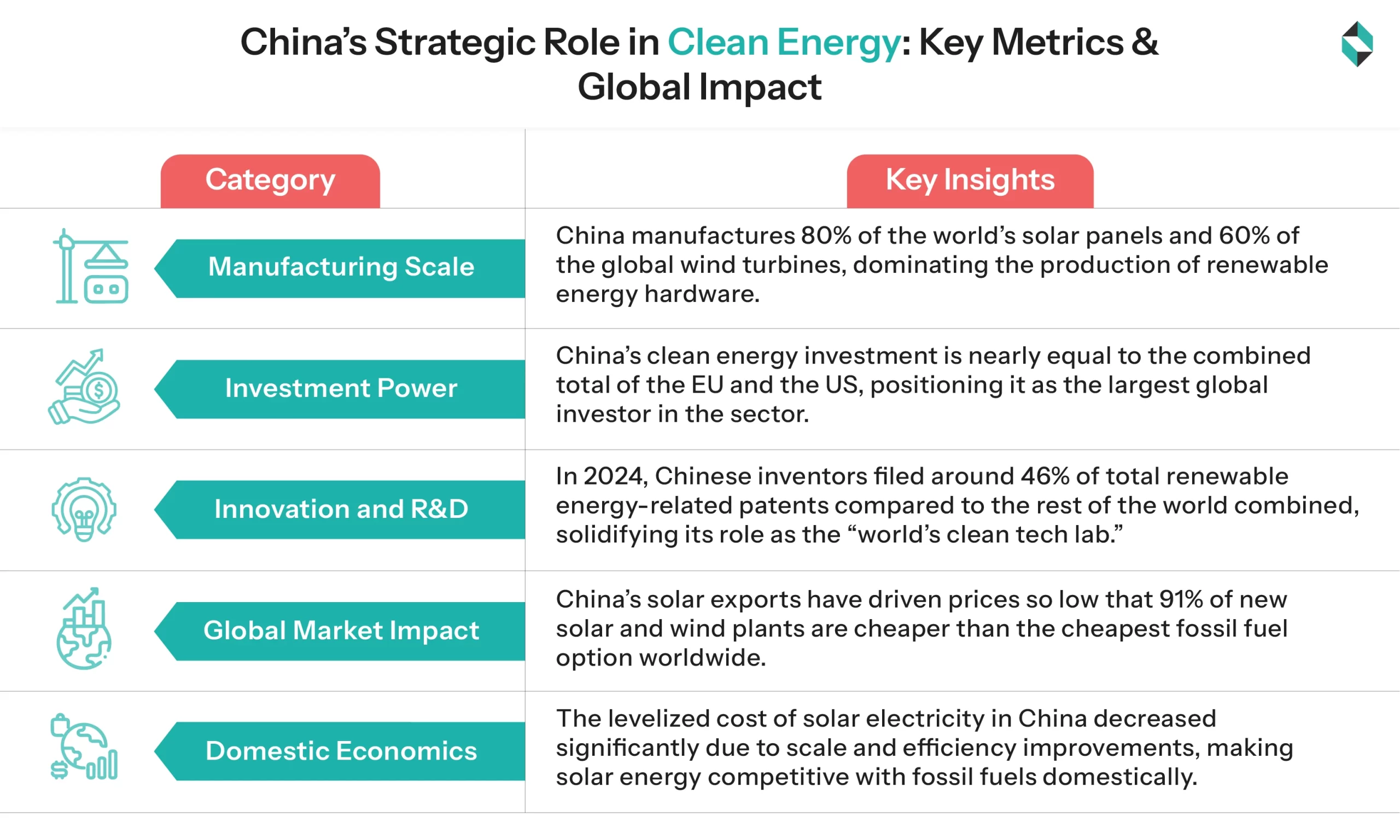

As part of its clean energy plan, China is striding toward technological leadership in solar energy, extending beyond merely increasing capacity in 2025-26. Currently, China manufactures over 80% of the world’s solar panels. Significant innovation and lucrative cost-reduction opportunities currently exist in the global energy market as a result of China’s exponential growth and expansion into smart grids and solar energy. However, companies face challenges related to tech transfer frameworks and the lack of transparent IP enforcement. The stakes are high for business leaders: those operating in line with China’s trajectory can seize market opportunities, while those unable to manage IP risks and evolving innovation agendas may encounter serious issues. Understanding this shift is necessary for market players to effectively manage risk and plan strategically.

Future-focused funding for R&D activities is driving breakthroughs in advanced manufacturing, flexible modules, and perovskite tandem cells. These efforts align with China’s Energy Law mandate to have renewable sources provide around 40% of its energy by 2030. Additionally, an increase in high-value patent registrations indicates a mature innovation ecosystem with important implications for technology suppliers, global licensors, and decision-makers.

The blog explores how Chinese dominance in smart grids and solar energy creates risks and opportunities for businesses in the global energy market, and how they can navigate this industry’s trajectory.

Scaling Next-Gen Solar: Challenges in Embracing Technological Breakthroughs

China aggressively shifted from laboratory to large-scale commercialization, with several Chinese firms piloting projects over 100MW, using agrivoltaic hybrids or perovskite-silicon tandem designs. They are also extensively exploring hybrid systems, such as concentrated solar power (CSP)-photovoltaic (PV) systems, to accelerate high-quality energy production. These projects enable real-time performance observation, yet the path to full commercial scale remains restricted. Module bankability also remains limited due to the restricted availability of long-term field data under various climate stressors.

Organizations across the solar and energy sector are prone to risks of slow commercialization timelines and higher investment due to difficulties validating durability, performance, and bankability, due to limited long-term field data. Such challenges aggravate the need for robust technology scouting, R&D validation, and reliability testing before hybrid CSP-PV solutions are widely financed and deployed at scale.

Engineering, procurement, and construction (EPC) firms and project managers struggle to establish a rigorous technology due diligence process before deploying next-generation modules. The key evaluation factors they can consider include degradation studies, temperature resilience, encapsulation integrity, mechanical stress tolerance, edge-sealing robustness, and compliance with both Chinese and international standards. Companies offering performance monitoring and third-party testing become appealing as risk eliminators, especially to financiers concerned about lengthy payback periods.

The strategic priority is swiftly shifting from adoption to achieving authority and leadership in the energy market. This requires a two-way approach: first, capitalizing on next-gen solar innovations, such as bifacial modules and advanced tandem cells, to fundamentally improve generation efficiency and cost-effectiveness. Second, integrating these assets with an Internet of Energy (IoE) framework to optimize distribution and maximize energy efficiency. This comprehensive strategy shifts a renewable energy portfolio from a compliance initiative to a competitive advantage, ensuring sustained energy security.

Get in touch with our renewable energy consulting experts to navigate the challenges prevailing in the energy market and ensure business resilience.

How Energy Storage is Powering China’s Smart Grid Revolution?

Novel energy storage systems are rapidly expanding in China. It is reported that by mid-2025, their combined installed capacity exceeded 164 GW, mainly due to lithium-ion systems outperforming pumped hydro. Additionally, the 2024 energy storage report showed an increase to approximately 73.76 GW (168 GWh), with annual growth exceeding 130%.

However, grid curtailment persists in the northwest region, where wind and solar capacity are high. Also, the absence of consistent standards and unified interconnection protocols creates hurdles for third-party storage integration. Therefore, storage manufacturers and software providers that develop systems in compliance with China’s grid-connection and interoperability guidelines effectively address and mitigate these challenges. Further, companies supplying grid-forming batteries, energy management platforms, and bidirectional inverters that comply with China’s grid regulations are well-positioned to profit from upcoming projects.

Hybrid solutions, such as floating PV paired with battery systems, unleash value where transmission or land limitations exist. Additionally, AI algorithms are often used to manage and efficiently distribute energy across the grid, with advanced sensors, such as Phasor Measurement Units (PMUs), providing real-time tracking and control to maintain grid stability. Moreover, distributed generation (DG) and microgrids, as part of China’s strategy, help effectively integrate renewable energy.

AI, Digitalization & Grid Management Trends in China’s Solar Power Sector

- Digital Twins: AI-based dispatch and digital twins are being tested in several key new solar zones, such as Gansu and notably Inner Mongolia, to predict fluctuations and optimize output.

- Utility Data Integration and Cybersecurity: Data silos pose significant challenges, and utility telemetry is often kept internal, limiting its use for forecasting and anomaly detection. Additionally, cybersecurity concerns also pose difficulties.

- Onshore AI Solutions: A notable trend in China’s solar energy market is the preference for onshore AI solutions or co-developed solutions over foreign SaaS. Thus, foreign companies consider sandboxing or joint R&D ventures that facilitate data sharing within a well-regulated framework.

- Virtual Power Plant (VPP): It is an emerging trend, fueled by the necessity for grid stability and the quick expansion of solar-like distributed energy sources.

What Does China’s Next-Gen Solar and Smart Grid Innovation Mean for Global Stakeholders?

- Market Differentiation: China-based companies increasingly integrate their value chains, making differentiation a crucial strategy for foreign firms. To stand out, foreign players should offer either proprietary intellectual property that is difficult to imitate, quicker innovation processes, or specialized capabilities such as degradation coatings, encapsulants, or advanced sensors.

- IP and Partnership Strategy: Conduct comprehensive freedom-to-operate (FTO) assessments prior to entering the Chinese market. Licensing agreements should include provisions for enforcement, quality control, and exit terms. In many cases, forming a joint venture may be a safer alternative than direct licensing.

- Licensing Frameworks: There is potential for foreign companies to license manufacturing tools, especially in agrivoltaics, perovskite production, and AI-based operation and maintenance (O&M).

Final Words

To sum up, the next-generation solar energy wave in China is about more than just scale; it also highlights depth in system integration, regulation, and material science. It implies that market players must protect IT robustly, align with regulatory and development paths, and position themselves in joint ventures or niche markets. Business leaders must act with precision by identifying technology gaps and tactfully selecting partner models to lead in solar innovation and the renewable energy frontier.

The energy consulting team at Stellarix is assisting companies in gaining a competitive advantage and reinforcing their positions amid regulatory changes, industry shifts, and slow market adaptation. By leveraging strategic foresight and offering a full range of energy innovation and R&D services, we help renewable energy businesses stay competitive, resilient, and profitable, focusing exclusively on clean and alternative energy sources.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.