Importance of Carbon Credits for O&G Companies

The oil and gas (O&G) industry plays a crucial role in global energy supply and is also one of the largest contributors to greenhouse gas (GHG) emissions. As global industries move quickly toward cleaner energy and sustainability, carbon credits have emerged as an essential mechanism for oil and gas companies to mitigate their environmental impact while ensuring business viability.

Understanding Carbon Credits in O&G

Carbon credits are tradable certificates that allow organizations to offset their carbon footprint by investing in environmental projects that reduce greenhouse gases. One carbon credit equals one metric ton of carbon dioxide (CO2) reduced, avoided, or removed from the atmosphere. These credits are part of a broader cap-and-trade system or voluntary market designed to encourage businesses to adopt greener practices. Thus, it is important for oil and gas companies to adopt it to stay relevant and competitive in the market that is demanding sustainability.

Market Size of Carbon Credits

The global carbon credits market is set to experience significant growth from 2025 to 2030, driven by an average annual growth rate of 27.6%. The market is projected to reach approximately USD 701.3 billion by 2025 from USD 550.1 billion in 2024. By 2030, the market size can be bolstered further and expand to about USD 3,053.7 billion, marking an impressive increase over the years. The trajectory showcases the accelerating global emphasis on sustainability initiatives and evolving environmental regulations, which will likely drive the demand for carbon credits in the coming years.

O&G Companies Using Carbon Credits

- Shell: The company relies on carbon credits to offset emissions from operations and invests in carbon projects. In 2020-2022, Shell used 9.9 million carbon credit units

- BP: The brand has teamed up with project developers to produce carbon credits via forestry projects

- Eni: It has teamed up with project developers to produce carbon credits via forestry projects

- TotalEnergies: TotalEnergies has teamed up with project developers to produce carbon credits via forestry projects. They aim to build up 100 million carbon credits from 2030

- Chevron: Chevron has teamed up with project developers to produce carbon credits via forestry projects. From 2020 to 2022, Chevron used 6.0 million carbon credit units

How Does Carbon Credit Function in the O&G Industry?

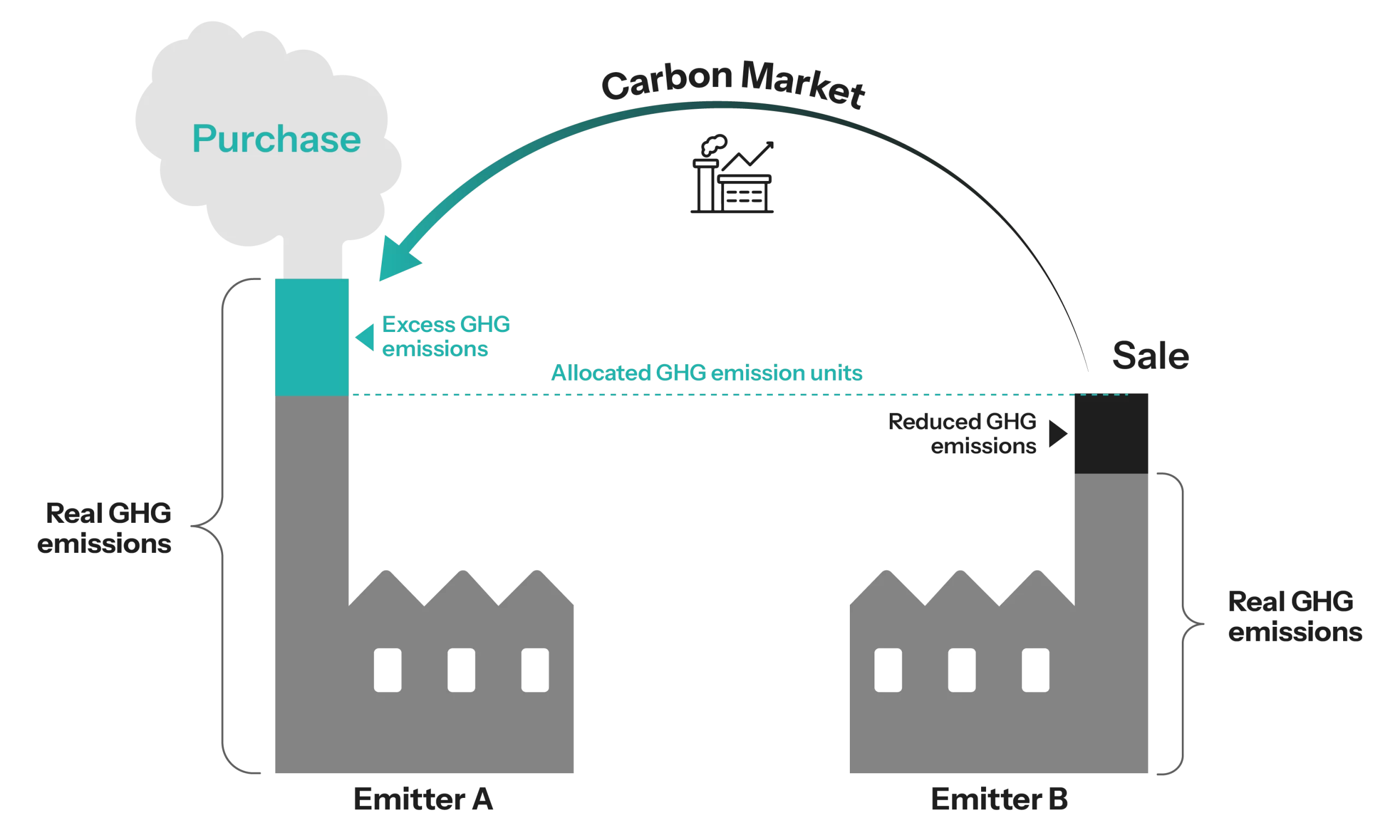

Understand It by an Illustration:

Imagine two companies, Company X and Company Y, each with a carbon emission cap of 650 tons.

On one hand, company X is projected to emit 850 tons this year, exceeding its limit by 200 tons, as it does not have enough resources to offset that carbon. On the other hand, Company Y is estimated to emit only 50 tons this year, leaving it with a surplus of 600 tons under its cap.

To avoid penalties such as fines or additional taxes, Company X can purchase carbon credits from Company Y, which has extra credits to spare. By doing so, Company X can offset its excess emissions, bringing it back within compliance.

Why Carbon Credits Matter for O&G Companies?

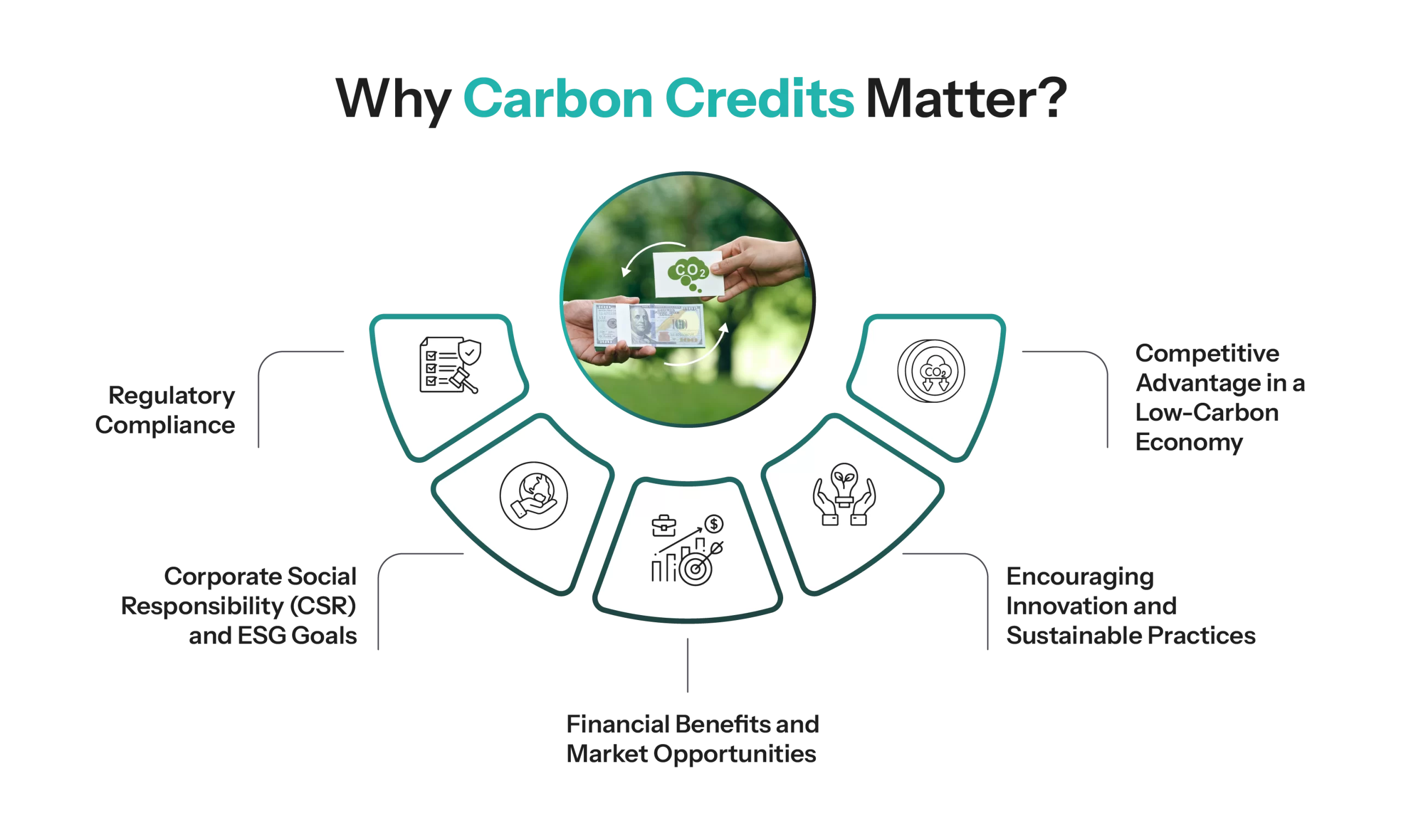

- Regulatory Compliance: Governments globally are putting stricter regulations on carbon emissions, with many regions requiring O&G companies to offset emissions via carbon credits to avoid fines and legal issues.

- CSR and ESG Goals: As consumers and investors aim at ESG criteria, O&G companies engaging in carbon credit programs enhance their sustainability reputation, building brand trust and stakeholder confidence.

- Financial Benefits and Market Opportunities: Carbon credit markets offer financial gains through trading credits from initiatives like CCS or reforestation. Proactive sustainability efforts can also attract green investors and eco-friendly funding.

- Encouraging Innovation and Sustainable Practices: The integration of carbon credits in corporate strategies encourages O&G firms to invest in innovative solutions such as:

- Carbon capture, utilization, and storage (CCUS)

- Renewable energy projects

- Methane capture and flaring reduction

- Energy efficiency improvements

5. Competitive Advantage in a Low-Carbon Economy: Many nations and industries are moving towards the idea of net-zero emissions to gain a competitive edge and ensure first-mover advantage.

Companies that proactively reduce emissions and offset their carbon footprint will be better positioned to secure long-term contracts, partnerships, and customer loyalty.

Strategic Importance for O&G Companies

Methane Abatement Projects: Projects focused on minimizing methane emissions have become significant sources of carbon credits, including plugging orphaned wells. For example, Rebellion Energy’s initiative in Oklahoma has generated significant credits by resolving methane leaks from abandoned wells.

Corporate Net-Zero Targets: Big oil companies like Shell and BP have committed to net-zero targets by 2050. To reach their goals, they depend on carbon credits to offset some of their emissions, allowing them to balance operational activities while working towards long-term sustainability.

Decarbonization Acceleration

Utilizing carbon credits can significantly speed up the decarbonization process for O&G companies.

- Internal Carbon Pricing: Firms can implement an internal carbon price, like Essar Oil’s $15 per ton shadow price, to incentivize departments to minimize emissions proactively. This pricing mechanism encourages innovation and efficiency improvements across the organization.

- Funding Research and Development: Revenue generated from trading carbon credits can be reinvested into research and development initiatives aimed at carbon capture technologies and renewable energy solutions. It can help achieve sustainability goals and position the company as a leader in the energy transition.

Market Flexibility for O&G Companies

The ability to trade carbon credits provides O&G companies with greater flexibility in managing their emissions:

Automated Trading Systems: Brands like Inatech are creating automated systems that allow companies to trade carbon credits without hassles. This flexibility is important as it enables firms to adapt their operations based on regulatory changes and market conditions.

Biofuel vs. Fossil Fuel Trading: Oil and gas companies can strategize to switch between biofuel (which generates credits) and fossil fuel (which consumes credits) transactions. This adaptability can enable them to optimize their credit positions and manage costs effectively.

Challenges in Carbon Credit Implementation

O&G companies face various challenges in leveraging carbon credits effectively:

- Market Volatility: Carbon credit prices vary frequently, affecting cost predictability

- Regulatory Uncertainty: Government policies’ changes and international agreements can affect the effectiveness of carbon credit programs in the long run

- Operational Adjustments: The application of emission reduction strategies demands substantial investment in technology and infrastructure

- Quality Assurance Concerns: A small percentage of available carbon credits currently meet high-integrity standards established by organizations like the Integrity Council for the Voluntary Carbon Market (ICVCM). Ensuring that projects deliver genuine emission reductions is vital for maintaining market integrity.

- Risk of Greenwashing: There is a risk that some O&G companies may overly rely on purchasing offsets instead of making meaningful operational changes. This overreliance can lead to accusations of greenwashing—where firms appear environmentally responsible without making significant changes to their practices.

Future Outlook for Oil & Gas Companies

The landscape for carbon credits is evolving rapidly, presenting both opportunities and challenges for O&G companies:

- Rising Credit Prices: Experts predict that the price of carbon credits could exceed $50 per ton by 2030 due to increased demand driven by regulatory pressures and corporate sustainability commitments. This potential price surge will encourage more investments in emission reduction projects.

- Addressing Scope 3 Emissions: The focus on Scope 3 emissions—those generated indirectly through supply chains—will grow. O&G companies will need to invest in sustainable practices throughout their value chains to effectively mitigate these indirect emissions.

Conclusion

For oil and gas companies, carbon credits offer a compliance tool and are an important strategic asset that provides sustainable growth. Notably, O&G companies can transition to a low-carbon economy while shouldering social responsibility and creating profitability through investments in carbon credit programs and mandates for cleaner technologies. Embracing carbon credits today ensures a more resilient and competitive future in the energy sector.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.