Scaling At-home Infectious Disease Diagnostics: From Promise to Practice

The COVID-19 pandemic catalyzed the decentralization of diagnostics, bringing them into homes from lab floors. With the FDA approving at-home testing kits for STIs and respiratory infections, the infectious disease diagnostics market is embracing its watershed moment. It is slated to reach $46.05 billion by 2032 at an implied CAGR of 7.89%. Currently, at-home diagnostic tests, particularly for infectious diseases, are emerging as a critical enabler of resilient healthcare delivery.

But the key question is, why is it limited to a handful of infections? This gap is both a challenge and a strategic imperative for the medtech industry. Scaling point-of-care and at-home testing solutions demands more than technological innovation. It requires new business models, agile regulatory alignments, and building consumer trust.

| Disease | Test Category | Sensitivity Range | Specificity Range | Highlighting Feature |

|---|---|---|---|---|

| COVID-19 | Ag-RDT | 64.3% – 76% | 99.1%-99.6% | High viral load |

| Influenza A | Multiplex LFT | 73.5%-89.7% | More than 97% | Suitable for early stage, high viral load |

| RSV | Multiplex LFT | 44.4%-100% | 99.75% – 99.9% | Much lower sensitivity than flu and COVID |

| HIV | Rapid Ab test | 99.6% | 100% | Digital support enhances its adoption rate |

| Malaria | RDT | 100% | 99.8% | High accuracy only in pilots, limited use for at-home diagnostics |

Why Near-term Action is Non-Negotiable?

The shift to personalized, decentralized, and proactive care began with the pandemic, but that wasn’t the finish line. The rising viral resistance, seasonal spikes, pathogens, and the global threat of antimicrobial resistance (AMR) are making quick diagnosis critical for disease management at the root level. It is further encouraged by AI integration, which is refining AMR detection through genome pattern analysis to identify treatment failure and pave the way for targeted therapies.

In the broader context, supply chain vulnerabilities, healthcare consumerization, and the rapid adoption of digital health ecosystems are driving the need for swift and accessible diagnostics. The strategic growth and adoption of at-home medical test kits for infectious diseases are slated to become a key enabler of real-time public health interventions.

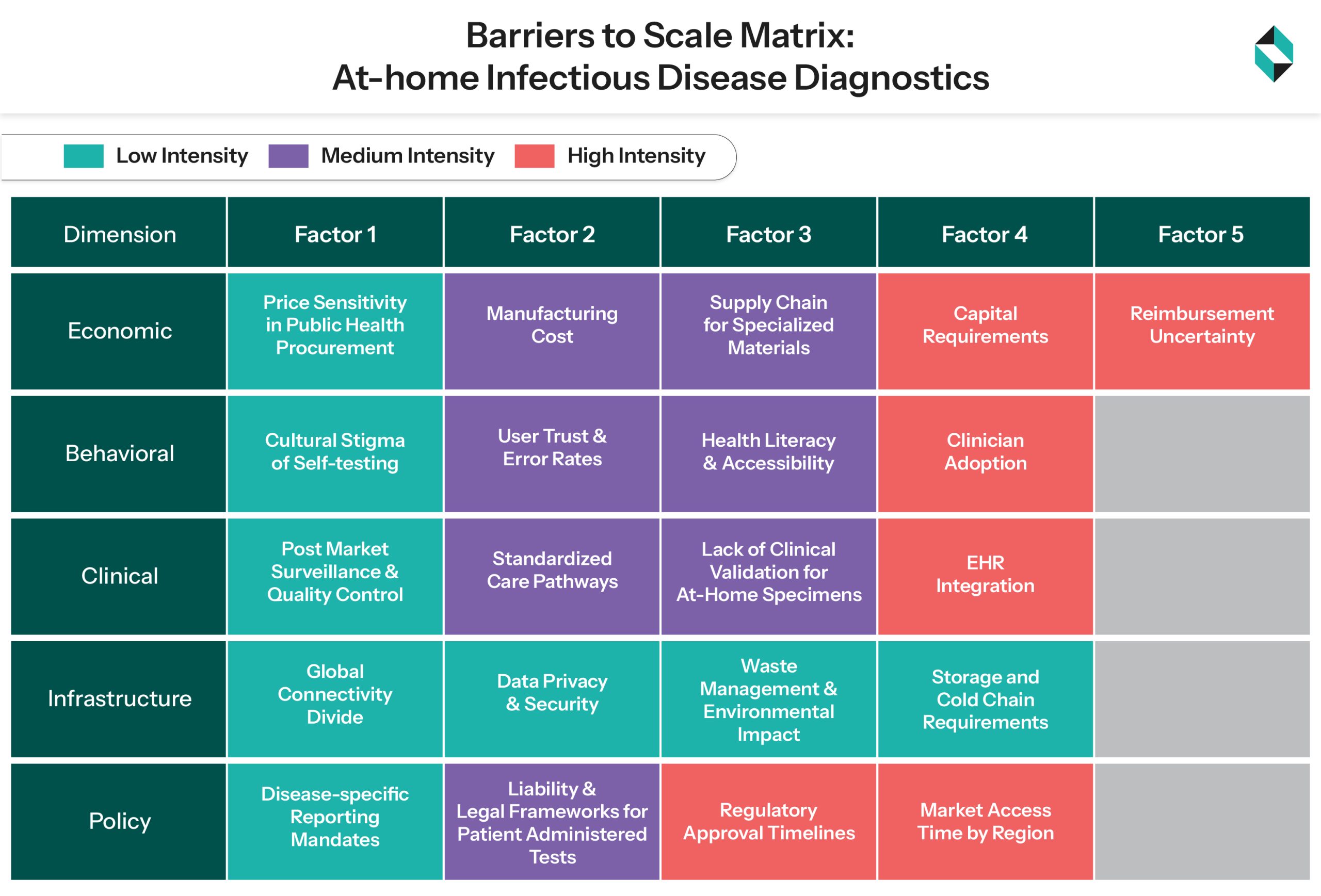

Deterring Factors: Why Widespread Reality Remains Elusive

- Economic Uncertainties: Reimbursement limitations teamed with expensive advanced technologies have been the biggest barriers to accessibility, especially in second and third-world nations. Also, clarification on ROI and value generation capacity for healthcare facilities and hospitals has been a deterrent in the commercialization of these kits.

- Behavioural and Clinical Limitations: The real-world effectiveness of these kits is yet to be validated by physicians. Building consumer trust, especially with respect to results, has been a limiting factor for these technologies.

- Policy and Infrastructure Complexities: Interoperability complexities with pre-existing healthcare infrastructure and hospital networks are another hurdle that needs to be crossed. Lastly, varying regulatory requirements across various geographies further complicate entry in global markets and innovation.

Market Dynamics and Growth Enablers

Baseline Metrics and Starting Line

The infectious diseases’ home test kits currently include COVID-19, influenza A & B, RSV, STIs, UTIs, and RSV. This range needs to be expanded with ensured alignment with varying regulatory compliance frameworks worldwide. There are several enablers of this segment, but the most fundamental ones include:

- Expanding Global Grip of Infections: With the WHO reporting more than 5,000 cases of chikungunya in January 2025 and a rising dengue burden across African nations, the imperative to stop the transmission of these diseases acted as the biggest precursor for the rising demand for at-home medical test kits. In the U.S. alone, syphilis cases grew over 70% in the last five to six years. Up to the end of 2024, an estimated 40.8 million people were living with HIV worldwide.

- Rising Consumer Demand for Healthcare Personalization: Both precision medicine and personalization are driving healthcare delivery. Medtech advancements in home diagnostic technologies promise tailored treatments based on individual patient data, promising enhanced safety and direct-to-patient strategies.

- Pandemic-accelerated Decentralization: The biggest impact of the pandemic has been in driving the shift toward alternative care options and home testing trends. It has been one of the major factors behind the rising demand for medical check-ups at home.

Technological Enablers

- Hardware Evolution: Advancements in paper-based diagnostics, microfluidics, and biosensors are improving the speed, portability, and cost. For instance, the miniaturized lab-on-chip (LOC) systems are enabling rapid, sensitive, and multiplexed testing.

- AI and Software Integration: AI algorithms capable of analyzing large and complex data patterns are improving detection sensitivity while reducing the chances of false positives. Overall, digitalization is pushing the accuracy curve of diagnostics, enabling predictive analytics, and streamlining workflows.

- Material Science & Reagents: Developments in enzyme formulations and multiplex detection tests are not just extending the shelf life of reagents but helping in the detection of multiple pathogens simultaneously, increasing their clinical and domestic utility.

Market Opportunity

The global POC (point-of-care) infectious disease market will surpass $13 billion valuation by the end of this decade, while the broader in-vitro diagnostics market will reach ~$30 billion by the same time. Demographically, the United States currently leads the market share while the Asia Pacific is rapidly catching up, owing to its increasing healthcare investment and rising prevalence of infectious diseases. For industry participants, the growth vector can be bifurcated into two segments:

- Pinning Market Expansion Areas: As the at-home medical test market expands beyond respiratory infections to include UTIs, STIs, and other medical conditions, it presents a multi-billion-dollar opportunity waiting to be harnessed. Currently, over 1 million individuals get STIs per day, representing over 300 million cases per year.

- Technology Integration: The convergence of telehealth and digital health platforms with at-home diagnostics represents unparalleled opportunities for integrated service offerings promising extensive care packages than mere discrete testing kits. The market share expansion will come to companies bundling consultation, treatment recommendations, and test interpretation with infection tests.

Competitive Advantage Determinants

A systematic approach to leveraging technology, business models, sustainability demands, and regulatory changes will determine competitive advantage in this segment.

- Data Analytics and AI: With the AI market expanding in the medtech and life sciences sectors, the time is ripe for value realization from it in product design, development, and life cycle management. It could help enhance cost efficiency by 5-20% over the next 3-4 years. Moreover, AI-based applications can be deployed to identify patterns and trends, streamlining product development lifecycles and accelerating innovation.

- Regulatory and Market Access Complexities: Over 8,000 global regulations must be navigated to create safe products and avoid delays in innovation and delivery. With the FDA’s novel Quality System regulation mandating the modernization and harmonization of requirements, companies can’t escape prioritizing compliance to stay ahead of the curve. Lastly, lack of reimbursement pathways is a challenge awaiting to be turned into a competitive advantage. Successful demonstration of better health economic outcomes will position adopters of HEOR (health economics and outcomes research) for favorable coverage decisions from integrated delivery networks and payers.

- Sustainability: The mounting pressure to reduce carbon footprint must be leveraged as a stepping stone to align revenues with ethical business practices. The agile adoption of new approaches, including the use of biodegradable materials, reprocessing single-use devices, and transitioning to recycling options and sustainable packaging, will enable at-home diagnostic companies to translate these mandates into opportunities.

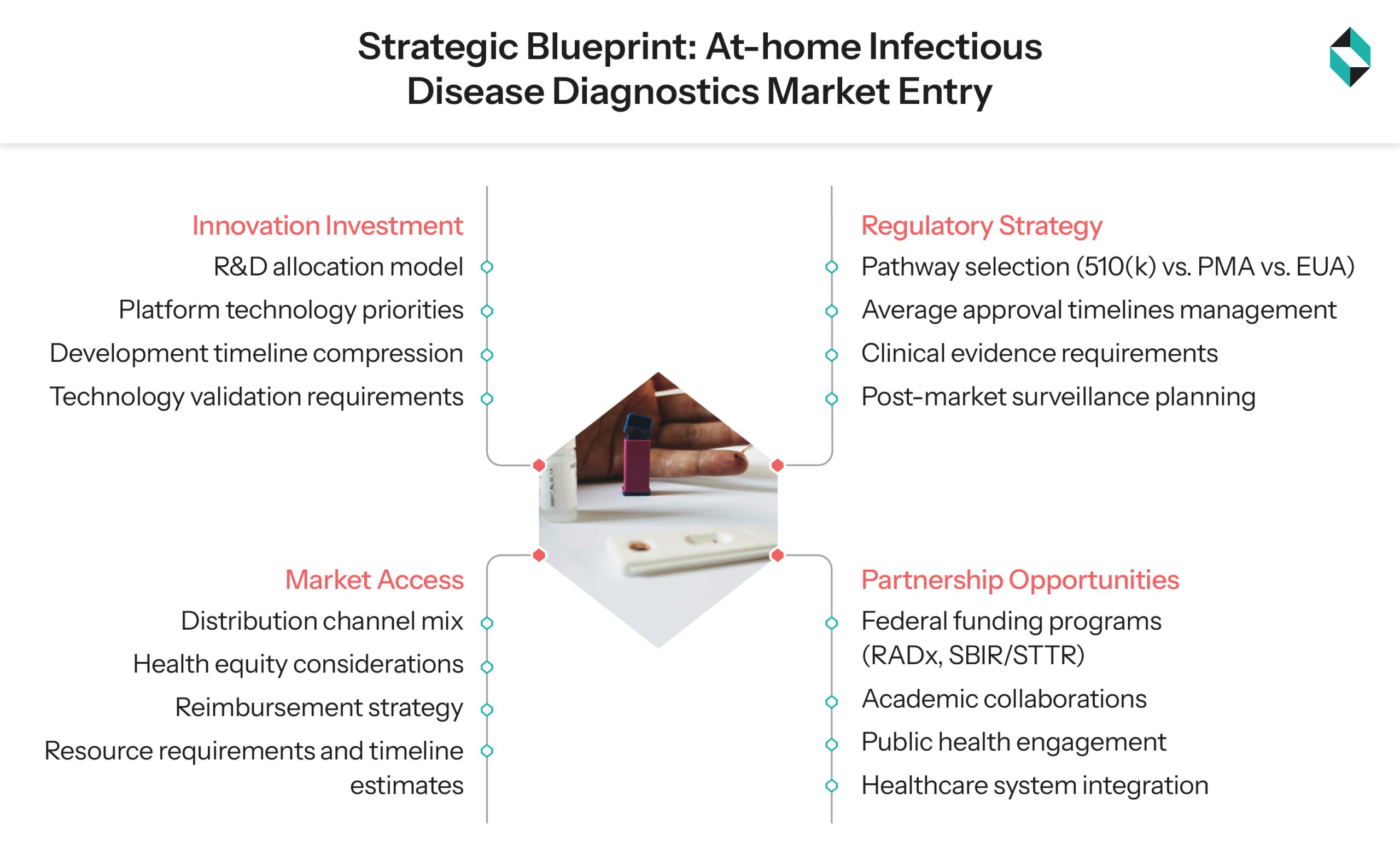

The Pathway to Market Leadership

Resetting Investment Priorities

Reassessment of R&D allocation will determine capitalization of opportunities in this segment. NIH’s investment model presents an ideal framework for strategic funding. Still, private organizations need to be more innovative in their approach by adopting focused investment in platform technologies to compress development timelines and sustain a stronger market edge.

Reframing Regulatory Compliance Approach

Following the FDA’s 300+ diagnostic test authorization precedence, the at-home test developers need to refresh their regulatory pathways, as even under the current plan, the average clearance time under the conventional 510(k) pathway is three times longer, extending the total time span from 2 to 6 months. The PMA pathway averages more than 8 months.

Leverage Public-Private Partnership Opportunities

Taking lessons from the RADx initiative’s success, companies need to explore academic partnerships, federal funding opportunities, and public health partnership models.

Final Words: Strategic Outlook

The trajectory of at-home infectious disease diagnostics is moving towards an integrated and predictive health ecosystem. A strategic blueprint to capture disproportionate value in biosensor wearables and AI could be the key to continuous pathogen monitoring and detection, even before infection symptoms appear.

Success in this segment will come from striking a balance between user experience and technological sophistication, enhancing accessibility, and maintaining agile regulatory compliance. A daunting task that demands strategic expertise, dedicated resources, and deep market analysis. At Stellarix, our Medtech experts are helping several industry participants navigate the complex landscape of at-home diagnostics and sustain a competitive advantage. Leading medtech organizations are engaging us to:

- Develop end-to-end at-home Diagnostics Strategies: To align core capabilities and their market position

- Integrate AI and Data Analytics: Across every stage of the product lifecycle and commercial offerings

- Navigate Regulatory Compliance Mandates: Narrowing down their time-to-market plans for their novel products

- Embrace Sustainable Business Practices: To reduce environmental impact and enhance brand value

- Level Up User Experience: To extend their brand presence, drive adoption, and build brand trust through DTC channels

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.