Robotic Surgery: A Paradigm Shift in Surgical Procedures

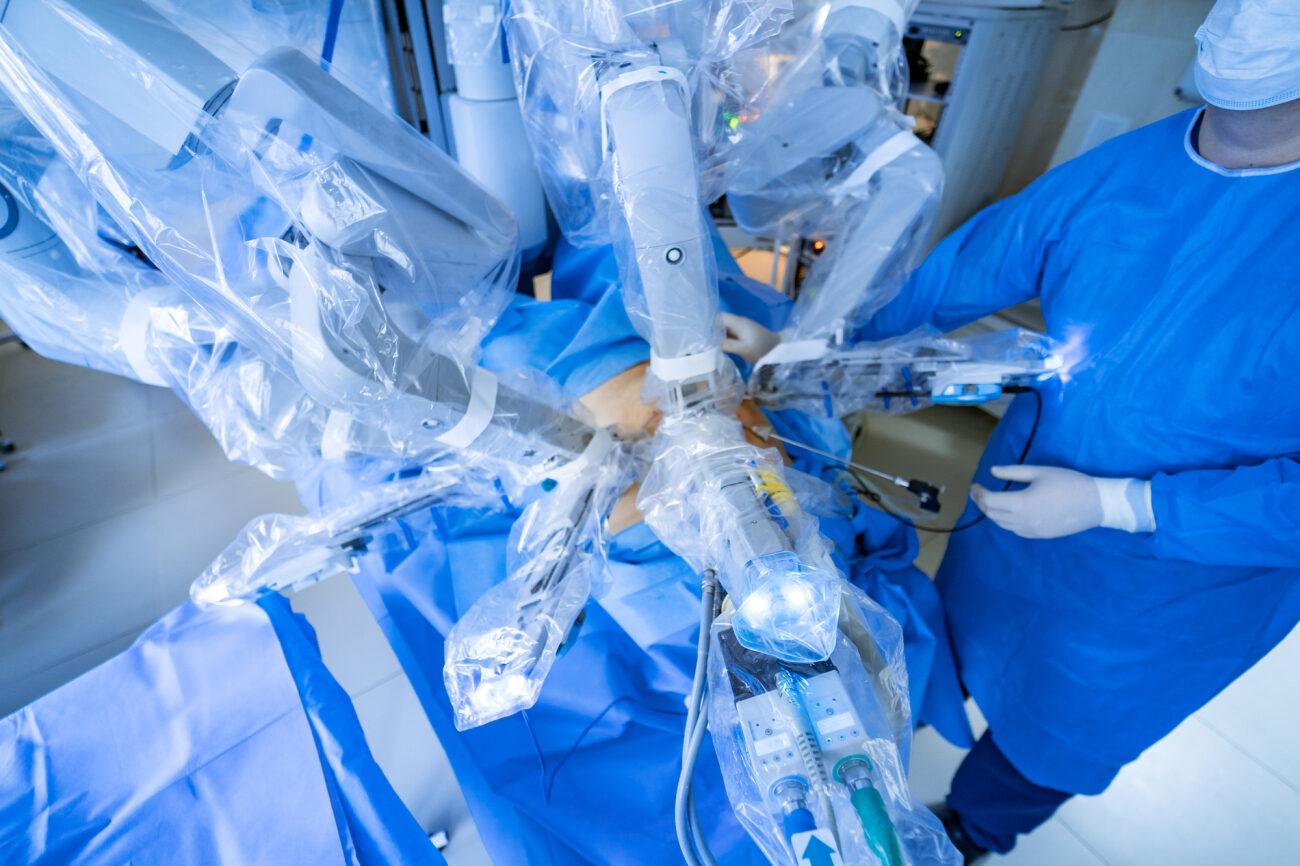

Robotic surgeries or robot-assisted surgeries (RAS) are types of surgical procedures done with the aid of surgical robotic systems. Robotic surgery is a rapidly evolving technology with significant growth in the last two decades fuelled by the rise of advanced technologies. Robot-assisted surgery might sound futuristic, but the application of robots in surgery dates approximately 36 years. Currently, the worldwide predominant robot system used in surgery is Da Vinci by Intuitive Surgical, but despite its supremacy, the evolution of robotic surgery is far from over, with multiple potential competitors and startups on the horizon pushing forward its standard.

Surgery is fundamentally a balance of removing targeted tissue while simultaneously preserving or reconstructing physiological function. The biggest challenge is that disease often occurs deep within the body cavity. During ancient times, a large incision through the abdominal or chest wall was required to access these hollows, disrupting multiple layers of muscle, fascia, and bone. The robotic surgery process provides precisions to surgeons while operating on an organ.

Evolution of Robotic Surgery

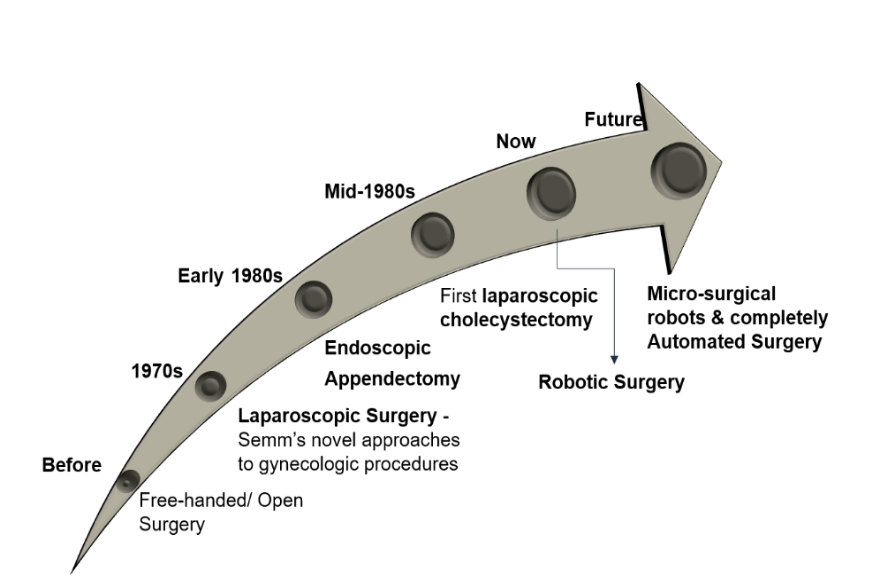

In the 1970s, surgical technology evolved towards the development of laparoscopic technology, allowing surgeons to visualize deep within the abdomen and pelvis for the first time with less tissue damage and impact on the surrounding healthy tissue. With the introduction of advanced video camera technology, accurate minimally invasive surgery evolved with Semm’s novel approaches to gynecologic procedures in the 1970s and subsequent endoscopic appendectomy in the early 1980s. Laparoscopic surgery was a true revolution, but some limitations hindered further adoption in complex cases. One of the primary disadvantages of laparoscopic surgery has been the fixed fulcrum of the trocar inserted through the body wall combined with straight instruments. This limits the surgeon’s ability to perform a procedure at certain angles, making suturing difficult. Second, the flat two-dimensional (2D) video with limited entry angles made laparoscopic surgical visualization very different from traditional open surgery.

In 2000, the da Vinci Surgery System was approved by the FDA to become the first robotic surgery system for general laparoscopic surgery. The da Vinci robotic system mitigated the shortcomings of laparoscopic surgery. Moreover, the distinguishing features of this system included the reproduction of open surgery in a minimally invasive platform using 3D video, 7-degrees of freedom through EndoWrist design that fit through small trocars identical to laparoscopy, smooth movements with tremor filtration, and motion scaling. All of these advances led to the third revolution in surgery. Thus ushered in a new world of minimally invasive surgery.

Intuitive Surgical: The Dominant Player in the Field

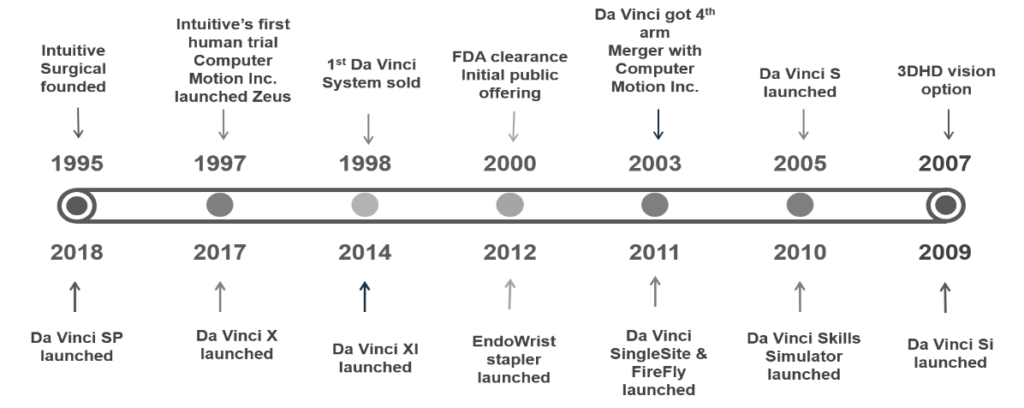

Intuitive Surgical, Inc. is an American organization founded in 1995 by John Freund, Frederick Moll, and Rob Younge. The company is one of the pioneers of robotic surgery systems. Additionally, it develops, manufactures, and markets robotic products designed to improve patients’ clinical outcomes through minimally invasive surgery, most notably with the da Vinci Surgical System. Also, Intuitive Surgical had an installed base of 5,989 da Vinci Surgical Systems and performed 8.5M+ procedures worldwide. Furthermore, Intuitive Surgical licensed telepresence surgical technology from SRI, and key technologies from IBM and MIT began developing the da Vinci Surgical System.

The timeline below indicates some of the company’s important activities.

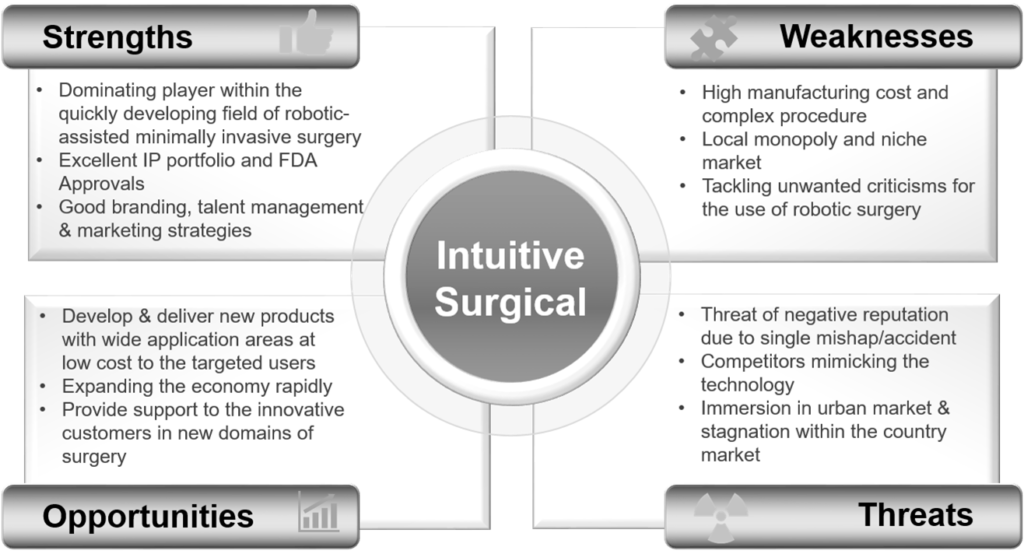

Figure 3 presents the SWOT Analysis of Intuitive Surgical. It includes four key elements: Strengths, Weaknesses, Opportunities, and threats. The strengths and weaknesses represent the company’s internal factors, while the opportunities and threats are the external factors that challenge Intuitive Surgical in the markets in which it operates.

Some of its competitors that have introduced robots with a more specialized focus include Medtronic, whose Mazor platform assists in spine and brain surgery; Stryker, with the Mako system for knee and hip replacement; Zimmer Biomet, with Rosa for spine and knee procedures; and Johnson & Johnson’s Monarch for lung biopsy.

Surgical Robotic Market

In 2021, the global surgical robotics market was valued at approximately 61 billion U.S. dollars. Projections indicate that by 2030, this market will nearly double, reaching an estimated 120 billion U.S. dollars.

Newer Approaches in Robotic Surgery

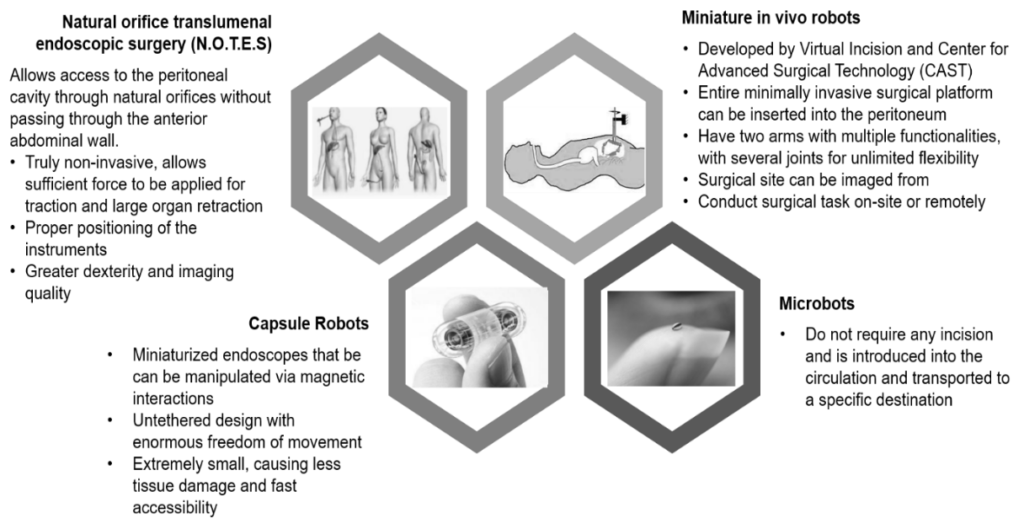

With growing technological advances, robot-assisted procedures are becoming even more popular. This is leading to more precise and efficient operations. Research is ongoing for new automated technologies that could take over repetitive tasks, such as suturing, to allow surgeons to focus on more complicated tasks and prevent fatigue during lengthy procedures.

Recent M&A Activities in the Robotic Surgery Market

There has been a flurry of mergers and acquisitions in recent years. Some of these are:

- Vicarious Surgical: In 2021, Vicarious Surgical, a surgical robotics firm, merged with D8 Holdings Corp., a special-purpose acquisition company (SPAC). Vicarious Surgical develops robotic technologies to enhance surgical efficiency, improve patient outcomes, and reduce healthcare costs. According to the companies, the private investment in public equity will increase the company’s value from USD 115M to USD 1.1B.

- Medtronic: In 2020, med-tech giant Medtronic acquired a London-based Digital Surgery and Artificial Intelligence (AI) firm for its surgical robotics platform. The company debuted its surgical robot in 2019.

- Johnson & Johnson: J&J took over the remaining stake in Verb Surgical from partner Verily as Verily exited the robotic surgery venture partnership. They also claim that their Ottava surgical robotic platform provides unmatched flexibility and control compared to the other devices in the market. Verb Surgical intends to combine its world-class robotics and data science capabilities with Johnson & Johnson’s healthcare leadership and global reach. This combination aims to provide more control and flexibility in surgery, enable patient access, enhance operating room space, and improve workflow.

Japanese Startups Enter Market as Core Patents Expire

Intuitive Surgical’s da Vinci surgical system dominates the surgical robot market. The company has filed thousands of patents on this system, which is still widely used worldwide. However, many of these patents expired in recent years, tied to some of da Vinci’s most essential features, such as its remote controls, arm joints, and automatic adjustments to the positioning of endoscopes. This gave newcomers like Riverfield an opening to enter the field.

Riverfield’s surgical robot runs using air pressure, allowing the doctors to feel subtle textures. Using air pressure reduces the system’s overall weight with fewer components. The system also has better tactile feedback and endoscope footage, increasing surgical accuracy. Riverfield aims to price its surgical robot at 100 million yen ($912,000) or less, almost half the price of da Vinci. The company is also targeting big hospitals looking for a second surgical robot.

A-Traction, a startup at the National Cancer Center Hospital East in Chiba Prefecture, has developed a surgical robot to assist doctors during surgery. This makes it easier for understaffed hospitals to conduct complex procedures. The surgeon takes charge of the operation. However, the robot performs support roles such as operating the endoscope camera or holding up surrounding tissue during the procedure. This makes endoscopic surgery possible in rural hospitals with few specialist doctors.

By narrowing the scope of the functions, the deployment cost of A-Traction was reduced to 30 million to 50 million yen per unit- that’s a fraction of da Vinci’s price tag. Notably, the robot is commercially available now.

Asahi Intecc, a Japanese medical device maker, acquired A-Traction Inc. on 1st July 2021.

Hinotori – the first made-in-Japan robotic-assisted surgery system of Medicaroid, won regulatory approval in August 2020. The device is a four-armed device that can perform a wide range of procedures.

Medicaroid was formed as a joint venture of Kawasaki Heavy Industries and medical electronics manufacturer Sysmex. Hinotori was developed based on Kawasaki technology.

The trend also triggered peripheral industries to jump in. Further, Yokohama medical startup Anaut is developing an artificial intelligence (AI) system that supports doctors using robots and endoscopes. AI analyzes camera images to identify organs and other items on-screen. Interestingly, Anaut plans to commercialize the system by fiscal 2023.

Intuitive Surgical has sought to extend patent protection for its products by filing new patent applications. It has done that for developments and innovations of its da Vinci systems to maintain industry control. How successful Intuitive Surgical’s efforts to maintain its monopoly remain to be seen.

Future of Robotic Surgical Procedures

Medical robotics has been used for more than thirty years. Despite rapid advances in minimally invasive telesurgery, challenges in form and feedback remained. However, robotic construction and network connection advancements have spurred new types of robotic surgery. Emerging 5G connections offer a massive benefit for near real-time technologies, data transfer velocities, and 10 times the bandwidth compared with 4G. Increased use of machine learning algorithms improves smart medical device applications.

Unsupervised machine learning algorithms can discover behavior patterns and improve patient outcomes. However, reinforcement-based tools can learn from mistakes, such as false positive results in treatment or diagnosis. Moreover, as robotic surgical procedures continue to mature to provide front-end applications and back-end IT support, it promises to alleviate staffing shortages and expand access to certain types of care. Additionally, from assistive robotic solutions to fully automated robotic surgery, 5G-enabled medical devices are paving the way for remote physicians. They can deliver superior care anytime, anywhere.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.