India as an Emerging Manufacturing Hub for EV Battery

India is making significant strides towards achieving net-zero carbon emissions by 2070 through the electrification of vehicles. The increasing adoption of electric vehicles is leading to a surge in the demand for EV batteries. This transition is being fueled by advancements in battery technology, charging infrastructure, and favorable government policies. To bolster the Make in India Initiative, the government is implementing various incentives and subsidies to promote the domestic manufacturing of EV components, particularly battery cells. These measures include the Production Linked Incentive Scheme (PLI), tax breaks, and investments in research and development.

Furthermore, collaborations with international entities are being encouraged to introduce cutting-edge technologies and foster innovation in the EV industry. Through these collective efforts, India aims to establish itself as a key player in the global EV battery manufacturing market while supporting its ambitious environmental goals.

Factors Influencing the Manufacturing of EV Batteries

India is encountering some obstacles in its journey to become a manufacturing center for electric vehicle (EV) batteries, but the country is making notable advancements. The issues of infrastructure development, land, raw material availability, and skilled workforce are being tackled to convert India into a competitive EV battery manufacturing hub.

- Availability of Raw Material: India is relying heavily on imports of lithium-ion cells used in EV batteries. However, a Bengaluru-based startup called Log9 Materials is striving to alter this situation. The company is producing lithium-ion battery cells and battery technologies specifically designed for tropical climates. It has already introduced fast-charging and longer-lasting battery packs for commercial vehicles and is currently focusing on in-house cell manufacturing.

- India is actively seeking collaborations with countries abundant in resources and promoting local mining to ensure a consistent supply. One example is the Indian Joint Venture firm KABIL, which is actively involved in partnerships with major mineral-producing nations like Australia, Argentina, Bolivia, and Chile. KABIL has recently established a comprehensive, collaborative agreement with Australia, enabling India to invest in lithium and cobalt reserves in the country. In Chile, KABIL is working with the state miner Empresa Nacional de Minería to jointly pursue lithium projects.

- Availability of Skilled Labour: The demand for skilled labor in the Indian electric vehicle industry is increasing, but there is a shortage of workers with the necessary technical skills. The government has proactively established Industrial Training Institutes (ITIs) to address the skills gap. The government is currently in the process of developing programs that will concentrate on electric vehicle (EV) battery technology at different ITIs. This effort aligns with the growing need for trained professionals in the quickly advancing EV industry. Additionally, the Skill Development Department is actively working on implementing counseling services for students. This includes encouraging more institutes to offer training programs in remote areas.

- Transport Infrastructure/Logistics: Companies can take advantage of India’s robust port infrastructure to import minerals and export refined products, cells, or vehicles. To become an EV hub, several states, such as Karnataka, provide the necessary infrastructure for accessibility and product transport for export or domestic use. Karnataka’s seaports, including the New Mangalore Port, are essential gateways for importing crucial minerals and exporting processed goods, batteries, and vehicles. Moreover, the state’s sophisticated road infrastructure ensures seamless transportation within urban areas and across state boundaries, facilitating manufacturers to distribute their products domestically and internationally. India’s port infrastructure and logistics experience positioned it well for the expansion in minerals production. For instance, India can import essential minerals from allies such as Australia and export them to other traders while building other supply chain segments. By refining imported raw minerals domestically, India adds significant value before exporting, making it an attractive supplier of high-quality, ready-to-use materials. This process supports the domestic manufacturing sector and positions India as a key player in the global supply chain.

- Land: Large-scale production is required for mineral processing and battery manufacturing, but companies face challenges due to India’s lengthy land permitting process. According to the World Bank’s Doing Business (2020) report, India ranks 150th in property registration. Despite this, the Indian government is actively promoting local companies to establish battery manufacturing plants. For example, Tata Chemicals owns 127 acres of land in Gujarat to produce 10 gigawatts of lithium-ion cells annually. In collaboration with Denso and Toshiba, Suzuki Motor Corp is establishing India’s inaugural lithium-ion battery manufacturing plant in Gujarat. Furthermore, International Battery Company (IBC) has secured a $971.89 million investment agreement with Karnataka, a state in southern India, to construct a battery manufacturing facility.

- Manufacturing Cost: India stands out as the most cost-effective location for manufacturing Nickel Magnesium Cobalt (NMC) pouch cells. Currently, the cost of manufacturing these cells can range from $100 to $120 per kWh globally. The subsidies offered through the PLI ACC program could further lower costs to $65/kWh. Land, labor, and materials expenses influence regional variations in construction costs. In 2019, India’s monthly minimum wage was $65, significantly lower than China’s $217. Additionally, from 2010 to 2019, India saw a 3.9% growth in real minimum wages compared to China’s 6%. These factors enable India to match or potentially surpass China in cost competitiveness.

Figure 1: Manufacturing Cost

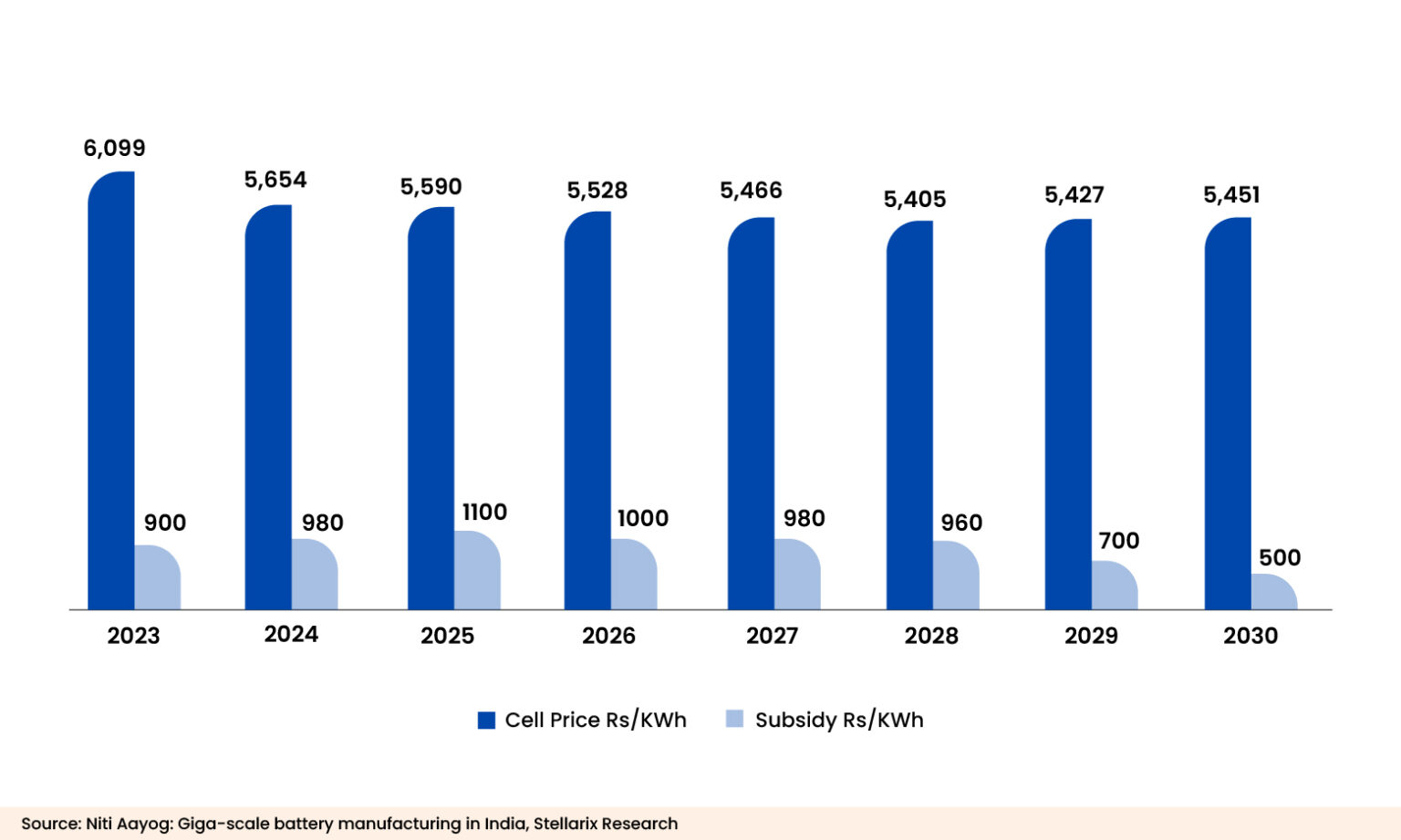

- Government Subsidy: Direct government support through subsidies and tax incentives plays an important role in mineral processing and manufacturing companies’ consideration of investment opportunities. State subsidies for capacity, capital expenditure, and employment are substantial, as evidenced by Epsilon Advanced Materials’ agreement with Karnataka. The PLI-ACC program provides production-related government subsidies, but additional subsidies beyond these incentives will help meet future demand.

Figure 2: Cell Price and Subsidiary Trends in India

- Government Policies: Several government policies promote EV battery production in the country. The reduction in GST rates for electric vehicles from 12% to 5% and for chargers and charging stations from 18% to 5% has increased affordability for EVs. The Production Linked Incentive (PLI) Scheme for the Automobile and Auto Components Industry, with a budget of Rs. 25,938 crores over five years, is designed to enhance local production of cutting-edge automotive technology goods and encourage investment inflow. The PLI scheme for manufacturing Advanced Chemistry Cells (ACC) will also reduce battery prices and lower electric vehicle costs. Under the FAME India Scheme Phase-II, the Phased Manufacturing Programme (PMP) promotes local manufacturing of electric vehicles and their components, increasing domestic value addition. These measures create a favorable environment for establishing India as a leading manufacturing hub for EV batteries.

- Geopolitics: The geopolitical situation presents significant opportunities for India in the global battery supply chain. As countries like the US, Europe, and Australia seek to diversify away from Chinese dominance in producing essential minerals, India can showcase its strong partnerships with these countries. India’s recent entry into the Mineral Security Partnership and possible mineral-related FTAs could make it a reliable supplier, reducing global reliance on China. The US is willing to enter into such agreements to meet domestic needs and reduce Chinese control over battery ore supplies.

Recent Investment

The manufacturing of battery cells for EVs is still nascent, as India is highly dependent on outsourcing the cells from China, Japan, and South Korea. Still, India aims to source and meet the domestic production demand. Several Indian states have successfully created ecosystems to attract EV battery manufacturers, bolstering the battery supply chain. Karnataka and Telangana have attracted corporations such as Exide, Ola, Amara Raja, and Allox to engage in cathode manufacturing and finalize a Memorandum of Understanding with Rajesh Exports. In Gujarat, TDSG, Exide, Tata Chemicals, and Renon are in the process of establishing their operations. Meanwhile, Minda is collaborating with C4V to establish a Gigafactory in Haryana.

Investments from Key Players

| Company | Investment | Description |

| International Battery Company (IBC) | $35 million | In January 2022, C4V signed an MoU with the Karnataka government to build a 5GWh cell manufacturing Giga factory with an investment of $538 million. Construction began in early 2022. |

| Ola Electric | $383 million | In January 2024, International Battery Company (IBC) announced that it had raised $35 million in a funding round led by RTP Global. Participation came from BeNext, Veda VC, and strategic investors from Korea and the US. IBC will use part of the investment to set up a 50 MWh plant in Bengaluru to produce batteries for the Indian market. |

| Lucas TVS and 24M Technologies | $343 million | In March 2023, Amara Raja Batteries Limited launched India’s largest Giga factory in Telangana. The facility will manufacture lithium cells with a capacity of up to 16 GWh and battery packs with a capacity of up to 5 GWh. The facility, which will manufacture lithium-ion batteries, involves a planned investment of approximately $1.16 billion over the next 10 years. |

| Tata Group | $1.58 billion | In June 2023, Tata Group signed a framework agreement to build a lithium-ion cell plant in Gujarat. With an investment of about $1.58 billion, the facility aims to strengthen the country’s EV supply chain and reduce reliance on imported batteries. By 2030, India aims to adopt electric vehicles completely and cut carbon emissions by 50%. |

| Amara Raja Batteries Limited | $1.16 billion | In August 2022, Suzuki, through its subsidiary Suzuki Motor Gujarat, invested about $914 million to set up an EV battery plant in Hansalpur, Gujarat. The plant will produce advanced-chemistry cell batteries for electric vehicles. Maruti Suzuki plans to launch EVs by 2025. |

| Suzuki | $914 million | In January 2022, C4V signed an MoU with the Karnataka government to build a 5GWh cell manufacturing Giga factory, investing $538 million. Construction began in early 2022. |

| Nexcharge | $30 million | In May 2022, Nexcharge, a joint venture between India’s Exide Industries Limited and Leclanché SA, announced the inauguration of its new manufacturing plant in Gujarat. The company has invested over $30 million in this manufacturing unit. |

| C4V | $538 million | In January 2022, C4V signed a MoU with the Karnataka government to build a 5GWh cell manufacturing Giga factory with an investment of $538 million. Construction began in early 2022. |

| ChargeXO and Greenco | $276 million | In January 2022, ChargeXO and Greenco planned to invest $276 million to build a 100-acre cell manufacturing facility in Hyderabad’s Mahbub Nagar Energy Park. |

Li-Ion Battery Manufacturers

By 2030, companies in India plan to build approximately 120 GWh of battery manufacturing capacity, and this number continues to rise. Recently, Tata Group announced a 20GWh gigafactory with an initial investment of around USD 1.6 billion.

Figure 3: Key Lithium-ion Battery Pack Manufacturers with Battery Capacities

Some other key manufacturers include Epsilon Carbon, Exide-Leclanché, Ather, Ola Electric, TDSG, GODI, LucasTVS, Reliance, Adani, Greenko, and ChargeXO.

Opportunities and Recommendations to Scale Up Production

India can explore opportunities for international cooperation with other countries and international financial institutions to reduce dependence on China in the global battery supply chain. The main strategies include:

- India can potentially become a major exporter of raw materials, precursor materials, Lithium-iron-phosphate (LFP) battery cells, battery packs for two-wheeled and three-wheeled vehicles, and black mass. For instance, overseas producers of nickel-cobalt-manganese (NCM) cathode material may face a shortage of manganese sulfate in their own countries or wish to diversify their suppliers. They could rely on India for their manganese sulfate needs.

- India can import end-of-life batteries and transform them into black mass within the country for recycling or export purposes. By establishing commercial infrastructure, India can convert black mass into essential raw materials such as lithium carbonate. The country can implement safe storage regulations and levy taxes on imported end-of-life batteries to encourage local recycling efforts.

- India’s focus on cobalt and lithium through KABIL involves exploring resources in Argentina and negotiating lithium asset acquisitions in Bolivia. Additionally, India can leverage its membership in the Minerals Security Partnership to assess and invest in mineral projects abroad, often in collaboration with other member nations.

- International financial institutions can provide loans, credit guarantees, political risk insurance, investments in infrastructure, and technical assistance. For instance, in April 2024, the World Bank planned to provide the State Bank of India with a $1 billion credit to support the Battery Energy Storage System (BESS) and electric mobility in India.

- India’s battery manufacturing sector is experiencing a surge in Foreign Direct Investment (FDI), particularly from prominent Japanese firms such as Suzuki, Toshiba, and Denso. The government of India has implemented more lenient regulations, permitting a maximum of 100% FDI through the automatic route for ACC battery production. This strategic move highlights India’s determination to become a key player in worldwide manufacturing and take the lead in the electric vehicle industry.

- Indian Institutes of Technology (IITs) can collaborate with institutions such as the University of Tokyo and the Massachusetts Institute of Technology in battery research. Government-to-government cooperation could expand research with organizations like the CSIRO in Australia and the US. National Laboratory will provide additional resources to commercial entities in India and partner countries.

Conclusion

India is rapidly becoming a global manufacturing hub, driven by the establishment of large-scale factories across various sectors and supported by government initiatives such as the Make in India campaign and Production Linked Incentives (PLI) schemes. The country’s liberal FDI policy, allowing 100% foreign investment in many sectors, attracts significant multinational investments. Enhanced logistics and infrastructure projects like the Dedicated Freight Corridors and Sagarmala Project, coupled with improved ease of doing business, further bolster this growth. Strategically managed geopolitical relationships ensure a steady supply of critical raw materials, such as lithium, necessary for key industries. Together, these factors create a robust environment for manufacturing, positioning India as a competitive and attractive destination for global manufacturing.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.