Carbon Credits: Profitable Avenue for Life Sciences

The growing global interest in sustainability and environmental responsibility has created new financial gateways for mainly every industry worldwide. Life science companies, usually dealing with pharmaceuticals, biotechnological, and medical devices, have recently found yet another way to get involved in environmental activities that will contribute to their environmental bottom line while not neglecting their revenue generation. One such opportunity refers to trading and applying carbon credits(CC). Relating to carbon credits, the discussion focuses on the companies in life science and how efficiently these companies can use this mechanism to generate additional revenues.

Understanding Carbon Credits

What Are Carbon Credits?

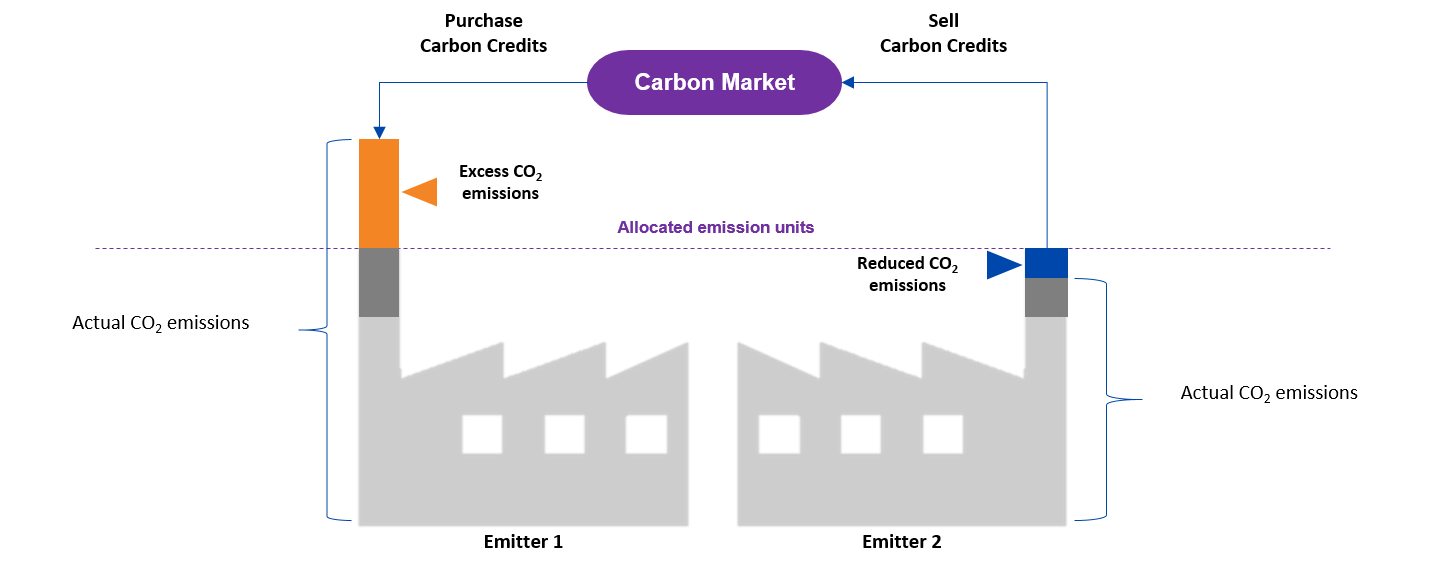

Carbon credits permit a company or organization to emit a certain amount of greenhouse gases, such as carbon dioxide. Traditionally, one credit represents one ton of CO2 equivalent that can be emitted. The concept of carbon credit was created to assign more of a financial value, or cost, to the greenhouse gases emitted.

Types of Carbon Credits

- Compliance Credits: Carbon credits utilized in regulated markets. Companies operating in such markets must adhere to the emission cutback requirements by the government or regulatory body. Once companies have exceeded their emission allowances, they have to pay the compliance credits required for companies adhering to set levels of emission cuts.

- Voluntary Credits: The very nature of such credits is to utilize them in voluntary markets when companies want to cut down on emissions beyond the regulatory requirement. Besides, these credits are also often bought to meet corporate social responsibility goals or to be more image-friendly.

How Do Carbon Credits Work?

There are several different marketplaces where carbon credits can be purchased or sold. Companies that have lowered their emissions can sell the extra credits to companies that need them. Such trading creates a direct financial incentive for investing in clean, environment-friendly technologies and practices.

Figure 1: Carbon Credits Trading Mechanism

Carbon Credits and Their Relevance to the Life Sciences Sector

Environmental Impact of Life Science Companies

Companies within the life sciences sector are traditionally known to have a wide footprint of environmental degradation due to their heavy manufacturing processes, diverse chemical uses, and heavy research and development activities. Participation of such companies in carbon credit markets will help them reduce their impact and contribute to emission reduction goals.

Regulatory Pressure

Like those from other industries, life science companies are under increasing regulatory pressure to reduce their greenhouse gas emissions. Therefore, participation in carbon credit markets can help such companies meet regulations without possible fines and penalties.

Corporate Social Responsibility (CSR) and Brand Image

Today, with consumers and stakeholders being more environmentally conscious, a life science company can use its brand image to meet its CSR goals in showing commitment to sustainability. The significant increase in reputation results from offsetting your emissions or, better yet, reducing them.

How Life Science Companies Can Use Carbon Credits?

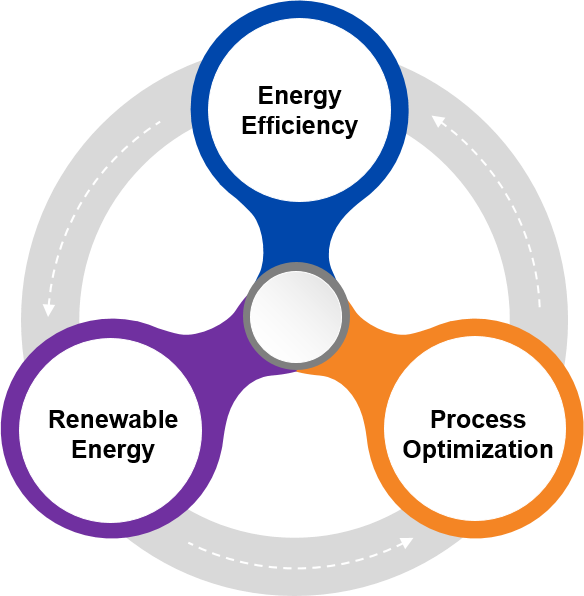

1. Emission Reduction Programs– Life science companies may take up a variety of means to reduce GHG emissions:

- Energy Efficiency: The application of energy-efficient technologies in manufacturing and research facilities can significantly reduce the emission rate

- Renewable Energy: This would mean using renewable energy sources, such as solar or wind, reducing dependency on fossil fuels.

- Process Optimization: With more efficient and less wasteful manufacturing processes, life science companies can minimize overall emission

Figure 2: Strategies for GHG Emission Reduction

2. Making Carbon Credits

All types of carbon credits while carrying out any emission reduction project become tradable in the market for life science organizations. For example, a life science company may invest in renewable power generation projects to increase the energy efficiency in their manufacturing process by a more significant amount than required by regulatory agencies or replace old machinery with more efficient versions. Then, the difference is qualified to be used to generate a surplus credit.

3. Purchasing Carbon Credits

Carbon credits can be purchased if avoidance of direct reduction is unavoidable. In this way, life sciences companies will have an opportunity to fulfill their CSR and regulatory mandate without any immediate disruption in their process.

4. Participating in Carbon Credit Markets

Both compliance and voluntary markets are available in carbon credit markets. A thorough grasp of market dynamics, regulatory frameworks, and tracing mechanisms is required for engagement in these markets.

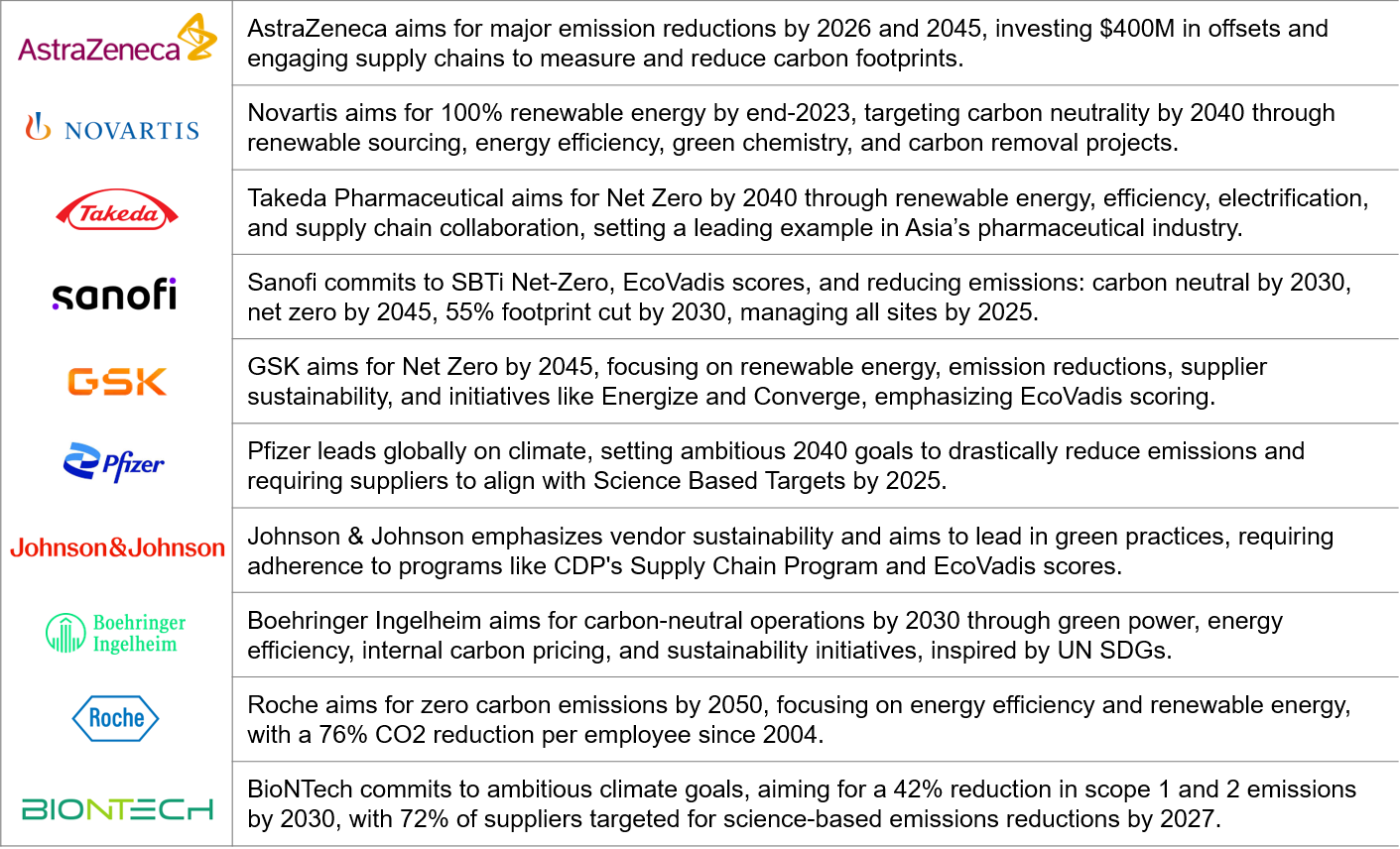

Case Studies: Life Science Companies Utilizing Carbon Credits

The life science industry is under great scrutiny nowadays to help meet the demands of stakeholders and regulatory bodies who have noticed how large some companies are expanding and lowering their environmental impact. As part of their corporate sustainability policy, numerous key industry players have committed to Net Zero emissions. To get there, these leaders lead efforts at a high level that can bring in policies and projects that drive such targets (such as buying carbon credits). Bringing carbon credits into the fold of their sustainability strategies helps life science companies like AstraZeneca and GSK create a path to meet climate goals while unlocking important financial potential.

- GSK: GSK is a leading example of a life science organization using CCs to achieve Net Zero emissions. GSK plans to secure carbon credits for 20% of emissions, which it estimates will be residual by 2030, and for a maximum of 10% of residual emissions by 2045.

- AstraZeneca: AstraZeneca: AstraZeneca’s AZ Forest project seeks to grow and maintain 200 million trees across the globe by 2030. A $400 million investment backs this effort. The project forms part of their “Ambition Zero Carbon” plan. It uses cutting-edge tech to check tree health, soil and water quality, wildlife variety, and carbon capture. Annually, the project could trap about 2 million tons of carbon dioxide. This might create up to 2 million carbon credits annually. AstraZeneca could see a substantial financial return with the growing demand for carbon credits.

Challenges and Considerations

Figure 3: Challenges and Considerations in Navigating the Carbon Credit Market for Life Science Companies

- Verification and Certification

One of the most significant difficulties facing the carbon credit market is issuing credible and genuine carbon credits. Life science companies must partner with a credible verification and certification institution to ensure compliance with their emission reduction projects.

- Market Volatility

Prices of carbon credits can be very volatile because of regulatory changes, market demand, and many other factors. Life science companies must be ready to follow these market dynamics and formulate strategies against price pressure.

- Regulatory Compliance

Life science companies typically find this a very complex regulatory environment; hence, participation in carbon markets becomes cumbersome and requires understanding the delicate nuances of the specific requirements and regulations in different jurisdictions.

- Long-term Commitment

Emission reduction and consequent carbon credit generation are majorly associated with long-term commitments to such investments. Life science companies should be poised to invest in the practices and technologies for sustainability that pay long-term dividends in carbon credits.

Future of Carbon Credits in the Life Sciences Sector

- Technological Advancements: Advances in technology are critical. They can help companies in the life science sector reduce their emissions and earn carbon credits. The invention of energy efficiency, renewable energy, and carbon capture and storage will open up additional possibilities for emission reduction.

- Increased Regulatory Pressure: Life science companies will experience more significant pressure to reduce their environmental impact since governments worldwide are increasing regulations on greenhouse gas emissions. Joining the CC markets will be a decisive strategy for both compliance and sustainability.

- Growing Market Demand: Demand for carbon credits is growing as more companies pledge to become net-zero emitters in line with sustainability objectives. Life science companies that generate and sell carbon credits will help benefit from this escalating market demand.

- Corporate Sustainability Goals: Over the years, many life science companies have set aggressive sustainability targets that include achieving net-zero emissions. Carbon credits will help these companies meet their goals, both through direct emission reductions and the purchase of offsets.

Conclusion

Making carbon credits into a revenue stream is one of the most promising avenues in which life science companies can align to meet sustainability mandates from countries across the world, enhancing their financial performance. Concerning emission reduction initiatives, given the fact that environmental responsibility has now become a business strategy, participation in carbon credit markets and the ability to become a leader in this segment amidst the emerging challenges means that these companies would, in all likelihood, be able to convert those market opportunities into profitability effectively. CCs will be an essential strategic play for life sciences in the future as sustainability gets to the forefront of world priorities, driving innovation, compliance with regulation, and long-term growth.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.