Ban on Forever Chemicals: Implementations and Impact

PFAS: A Next Challenge Ahead of Industry

Per- and polyfluoroalkyl substances (PFAS), or forever chemicals, are over 14,000 synthetic compounds widely used in industrial and everyday consumer products. Chemically, PFAS compounds are man-made chemicals wherein hydrogen atoms in carbon chains are replaced by fluorine atoms.

In doing so, the strong C-F covalent bond gives PFAS chemicals high strength, making them very stable and resistant to heat, water, and oil. However, this exceptional strength and stability prevent PFAS from breaking down into methane, carbon dioxide, and simpler substances, leading to environmental persistence and potential health risks.

As a countermove, the regulatory bodies are creating frameworks to push market participants towards PFA alternatives. It is evident in the European Union’s proposed broad restrictions on PFAS and its push for a ban expected in 2026. Similarly, the US EPA has also taken action by establishing drinking water standards for six different PFAS chemicals, and other regulatory agencies are tightening rules on the use of Perfluorooctanoic Acid (PFOA) and Perfluorooctanesulfonic acid (PFOS) in food packaging, cosmetics, textiles, and firefighting foam. Leading chemical companies such as 3M, BASF, and Ecolab have already begun taking steps towards safer, environmentally friendly PFAS alternatives. For instance, 3M announced to discontinue PFAS manufacturing and use from its product portfolio by 2025, and is progressing towards the exit of all PFAS manufacturing. Similarly, BASF & Ecolab are also taking steps to phase out PFAS, following the direction set by 3M. Additionally, 3M is evaluating the feasibility to eliminate PFAS-containing third-party products used in certain applications of 3M’s product portfolio, such as lithium-ion battery, printed circuit boards, seals & gaskets, etc. Companies like Daikin and Chemours also initiated programs to achieve ~99.9% PFAS capture from discharge water and to reduce emissions, respectively, to meet regulatory compliance and reduce their environmental footprint. Overall, the PFAS ban is gaining traction among companies and is likely to expand gradually in the coming years, with some exceptions for high-performance applications until effective alternatives are found.

Why PFAS Matters: Essential Today, Risky Tomorrow

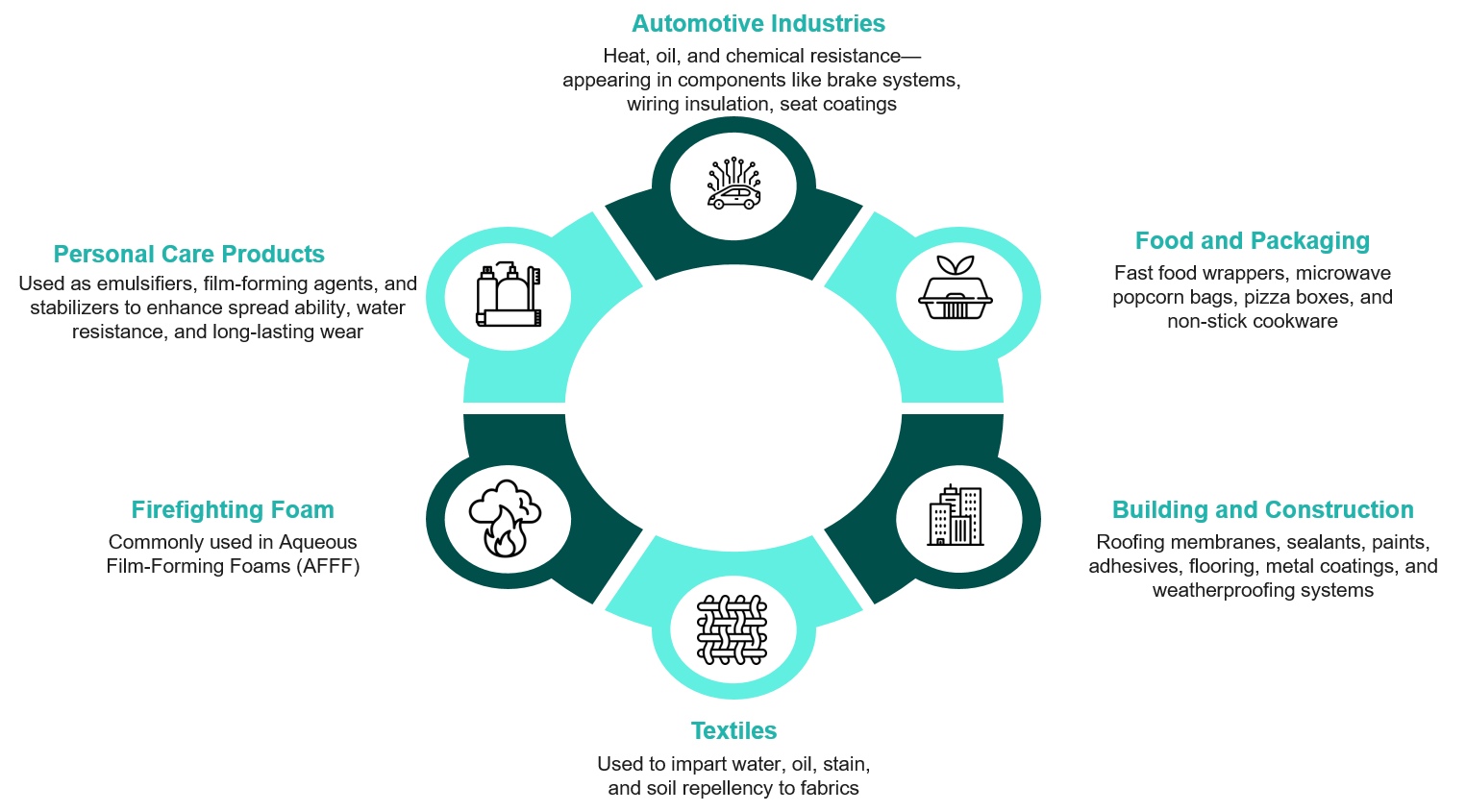

PFAS is an important component across various industries, from small-scale to large-scale, including food packaging, automotive, aerospace, and chemical facilities. PFAS-based fluorosurfactants are expensive and can cost 100 to 1000 times more than hydrocarbon surfactants. They are often employed in situations where hydrocarbon-based surfactants are ineffective, and a small amount of fluorosurfactant achieves the same effect as a large amount of conventional surfactant.

Despite their widespread use and high effectiveness, PFAS are linked to significant health risks for both humans and animals. Exposure can lead to serious health problems, including cancer, liver and heart damage, immune system issues, and other severe conditions.

Worldwide Regulations Tightening Around PFAS Use

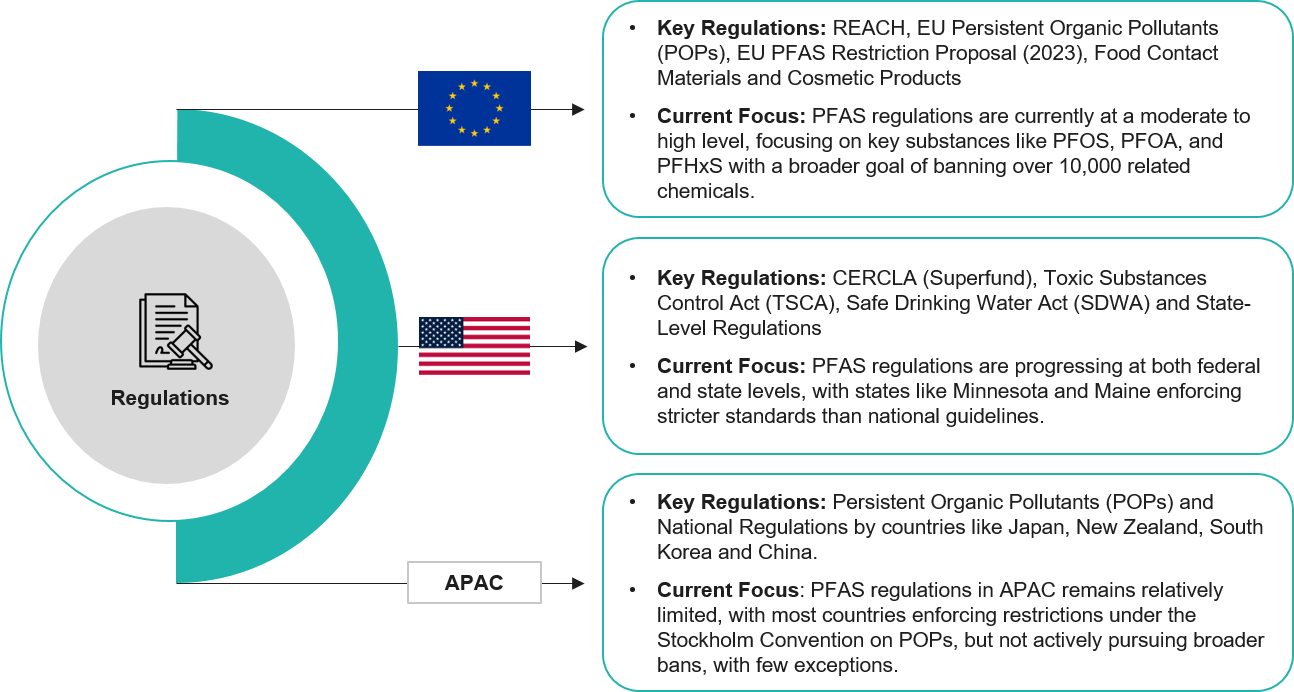

PFAS regulation is increasing at both the federal and state levels in the United States due to growing public awareness and legal pressure. The USA is not a signatory to the Stockholm Convention; however, it aligns with its goals through independent regulatory actions. Federally, the USA focuses on controlling PFAS levels in municipal water supplies rather than banning PFAS entirely. States like Maine and Minnesota have implemented strict measures to address PFAS, including bans on consumer products such as food packaging and cosmetics.

The US EPA has proposed under CERCLA (Superfund) to classify seven PFAS and their salts as hazardous substances for mandatory cleanup and reporting of contamination. In April 2024, the EPA introduced the first national drinking water standards for PFAS with contaminant levels as low as 4 parts per trillion for PFOA and PFOS. Through the National Pollutant Discharge Elimination System (NPDES) and Toxics Release Inventory (TRI) programs, the US EPA also plans to regulate PFAS discharges and mandate product reporting at any concentration, eliminating previous thresholds.

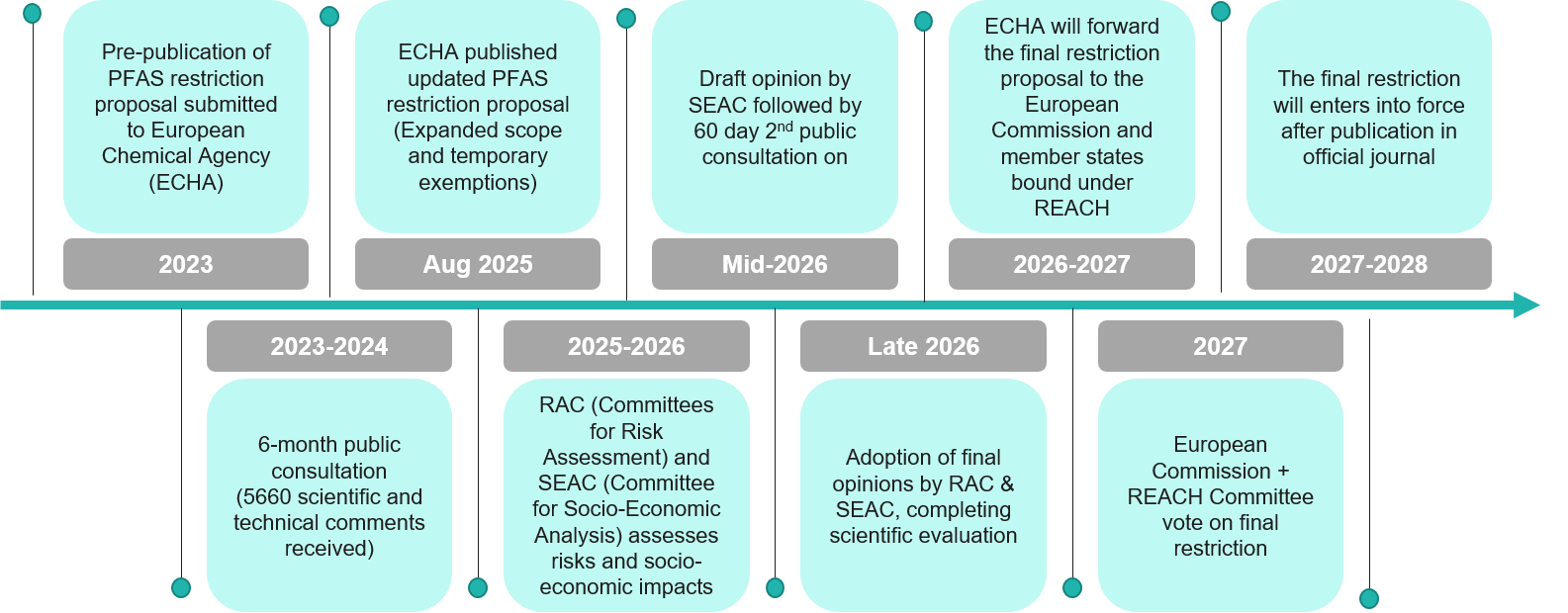

In Europe, PFAS regulation is more stringent under the REACH framework, with updates managed by the European Chemicals Agency. Since 2023, there have been strict controls over PFOS, PFOA, and C9–C14 per-fluorinated carboxylic acids, including their salts and precursors. A few European countries, such as Germany, Sweden, the Netherlands, Denmark, and Norway, proposed a ban on 10,000 PFAS compounds all over Europe. Several Asia-Pacific countries are advancing PFAS regulations and aligning with international frameworks, such as the Stockholm Convention, which restricts PFOS, PFOA, and Perfluorohexane Sulfonate (PFHxS). Japan has expanded the restriction to include 138 PFOA-related compounds effective 2025, in addition to the existing 2020 ban on manufacturing and use of PFOS and PFOA. New Zealand will prohibit PFAS in cosmetics by 2027, and Taiwan will implement drinking water limits for PFAS. Latin America remains at an early stage of PFAS regulation, while APAC is seeing a shift toward a more stringent regulatory landscape amid global environmental commitments.

Key Challenges Associated with PFAS Use and Management

PFAS is linked with severe challenges, mainly environmental and health-related, such as:

Environmental Hazard: Due to PFAS’s strong carbon-fluorine bond, it persists in the environment for longer, causing serious problems in soil, water, and air. Long-chain PFAS are generally removed using various technologies, but short-chain PFAS are difficult to extract, making them more mobile and harder to eliminate, thereby spreading across ecosystems.

Regulatory Complexities: There are over 14,000 different compounds classified as forever chemicals, which are not equally harmful, yet they are grouped. Some PFAS compounds are crucial in applications such as aerospace, medical devices, and semiconductors, for which no alternatives currently exist. Addressing this regulatory dilemma is challenging at this stage and requires exemptions, which in turn lead to weaker rules.

- Production continues- Even if PFAS used in consumer products is restricted, demand in high-tech industrial applications will persist, leading to PFAS products filling the gap.

- Geographical fragmentation- Different countries or states may define essential use differently, which leads to inconsistency and shifting of PFAS operations to states or regions with fewer exemptions.

- Monitoring challenges – It is difficult to differentiate between legitimate and non-legitimate uses of PFAS, creating a grey area that leads to unreported PFAS usage.

Health Hazards: Exposure to PFAS is associated with serious health issues, including cancer, liver-related issues, and chronic kidney problems. PFAS persist in the body for several years and accumulate over time, potentially leading to long-term health impacts.

Industrial Implications of PFAS Restrictions

Industrial sectors are reshaping in response to upcoming regulations and PFAS bans. Companies are forced to focus on sustainability strategies that hinder the use of material resources and processes. This has impacted not only the operational end but also caused financial disruptions.

Supply Chain Disruptions: Regulatory restrictions will force the companies to source alternative materials, disrupting established networks. Industries need to restructure processes to eliminate PFAS; these changes will lead to increased costs and investments.

Sustainability: Companies’ focus lies on transitioning from toxic PFAS to PFAS-free alternatives. This will, in turn, enhance brand reputation, environmental responsibility, and transparency. Companies are looking ahead to this as a golden opportunity to shift towards sustainability and gain environmental credits. To raise consumer awareness, brands are labelling products as “PFAS-Free,” reshaping market expectations.

Financial Difficulties: Industries will face rising costs as they need to invest in extensive testing and maintain detailed compliance with evolving regulations. Investments in research and innovation, legal liabilities, and site remediation for PFAS contamination would further increase substantial financial burdens.

What is the Way Forward for Companies

Widespread development of PFAS bans across various sectors is increasing pressure on industry players to prepare for compliance with strict regulatory requirements. Currently, no country or region has proposed a complete ban on all PFAS. Regulatory actions have begun with restrictions on high-risk PFAS chemicals, such as PFAS and PFOA, and are evolving from substance-specific bans to class-based bans.

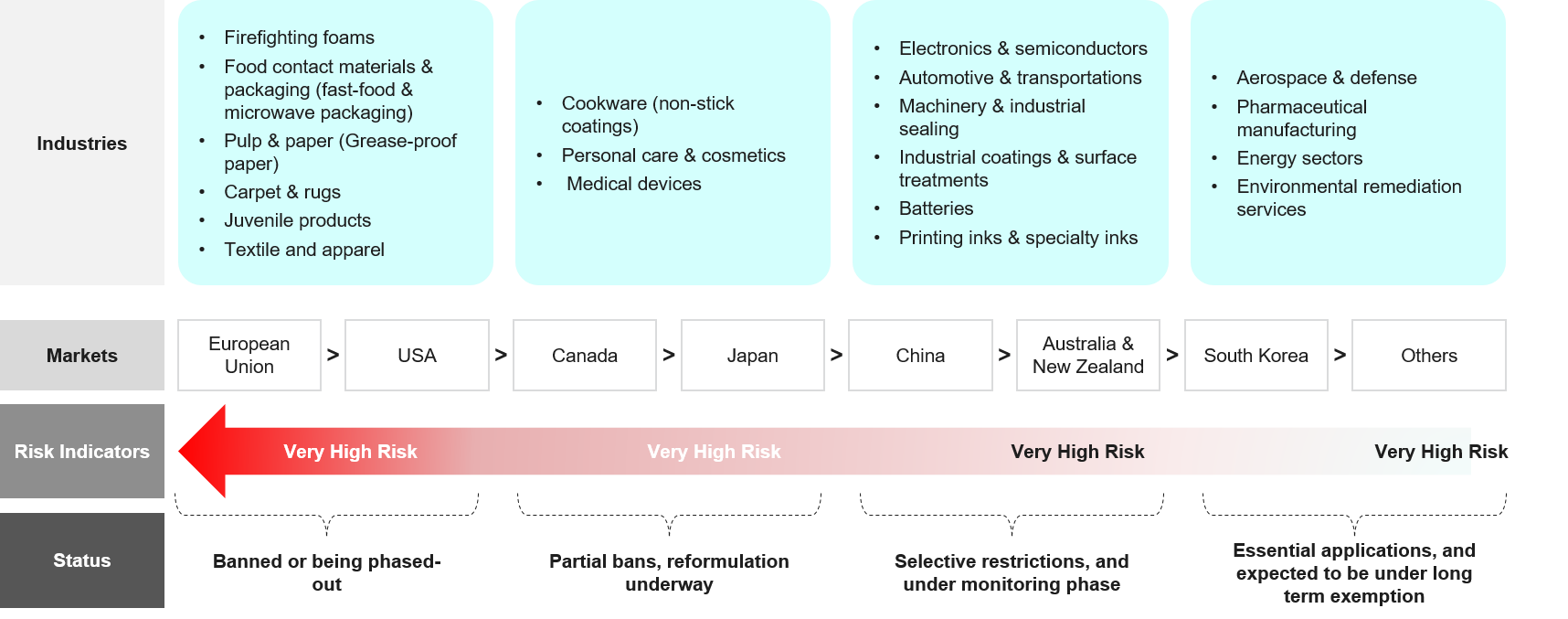

Currently, regulators and government agencies are steadily increasing their efforts to gather scientific evidence on persistence, bioaccumulation, and potential adverse effects on human health and the environment, paving the way for a complete ban. As a result, industries that heavily rely on PFAS, such as firefighting foams, cosmetics and personal care products, juvenile goods, textiles and apparel, food-contact materials, and packaging, are facing greater compliance challenges.

As PFAS bans become stricter and their scope broadens, companies that have overlooked these risks may face serious consequences, including market share losses, supply chain disruptions, reputational damage, legal issues, and financial losses. To stay competitive, industry players need to think beyond mere compliance with regulations and take proactive steps to innovate and reduce overall risk. Key strategies for achieving PFAS compliance include:

A. Thorough Risk Assessment and Management

Conducting a thorough risk assessment is a vital step in achieving PFAS compliance. It involves identifying potential PFAS sources in the value chain and evaluating the risks associated with each. Risk assessment may require:

- Comprehensive Review and Inventory of PFAS Usage: Companies need to conduct thorough evaluations of raw materials, components, finished products, and packaging for PFAS content using advanced analytical methods with high accuracy. Additionally, they should assess the manufacturing process to identify how PFAS enters or is disposed of in water discharges. This will help in mapping products at risk before implementing PFAS bans.

- Supply Chain Engagement and Transparency: Companies should collaborate with their suppliers to collect data on PFAS content in chemical compositions, components, or raw materials used in manufacturing finished products, along with relevant certifications. Additionally, companies should establish PFAS expectations and set phase-out timelines in contracts or agreements.

- Prioritizing Early Risk Segments: The PFAS regulatory landscape is rapidly evolving toward complete bans. However, this will happen gradually as the world continues to find effective alternatives for many critical applications. Prioritizing segments or applications at early risk can help companies gain a competitive edge, rather than focusing only on critical applications exempted from the current scope.

B. Risk Mitigation Strategies

Following the identification of potential risks across the value chain, companies should establish and implement various risk mitigation strategies as outlined below:

- Strategic Material Substitution and Product Redesign: Focus on identifying PFAS-free or sustainable alternatives and conducting detailed assessments to evaluate functional performance, human and environmental safety, and cost comparisons to find the best solutions. Companies should also invest in R&D and collaborate with academic or industrial partners to develop future alternatives that are not yet available, as well as reformulate existing products to eliminate PFAS requirements.

- Process Optimization: Modifying the manufacturing process to eliminate the use of PFAS-containing substances, which may require developing innovative methods for producing the final product.

- Avoid Potential Supply Chain Disruptions: Identify new suppliers that comply with the law, or engage existing suppliers to obtain detailed chemical composition and certifications, ensuring compliance with the PFAS threshold defined under PPWR, POPs, etc.

- Continuous Regulatory Monitoring: Keeping a close eye on regulatory developments and updates is essential, as the PFAS ban is evolving and varies across regions. This helps avoid compliance gaps and potential market disruption while prioritizing investments.

- Developing Analytical Capability: Building internal or third-party analytical skills remains essential for accurately measuring PFAS levels to meet compliance standards. The company should prioritize establishing reliable testing frameworks to identify, quantify, and monitor PFAS in raw materials, products, emissions, and environmental discharges. This capability will help validate supplier claims and ensure compliance with threshold limits.

- Waste Disposal and Remediation Planning: Assessment of PFAS presence in waste streams, wastewater, and other contaminated sites must be included in the remediation plan. Companies should advance their waste-disposal and remediation planning to meet regulatory requirements regarding PFAS content. Advancements may include developing new technologies, upgrading existing treatment systems, and partnering with disposal and remediation suppliers specialized in PFAS waste management.

Innovation in Action: Global Leaders Shifting to PFAS-Free Materials

Industry leaders are investing in innovative materials that mimic PFAS performance. Few alternatives are already on the market, but most are still in the development phase. Notable innovations include:

- In December 2023, Clariant launched PFAS-free additive portfolio reflecting to be in commitment of global regulatory standards and sustainability. Ceridust 8170 M is a product under Clariant’s PFAS-free portfolio, which is a modified maleic anhydride grafted polyethylene designed as a texturing agent for powder coatings. Shifting to a PFAS-free additive portfolio helped Clariant reduce regulatory and liability risk, position itself as an early mover in the alternative PFAS portfolio, and strengthen its ESG and customer value proposition.

- Similarly, in October 2024, Designtex eliminated PFAS from its inventory and product portfolio, shifting towards sustainable goals, and announced that it would become a PFAS-free company. The company offers products that provide stain resistance without PFAS chemistry.

- Ahlstrom offers PFAS-free grease-resistant papers through its FluoroFree® technology. This technology is widely used in common fast-food packaging, camp shells, butter wraps, popcorn bags, and more.

Conclusion

Companies are mainly focused on the strategic phase-out of PFAS and promoting alternative products, driven by stricter regulations and public demand. Currently, investments prioritize innovation to develop safer material options that help avoid compliance problems or damage to reputation. Firms like Clariant and Designtex have already adopted PFAS-free portfolios, highlighting their sustainability commitments and positioning as early adopters in the alternative market. As regulatory policies evolve and consumer awareness grows, it is crucial for industry leaders to act swiftly and remain competitive to prevent delays.

To navigate this, industry players need to prepare for PFAS bans and develop a strategic roadmap focused on strengthening innovation, addressing supply chain disruptions, ensuring regulatory compliance, supporting sustainable operations, and fostering brand leadership in a rapidly changing market. At Stellarix, we assist businesses in taking action by offering customized services at every stage of the value chain, starting from identifying alternative PFAS-free solutions, benchmarking performance, mapping active ecosystems, and finding the best partners for business collaborations and co-development. We look forward to connecting with you to move toward a sustainable PFAS-free future.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.