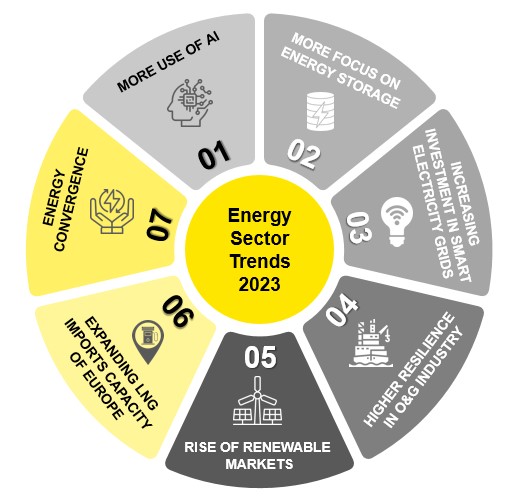

Figure 1: Energy sector trends 2023

2022 changed the global energy industry in several ways. It underlined the significance of energy self-reliance for almost half of the world. Top nations like the U.S. were compelled to improve their grid resiliency and policies regarding a smooth energy transition. As governments worldwide build foundations to meet their respective net-zero targets, several factors challenge developments in this direction. It wouldn’t be a stretch to say that these problems will continue to define the momentum and development in the energy sector even in 2023. Nevertheless, despite all hurdles and hassles along the way, a few changes will lead the tide of growth and development in the global energy sector in the coming year. Here is a summarized view of the energy industry outlook for 2023 and beyond:

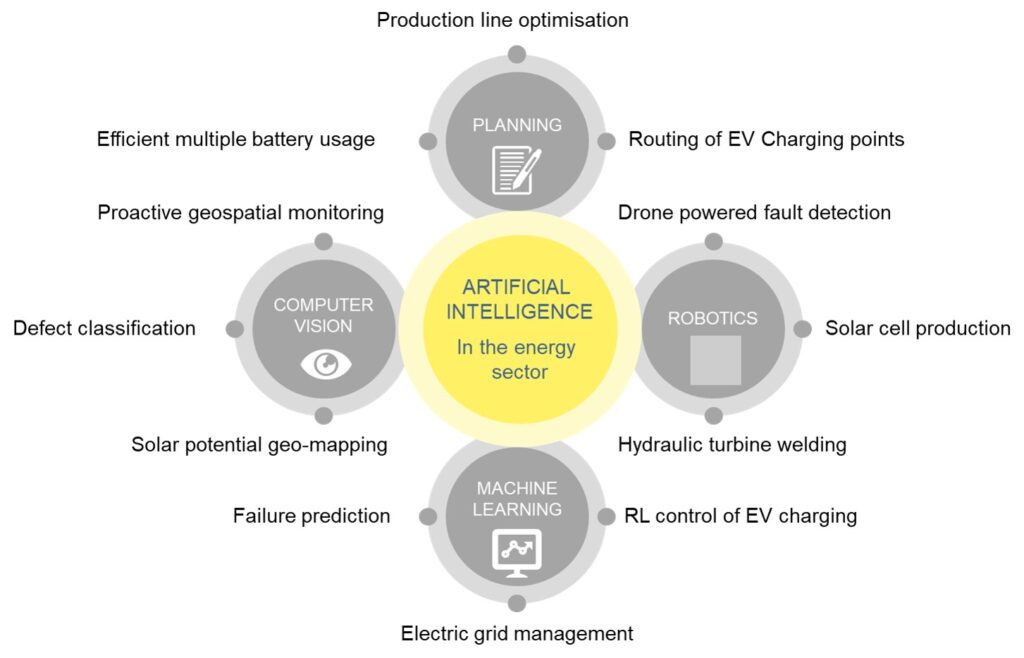

- Higher adoption of AI in the energy sector: According to a World Economic Forum report in 2021, the energy sector needed to acknowledge the role of AI more seriously. The deployment of AI could be a game changer in terms of a smooth global energy transition. The BNEF’s net zero scenario model states that a mere 1% rise in demand for energy efficiency will create a value worth $1.3 trillion between 2020 and 2050 as it will reduce investment requirements. AI can potentially turn this hypothetical assumption into a reality as it can flex demand while enabling better energy efficiency. As more and more corporations, governments, and global institutes are setting and working on their respective net-zero targets, the rise in the application of AI is bound to happen. However, higher costs of system recalibration will compel AI-based business practices, additional investment in the development of innovative solutions, and accelerated adoption of AI.

- More focus on energy storage: The rising demand for renewable energy and transportation mediums has increased for the last few years. Even in 2023, short-term and long-term battery storage technologies will be critical. These technologies will significantly impact EV (Electric Vehicles) markets, whose share is expanding at a consistent pace. By 2050, it is expected that there will approx. 836 million EVs on roads. Despite technological evolution, a vast scope remains for improving utility infrastructure and battery storage capacity to ensure better performance. Innovation in this area will open gates to developing renewable energy infrastructure in remote and underdeveloped areas. Energy storage will be an inseparable part of grids worldwide as power suppliers strive to manage peak onsite demand and facilitate large-scale EV charging in the coming years.

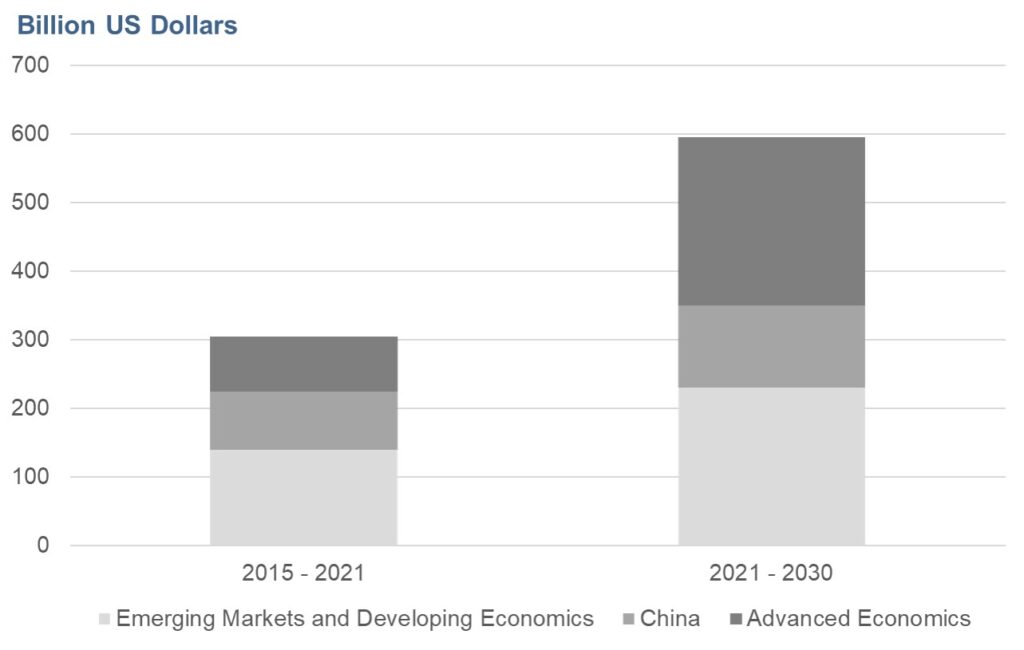

- Higher Investment in Smart Electricity Grids To Meet Net-Zero Targets: The International Energy Agency (IEA) clearly stated that the global energy industry needs a minimum of $600 billion annual investment in electricity grids to meet the net-zero targets. It is a humungous task requiring scores of collaborations between public and private organizations. Europe is already on its way, where an Edge for Smart Secondary Substation Alliance (E4S) has been established with several technology leaders, including Intel, to develop a smart grid. Similar collaborations are underway in several parts of the world where Intel, Dell, Toshiba, Qualcomm, AT&T, and others are leading the way. Significant developments are expected in this direction in 2023.

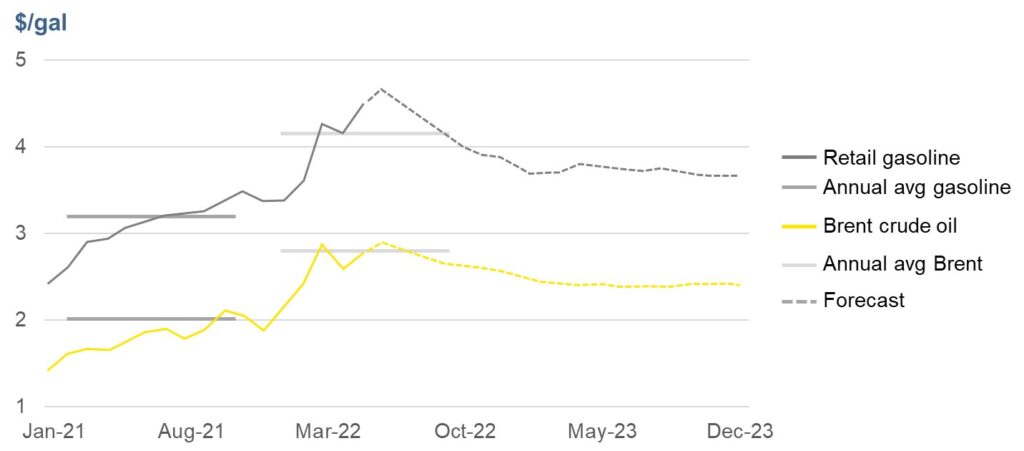

- Higher Resilience of the Oil and Gas Industry Amidst Geopolitical And Supply Chain Disruptions: 2022 was a good year for the oil and gas industry, registered ample cash flow owing for obvious reasons. Though the geopolitical situation caused plenty of supply disruptions and price hype, it highlighted the lack of investment in the energy industry and opened gates for modifications and corrections. Experts think that though a steep price rise accompanies the initial phase of this restructuring, the revenues earned by oil and gas companies will undoubtedly be used to address the concerns regarding energy security, more giant carbon footprints, and supply chain mismanagement. In crux, 2023 will be the year of more efficient capital deployment, balanced investment, and an accelerated energy industry transition.

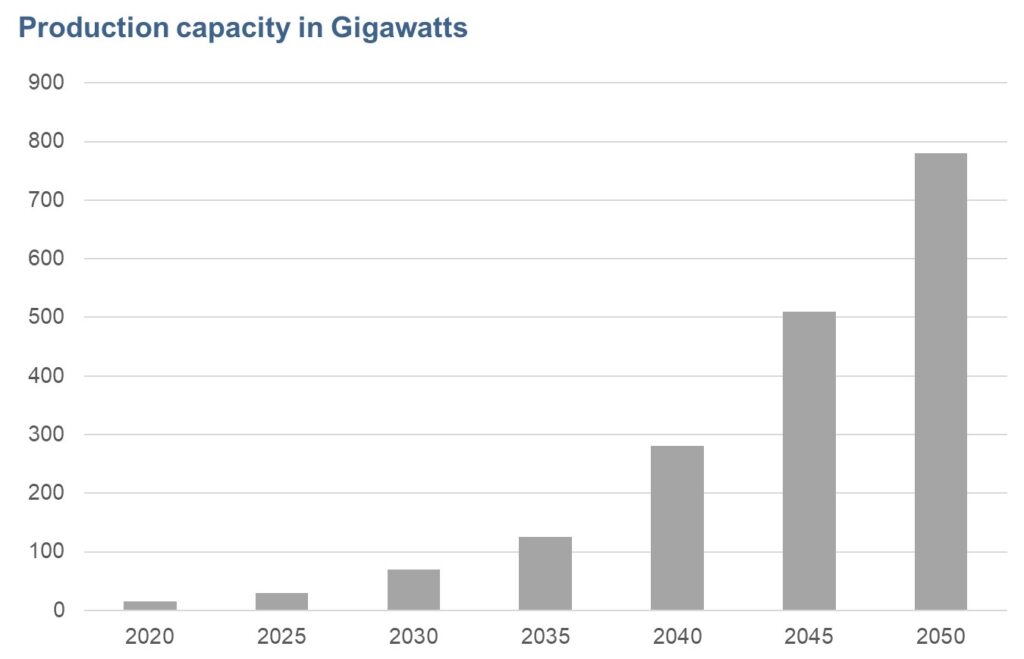

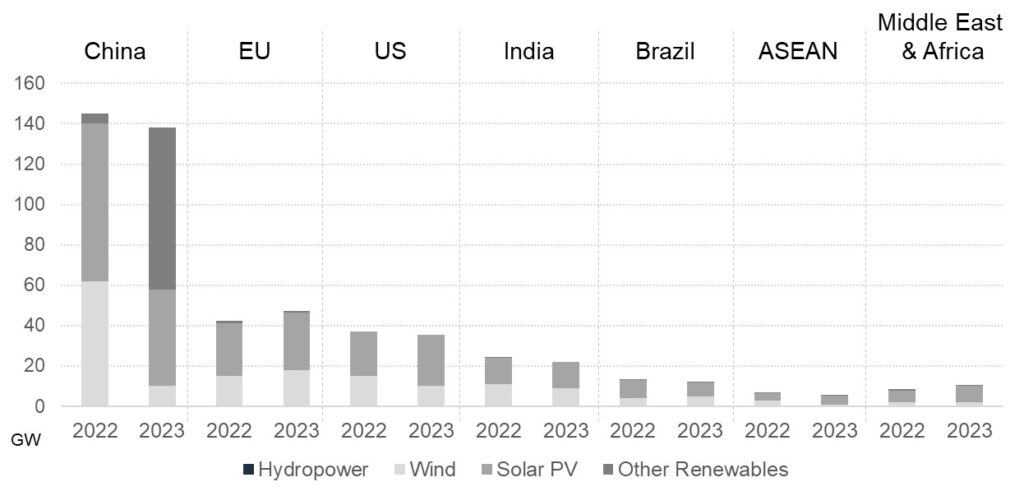

- Rise of Renewable Market Despite Geopolitical Vicissitudes: From solar to wind power, every segment of the renewable market is slated for an uptrend growth in 2023. Economist Intelligence Union predicts an 11% surge in solar and wind energy consumption in the coming year, putting the assumed 10% annual renewable energy industry growth in the next decade. Asia will continue to lead the world in renewable energy investment, where the most significant chunk of revenues will go to Japan, India, South Korea, and China. In Europe, we may see a return of nuclear power and some non-renewable energy projects in the wake of the present crisis, increasing the cost of supporting renewable energy projects and the urgency to substitute Russia’s gas and oil supply. The rising inflation, interest rates by Central banks, and O&G price volatility may bring down the financial support for energy transition projects in the LMIC nations, increasing the woes of economically weak countries.

- Europe’s Expanding LNG Import Capacity: The UK and Europe are working vigorously to raise their LNG import capacity and fill the gap left by dwindling Russian gas supplies. Europe and the UK plan to increase their LNG import capacity by 6.8 billion cubic feet per day by 2024. By the end of 2023, Europe aims to increase its regasification capacity by 5.3 Bcf/d. Work on several Floating Storage Regasification Units (FRSUs) is currently underway in Germany, the Netherlands, and Finland. Seven EU nations are now building regasification terminals, which are dated to be finished by the end of 2023. These include Greece, Italy, Estonia, Finland, Poland, France, and Germany.

- The Increasing Pace of Energy Transition Will Resolve The Economic Struggle of Key Metal Markets: A recent report by S&P Global, the increase in renewable energy generation and demand for EVs worldwide will increase demand for metals like nickel, cobalt, lithium, and copper. This steep rise in demand will stand much taller than the supply, giving much-needed life to the economically dwindling key metals market. The commodity prices for such metals are expected to drop significantly yearly in 2023. However, the growing consumption of EV batteries will surpass the supply capacity of the mining industry, rising prices again at the beginning of 2024.

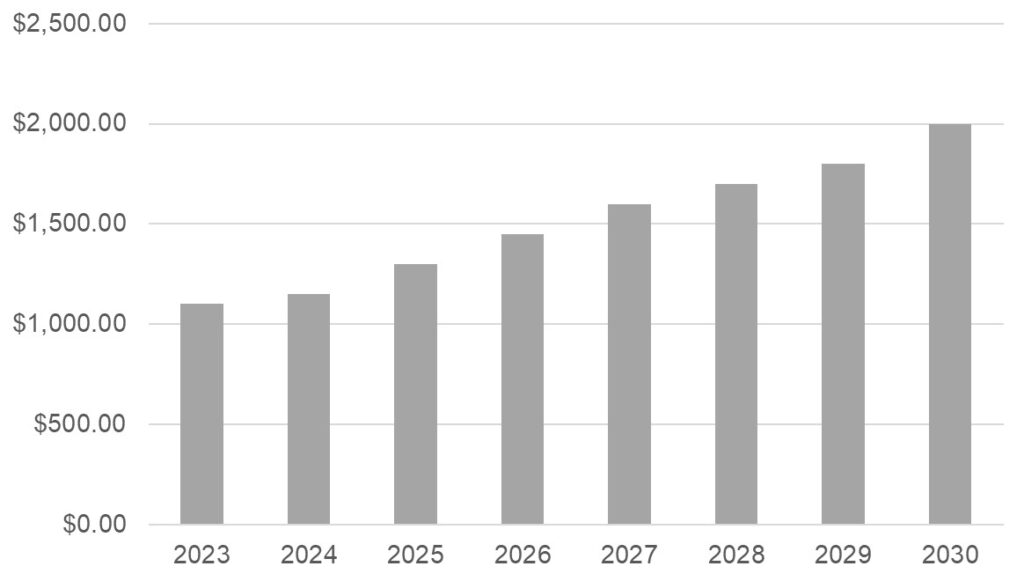

- Cleantech Investments and Energy Convergence Will Continue to Soar: All kinds of natural resources companies ranging from metal to O&G will keep investing in renewable energy technologies like CCUS (Carbon Capture, Utilization, and Sequestration) in 2023 to constrict their carbon footprint and diversify their portfolio. In 2023, approx. Twenty global O&G companies will join the Oil and Gas climate initiative as compared to 13 in 2022. Also, it is predicted that venture capital and private equity will return to the cleantech market full-fledged. In numbers, the global private investment in this market will reach $600 billion by the end of 2023.

- Re-emergence of Nuclear Energy: The current European energy crisis has prompted several governments to reconsider their nuclear power phase-out plans. Japan, for example, plans to reinstate its nuclear plants, most of which were idled after the Fukushima Daiichi disaster. Similarly, France and Germany plan to bring their offline nuclear plants online to meet the energy demands by extending the lifespan of their plants. In 2023, several other nations like China and India may join the league to ensure energy security in the rapidly uncertain geopolitical scenario.

- Extreme Weather Conditions Will Exacerbate Coal Utilization: The sporadic extreme weather calamities like hurricanes, heatwaves, and droughts have severely slowed the deployment and implementation of renewable energy systems. Europe and Asia, for example, had unprecedented heat waves during summers while dry conditions led to drought in several rivers that happened to the lifeline of their countries. The Rhine in Europe, the Yangtze in China, the Colorado River in the US, and Maine in France have dangerously low water levels that may threaten millions’ food security and well-being. The water deficit in these rivers impacted hydro and nuclear power generation, overshadowing low-carbon power production for half of this planet. Heatwaves can easily peak power demand and result in blackouts, and power plants stagnate productivity, threatening the overall energy infrastructure of these dense energy economies. In 2023, the world may witness short-term power crises due to similar random extreme weather conditions. It has and will compel middle – and low-income countries to increase coal consumption, countering all the efforts toward a smooth energy transition and controlling global temperatures.

Final Word

The global energy market is on its path to restructuring, but it will worsen before it gets better. The key to rising above all these challenges is building better industry resilience and energy efficiency on all scales. Our world is currently in the middle of a global energy crisis that is too deep and complicated. While the top brass economies have a fair chance to battle it out, the underdeveloped nations are bound to suffer. The developments mentioned above and dilemmas wouldn’t mellow with time, so the only way out is to fight the odds and get over the roadblocks as efficiently as possible as we move towards a well-balanced energy equation. The energy industry outlook is promising, with both public and private sectors attempting to address issues on energy security, green practices, and advanced technological innovation. With the growing pressures and urgency to meet net-zero targets, we may expect exciting developments and innovations in this direction in the coming years.