Digital Twin Technology for Banking and FinTech

One will agree that financial or generic success is doing what you want when you want, where you want, and as much as you want. These three, open banking, payment rails, and Fintech, are aggrandizing the embedded pecuniary products and service delivery. Financial digitalization started in 1990, accelerated during/post-pandemic, and is currently a win-win for customers, BFSI providers, and regulators. The Neobanking market, Digital twin technology for the next generation, and Fintech are bringing uninsured and non-customers to banks.

What is Digital Twin?

A digital twin gives an accurate picture or representation of a physical object through a virtual form. A system is designed to reflect it precisely. It reviews an object’s lifecycle and incorporates technical prowess, including logical reasoning, machine learning, and simulation, for decisiveness. Moreover, it accentuates real-time data to present the proper image or graphics.

Active Online Banking Users

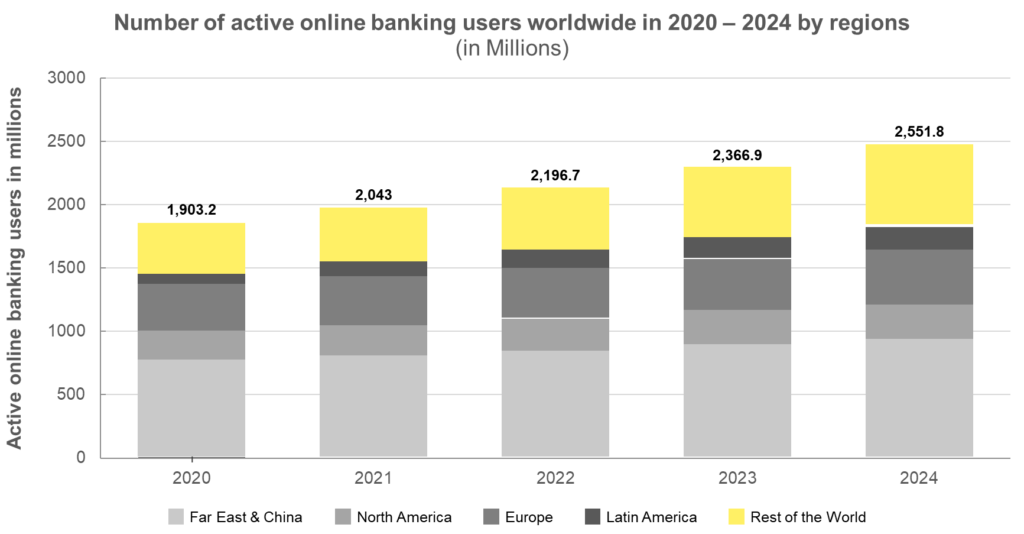

As per Statista findings, the number of active online banking users worldwide will be 2366.9 Million in 2023; by 2024, they will reach 2551.8 Million. Britain had 93% online banking usage as of 2022, 78% preferred online banking in America (2022), and Europe had over 96% penetration of online banking. There are 904 million online payment users in China, and the Asian market is the largest virtual banking market. With the above numbers, it’s clear that the digitalization of the banking sector is growing by leaps and bounds.

Figure 1: Digital Twin Technology: Active online banking users worldwide

SupTech, Neobanking, ESG compliance, Robotic Process Automation (RPA), Bank-as-a-Service (BaaS), personalized banking, and predictive analysis are changing the role of digital twin technology and digitalization in the global BFSI industry. This blog shares insights on how hybrid and standalone digital prototypes shape the global banking, financial services, and insurance sectors.

Open Banking Legislation & FinTech

The financial industry has always embraced technology, starting in early 1994 with names like PayPal and NetBank. Fintech has moved from the inception phase to Venture Capital investments and is now at a peak collaboration phase.

With the proliferation of hundreds of online financial apps/tools, the need to monitor and regulate these Fintech providers has become paramount. Major global banks like DBS, Citi Bank, JPMorgan Chase, U.S. Bank, American Express, and many other key financial institutions have created digital twins of their prime services, processes, and customers.

The banks offer their bank APIs online to developers to create other value-added services for their customers. Many countries are enacting open banking legislation to safeguard the best interests of banks and their customers. This helps customers know the registered third-party providers associated with their respective banks.

Introduction By Europe

Europe introduced a revised Payment Services Directive (PSD2), under which banks were mandated to allow customers to securely share their account information with Fintech, Third Party Providers (TPP), and registered non-financial institutions. Mastercard’s Open Banking Tracker for Q2 2022 (developed by MasterCard) shows 559 third-party providers are registered to provide payment initiation services with National Competent Authority in Europe.

The U.K. already has open banking regulations and is working on premium APIs. Likewise, Australia has open banking that allows customers and banks to share their bank details with Fintech and non-financial service providers. Open banking regulations help protect banks and customers from unapproved TPP and data/financial frauds. China has started the process of regulating bank API and API aggregators. Singapore and Hong Kong, too, focus on open API for banks, which will help SMEs and third-party aggregators launch their offerings officially and quickly. India, Japan, and South Korea have yet to develop supervisory law around this fully.

DT, Robotic Process Automation, and Underwriting

Digital Twin Technology (DT) are virtual models encompassing physical versions of processes, data, customers, products, social media interactions, and hundreds of interconnected parameters with artificial intelligence. DT serves as a counterpart/twin of their physical version and the highly advanced use of Information and Communication Technologies (ICT). Digital Twin uses Artificial Intelligence (AI), scalable Machine Learning, Neural Machine Learning, and Natural Language Processing (NLP).

Financial Digital Twin uses advanced and innovative application programming interfaces (API) to open new customer accounts. Offline banks with their digital twin asset (i.e., apps) get customer onboarding and verification, called Customer Due Diligence (CDD), done seamlessly online.

Digital Twin Revolution: Banking-As-a-Service

As non-banking entities, Fintech utilizes banking as a service (Baas) to aggregate outside data in their own data sets. Many financial start-ups and companies work in the robo-advisor and loan disbursement business. Here are a few notable ones:

Affirm: It’s a Buy Now and Pay Later (BNPL) app/service with the option of entirely zero interest for four payments every two weeks and clear interest charges consequently. For businesses, they have flexible payment options. Merchants’ customers can select flexible purchase options, which helps increase revenue for SMEs. Affirm offers an annual percentage rate (APR) for loans, and the service is worth it for those looking at a flexible loan repayment method with zero late fees.

Upstart: It is again a U.S.-based loan provider that lets one avail of a personal and car loan at a low fixed rate and is entirely A.I.-based. Also, with AI loan approval, the deserving ones mostly get their loan approved.

Zilch: The app works in U.S. and U.K. and makes online purchases easy. U.S. customers can pay in 4 weeks, with 0% APR and zero fees.

Coinbase: There are over 120 coins available on Coinbase for buying and selling cryptocurrencies.

Funding Circle: This is a UK-based online business loan provider with a flexible, interest-free line of credit for SMEs. It is a peer-to-peer lending website for quick FlexiPay.

Plaid: It includes a tie-up with financial entities for various use cases, such as personal finances, lending/loan, wealth management, consumer payment, digital banking, and business finances. It offers access to various apps powered by it, and all the information shared remains secure through its APIs and GitHub.

Proliferation of Neobanking and Robo-Advisory

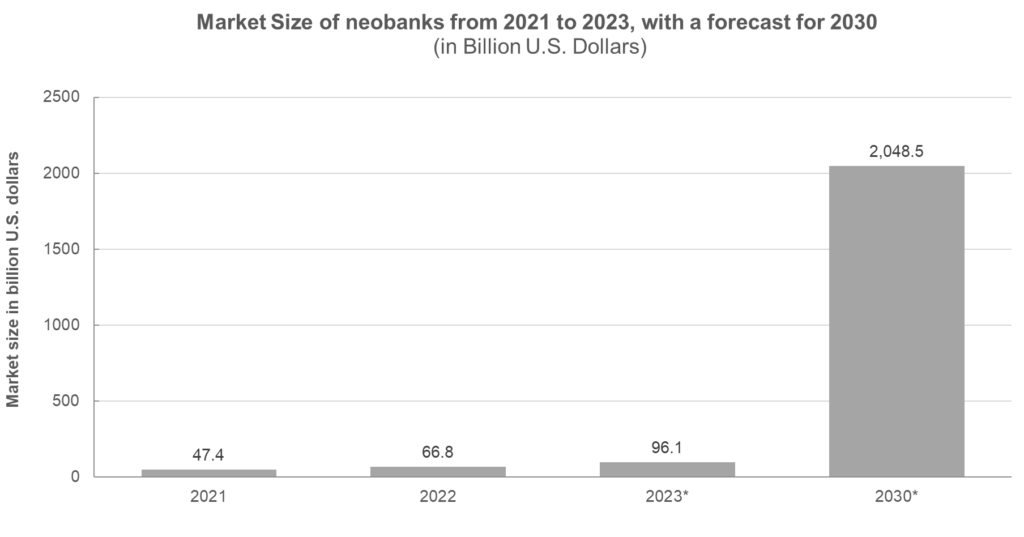

Digital-only banks have gained traction in the last year. This is particularly true as people, especially the younger generation, prefer to manage all their banking needs via apps. Neobanking uses cloud computing, APIs, and mobile apps to deliver accessible banking anytime and anywhere. According to Statista report, the Neobanking global market is expected to grow at a CAGR of 53.4% between the periods of 2021-2030. Also, there are currently over 276 neo-banks in the world. So, we can say both Banks and their Third Party Partners (TPP) are using APIs, ‘the common tech’ to create digital twins of their services.

Figure 2: Neo Banks Market Size

Neobanks like Nubank in Brazil, Chime in the U.S., and Revolut in the U.K. are currently leading online-only banks. Nu is operational in Brazil, Mexico, and Colombia, with 70 million customers as of 2022. Despite operating as a brick-and-mortar bank, it offers several features. These include a zero account opening fee and the ability to send/receive payments at no cost. The bank also provides digital salary portability, credit card and loan services, investment options, FGTS aid syncing, and the convenience of debit card/cash withdrawals. Nubank service for business accounts also includes Nutap for quick and contactless payment and other banking facilities.

Chime, a U.S.-based financial technology company, has over 14.5 million customers. The benefits comprise a free debit card and the Chime Spotme fee-free overdraft. Additionally, users get a credit-building facility, early access to payment through direct deposit, and access to over 60,000 fee-free ATMs. Furthermore, they can enjoy a high-yield savings account with a 2% APY.

The Chime checking account can also be used to send checks. Like all financial dealings, Chime Neobank has its terms and conditions. These include features like early access to direct deposit and dependent payment files from the payer.

Digital Twin Technology: Roboadvisor Wealth-As-a-Service

Robo-advisor technology is a wealth management app and web-based investment and savings tool created with A.I.-based APIs. The robo-advisor provides low-cost financial advice on various aspects, such as building wealth and investing in a specific goal. It also offers guidance for investing in retirement and crypto, like U.S.-based Betterment.

Sofi is an algorithm investing service that actively invests in personal goals, recurring deposits (RD), automated investing, individual retirement accounts (IRAs), IPO investing, and ETFs. The Robo-advisor market is seeing robust growth and is expected to reach $3.19 trillion worldwide by 2027. Robo-advisor apps mostly offer zero fees on automated investing. Additionally, they generally charge lower fees compared to financial advisors for other investment advice. The other key Robo-advisor apps are E*TRADE Core, Fidelity Go, SigFig, Vanguard, Ellevest, and more.

Digital Twin Technology: Need For RegTech, SupTech, and ESGs

Both offline and online banks have grave compliance and regulatory concerns. Concerns exist about money laundering, bad loans, account verification, fulfilling claims, phishing, and card scams. Also, new apps that verify customers with image, handwriting verification, and other RegTech solutions are supporting the banking industry in reducing financial fraud. With Neobanking, the impact on energy and resource savings will be big, and it is a forward-looking approach. Blockchain, digital currencies, and bolstered financial transactions make supervisory technology (SupTech) essential for a fluid and strong economy.

Conclusion

Banking and investment are necessities for everyone for obvious reasons. A significant gap exists in access to banking services among different groups of people. Some individuals have easy access to banking tools, while others are unable to avail themselves of such services. The Neobanking market, Digital twin, and Fintech are bringing uninsured and non-customers to banks. However, it is yet to be seen how neobanks will be able to regulate the transactions and investment portfolios fully and how they will be able to minimize fraud and black money. Moreover, SupTech is in the process of development, and it needs to construct more robust systems to safeguard pro-Fintech entities – the customers and investors.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.