Unrivaled customer demand and supply led to an uproarious shortage of semiconductors across the industry. Being complex to design and manufacture, this industry has a high level of investment both in R&D and in capital expenditure. Semi-conductors are the most useful components in electronics, and they are used in computers, smartphones, cars, electrical equipment, household appliances, etc. The common definition of semiconductors is that they are good conductors of electricity but with less conductivity than copper or aluminum. These semiconductors consist of silicon and are doped with an external material to improve its conductivity. This semiconductor industry is quite large globally and is a major contributor in terms of employment, revenue, device manufacturing, etc. The supply chain of these semiconductors across the globe follows almost similar patterns, with the following steps: design, fabrication, testing, and distribution. Even if there is disruption in any one of the steps, the whole supply chain gets affected.

Navigating the Semiconductor Shortage

Semiconductors – highly specialized components providing essential features to electronics, automotive, etc.- are facing a crisis. A chip shortage has led to increased prices and delayed supplies, and longer lead times are reported. The Semiconductor Industry Association observed a decrease in sales by 8.2% compared to 2022. Except for Europe, all other countries, such as China and America, observed a similar dip in sales by the end of 2023. Industries dependent on semiconductors are worried that their innovations will be halted.

Demand-Supply Facts

There has been an increase in the global market for components like analogs and microcontrollers, but due to the ongoing semiconductor shortages, the lead time has extended to 52 weeks. The demand for chips is further driven by IoT (Internet of Things), 5G, and auto motives; intensive capital-driven wafer manufacturing supported by government initiatives puts East Asia at the forefront of wafer manufacturing. Less capital-intensive areas supporting the value chain expansion – assembly, packaging, and testing are predominated in China and South East Asia. The COVID-19 pandemic kick-started the chip shortage, and its long-reaching effects, including virus outbreaks, labor challenges, and geopolitical uncertainties, have fuelled it.

Supply Chain for Semi-conductors: Industry’s Plan of Action

The supply chain disruptions are continuously increasing. Companies deal with this by increasing their production capacity and making their suppliers less dependent on any one company or region. This step requires proper planning, and a lot goes into investment. Compact devices with reduced cost and involvement in the technological field pointed towards its increased production that was not very well met by the supply logistics. Companies are investing in R&D in order to develop new technologies that can help reduce the time spent on chip production. Some major investments are: Intel broke ground in 2021 on two new foundries in Chandler, Ariz.—a $20 billion investment—along with an advanced packaging facility (910) in New Mexico

Intel is planning to invest around $3.5 Billion to expand its manufacturing operations in New Mexico. Another large chipmaker, Micron, has also invested $15 billion to add memory chip fabrication facilities to its headquarters in Boise, Idaho. Global Foundries, Samsung Foundry, Texas Instruments, and Taiwan Semiconductor are all building new fabrication sites in the U.S. because the government is defraying the cost by offering incentives or tax breakage to boost the development of domestic fabrication plants. In the US, in 2021, Samsung announced that it would increase its chip production capacity by 17 billion in Austin, Texas. This plant is operational but will only be at full capacity by 2025. Intel is also in the process of expanding its presence to regain its legacy in the semiconductor industry. TSMC, one of the biggest chipmakers worldwide, is also on its way to increasing its presence in the market. It started a manufacturing complex in Arizona in July 2021 that was worth $12 billion.

Supply Chain for Semiconductors: Role of Government Policies

A stable policy framework is needed in the semiconductor industry. Thus, market-driven government incentive programs, sponsorships, and stable control over the trade of semiconductors are the keys to stable demand-supply.

In the 1980s, The Microwave and Millimetre Wave Integrated Circuit (MIMIC) program of the Department of Defence was a program of gallium arsenide (GaAs) transistors that enabled smartphones to establish a wireless communication link to cellular towers were developed. In 2020, the Department of Defense awarded more than $197 million to strengthen the American microelectronics industrial base. The Indian government also approved a 76,000-crore incentive plan for the semiconductor industry. In 2023, the Japanese government offered Taiwan Semiconductor Manufacturing Company a subsidy of 476 million yen, which is half the cost of the factory price, which TMSC has decided to build at Kyushu Island with the production of 12 to 14 Nanometre chips. This plant opened in February 2024 with the aim of boosting the domestic production of chips. Rapidus has also secured around 70 million yen from the government.

| Region | Policy/ Intervention |

| USA | In July 2022, Congress passed the CHIPS act to strengthen domestic semiconductor manufacturing, design, and research, fortify the economy and national security, and reinforce America’s chip supply chains |

| European Nations | The government has enacted the European Chips Act aims to accelerate the development of semiconductors |

| South Korea | South Korean government has passed the K Chips Act that raises the Tax credit for facility investment up to 25-35% |

| Japan | Japan’s Ministry of Economy, Trade and Industry has imposed export regulations on 23 types of semiconductors. As per the new rules, the Japanese suppliers are bound to obtain a license from METI before exporting any of the 23 semiconductors |

Role of Value Chain

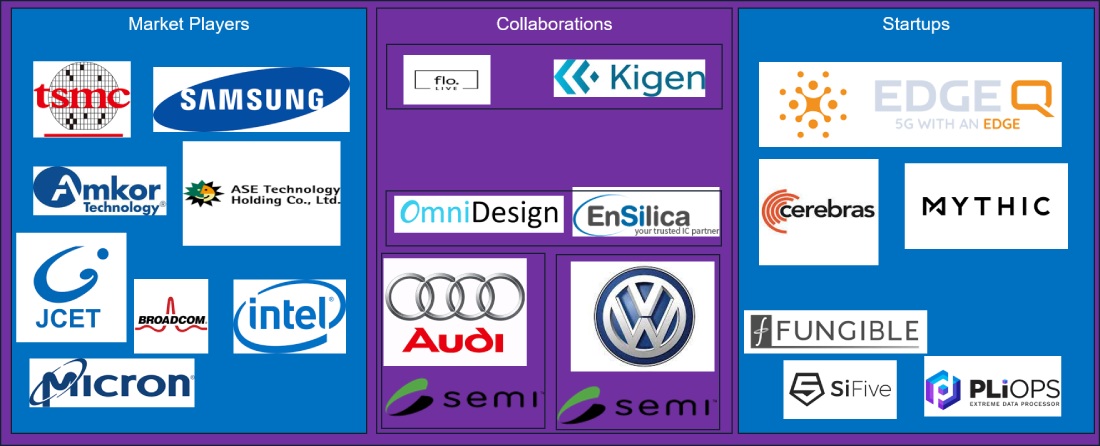

A strengthened ecosystem is a must to overcome disruptions in demand, supply, and interdependence on foreign players. Companies are looking forward to collaborations to strengthen the value of the semiconductor supply chain. Audi and Volkswagen joined the SEMI industry association to strengthen the automotive collaboration with the semiconductor industry. Omni Designs, an IP solution provider, collaborated with EnSilica, an ASIC design and supply solutions provider. FloLive announced a collaboration with Kigen and Sony Semiconductor Israel to provide secure and effective connections.

Collaboration between HCL Technologies (HCLTech) and Intel Foundry has been extended for the development of customized silicon solutions for semiconductor manufacturers, system OEMs (Original Equipment Manufacturers), and cloud services providers. AMD has announced that it will invest around $400 Mn in India to develop R&D operations. AMD investment is expected to create the largest AMD design center with the addition of approximately 3,000 engineering roles. The US-based Silicon Power Group investment in Odisha ($121.73 million) mainly focuses on making a 150-millimeter silicon carbide, a semiconductor component. The company has committed to starting operations by 2024. A strong, sound, and stable decision of the key players, value chain partners, and policymakers may drive toward a consistent demand-supply pattern in the semiconductor industry.

Figure: Key market players

Start-ups are also gaining pace. A few among them are Cerebras Systems, whose system developed by the start-up is adopted by the University of Edinburgh’s EPCC supercomputing Center, GlaxoSmithKline, Tokyo Electron Devices, and the U.S. Department of Energy’s Argonne National Laboratory and Livermore National Laboratory. EdgeQ, another US-based start-up, promises a 50% reduction in the total cost of ownership for 5G base stations.

Conclusion

Although the semiconductor industry’s shortage of chips presents many challenges, countries are continuously focusing on improving semiconductor production. This is done by enabling new policies or strategically collaborating with different regions. The process is slow, but finding a solution can have a long-term effect on all aspects. And given the rising manufacturing of electronic items, vehicles, and other products, a strengthened supply chain for semiconductors can do wonders.