Comparator drugs are of significant importance in clinical research. Based on pharmaceutical comparator studies and blind comparator stability testing, a drug product’s similarity or superiority to a commercial drug product in the same therapeutic class can be determined.

With rising diseases, pharmaceutical companies are under pressure to develop strong strategies for choosing a comparator drug and then sourcing and ensuring an uninterrupted supply of that drug to all trial sites economically. To achieve this, they are now focused on creating and introducing innovative solutions that cater to the demands of patients and healthcare professionals to capitalize on the growing demand for biologics and personalized medicine.

What are Comparator Drugs?

A comparator drug is any existing drug treatment that is used as a benchmark to evaluate the efficacy and safety of novel developed drugs in clinical trials. These can be marketed or investigational medicine, placebo, or active comparators that serve as a standard in a clinical trial. Comparator drug selection and application can directly affect the understanding and results of clinical research or practice and regulatory decisions.

Selection Criteria for Comparator Drugs

For a successful clinical trial, a significant comparator drug selection is important. Below are some main areas that can be considered during the comparator drug selection:

- Standard of Care: The comparator drug should be the most commonly used treatment to ensure that the new drug is tested against the best available treatment

- Clinical Relevance: The comparator ought to represent real-world clinical settings and be relevant to the patient population

- Safety Profile: The comparator drug’s safety, side effects, and risk must be well-documented

- Regulatory Requirements: Adherence to local regulatory standards is necessary as different regions may have specific requirements for comparator drugs

- Ethical Considerations: If no current standard treatment exists only for that condition, using a placebo as a comparator is ethical. During the trial, patients must receive at least the standard of care.

Impact on Drug Development

The development of new drugs is greatly impacted by the use of comparator drugs in clinical trials:

- Enhanced Credibility: Robust data from comparator drug trials can enhance the credibility of the new drug, facilitating regulatory approval and acceptance by the medical community

- Differentiation in Competitive Market: Showcasing a new drug’s superiority or additional benefits over existing therapies can help it stand out in a competitive market, potentially leading to better adoption and sales

- Informed Decision-Making: Comparable data can help healthcare professionals and patients make better-informed decisions that will enhance treatment outcomes and patient care

- Cost-Effectiveness: Trials showcasing a novel drug’s cost-effectiveness compared to current treatments may impact pricing and reimbursement decisions, affecting its accessibility and affordability

Comparator Drug: Market Drivers

Pharmaceutical companies invest millions annually to acquire commercially marketed drugs for clinical trials. Stakeholders such as wholesalers, local distributors, inventors, and medication producers can all engage in direct comparator sourcing, and depending on the requirements, they either use the central or local sourcing paradigm. There are some opportunities and challenges in the comparator drug market, which are as follows:

- Opportunities: Some of the opportunities are as follows:

Figure 1: Opportunities available

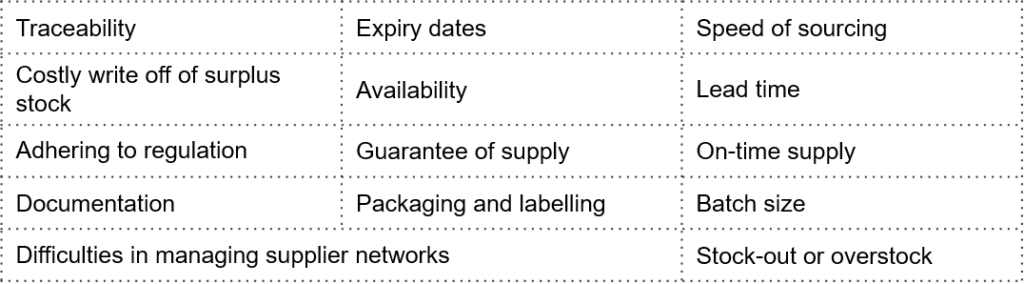

- Challenges: The selection of the wrong vendors is the major challenge, as the comparator supply chain is confronted with the following primary problems

Figure 2: Comparator Drug Sourcing Challenges

Comparator Drugs: Market Overview

The global market for comparator medication sourcing is expected to grow steadily.

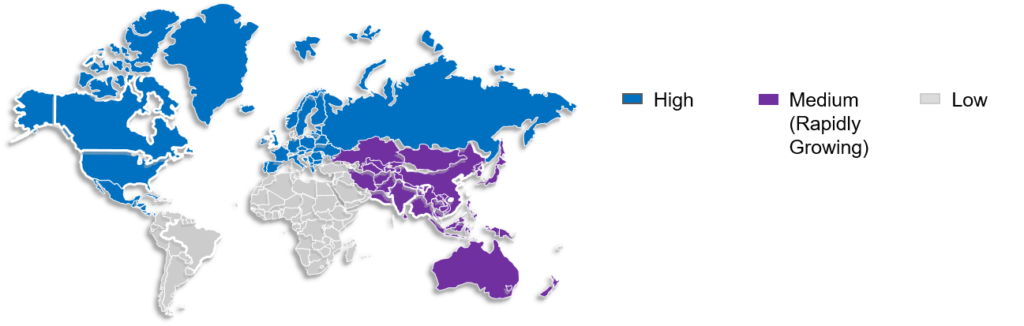

The global comparative drug sourcing market is divided into four regions based on geographic factors: Latin and North America, Europe, Asia Pacific, and the Middle East and Africa.

The comparator drug market is expected to be led by North America due to the availability of cutting-edge technology, research and development facilities, and an increasing number of new medication trials.

The largest populations are found in the APAC region’s major economies, like India and China; this led to a rise in healthcare requirements, making Asia Pacific the fastest-growing market worldwide. The need to find affordable drug solutions and the local population’s diverse healthcare needs are some of the factors that are expected to fuel market growth in the area.

Figure 3: Market Overview (Regional)

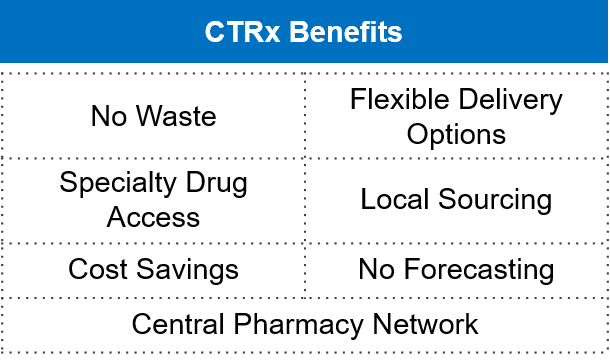

Myonex introduced Europe’s first and only on-demand local medicine procurement service on September 29, 2022. Based on a proven North American model, CTRx Europe provides substantial benefits for trial sponsors, patients, and locations. For clinical sites across Europe, the new CTRx Europe service is revolutionary since it assists in locating local medications for patients in those nations.

Figure 4: CTRx Benefits

Thermo Fisher Scientific unveiled a new Quick to Clinic solution at BIO Digital 2021 on June 14, 2021, to assist biologic drug researchers in expediting preclinical development. With the improved Quick to Clinic solution, biopharma companies can file for an Investigation New Drug (IND) evaluation and begin Phase 1/First-In-Human trials in as little as 13 months from transfection.

Figure 5: Key Players

Comparator Drugs: Breakthrough Innovations

Swift advancements in communication technology and information are currently taking place globally. All individual stakeholders involved in the healthcare industry, including cost-effective health services and inexpensive healthcare, are gaining greatly from the adoption and use of these technologies.

- Artificial intelligence (AI)-driven digital twins and simulation platforms are being used to lessen reliance on comparative medications. By using artificial intelligence (AI) and statistical modeling approaches to create synthetic/intelligent control arms, pharmaceutical companies can conduct research and clinical trials with fewer patients enrolled in control arms. Stimulating platforms can also improve drug prediction reality, reducing the number of drug comparators required. Recent initiatives include the following:

Examples:

- AI-based QSAR techniques, such as linear discriminant analysis (LDA), support vector machines (SVMs), random forest (RF), and decision trees, have been developed from QSAR modeling tools that have been used to identify possible drug candidates. These techniques can expedite QSAR studies.

- GNS and Servier partnered in August 2022 to advance multiple myeloma drug discovery and clinical development. As part of this partnership, GNS’ digital twin AITIA is using rich, multi-modal patient data produced by the multiple myeloma research foundation to simulate clinical trials and assess drugs’ efficacy.

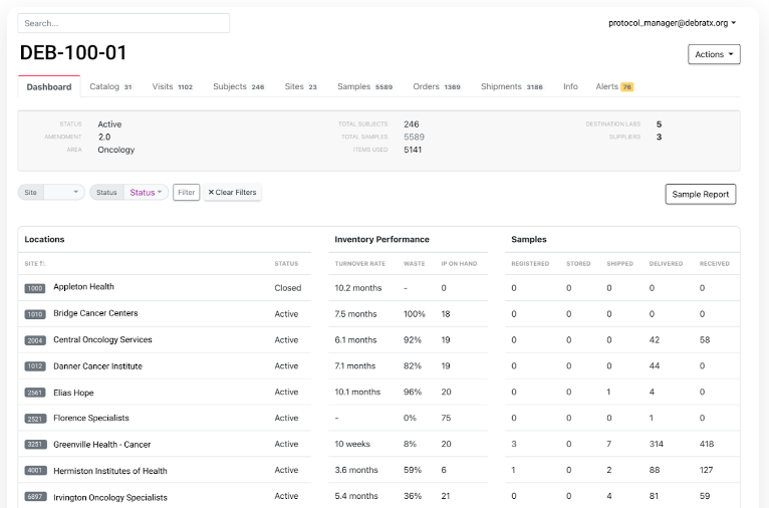

- Advanced digital technologies are being developed to improve clinical trial supply management. Dashboards and simulation tools are being created to improve clinical trial supply management and reduce waste. The most recent releases of these tools are as follows:

Examples:

- IoT-powered, real-time quality and adherence tracking, a cloud-enabled digital core, a Mobile-centric digital patient experience, and analytics-driven performance are some factors that can improve Clinical supply chain performance.

- In November 2022, Slope introduced an interactive study dashboard to inform sponsors about the medicine, lab kit, and auxiliary supply chains used in clinical trials. The dashboard allows sponsors to analyze trial supply inventory management, waste creation, and other metrics to identify high-performing and low-performing sites.

Figure 6: Advanced Digital Technologies – Study Dashboard

Conclusion

Comparator drugs play an important role in the drug development process, providing critical reference points for evaluating new treatments. The selection and application of new drugs depend on their efficacy and safety in clinical trials.

Advancements in various artificial and digital technologies are currently taking place. While there is still plenty of work to be done, we have come a long way in recognizing the need for smart healthcare and taking steps to ensure it.

Changes in the regulatory environment have increased scrutiny of the use of real-world data as external comparators in the clinical evidence package used in regulatory drug submissions.

Various organizations, such as the FDA, Drug Information Association, and International Society for Pharmaco-epidemiology, are working on guidelines regarding using external comparators as a component of the clinical evidence package.

For clinical trials to succeed in the future, a fundamental shift in the planning, execution, oversight, reporting, and regulation of clinical trials to produce the best evidence is necessary.