The global costs of diabetes are estimated to reach $2 trillion by 2030. This is due to the increasing number of type 2 diabetes patients and high drug prices. To reduce the global economic burden, expenditure, and effect of this disease, several policies are being developed in terms of health and social security systems. To devise policy solutions related to the high cost of antidiabetic drugs and ensure the effective execution of policy solutions, policy developers are creating transparent payment and drug pricing systems.

The development of transparent laws helps create a platform that enables strategies for lowering the cost of the drug. Furthermore, policies on Prescription Drug Affordability Boards (PDABs) enable moderate price increases over time, accountability for high launch prices, and data infrastructure for policy solutions. Increasing patient cost sharing is a mechanism adopted to ensure optimal allocation of healthcare expenditures. Furthermore, there have been significant discrepancies amongst the socioeconomic groups globally in accessing health care services.

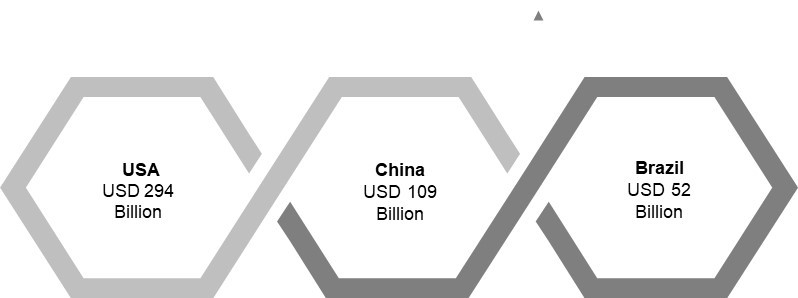

Annual Diabetes Drugs Costs Per Patient

In 2022, there were approx. 491 million people with diabetes mellitus globally, and this number is expected to reach 578 million by 2030. The steep rise in the number of diabetic patients is directly associated with enhanced morbidity and HRQOL. Besides the costs of diabetes treatment and associated complications.

Several factors contribute to increased health expenditures and the cost of medicines used to treat Type 1 and Type 2 diabetes globally. The number of diabetes cases is exponentially growing due to a sedentary lifestyle, high levels of stress, and poor dietary habits. Along with these numbers, the need to develop and implement pricing policies to increase the cost-effectiveness of drugs is rising.

Factors Influencing Antidiabetic Drug Prices

- Approximately 95% of the population has Type 2 diabetes, and it affects the majority of people due to increased insulin resistance

- According to WHO, 422 million people were diagnosed with diabetes across the globe, with a large number of patients residing in low-income nations

- There are several consequences of high antidiabetic drug costs, which could lead to an enhanced global economic burden

Cost Strategies Adopted by Companies for Antidiabetic Drugs

The players constantly revamp their product portfolio and devise effective cost strategies to maintain their overall profit margin. Here are some of them:

Sanofi

- In March 2023, Sanofi announced to reduce its insulin price by 78%, including the establishment of a $35 monthly cap with private insurance

- Those uninsured could get Sanofi’s Insulins Valyou Savings Program, enabling them to buy one or multiple insulins for a 30-day supply for $35

Cigna

- Cigna extended its Patient Assurance Program in July 2022, which enables patients to pay $25 for each one-month supply of insulin from network pharmacies

- The program also provides coordinated diabetes management to the patients along with cost-saving

Novo Nordisk

- Novo Nordisk started selling a version of its insulin at Walmart in March 2023 and provided one-time, 30-day supplies to people at risk of rationing their insulin

- Evolving patient needs and focus on providing sustainable solutions enable the company to revamp its cost strategies constantly

Mark Cuban

- Mark Cuban Cost Plus Drug Co., in Dec 2022, adopted cost plus plus-selling strategy enabling uninsured people to get insulin at a cost-effective price

Civica

- Civica Rx had priced $30 per vial and no more than $55 for a box of five pen cartridges, and a significant discount to uninsured individuals in March 2022,

- The company had also adopted a product bundling strategy to sell generic versions of insulin to consumers

Eli Lilly

- In March 2023, Eli Lilly announced a reduction in insulin prices by 70%

- The company will cap insulin co-pays at $35 for those with commercial health insurance and uninsured patients under their policy of Insulin Value Program

Regulatory Implications of High Antidiabetic Drug Prices

Recent regulatory policies, the availability of novel biosimilars, and updated tax rules can reduce diabetes treatment costs. High prices of antidiabetic drugs reduce senior citizens’ ability to afford medication, leading to non-adherence, higher medical spending, and death. As a result, policies about drug price rises will help decrease premature deaths and patients’ medical expenses. A few regulations towards high prices of Antidiabetic drugs are highlighted below:

- Medicare Part D plans and manufacturers cover 75% of a drug’s list price cost, making patients pay for rest 25%

- The drug manufacturers are raising their list prices, thus enabling patients to experience a significant increase in their coinsurance costs

- Insulin Price Reduction Act 2019 would provide significant cost savings

- Act restricts pharmacy benefit managers (PBMs) and other insurers from receiving rebates, wave deductibles, and other remuneration for insulin products

- Inflation Reduction Act 2023 had limited monthly cost sharing for insulin products to not more than $35 for medicare beneficiaries

- It comprises insulin covered under both Part D and Part B of the act, and no deductible will apply

Regulations Directed Toward Drug Manufacturers

- Product-by-product price controls:

- Prohibits manufacturers from selling drugs above approved prices

- New product prices emerge from negotiations between the government and drug manufacturers

- France and Sweden use this strategy for outpatient prescription drugs

- The strategy develops the therapeutic value of the drug, the price of comparable treatments, and the contribution of the drug’s sale to the national economy

- Limits on insurers’ reimbursement levels:

- The ability of the consumers to limit manufacturers to incur out-of-pocket costs and charge a price higher than the reference price

- In Germany, the reference price is computed essentially as the average of the prices of a specific drug and similar other products

- Furthermore, the statutory health insurers (known as sickness funds) pay the price that manufacturers set for drugs without a reference price (less the required patient copayment)

- Profit controls:

- In the UK, a manufacturer introduces a drug product by freely setting the price at any level by maintaining significant profit for the company

- Further, National Health Service (NHS) helps most drug manufacturers to generate

- Manufacturers freely set prices and do not exceed the target level without prior approval from the government

Impact of High Prices and Policies

High prices of antidiabetic drugs impact adherence to insulin, and non-adherence can easily push diabetes-related complications to another level. High out-of-pocket healthcare costs contribute to financial hardships affecting individuals’ overall health and well-being. However, in Jan 2023, IRA out-of-pocket spending cap took effect in the USA, indicating that almost 1.5 million medicare beneficiaries using insulin will be able to control their treatment expenses to a considerable extent. The price controls on antidiabetic drugs have been prominent in the U.S., Germany, Sweden, and France. Alongside this, the United Kingdom has implemented regulatory and market-based policies. The balance between the two concepts varies from country to country based on reshaping incentives and legal and administrative sanctions.

Apart from price controls, more policies must be directed toward increasing innovation and market competition to offset the rising treatment costs. Furthermore, creating incentives for the FDA could lead to insulin access, affordability, and faster approval of biosimilar insulins. This could be further attained through the senior savings model and high-deductible health plans that cover insulin pre-deductibles.

Moreover, it is recommended that policymakers addressing insulin costs consider unintended consequences, such as high premiums, more significant deficits, and the risk of stifling innovative treatments and cures. To support insulin cost-sharing, insurers need to shift the increasing costs in the form of higher premiums to their customers.

Conclusion

Patients across the globe are anticipated to benefit from policy combinations across various countries. However, governments are observing restraints regarding pharmaceutical prices and increases in total drug spending. Additionally, imposing stringent product-by-product price controls and profit controls could enhance patient access to antidiabetic drugs.