The use of Blockchain-based technology, Non-Fungible Tokens (NFT), for data protection is increasing at an alarming rate. The Non-Fungible Tokens create untouchable, unduplicable, or unalterable transaction records of data to enhance cybersecurity. Integrated security features, the ability to create digital signatures on each transaction, and encrypted messaging services are additional features that NFTs utilize to improve cybersecurity. NFTs protect users by employing authentication while communicating with identity managers to eliminate the risk of impersonation. It also uses cryptography, which allows users to apply it in multiple ways because it is adaptable and increases data security.

What are NFTs or Non-Fungible Tokens?

Non-fungible tokens (NFTs) are unique in that they identify Blockchain-based cryptographic assets and metadata that depict real-world goods such as artwork or collectibles, music, tangible-intangible assets, etc. These digital assets are not interchangeable, tradeable, replicable, or exchangeable, constituting a single, distinct digital asset.

Working of NFTs

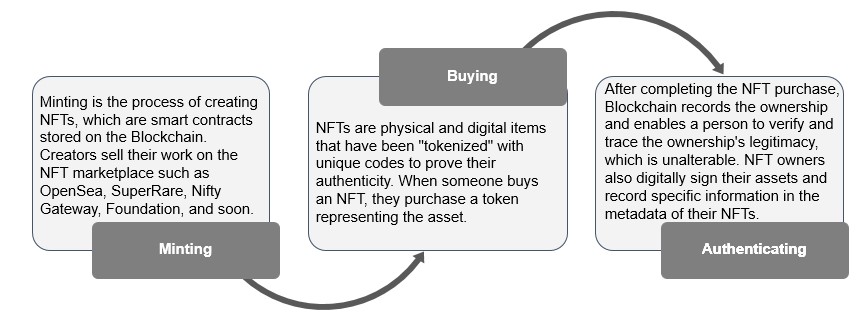

Non-fungible tokens are generated by a process known as minting and stored in a public Blockchain that is open and accessible to anyone. NFTs are minted through smart contracts that assign ownership and manage the transferability of the NFTs by enabling the addition of detailed properties such as the owner’s identity, extensive metadata, and secure file links. The items they represent are verifiable and traceable, while the owner remains anonymous. From producing a new block to validating and recording the data on the Blockchain, the minting process consists of the following steps – Minting, Buying, and Authenticating, as presented in Figure 1.

NFTs Standards

NFT standards explain how to build Non-Fungible Tokens on a Blockchain protocol. The following are Ethereum, Blockchain, and ERC standards for non-fungible tokens:

- Ethereum – ERC-721: Non-fungible ERC721 tokens are unique, indestructible, or unreplicable with varied pricing. Utilizing these unique digital assets or artwork of an artist or creator as a token. Because of the uniqueness and rarity of its properties, each token can be considered a collectible. ERC-721 provides a standard safe transfer function, known as safe Transfer From, to categorize safe and unsafe transfers while constructing non-fungible token platforms.

- ERC1155: Users can register fungible (ERC20) and non-fungible (ERC721) tokens using the same address and smart contract with ERC1155 tokens. Keeping games in mind, creating this token standard, where fungible tokens represent in-game transactional cash and NFTs represent in-game collectibles and exchangeable assets. ERC-1155, like ERC-721, is based on the Ethereum network, ensuring that tokens created using these standards are secure, marketable, and resistant to hacking.

- ERC998: ERC998 tokens are similar to ERC721 tokens as both are non-fungible. These tokens also have composability, allowing individuals to combine or structure the assets or values within them into complex positions and transfer them with a single ownership transfer. These tokens can carry unique non-fungible tokens and uniform fungible tokens. The ERC998 token can be viewed as a portfolio of assets or a holding corporation for a diversified group of assets because it can own a unique set of digital assets.

How Do Well-known Brands Utilize NFTs?

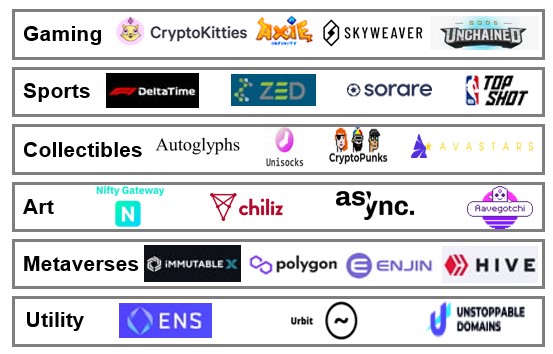

The NFT ecosystem is expanding at breakneck speed, where the creation of non-fungible tokens describes any real, digital, or metaphysical asset in the virtual world. Digital art, digital collectibles, video or music materials, and event tickets are the most frequent NFT assets. Artists, athletes, and celebrities use NFTs to connect with fans and offer them unique content. In 2019, for example, the NFT sector was altered when manufacturing giants like Nike and Formula 1 entered the market. Nike has patented a method for employing an NFT system to validate the authenticity of sneakers, which it calls Crypto Kicks.

Some Other Widespread Use Cases of NFTs

- Zed Run Horses: A digital horse racing platform, Zed Run runs 24*7, where the “horses” exist as NFTs to only serve as digital assets. The Australian-based Virtually Human Studio created these NFT horses, and they are available on the Ethereum network as ERC-721 coins. Each horse’s unique “breathing NFT” distinguishes its digital horses from other NFTs. Each horse has a bloodline that can be traced on the blockchain and can breed with other horses to produce new horses. Every horse has qualities that it can pass on to its children, and even children can race (using the Blockchain to view their racing history).

- Taco Bell “Transformative Tacos”: To raise brand awareness, Taco Bell, a fast-food chain, auctioned 25 NFT GIFs on the NFT marketplace Rarible. The NFTs paid homage to the legendary Taco dish by combining the digital and physical worlds. The inaugural ‘Transformative Taco’ purchaser received a US$500 electronic gift card to spend as they pleased. The bidding price for each GIF was $1, and all 25 NFTs were sold for thousands of dollars in just 30 minutes, with one going for $3,646.

Are Non-fungible Tokens Secure?

Many features of NFTs make them safe and secure to use. Each NFT has a distinct, unique attribute that stores token information. It provides digitally authentic ownership that quickly verifies the fraud as it consists of indivisible tokens. Below, we list some of the main benefits.

- Ownership: Non-fungible tokens have unique tags specifically linked to a particular asset. The ownership is easily transferable, thus allowing for an easy transition of asset ownership with NFTs in the real world. Verifying authentic artwork and digital ownership helps facilitate buying and selling on digital media.

- Authenticity for the creator: Blockchain technology and NFTs empower artists to monetize their work by securely recording ownership and authenticity. This decentralized system offers new opportunities for artists to showcase and sell their creations. Also, NFTs generate an ecosystem where artists can authenticate the actual ownership of their work by recording the metadata on-chain. The immutability of blockchain-based NFTs ensures that no one can change, remove, or replace the goods or assets.

Additional Information

- Authenticity for the collector: NFTs provide proof of ownership for the collector in the digital space, as they legitimately own tokens purchased using NFTs. When tokenizing a digital asset, investors gain value and the ability to buy and sell it multiple times. A copy of the NFTs is verified using the unique identifier embedded in the NFT while maintaining the ownership copy. It’s simple to track because it has a unique identification and a Blockchain record of the work.

- Portability: It is simple to trade NFTs freely on specific markets with various trading alternatives. In the case of games, the creators may issue NFTs that players could save in their digital wallets as in-game products. Players could then use the in-game assets outside of the game or even sell them to get money. Building NFTs on smart contracts enables individuals to utilize specific requirements set between the buyer and seller. These requirements facilitate flexible ownership transfers by leveraging smart contracts.

- Security: Storing the NFTs on Blockchain automatically creates the smart contract. Once the criteria are met and verified, the system ensures the impossibility of code modification and maintains the transaction’s unalterability. Thus providing a sense of security to both artists and purchasers.

Challenges Existing While Adopting NFTs

Non-fungible token adoption faces several problems and concerns, such as:

- Complexity: With the increasing adoption of NFTs among start-ups and enterprises, the complexity of non-fungible tokens and decentralized applications (DAPPS) still exists with the technology tooling the Blockchain-based NFTs. This complexity increases the chances of market risk, market volatility, illiquidity, and fraud.

- Regulatory/Legal Implications: The introduction of emerging NFT technologies involving speculative or high-value assets increases the chances of new regulatory and legal considerations being implemented faster.

- Consistent Change: A tremendous increase in the NFT ecosystem and Blockchain network offers various obstacles like constant change, adaptability, and modularity to the technology users.

- Environmental Concerns: NFTs significantly impact the environment by using energy-intensive computer transactions to authenticate and sell artwork or collectibles.

- Miscellaneous: Some collectibles have become extraordinarily expensive due to the NFT craze, and they may not keep their worth in the long run. In addition, just like other cryptocurrencies, they could be hacked if the NFTs are not stored carefully.

Conclusion

People widely utilize NFTs to market digital art and collectibles, showcasing their tremendous potential beyond gaming. Using NFTs, tokenization of any real-world asset in the future is possible, making asset ownership visible and incorruptible. Business owners are investigating intellectual property rights holders and Blockchain initiatives. They aim to identify, certify, ticket, and enable fractional ownership of digital and real-world items. This approach ensures clear ownership and traceability.

However, the challenges that this market faces will necessitate regulatory involvement. Considering the legal and regulatory concerns associated with NFTs is critical. As the NFT market grows, the need for an international regulatory organization for non-fungible tokens becomes increasingly important to ensure appropriate regulation and legalization. This will have a significant influence on NFTs and will determine the future of NFTs.