Bridiging Innovation and Scalable Impact in Surgical Robotics

The Inflection Point: From Hardware Sales to Value Ecosystems

Surgical robotics has reached a crucial milestone. Once considered luxury prestige technologies, robotic platforms are now being seen as essential hospital infrastructure by hospitals worldwide. As the market is expected to grow, it will be business model innovation, not technological advances, that determines which companies dominate future growth.

The traditional capital-intensive model, which relied on multi-million dollar sales of hardware through contracts and proprietary instruments, has been replaced by a service-oriented approach. Although this strategy was successful in healthcare in earlier years, it is increasingly misaligned with modern healthcare economics. Hospitals face rising cost pressures, payers demand outcomes-based accountability, and new entrants target established players with flexible, software-driven solutions.

Business Model Innovation Requirements and Emerging Surgical Robotics

Surgical robotics has revolutionized minimally invasive surgery by providing greater precision, dexterity, and visualization. The original business model, which focused on selling expensive robots, was quite successful in establishing a niche in the market. However, there are several limitations associated with this CapEx-intensive approach.

- High Initial Cost: The notable financial barrier at the outset will make it unavailable to most of the hospitals and health care systems, especially those with tight budgets.

- Utilization Issues: Achieving the maximum in relation to the expended investment in relation to high utilization rates can be challenging, because of the issues of surgeon training, case mix, and scheduling restrictions.

- Poor Scalability: The capital-intensive scheme impedes expansion and market penetration in new markets, particularly in developing nations.

The existing business models in the surgical robotics market are quite restrictive; as the market evolves, there will be a need to shift toward more flexible and value-oriented models.

The New Frontier: Modular, Flexible, and Data-driven Models

The new generation of business models in surgical robotics reflects a broader shift in healthcare: the transition from asset ownership to outcomes-based access. Rather than capital equipment sales, industry leaders are pursuing modular, data-rich models that can more clearly align incentives with clinical and financial outcomes. In this evolution, five dimensions can be distinguished:

1. Revenue Architecture

- Subscription and Leasing Models- Capital expenditure (CapEx) to operating expenditure (OpEx) to facilitate adoption.

- Per-Procedure Pricing – Transaction-based pricing (typically $1,500–$3,000 per case) that aligns costs with utilization.

- Bundled Service Models- This reduces administration complexity by providing a packaged deal of robot + training + analytics.

2. Customer Segmentation

- Beyond Academic Hospitals – Diversification into ambulatory surgery centers (ASCs), mid-tier hospitals, and Global South markets.

- Tiered Solutions – Offering solutions to mature high-income markets and emerging markets with limited budgets.

3. Expanded Product & Service Stack

- Training & Proctoring – Structured training, live proctoring, and continuing medical education (CME).

- Remote Assistance – AI-enhanced instruction, tele-proctoring, and timely notifications.

- AI-Guided Surgery – Benchmarking, predictive analytics, and Safety alerts integrated into workflows.

- API Ecosystem – Efficient integration with electronic medical records (EMR), imaging, and optimization of surgical workflow.

4. Visible vs. Invisible Value

- Visible Value – Precision, faster recovery, fewer complications, and improved patient outcomes.

- Invisible Value – Surgeons’ confidence, institutional prestige, staff recruitment/retention, and reduced litigation risk.

5. Pricing Transparency

- Visible Price – Clearly structured per-procedure fees or subscription tiers.

- Invisible Price – Opportunity costs such as training time, OR downtime, workflow disruption, and vendor lock-in.

Emerging Business Model Trends

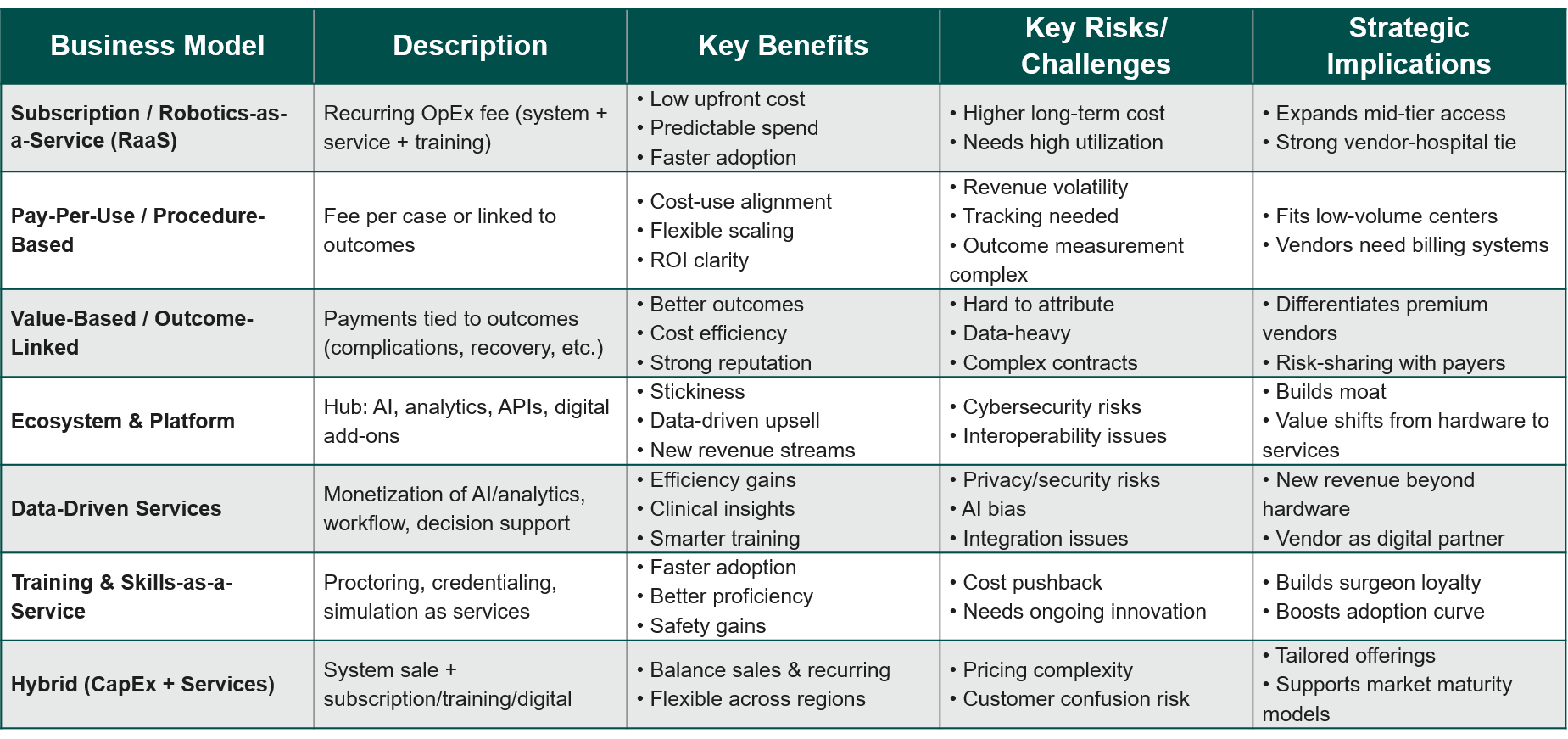

Surgical robotics is shifting from a traditional capital-focused approach to more flexible, data-driven models and outcomes. The models outlined below are becoming more popular, each providing a unique value proposition and related risks.

Table 1: Emerging Business Model Trends

Stakeholder-centric Value Delivery

The critical competitive edge is no longer hardware capacity; it is stakeholder-centric value orchestration. Individual actors have different perceptions of benefits to the healthcare ecosystem:

- Physicians: Ergonomic relief, AI-driven decision support, and real-time feedback on performance

- Patients: Reduced infections, reduced recovery time, enhanced surgical accuracy

- Hospital Administrators: Cost predictability, increased throughput in OR, accreditation benefits

- Payers and Insurers: Lower /reduced readmissions, better quality-adjusted outcomes, predictable cost of care episodes

This convergence is moving surgical robotics beyond a technology acquisition to a strategic healthcare investment.

Strategic Implications: Three Imperatives for Industry Players

The next generation’s leaders won’t be those who sell surgical robots, but those who create platform ecosystems—integrating revenue, customer segmentation, and data-driven services into a self-sustaining cycle of adoption, value, and loyalty.

Reinvent Revenue Beyond Hardware

The recurring digital and services revenue will drive sustainable growth. Data monetization through benchmarking dashboards, predictive analytics, and AI-driven workflows will be a key part of this process.

Design for Modularity and Accessibility

Elastic pricing and modular systems will increase adoption among ASCs and in emerging markets. Organizations need to customize products to the local healthcare provider economies worldwide.

Architect the Ecosystem

Future leaders will be those who shift their focus toward thinking in terms of ownership of surgical ecosystems rather than selling robots. That entails opening APIs and developing surgeon training networks and platforms on which third parties (e.g., imaging, AI, analytics) can integrate.

Conclusion: Business Model Will Determine the Winners

Surgical robotics is entering a phase in which competitive advantage is increasingly determined by how value is created, rather than by technological innovation alone. As systems transition from capital assets to essential clinical infrastructure, success will depend on how effectively business models integrate access, utilization, outcomes, and long-term sustainability. Modular platforms, data-driven services, and outcome-linked economics are no longer optional—they are becoming vital for scaling and maintaining relevance.

The defining question for the upcoming decade is not the extent of advances in robotics, but rather the effectiveness of the underlying model in delivering value throughout the care continuum. Organizations that reconsider revenue strategies, ecosystem architecture, and incentive structures will be better equipped to convert innovation into enduring impact.

Key questions leaders should be reflecting on:

- Are our current business models enabling adoption and scale or constraining them?

- Do we fully understand the visible and invisible value (and costs) our platforms create?

- Are we building products, or designing ecosystems that compound value over time?

At Stellarix, we assist organizations in addressing these questions by integrating healthcare strategy, data-driven insights, and advanced technological expertise, along with supporting business model development, value assessment, and ecosystem strategies in surgical robotics and related fields. If your organization is re-evaluating how to scale innovation, align outcomes, and future-proof its business model, this is the time to step back and reconsider the fundamentals.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.