Reinventing Relevance: Five Levers for MedTech OEMs in the Era of Decentralized Diagnostics

Competing in this new landscape will require pragmatic approach, beyond mergers, acquisitions, startup acceleration, or technology additions. It calls for a rethinking of how these companies operate, how they create, deliver, and sustain value in a system that’s no longer centred on the lab.

Part 1 of this article discussed a business hypothesis and a key challenge: as self-diagnosis of HPV screening advances and lab-based tests are decentralized, diagnostic manufacturers (OEMs) would see their traditional revenue models split across many smaller players. However, we argued that “Fragmentation doesn’t necessarily mean a loss”, it would change the operational, supply chain push-pull boundaries, and pricing & customer engagement approaches. Access and control over the supply chain will shift toward data owners & orchestrators. Thus, the way companies create value would be changed.

The next question leaders would ask is: “How can HPV assay OEMs use this shift to their advantage to stay relevant and competitive beyond M&A?”

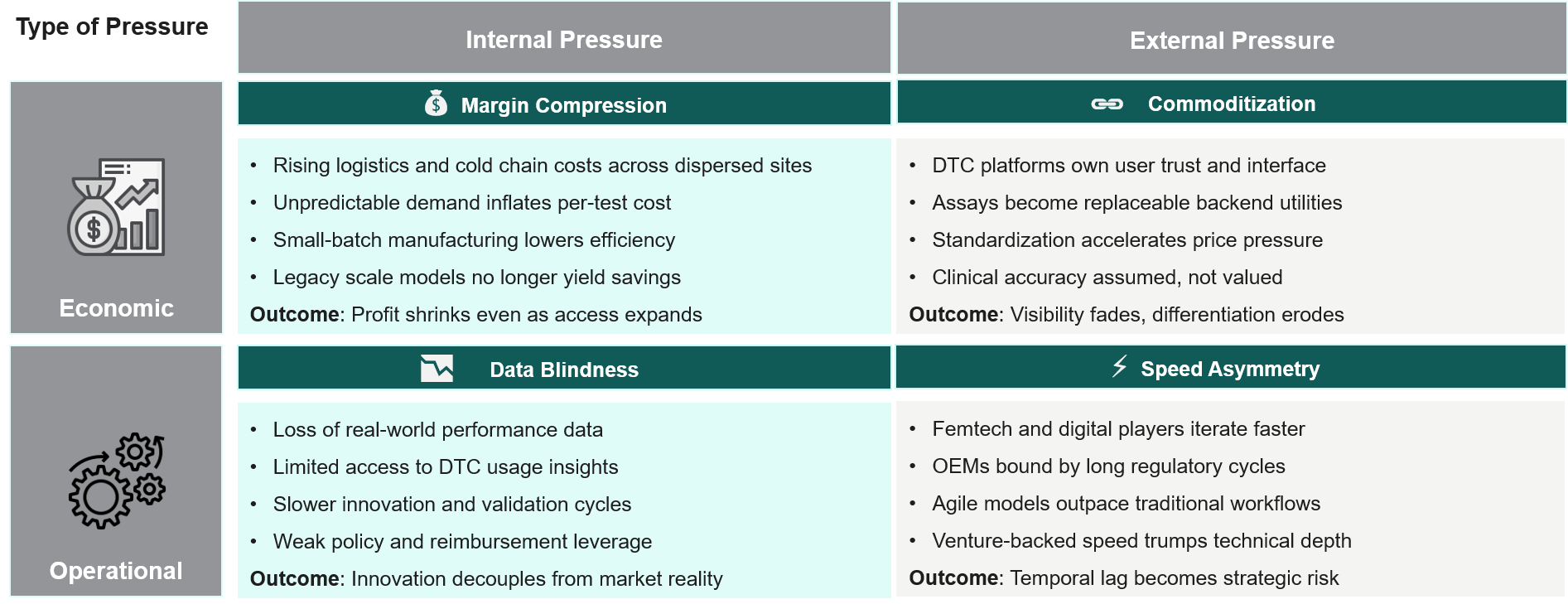

Risks to Navigate

As diagnostic OEMs must have observed, HPV self-sampling and decentralized screening are eroding the advantages they once had in centralized labs: i.e., predictable volume, high reagent pull-through, and control of assay standardization.

Our research shows that diagnostic OEMs are facing the following pressures arising from within, the macro environment, and operational changes.

The interaction of these forces produces a combined impact. The traditional business frameworks surrounding volume assurance and lab-based control are no longer sustainable, as value is now created by frameworks that can easily shift toward coordinating fragmented diagnostic journeys rather than just providing instruments.

Thus, the next decade will reward OEMs who shift from selling instruments to shaping diagnostic journeys.

So What?

The article discusses five levers that address structural gaps that even the big diagnostic OEMs have not yet solved, and recommends a framework to prioritize these levers.

Reinvention Playbook: Five Levers for the Decentralization Era

Based on our assessment, OEMs could work around one or more of the following levers:

Lever 1: Rethink How You Earn and Add Value

From “Product Vendor” to “Diagnostic Infrastructure Provider”

Based on decades of experience and lab testing, OEMs build internal intellectual property, APIs, QC algorithms, instrument telemetry, and assay performance analytics. But a very few package these into a service layer for FemTech or DTC players.

Among many suggestions, OEMs can build the following offerings, which are not observed as a package yet:

- On-demand verification algorithms for self-collected samples

- Providing assurance dashboards that platform partners can embed directly into apps

- Creating OEM-led QC certification for home-based testing flows

Lever 2: Turning Fragmentation into Long-Term Value

From Reagent Sales to “Verified Test Event” Economics

Outcome-based pricing seems familiar, but almost nobody has applied it to diagnostics.

With suitable technological integration, OEMs can tie revenue to:

- A valid HPV-positive result

- A verified assay cycle

- A confirmed test completion in decentralized workflows

This aligns incentives across:

- At-home testing companies

- National screening programs

- Payers

- Public-health agencies

Impact: Using Agentic AI, this transformation would create a new economic model for decentralized testing.

Lever 3: Expanding Reach through Shared Innovation

IP Unbundling and Licensing

MedTech OEMs typically protect IP, and very few have unbundled it the way semiconductor firms did.

However, smaller firms (e.g., portable PCR companies) often lack assay-chemistry maturity but have sufficient margins and pricing power to cover licensing fees.

Thus, unbundling IP and licensing allows OEMs not only to become a core part of smaller diagnostic firms in chemistry, interpretation, and quality, but also to enable other device makers to innovate in hardware and UX.

By opening up the intellectual property, OEMs can become indispensable in the decentralized value chain.

Lever 4: Building Value through Data

From “Test Provider” to “Screening Intelligence Partner”

In a decentralized testing world, data itself becomes a key source of value. As part of their operations, OEMs collect data, analyze it, synthesize information, and validate trends around:

- Amplification curves

- Invalid test rates

- Sample integrity trends

- Population-level patterns

- False-positive clustering

- Reagent performance under non-lab conditions, etc.

Currently, no DTC, FemTech platform, or accountable care organization (ACO) generates this level of insight. OEMs can own the “diagnostic intelligence layer” of decentralized screening, something competitors can’t easily replicate.

| Partner Type | OEM Role | Value Exchange |

| FemTech/DTC Brands | Technology enabler | IP, assay validation, co-branding |

| Health Platforms | Data collaborator | Access to anonymized screening data |

| Device Makers | Ecosystem integrator | Joint PoC development |

| Payers/Public Health | Outcome partner | Reimbursement pathways and population analytics |

Lever 5: Making Experimentation a Core Practice

Co-Development and CVC Acceleration

Most OEMs today invest late in mature platforms. But decentralization rewards hands-on technical support for early-stage players who define user experience.

OEMs can collaborate closely with startups in areas like women’s health, decentralized testing, and digital health platforms through joint product development, investments, or corporate venture capital (CVC) programs to:

- Support early UX experiments

- Embed assay scientists into partner R&D

- Co-design sample-collection standardization

- Co-own data validation protocols

This lever becomes compelling because OEMs can shape the success of new platforms rather than chase them after they scale.

| Shift | From | To | Strategic Implication |

| Pricing Model | Per Kit | Per Diagnosis | Align economics with outcomes |

| Customer | Labs | Patients & Platforms | Build B2B2C capabilities |

| Core Asset | Assay IP | Data + Continuity | Create longitudinal value |

| Business Model | Transactional | Platform | Enable APIs & validation layers |

| Growth Strategy | M&A | Co-Development | Hedge disruption through partnerships |

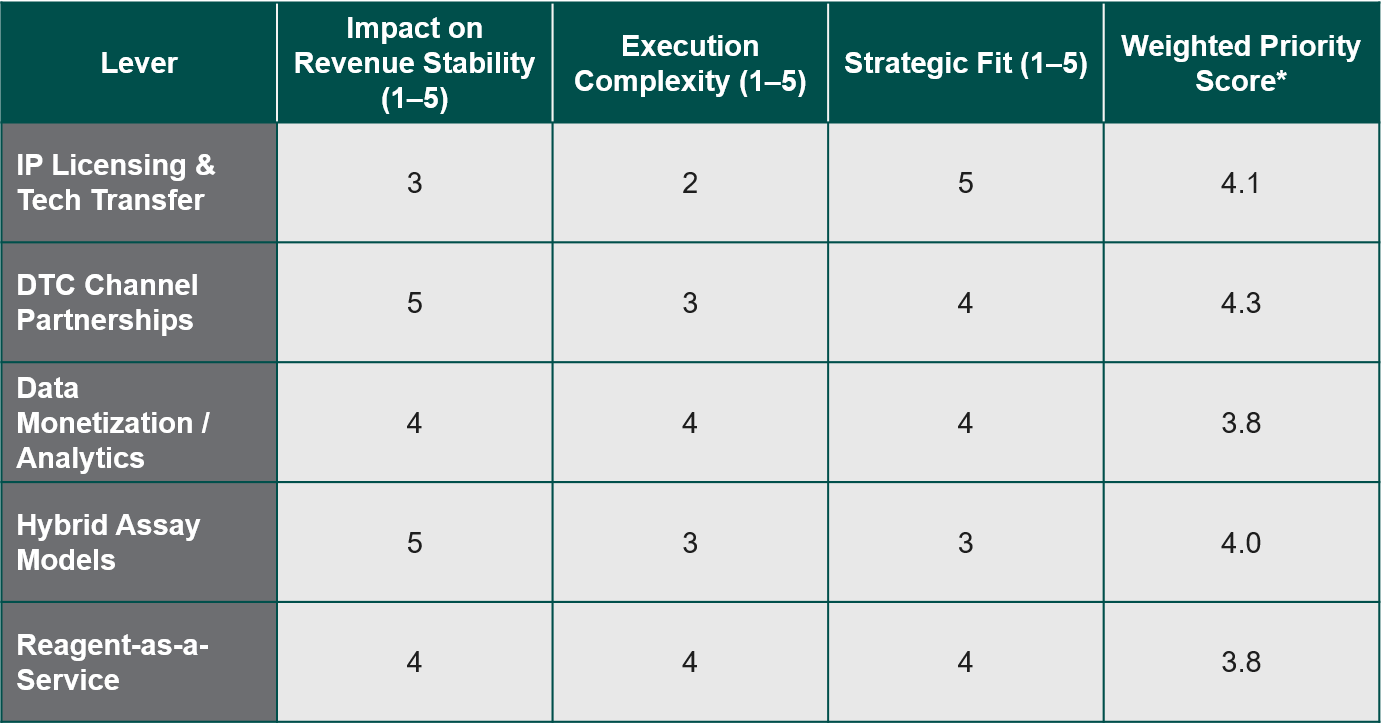

Prioritization Framework

OEMs can’t pursue all innovation levers at once. The following framework would help leaders decide which opportunities to pursue immediately and which to develop more gradually or through partners.

This prioritization matrix would help leadership teams compare and rank different options using three key factors:

- Impact on Revenue Stability: How much does it buffer or grow future earnings?

- Execution Complexity: Assess the difficulty of implementing given organizational, regulatory, and technical constraints.

- Strategic Fit – alignment with the OEM’s core capabilities, IP, and brand.

It visually maps which levers to Accelerate, Pilot, or Monitor.

Step 1: Identify the Five Levers

For HPV/assay OEMs in decentralization, five high-potential levers are: IP licensing & tech transfer, DTC channel partnerships, data monetization/analytics, hybrid assay models, and reagent-as-a-service.

Step 2: Evaluate Each Lever

*Priority Score Formula: Priority Score = (0.4 × Impact) – (0.3 × Complexity) + (0.3 × Strategic Fit)

Note: Actual scoring values may differ based on organizational strengths, leverages, and constraints.

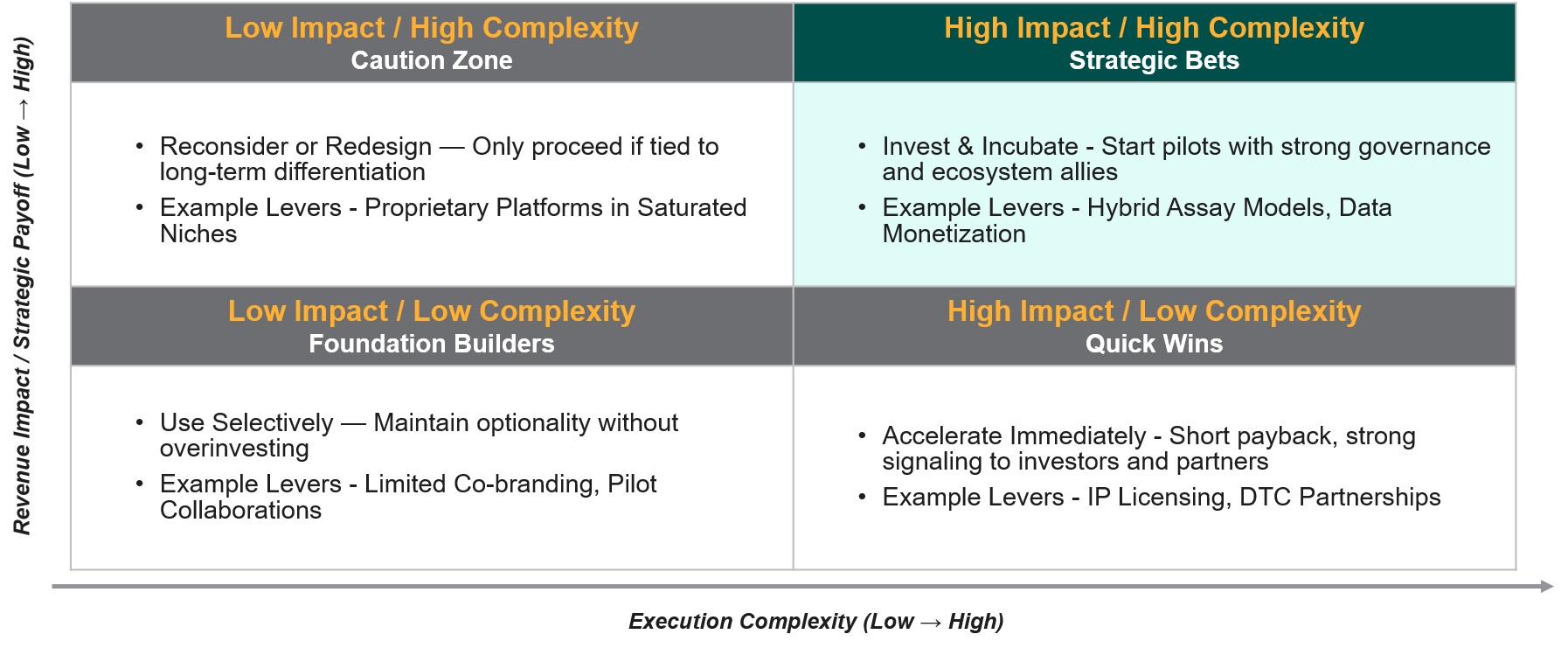

Step 3: 2×2 Prioritization Matrix

This matrix provides structure and clarity to planning efforts. It also helps align teams around where true value lies, ensures resources are directed toward the highest returns, and shifts the mindset from safeguarding current volumes to building the future economics of HPV and assay-based diagnostics.

Conclusion: Designing for Distributed Relevance

“Decentralization isn’t the end of traditional OEM business models; it’s a signal to think differently.”

For diagnostic and assay manufacturers, the key question is shifting from “How do we keep control?” to “Where should we now create value?” As testing moves beyond central labs into clinics, homes, and digital platforms, growth will depend less on protecting existing margins and more on building new connections linking data, diagnostics, and patient trust across a wider network.

This raises two immediate questions for diagnostic and assay manufacturers:

- Which capabilities will most determine your relevance in a decentralized landscape?

- And where should you place your next strategic bets to stay ahead of accelerating change?

If your organization is navigating this transition, we welcome a conversation on how to prioritize the right levers, build the right partnerships, and convert fragmentation into long-term advantage.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.