Biogas: The Silent Engine of the Energy Transition

From the Periphery to the Mainstream

Renewable energy technologies such as electrolyzers, solar panels, and wind turbines are now in the spotlight worldwide. As the shift to sustainable energy grows, planners are recognizing the drawbacks of centralized, linear systems. This shift has helped biogas become a popular energy choice for homes, businesses, and industry.

Biogas is helping achieve goals like inclusive growth, waste reuse, decentralized energy, and climate action all at once. Originally developed for waste management or as a rural by-product, biogas now meets four key needs for energy decarbonization.

- Decarbonizing Hard-to-Electrify Sectors: Whether it’s agriculture, manufacturing, or heavy transportation—where electricity use is costly, energy-intensive, or results in high emissions—biomethane is a promising alternative to fossil fuels.

- Improving Energy Security: Producing biogas from waste reduces the reliance on fossil fuels. According to the IEA, its sustainable potential is 1 trillion cubic meters per year, or 25% of current global natural gas demand, and it reduces reliance on imported fuels.

- Promoting Circular Economy: As waste is converted to energy and digestate, emissions are reduced, and resource loops are closed in the waste, energy, and food systems.

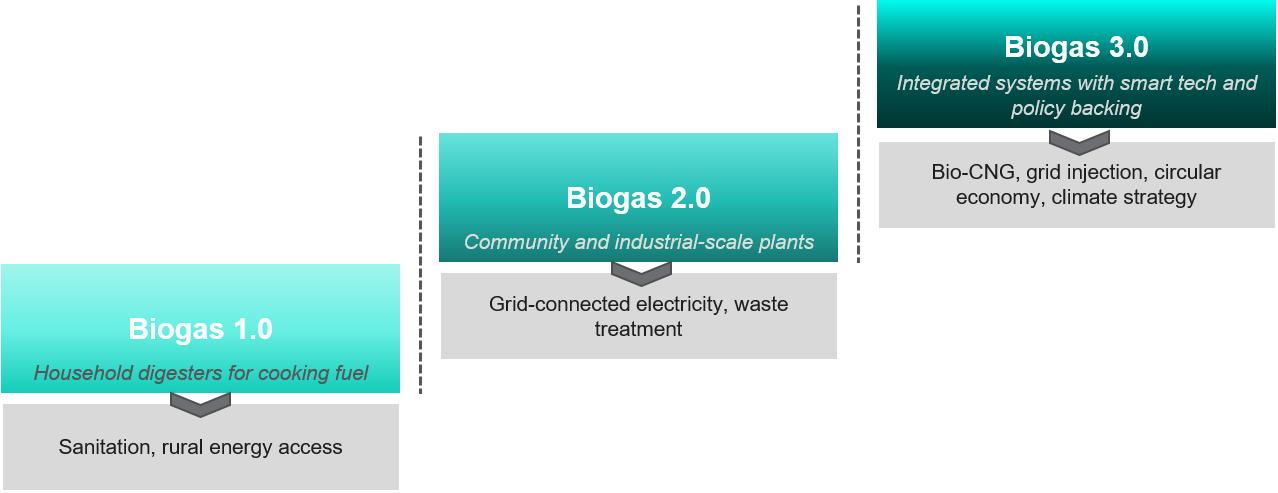

Biogas’s Evolution: Entering Biogas 3.0

This evolution is generational rather than merely incremental. Biogas has grown from home digesters to large-scale systems, showing both technological progress and greater strategic importance. Biogas 3.0 uses a systems-thinking approach to connect energy production, agriculture, and waste management, supporting green infrastructure and strong economies.

The Market Momentum: Global Push, Policy, and Growth

Biogas is growing to meet the global demand for flexible, clean energy. The International Energy Agency (IEA) forecasts biogas demand to increase by 30% by 2030 globally. However, despite the growth forecast for biogas, the climate objectives remain unattainable. To meet the Net Zero by 2050 target, biogas production should rise by 270%. This highlights the demand for biogas production at an exponentially higher rate. The shift from underutilization to widespread adoption depends on modernizing regulations, expanding and developing infrastructure, and incorporating renewable energy into national energy matrices, in addition to environmental urgency. Thus, the upcoming growth in the Biogas 3.0 phase is more policy-engineered and less incidental.

In all major geographies, biogas policy is evolving from ad hoc approaches to a well-structured national strategy. The European Union is the front-runner in setting regulations and frameworks–REPowerEU, RED III, and the Fit for 55 package–all backed by feed-in tariffs, funds under the Common Agriculture Policy (CAP), and R&D support under Horizon Europe Initiative.

Under the EU Emissions Trading System (ETS), the two tenets of Origin Accountability and emissions-based pricing ensure traceability and integrate carbon costs into the market. Germany and France are blending mandates and national biomethane strategies.

While the US lacks a centralized federal strategy for biogas, the sector nonetheless leverages key policy mechanisms, such as the Renewable Fuel Standard (RFS) and Low Carbon Fuel Standard (LCFS). The Inflation Reduction Act (IRA) has unlocked substantial tax credits for biogas projects, while USDA grants and LCFS-linked carbon markets (especially in California, Oregon, and Washington) are creating strong regional momentum.

In developing economies like India, the biogas ecosystem is developing as a complex network of national and state incentives. SATAT and the National Bioenergy Programme are increasing supply via subsidized loans. Demand is fulfilled through long-term offtake agreements with OMCs and blending mandates. Further, GST exemptions along with digestate certification, as well as agri-logistics upgrades, are creating a solid ecosystem for rural deployment.

Experts estimate that most future growth in the biogas sector will occur in developing countries such as India and Brazil, which account for 80% of the world’s sustainable biogas potential.

The Hidden Hurdles to Scale

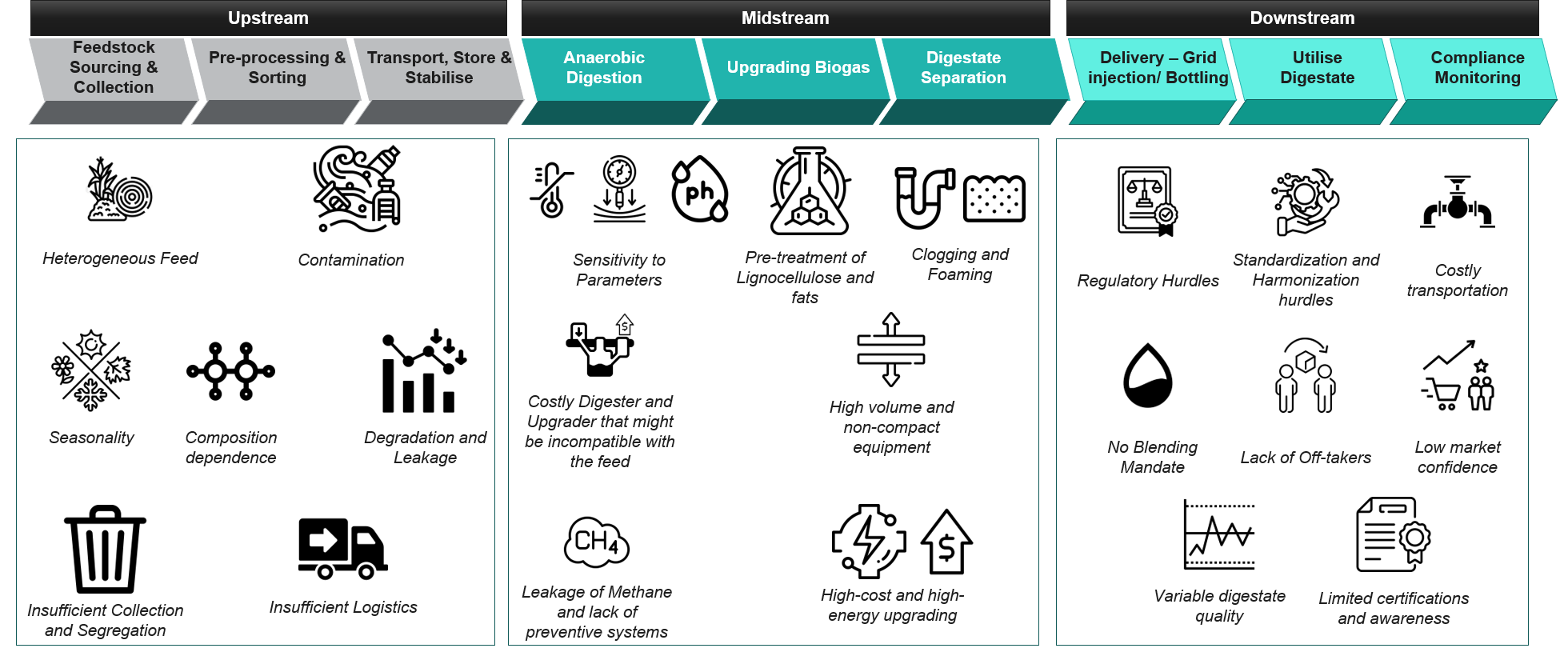

Scaling the biogas into the mainstream adoption faces challenges from technical, financial, and policy dimensions, and addressing them is crucial for biogas to be a part of the world’s Net-Zero journey:

- Technical Complexities: Biogas systems are inherently decentralized, resulting in significant collection, logistical, and processing costs. In most developing economies, low-density feedstocks lack an effective aggregation mechanism, and urban waste streams lack sorting efficiency. Transporting these feedstocks is expensive, and infrastructure gaps—such as limited pipeline injection access or inadequate digestate processing—limit scalability to achieve a national-scale impact. Also, methane leakage along poorly monitored value chains can ruin the biogas’s climate benefits.

- Financial Hurdles: Biogas faces a high capital expenditure burden, especially when upgrading to biomethane or connecting to the grid. The long return on investment periods discourage small-scale entrepreneurs. Carbon credits’ value is adversely affected by a fragmented registry and complex verification procedures.

- Policy Fragmentation and Public Perception: Absence of comprehensive national strategies and inconsistent permitting and certification standards restrict scalability. Other than this, the public notion of biogas as a “waste” technology also limits its recognition as a viable climate solution, allowing solar and hydrogen to capture greater attention.

Technology Spotlight: Innovations Redefining the Biogas Ecosystem

The industry is unlocking targeted innovations to overcome frictions across the lifecycle, including upstream sourcing, midstream digestion, and downstream utilization.

Upstream–Making Collection Smarter and Pre-Treatment More Effective

AI-enabled waste-tracking systems optimize collection routes using predictive analytics, ensuring that organic feedstock flows timely and efficiently.

Startups like Carbon Loops (India) and Rekosistem (Indonesia) are some key players, using sensor-based platforms and real-time mapping to accelerate urban waste flow and segregation, and forecast supply using machine learning.

Decentralized pre-processing facilities are being piloted in developing economies such as India, Kenya, and Brazil. These facilities help densify biomass at the point of generation, reducing transportation costs and preventing feedstock spoilage.

Major developments are underway in feedstock pre-treatment, with a focus on using more feedstock sources to produce biogas. Process intensification of feedstock treatment via cavitation, thermal hydrolysis, alkaline treatment, and enzymatic treatment improved biodegradability and methane yields.

ALPS Ecoscience (UK) has developed the Sequential Multiple Anaerobic Stages with Hydrogen (SMASH) process, which deploys hydrodynamic cavitation to micronize the cellulose in lingo-cellulosic feedstock, while Anessa (Canada) is leveraging data analytics and AI to model multiple feedstock combinations, and predict and model the digestion outcomes to further optimize plant designs virtually.

Midstream–Resilience and Efficiency-Driven Digestion and Upgrading

Innovation and digital transformation are at the heart of the biogas value chain, which involves the anaerobic digestion process. This process has historically faced challenges such as inconsistent yields, high energy use, and inflexible technology setups.

Technologies such as hybrid digesters, which can operate on both dry and wet feedstock, help address these issues. Additionally, two-stage reactor designs tend to separate stages by process, leading to better process stability and higher conversion efficiency.

Armatec-FTS India’s EVO slow-speed-high-circulation-rate mixing side impeller makes operations more efficient. Biological enhancements improve digestion performance. Co-digestion tactics foster microbial energy, ultimately increasing gas yields. Trace metals such as iron and nickel are used to stimulate microbial bioactivity, while enzymatic additives, such as cellulase and protease, offered by Envirozyme break down fibrous materials, accelerating the digestion cycle.

The digitalization of midstream operations is increasingly evident in pilot plants. The use of AI-powered sensors, along with digital twins and smart Leak Detection and Repair (LDAR) systems, is popular. Such digitalization enables real-time monitoring, predictive fault detection, and methane leak mitigation.

Companies like Reverion in Germany and esylys are using these digital capabilities in modular digesters, while Kanadevia Inova’s AI-based DPM system replaces traditional lab testing with predictive control for dry digesters, enhancing reliability and responsiveness.

Upgrading technologies is also evolving rapidly. Low-pressure Pressure Swing Adsorption (PSA) and membrane separation systems achieve over 96% methane recovery with less energy input. Cryogenic distillation methods, such as those developed by Sublime Energie in France, not only purify biomethane but also capture biogenic CO₂ for food-grade applications.

Nordsol’s Flash-2-Sweep technology introduces internal recycling loops that efficiently remove CO₂ and water, improving overall system performance. In October 2025, Clarke Energy commissioned its first membrane-based biogas upgrading plant in India. The upgrader processes biogas into high-purity biomethane (>97.4% methane), supporting India’s push for bio-CNG/biomethane. Emerging biological upgrading pathways—where CO₂ is converted to CH₄ via specialized microbes—are opening new frontiers in microbial valorization.

Strategic scaling efforts underscore the growing confidence in midstream infrastructure. Vanguard Renewables, in a joint venture with TotalEnergies to develop, build, and operate Farm Powered® anaerobic process-based renewable natural gas (RNG) projects in the US, which will help Vanguard Renewables scale up its operations to over 100 facilities across the US by 2028.

Considering international level collaborations, Electrochaea (Germany) has entered a Cooperative Research and Development Agreement (CRADA) with Lawrence Livermore National Laboratory (USA) and SoCalGas (USA). Additionally, EU Horizon-supported bio-LNG pilot plants in Belgium and Italy are advancing toward integrated CO2 recovery and liquefaction technologies.

Collectively, these innovations in the midstream technology ecosystem are making the overall system highly modular and adaptable to various feedstocks, preparing it for industrial deployment across diverse geographies and making it more resilient to supply chain issues.

Downstream–Improving Grid Compatibility & Unlocking New End-Use Markets

A strategic transformation in the downstream segment, including distribution, utilization, and by-product valorization, will enhance grid compatibility and expand end-use applications. In regions with limited pipeline infrastructure, virtual pipeline models using high-pressure trailers are emerging as cost-effective options, enabling last-mile delivery and access to bio-CNG for industrial clusters, transportation fleets, and rural microgrids. Modular compression and bottling units further reduce storage and dispatch costs, making bio-CNG more affordable for decentralized energy systems.

Grid integration is becoming smarter with advanced metering. Additionally, SCADA systems now enable real-time flow regulation and the dynamic injection of compressed biogas (CBG) into existing city gas distribution (CGD) networks. At the same time, microgrids powered by hybrid biogas-solar systems are emerging as dependable solutions for rural electrification and energy-intensive MSMEs, especially in Asia and sub-Saharan Africa.

With fleet decarbonization initiatives gaining momentum, logistics giants like DHL and UPS are partnering with bio-CNG producers to transition heavy-duty vehicles towards cleaner fuels. These efforts are reinforced by many national blending mandates and financial incentives promoting bio-CNG use across commercial fleets. A collaborative venture between Veolia, Waga Energy, and ENGIE is working to modernize RNG infrastructure to support large-scale grid integration and mobility applications.

Downstream innovation is also redefining the role of biogas by-products beyond the energy industry, into applications such as agriculture. Initially considered difficult to dispose of, digestates are now being used as valuable agricultural inputs through various physical, chemical, and/or physicochemical processes. This yields products such as biofertilizers and biochar, which simultaneously support carbon sequestration and soil health.

The emergence of integrated biorefinery represents the most advanced frontier in downstream biogas. These advanced plants merge the production of biomethane with hydrogen, volatile fatty acids (VFAs), and industrial biogenic CO2, unlocking new revenue streams while supporting circular economy models. AmuGreen (Ireland) has developed a solution ideal for homes, institutions, and decentralized applications that converts food waste into biogas and liquid fertilizer. These biorefinery models are paving the way for resilient, multi-output systems that align with net-zero and resource efficiency objectives.

These downstream innovations are making biogas more grid-compatible, economically feasible, and environmentally beneficial, opening new markets and strengthening its role in the global energy transition.

Other Notable Developments – Beyond the Farm and Grid

While biogas is regarded as a high-value product relative to its source, many innovations are being developed to create higher-value products such as fuels, plastics, and other valuable chemical feedstocks.

Targeting to accelerate the decarbonization in sectors like marine transportation and aviation, many European and American start-ups are working to develop processes that either individually leverage or combine photochemical, electrochemical, and thermochemical processes to sustainably produce marine and aviation fuels from biogas.

Mango Materials, in collaboration with its many academic and corporate partners, is working to scale up and commercialize the processes of producing polyhydroxyalkanoates (PHAs) from biogas. The aim is to enhance the materials-production potential of low-resource environments, making them further useful for a variety of applications, from packaging to medical use.

Neustark is also working to capture and mineralize the CO2 produced from biogas production into recycled concrete, further paving the way for sustainable building materials.

In Australia, AGIG and Delorean have launched a first-of-its-kind project to inject 58 GWh per year of biomethane produced from 70,000 tonnes of organic waste into South Australia’s gas grid, expanding the supply of grid-connected green gas. These advancements are broadening biogas’s reach into higher-value sectors and setting new benchmarks for industrial decarbonization.

Another notable industry development is the focus on high-value fuel pathways. Syzygy and Kent world’s first electrified biogas-to-SAF plant in Uruguay to convert manure-based biomethane, CO₂, and renewable electricity into ASTM-certified jet fuel, producing 350,000+ gallons annually. This marks a significant step in pushing biogas beyond heat, power, and CNG into true aviation-grade fuels.

These technologies, in a cumulative manner, can not only facilitate access to biogas in new and emerging markets but also establish a potential benchmark within these applications.

Conclusion

Biogas is at a critical stage, especially where technology, climate policy, and industrial decarbonization intersect. For this industry to reach its full potential, several key areas need attention. Consistent financial support and policy alignment are essential for ongoing growth. It’s also important to integrate AI and digital technologies while promoting cross-border and cross-industry collaborations. Lastly, the industry must expand into both mature and emerging markets to contribute to the energy transition.

With the decentralization of both feedstock and energy, the integration of AI, and growing ties to mainstream energy, biogas is set not only to serve as a decarbonization tool but also to lead in the energy transition. The biogas sector is rapidly evolving, creating exciting opportunities for new fuels, materials, and circular technologies. At Stellarix, we assist businesses in navigating this dynamic biogas and biomethane landscape, helping them identify the right technologies, partners, and market pathways to unlock valuable new revenue streams. Whether it is emerging fuel innovations or advanced material opportunities, we’re here to support businesses in seizing growth at every stage of the value chain. We would be happy to connect and discuss how we can help accelerate your journey in this fast-growing sector.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.