Functional Beverages: Turning Lab Promises into Commercial Reality

The beverage market growth is fuelled by the convergence of diverse consumer trends prioritizing health over convenience and pleasure. As R&D and product features align with this demand, a completely new class of innovations is emerging, spanning beverages that can reduce blood alcohol levels by half in 30 minutes and nutrient-fortified coffee. But despite progress on the innovation front, they remain alienated rather than leading product claims and portfolios.

The question is: what’s keeping food and beverage companies from accelerating these innovation pipelines towards commercialization?

“As in 2026, scientific validation has become a primary driver of commercial viability as consumer sophistication and regulatory oversight increase. But the gap between the two still needs to be bridged.“

So, what kind of barriers need to be navigated to keep revenues and differentiation afloat in this segment that is swiftly transforming from niche to mainstream market? In this article, we dive into the reasons impeding innovation cycles along with some pathways to turn these challenges into a sustained market edge.

The Convoluted Equation of Healthcare, Retailers, and Consumers’ Expectations

The global functional beverages market was valued at $154.62 billion in 2024 and is expected to grow to $296.69 billion at a CAGR of 8.25%. A major contributor to this exceptional growth will be the billions invested by leading beverage startups, CPG players, and food manufacturers to redefine beverage functionality. Here is a short summary of the breakthroughs shaping the future of beverage offerings:

| Innovation | Focus Area | Functionality | Notable Features |

|---|---|---|---|

| Sure Shot | Health & Wellness | Swiftly reduces blood alcohol | Patented, clinically accepted |

| Pro and Prebiotic Sodas | Health & Wellness | Supports digestion, gut health, and immunity | Higher active microbial content per serving |

| Lactobacillus gasseri CP2305 | Health & Wellness | Alleviates stress, improves sleep, and mood | Passed over eight human clinical trials |

| Citicoline, Magnesium L-Threonate | Health & Wellness | Mood, memory, and cognitive ability-enhancing properties | Passed human trials and offers cognitive support |

| Alpha Tea (L-theanine) | Health & Wellness | Improves focus and sleep | Green tea extract, clinical studies ongoing |

| Nanoencapsulation | Ingredient & technology | Improved bioavailability, taste masking, and stability | Nanoparticles in vitamin D3 & omega-3 |

| Probiotics Microencapsulation | Ingredient & technology | Secures probiotic viability & improves gut health | It can be co-encapsulated along with prebiotics |

| Bioactive Peptides & Polyphenols | Ingredient & technology | Anti-inflammatory, antioxidant properties | Encapsulated to improve stability |

| Mycelial Fermentation | Ingredient & technology | Sustainable new proteins, embedded with bioactives | MycoTechnology |

| Cold-stirred Foam Technology | Ingredient & technology | Better mouthfeel and sensory innovation | Maxwell House cold-stirred foam beverages |

| Genetically Modified Biofortification | Ingredient & technology | Excels in micronutrient delivery | Golden rice, iron-iodine microparticles |

| rPET Bottles | Sustainability | Double recycled content in beverage packaging | Reduced use of virgin plastic |

| FSC-certified Paper Trays | Sustainability | ~75% lower CO2 emissions, 85% paper fiber trays | Promises to restrain carbon footprint |

| Deposit Return Systems | Sustainability | Romania DRS, over 3 billion packages collected within the first year | Higher recycling rates |

These breakthroughs and their focus areas reflect the evolving expectations of stakeholders in the beverage value chain:

- Consumers: The growing awareness has shifted the consumers’ expectations towards clinical evidence, ingredient transparency, clean label products, and value for premium pricing. It is compelling brands to innovate to win consumer trust and ensure convenience and tangible results.

- Retailers: Increasing the content of natural ingredients is reducing shelf stability and raising logistics complications for retailers. While it is changing the margin structure, it is also offering a strong differentiation leverage to brands by reducing the shrinkage risk.

- Manufacturers: Manufacturers require innovations that are compatible with existing lines and have high tolerance to processing parameters | Ingredients for functional beverages have efficacy but lack manufacturability.

- Investors: Lastly, investors are increasingly demanding scalable manufacturing solutions, clear pathways to profitability, and exit opportunities to support their strategic goals of multiplying returns and risk mitigation.

This interconnected web of expectations highlights a significant whitespace in this segment:

“In the wake of current market offerings, latent stakeholder needs spanning personalization capabilities, sustainability credentials, and ecosystem integration are still unaddressed to a large extent.”

The Biggest Question: Are Current Innovations levelling with Commercial Expectations?

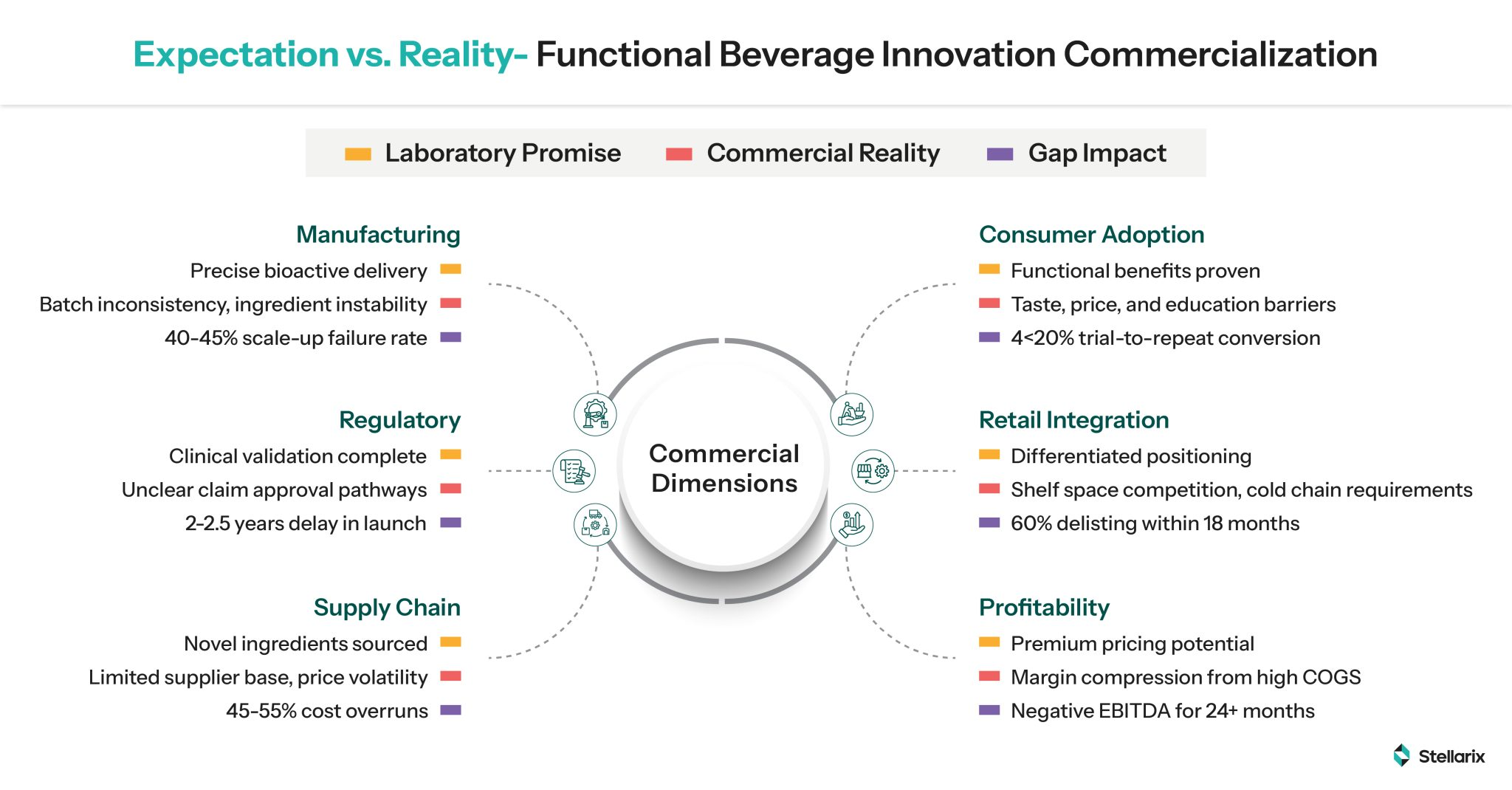

We analyzed over 50 current functional beverage innovations, ranging from bioactive peptide integrations to precision fermentation proteins and postbiotic platforms. Our assessment concludes that while most of these novelties are technically feasible and clinically sound, they need to overcome critical commercial execution and revenue-generation gaps.

So far, the achieved expectations list includes:

- Proven Efficacy: Controlled clinical trials legitimize functional claims to support targeted health results

- Market Momentum: The global functional beverage market is expected to grow at a rate of 8.25% and reach $296 billion by 2032. A significant part of this growth will be led by the postbiotics segment alone

- Technological Readiness: Several ingredients and technological innovations, including microencapsulation, metal-organic frameworks, and precision fermentation, reach TRL 7-8. Very few products are in the early commercial development phase, but this number needs to go up.

Bridges that still need to be crossed:

There is a significant gap between potent innovations and their revenue-generating, scalable commercial versions. It is not about what is successfully created in controlled lab environments, but what can be manufactured at scale consistently and distributed efficiently to be adopted across varying demographics worldwide. Some things remain unresolved

- Stability in processing and shelf life

- Manufacturing feasibility

- Cost when compared to conventional beverages

- Claims in different jurisdictions vary

- Consumer adoption challenges

So, the question that needs to be answered is “what beverage companies can do to overcome the ‘valley of death’ between innovation and commercialization, especially during the 1-2 year scale-up window?”

Obstacles Impeding the Pace of Innovation Commercialization

Manufacturing Complications & Scaling Risks

- The new class of ingredients produced from novel methods is yet to match any pre-established manufacturing protocols

- Bioactive stability via aseptic filling or thermal processing, along with an extended shelf life, is still a distant possibility

- Co-packaging partnerships frameworks do not have the required experience to preserve new functional ingredients

Regulatory and Claims Complexities

- Threshold ambiguity over EFSA/FDA functional or structural claims against medical claims

- Varying regulatory architecture across nations for novel ingredients

- High clinical trial costs that usually vary between $2-5 million and substantiation timelines extending from 2-5 years

- Post-purchase surveillance mandates for safety monitoring

Fragile Supply Chains and Volatile Cost Structures

- Centralized dependence on new ingredients

- Biotech ingredient availability risks due to geopolitical shifts

- Lack of commoditization increases costs by 200-380% as compared to traditional ingredients

Economic Models’ Feasibility

- Higher COGS are suppressing margins

- High marketing expenditures consume 25-30% of revenue for trial and consumer education

- The breakeven and profitability timeline extends to 2-3 years, as compared to the conventional 12-18 months period

IP and Competitive Defensibility

- Patenting complications related to novel molecules versus ingredient combinations

- Rapid follower risk from market leaders who already hold distribution advantages

- Trade secret protection in co-manufacturing ventures

Will these Developments Open Doors to Better Opportunities?

New strategic imperatives are slated to emerge from the current technological trajectory and market dynamics in the functional beverage landscape. As developments neutralize commercialization barriers, they will pave the way for value-generation opportunities. The most promising transformational trends include:

- Precision nutrition platforms

- Distributed biomanufacturing

- Regulatory harmonization

- Vertical ecosystem integration

- DTC subscription models

- Sustainability premiums

Bottomline

The business case of functional beverages is very intriguing due to the intersection of legit consumer inclination, mature technology, and a market throbbing with value generation possibilities. Nevertheless, the aforementioned gaps need to be closed on manufacturing, regulatory, supply chain, economic, and several other fronts. By 2030, the market will segregate into edge-holders successfully commercializing innovations strategically, and others pursuing it as a technical exercise. The former will be the leaders who will cater to stakeholders’ expectations, prioritize strategies based on feasibility and impact, and mitigate risk while ascertaining the path to profitability.

The future of functional beverages is no longer about whether they will define the future of this industry, but which players will stay ahead of the curve and which will strive to stay resilient to this disruption.

Where Do We Come In?

Stellarix’s food and beverage consulting team practices collaborative associations with manufacturers, industry leaders, and other participants. We are helping several companies find a path to scaling, commercialization, regulatory navigation, etc for a strong market and competitive edge. The strategic intelligence delivered by our team is enabling clients to:

- Scale Up without Risks: Prioritize innovations and investments to move beyond technical feasibility and increase the probability of margin and manufacturing success

- Substantiate Claims: Navigate convoluted EFSA and FDA frameworks to secure defensible claims without delays

- Architect Value Chain Resilience: Establish co-man and supplier relationships to control ingredient stability, costs, and quality

- Validate New Business Models: Test run GTM strategies from end-to-end to lock profitability within a rational timeframe that investors concur on

Ready to translate market changes into a scaled, defensible, and value-generating advantage? Let’s create your strategic blueprint together.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.