Decentralization Dilemma – Why Diagnostic OEMs Must Redefine Relevance?

HPV Self-Sampling & Diagnostic Decentralization

Business Hypothesis:

As self-sampling and decentralized screening become mainstream, diagnostic value will migrate from centralized assay throughput to distributed patient participation.

Traditional OEM business models, which rely on reagent volume, lab automation, and service lock-ins, continue to face the risk of economic erosion unless they redefine how and where they capture value.

Introduction:

For decades, HPV assay manufacturers (OEMs) have relied on well-established models of centralized laboratories, batch-driven workflows, and predictable reagent usage. That approach provided stability, visibility, and scalability.

Today, the landscape is evolving. Growing adoption of self-sampling, pharmacy-based testing, and home collection is transforming cervical cancer screening from a laboratory process into a personal act of health ownership. The new approach is expected to expand access, enable earlier detection, and improve screening adherence.

However, this transition also raises new strategic questions for assay developers and OEMs. As testing shifts closer to the patient from the current centralized laboratory model, traditional concepts of efficiency, control, and value are being reevaluated.

“The discussion is no longer about whether decentralization will occur but how stakeholder redefine their role as value migrates beyond the laboratory.”

The experience of other industries shows that decentralization need not erode value.

“Fragmentation ≠ Market loss”

This article discusses how companies in other industries have responded to waves of decentralization, and what lessons assay manufacturers can draw to keep control over the supply chain, coexist, and grow in a more distributed future.

Observed Adoption & Policy Drivers

For decades, assay OEMs have optimized around scale. Centralized testing facilities have enabled OEMs to achieve predictable throughput, stable reagent consumption, and defensible margins. A larger installed base has provided a strong competitive advantage. However, over the past few years, it has been observed that research and adoption of HPV self-sampling and decentralized screening have gained traction and policy endorsement. National screening programs in the Netherlands, Australia, and the UK already recognize self-sampling as a primary screening pathway.

The rise in overall demand, despite lower revenue per unit, will necessitate a new value-creation approach and enhanced customer engagement, resulting in a broader shift in the operating model.

Impact & Observed OEM Response

Assay OEMs are already anticipating several structural implications of this shift:

- Decline in predictable demand creating Bull-Whip effect in the supply chain: A million tests distributed across 10,000 decentralized settings create far more variability in demand, logistics, and usage patterns than a million samples processed in 100 centralized laboratories.

- Shift in Push-Pull boundaries: As testing becomes more decentralized, demand moves from bulk lab orders to smaller, user-driven requests. Tighter inventory control and faster response cycles are necessary to accommodate the frequent and less predictable demand pulls.

- Shift from B2B to B2B2C communication: In direct-to-consumer models, the end-user interacts primarily with the testing platform, not the assay maker. This causes reduced brand recognition, limited direct communication with users, and shifts marketing from direct promotion to co-branding and partnership visibility

In light of the above shift, assay OEMs have already started making the shift:

- Roche is expanding molecular workflows compatible with self-sampling and has strengthened its digital connectivity through acquisitions such as TIB Molbiol and GenMark.

- QIAGEN is embedding its technology into portable PCR ecosystems and enabling IP licensing to support decentralized applications.

Upon closer examination, these are necessary moves, but they are still largely defensive, as they aim to protect relevance rather than reinvent it.

Assessing Readiness for a Decentralized Future

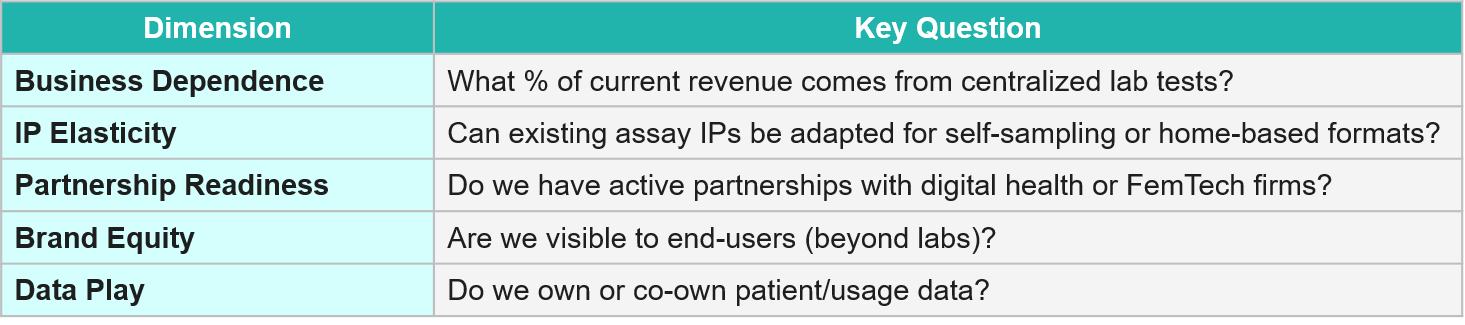

As the testing landscape shifts from laboratories to distributed and at-home models, reagent and Assay OEM leaders and suppliers may face a strategic question: How resilient is our relevance?

Leaders may use the following self-check framework to assess their organization’s exposure and adaptability across five dimensions critical to sustaining value in a decentralized future.

Organizations with flexible IP, clear partnership or venture frameworks, and strong data feedback loops would be better positioned to absorb near-term disruptions while also capturing long-term advantages, turning decentralization from a structural risk into a source of growth.

While these dimensions offer a broad perspective, their specific application may vary across different business models, portfolios, and markets. Tailoring this framework to a company’s unique exposure, capabilities, and strategic intent can reveal where to reinforce resilience.

“Our experience shows that organizations that operationalize such assessments early often shape, rather than follow, the next phase of industry transformation.”

Learning from Other Industries: Turning Chaos into Continuity

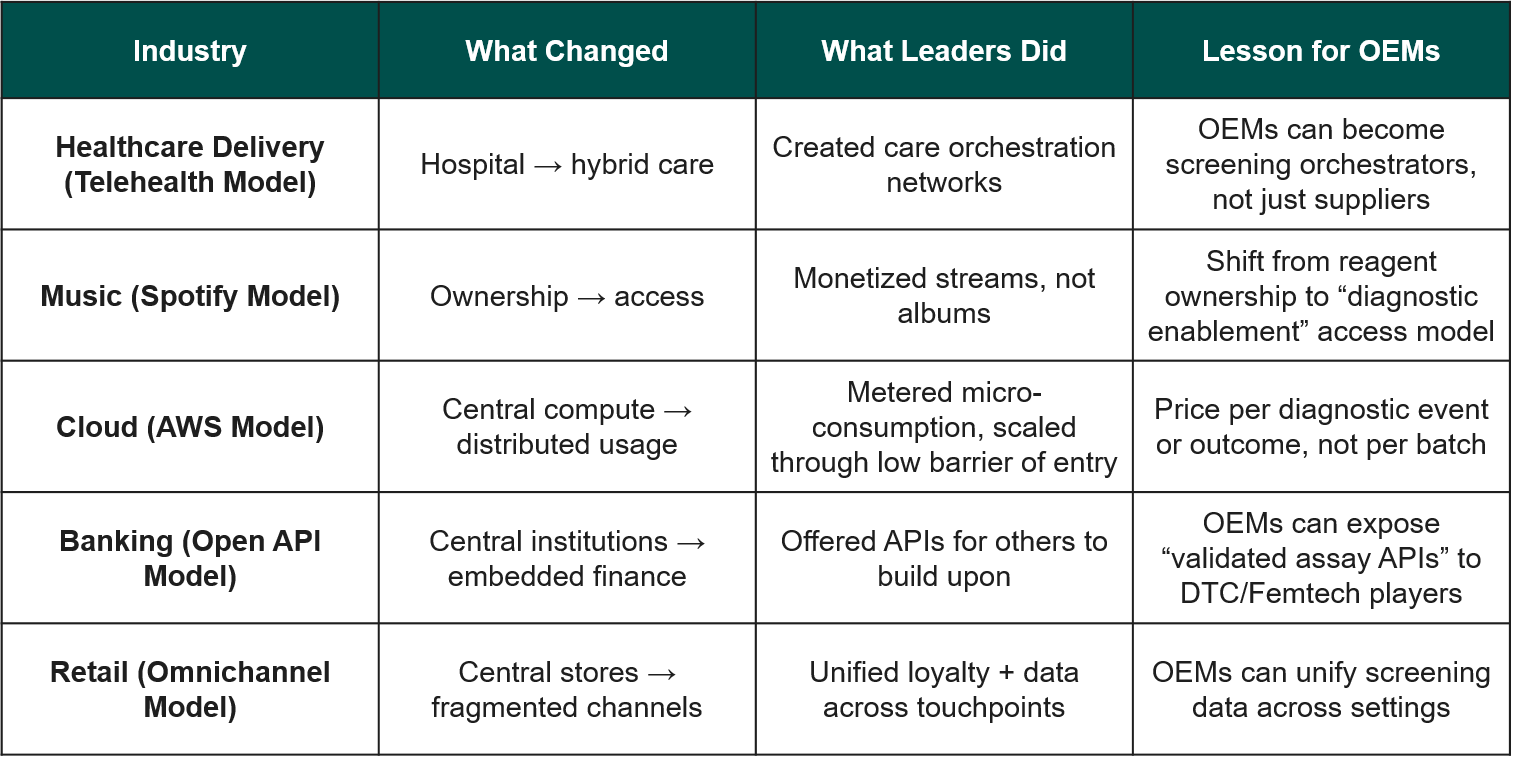

The tension between decentralization and profitability isn’t unique to diagnostics. Other industries have faced similar disruptions and have emerged stronger by redefining what it means to own value.

Adobe Inc., originally a software company selling perpetual licenses, pivoted to a subscription-based model, turning fragmented product sales into predictable recurring revenue streams. As documented, this shift enabled the company to stabilize margins, increase customer engagement, and capture continuous value rather than one-time transactions.

Assay OEMs may also learn from how players in other industries, and their peers, have responded or are responding to the shift:

From telecom to energy to software, decentralization has challenged how companies create, capture, and protect value. Companies that maintained profitability didn’t resist dispersion; instead, they redefined their roles within it.

Companies have moved from owning the transaction to orchestrating the ecosystem, from selling products to providing continuous access, and from guarding data to using it collaboratively.

For assay OEMs, the parallel is clear: relevance in a decentralized world will depend less on maintaining control and more on creating adaptive roles within new networks of care, data, and consumer trust.

Conclusion and the Path Forward

The rise of HPV self-sampling and new screening policies clearly indicates that decentralization is here to stay. For assay OEMs, adapting to this change is not just about technology but about redefining how relevance is created and sustained.

Companies like Roche and QIAGEN are already expanding their digital connectivity and integrating their technologies into portable PCR ecosystems. Their response reflects a broader lesson seen in other industries, where players like Adobe turned disruption into opportunity by rethinking how value is delivered.

As a consulting partner to assay manufacturers and FemTech leaders, we invite reflection:

- Where does your organization’s relevance resilience stand today?

- Which dimension, IP, partnerships, data, or brand, will shape your next horizon?

Connect with our medtech team to explore how leading peers are redefining relevance, control, and growth in the next diagnostic era.

Next in our series: “Reinventing Relevance: Five Levers for the Decentralized Diagnostics Era.”

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.