How Microfactories De-Risk Supply Chains and Meet Regulations?

Modular or decentralized manufacturing is rapidly surpassing centralized mega-factories and fragile logistics trends, with increased focus on supply chain resilience. US businesses are operating in an unpredictable terrain, governed by complex regulatory frameworks, geopolitical uncertainties surrounding tariffs, and energy volatility. The global supply chain is no longer defined by efficiency but by volatility.

Microfactories refer to an automated, modular, smart, and localized manufacturing framework that is reshaping the way organizations innovate, build, and distribute at present. It is touted as a profitable and viable response to intensifying regulatory pressures and supply chain risks, such as under the Inflation Reduction Act (IRA). Micro-factories use about 90% less water, 80% less energy, and 50% fewer chemicals compared to traditional manufacturing, helping manufacturers optimize resource use and promote sustainability. Regarding this, the blog explains how a strategic shift to microfactories is a compelling solution, de-risking supply chain operations and aligning business objectives with the evolving legal regime.

Shift from Centralized Manufacturing to MicroManufacturing: Key Drivers

Global supply chains remain all-time vulnerable to either labor disruptions, trade barriers, or foreign policy shifts. So, the shift is taking place due to:

- Legislative Recognition: The Promoting Resilient Supply Chains Act of 2025 highlights the risks of centralized production, encourages small, flexible, decentralized production facilities, and enhances domestic capability. Additionally, US policies under the Science Act, CHIPS, and IRA all encourage domestic production to reduce global dependency.

- Cost Fluctuations: Fluctuating shipping rates, surges in fuel prices, and international tariffs cause cost unpredictability.

- Geopolitical Pressure: A deteriorating US-China relationship shifted the supply chain discussion from global optimization to concerns about economic and national security. Therefore, for US-based businesses, relying on foreign mega-factories will soon become a regulatory issue as well as a strategic risk.

- Supply Chain Resilience and the Economic-Climate Agenda Nexus: Green industrial policy overlaps with economic security and supply chain resilience, so a comprehensive and sustainable approach is needed that includes trade, climate strategy, domestic economic policy, and geopolitics.

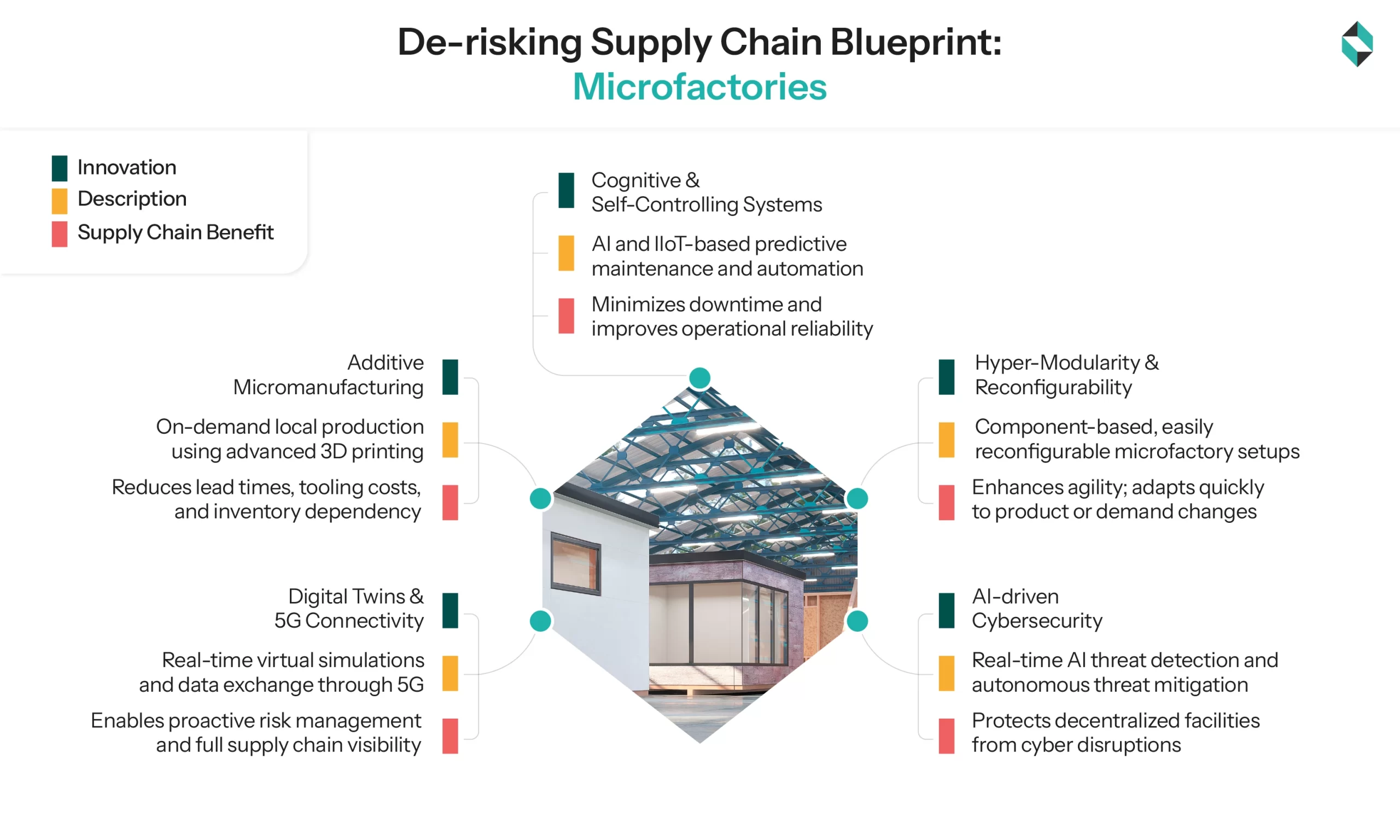

How Microfactories De-risk Supply Chain: Key Innovations

Microfactories, through their highly automated, small, and modular manufacturing units, offer a tech-forward, robust alternative to traditional supply chains, thereby helping US manufacturers eradicate prominent operational risks. Some major innovations leading the way are:

Advancements in Additive Micromanufacturing

By integrating additive manufacturing processes and advanced 3D printing, microfactories can produce specific components on demand locally, thereby eliminating risks associated with long lead times and expensive tooling for new parts. 3D printing increases construction speed by around 50% and reduces material waste by up to 60% thereby enhancing productivity. Additive micromanufacturing removes dependence on specialized suppliers and the need for large inventories, which ultimately shortens lead times and reduces supply chain vulnerabilities caused by delays and disruptions from suppliers.

Read our latest article on adaptive and intelligent manufacturing

Cognitive and Self-Controlling Systems

Operational downtime caused by machine failure or human error can threaten the efficacy of manufacturing supply chains in traditional manufacturing setups. The microfactories equipped with big data analytics and AI enable them to function as cognitive systems, wherein these smart systems can detect issues before they become problematic. Also, predictive maintenance through IIoT sensors, machine learning, and robotic automation minimizes unplanned downtime. For instance, unplanned downtime expenses are reduced by around 71.4% in industrial systems equipped with advanced predictive maintenance features. This smart and agile facility can adapt to varying business conditions, reducing the need for human intervention. This transition to an autonomous factory significantly enhances production reliability and reduces unscheduled downtime.

Hyper-Modularity and Reconfigurability

Lacking agility or slow responsiveness to new market demands and product designs can harm supply chain resilience, which is where hyper-modular microfactories come into play. The component-based design of hyper-modular factories allows for easy and quick reconfiguration to produce different products. This flexibility helps the supply chain adapt to new demands and reduces the risk of obsolete inventory.

AI-driven Cybersecurity

Decentralized manufacturing facilities are vulnerable to cybersecurity threats, but AI-driven cybersecurity innovations help by creating strong security protocols in real-time. These systems can detect and neutralize threats automatically to keep the network of microfactories protected from malicious cyber-attacks that could disrupt production. A GPT-based AI framework was deployed to evaluate cyber threats, achieving an accuracy of around 99.8% in categorizing and recognizing cyber events, thereby enabling proactive threat management.

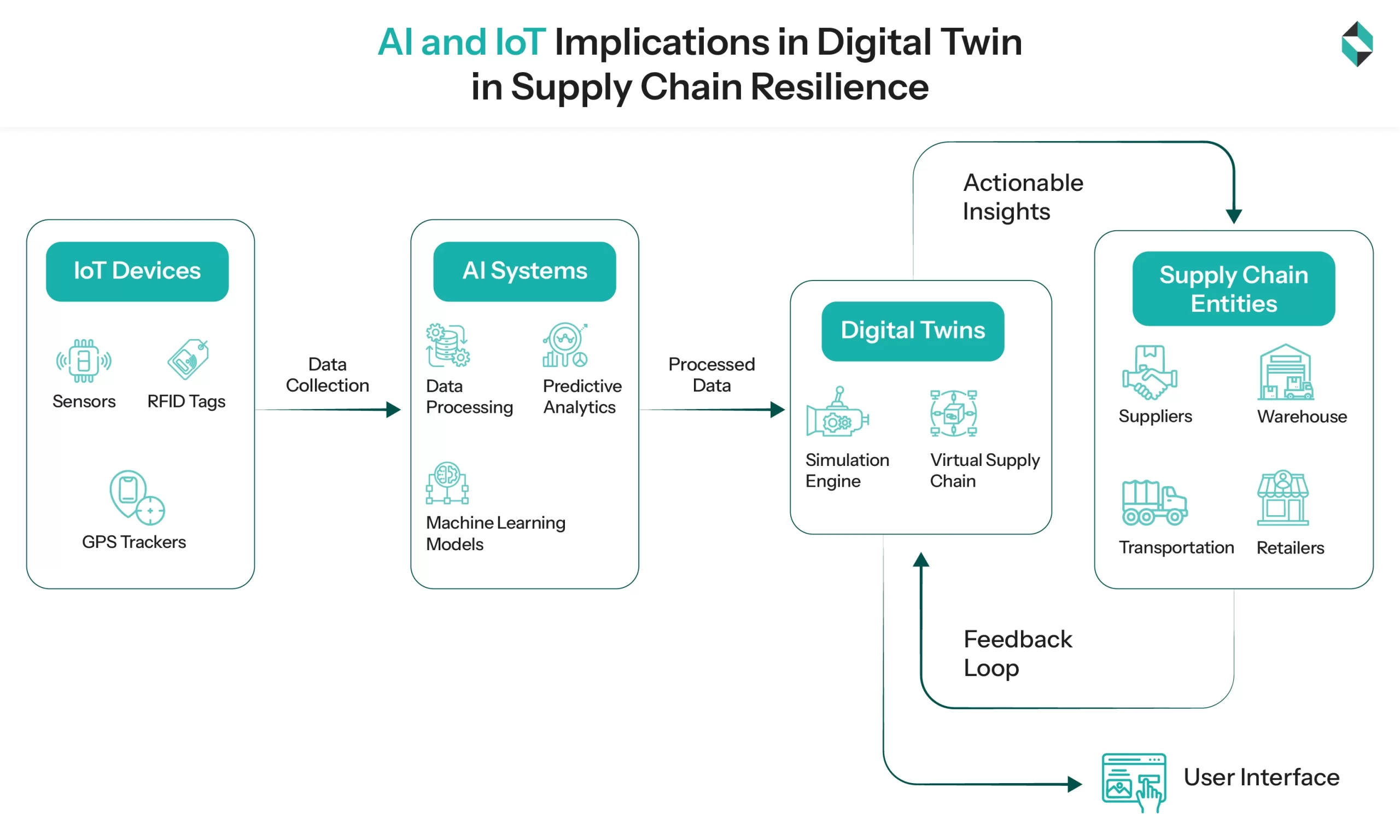

Digital Twins and 5G

Utilizing digital twins and 5G technologies within Industry 4.0 minimizes supply chain risks in microfactories by facilitating real-time data exchange and enabling detailed virtual simulations. Proactive risk management, supported by enhanced end-to-end visibility, allows for quick, data-driven decisions to anticipate potential disruptions from geopolitical issues and raw material shortages.

Microfactories Driving Business Compliance with IRA and Similar Regulations

- The Advanced Manufacturing Production Tax Credit (45X) incentivizes clean energy components like batteries and solar panels, encouraging domestic production. Microfactories help qualify more quickly for IRA-related tax incentives of up to $35/kWh for batteries made in the USA.

- The Investment Tax Credit (48C) offers a credit for investing in retrofitting manufacturing setups or new, flexible small setups for clean energy technologies. This regime provides a 30% tax credit, which aligns well with the intent of agile and decentralized microfactories.

- By ensuring localized production, microfactories offer direct solutions to businesses aiming to meet the strict domestic sourcing requirements of the IRA and be eligible for $7,500 EV tax credit, thereby transforming a compliance issue into a strategic benefit.

- Concerning Scope 3 emissions, microfactories help eradicate long-haul shipping, which decreases logistics-linked carbon footprint, which is a key to carbon reporting and ESG requirements.

- The US climate target of a 50–52% reduction in GHG emissions by 2030, compared to the 2005 level, aligns with increasing legal pressure to invest in local supply chains and eco-friendly technologies, which can be achieved through the deployment of micro-factories. It also supports the growing regulatory push to invest in sustainable technologies and localize supply chains.

- By harnessing the benefits of lower energy, water, and chemical use in microfactories compared to traditional manufacturing, manufacturers can boost profitability through greater resource efficiency and improved sustainability.

Furthermore, the EU Emissions Trading System (ETS), the Corporate Sustainability Reporting Directive (CSRD), and the EU Critical Raw Materials Act (CRMA) support decarbonization and sustainable manufacturing. CRMA specifically aims to increase the EU’s domestic capacity for raw materials. Microfactories help achieve this goal by localizing manufacturing and processing, reducing reliance on non-EU imports.

High-Impact Use Cases of Microfactories

- On-Demand Production: Unilever utilizes mobile “travel factories” housed in shipping containers to rapidly produce goods in response to local demand, minimizing waste and reducing supply chain lengths, thereby supporting sustainable manufacturing in line with evolving regulatory frameworks.

- Reconfigurable Manufacturing and Dual-Use: The U.S. Department of Defense(DoD), as well as companies like Divergent Industries, along with US Marines, use flexible microfactories to produce critical defense components and commercial products. Such a highly flexible setup quickly responds to supply chain conflicts.

- Decentralized Supply Chains: DoD’s investment in building a network of deployable and local factories, along with the “Future of Defense Manufacturing Act of 2025,” both work to reduce dependence on foreign sources and strengthen the local supply chain.

Core Strategic Measures for Microfactories’ Integration

- Cohesive Digital Twin Framework: Develop a centralized, cloud-native Digital Twin for the decentralized network. This facilitates remote management, rapid reconfiguration, and real-time risk assessment. It decreases the time needed to recover from disruptions.

- Compliance-First Deployment: Focus on deploying microfactories with consideration to localized sourcing to further maximize eligibility for tax credits, domestic incentives, and IRA tax credits.

- Collaborative Ecosystem: Firms should prioritize forming strategic partnerships and joint ventures to share resources and capacity, thereby reducing capital investment risks and expanding market reach.

Final Words

With the US aligning economic, national security, and trade policies through the IRA and other relevant frameworks, companies that adopt tech-enabled, small, smart, and decentralized manufacturing are rewarded with tax incentives and supply chain resilience. However, transitioning to microfactories faces challenges like high initial capital costs, limited local talent, and coordination across multiple sites. Here, IRA grants, planning for distributed manufacturing networks, investing in traceability systems, and developing a local supplier ecosystem are the key strategies for future-focused manufacturers looking to harness the benefits of microfactories to enhance business resilience.

At Stellarix, we help manufacturing leaders navigate the complexities of centralized production and high costs. Through deep industry expertise, our strategic R&D consulting services facilitate the shift to a decentralized network of smart, agile facilities. This enables you to create a responsive and resilient supply chain geared toward sustainable growth.

Partner with Stellarix to future-proof your business growth, replacing rigid, centralized models with intelligent, responsive supply chain ecosystems that drive growth.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.