Navigating Global Regulatory Challenges in Pharma: 2025 and Beyond

The pharmaceutical industry is one of the most regulated industries in the world. The regulatory environment is changing rapidly as we approach 2026 due to progress in drug development, changes in digital health technologies, and other implications of geopolitical changes. Companies must deal with intricate compliance obligations, global interoperability, and emerging trends in their regulated environments, such as AI-based drug discovery, precision medicine, and the use of real-world evidence (RWE).

This article identifies the key regulatory challenges confronting the pharmaceutical industry, with examples of the real-world implications companies are experiencing. In addition to understanding the regulatory environment, a key objective of the article is to identify ways companies can become more proactive in anticipating these challenges.

Key Regulatory Challenges & their Follow-on Strategy in Pharma

1. Divergence amid Globalization: Fragmented Regulations

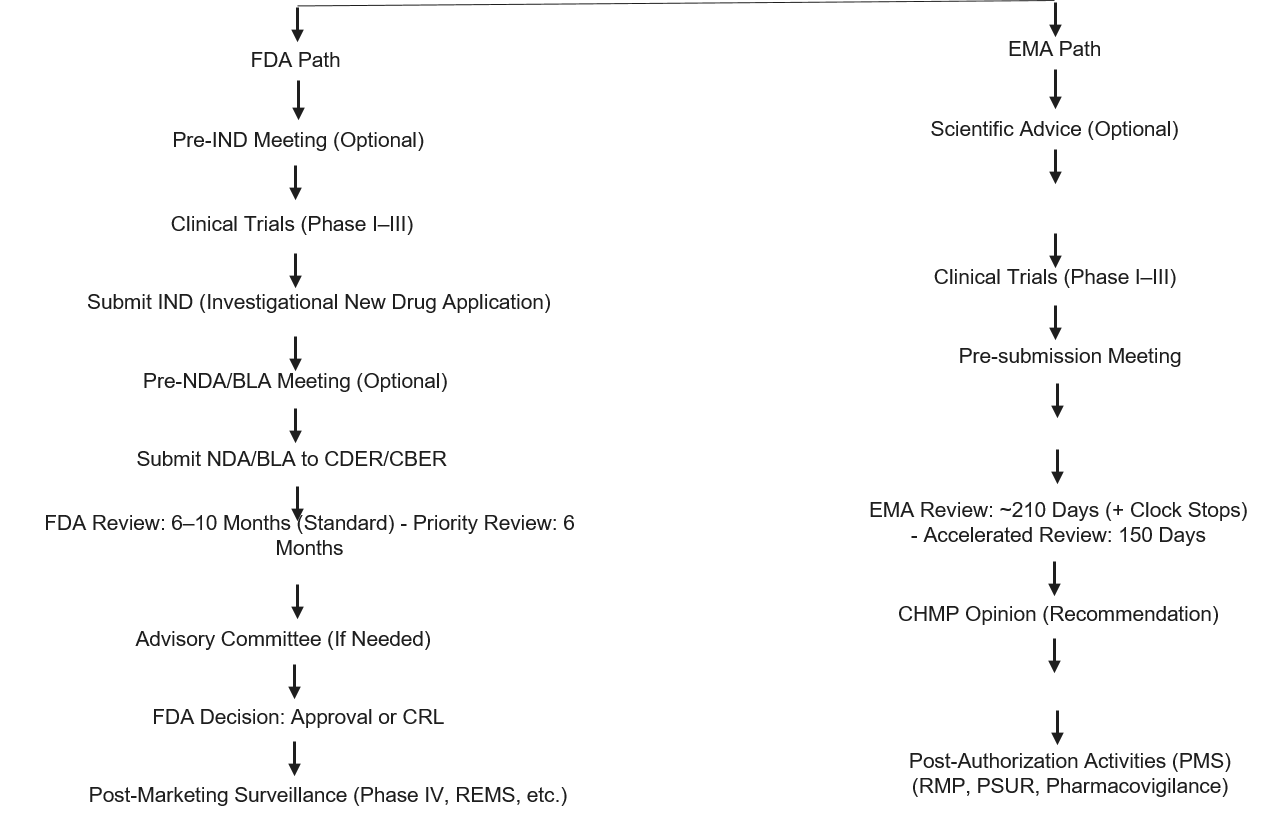

Pharma companies engaged in developing products for global markets face fragmented regulatory expectations. The FDA, EMA, PMDA (Japan), and NMPA (China) all have similar goals related to drug safety and efficacy; however, the approval processes, submission requirements, and timelines are often markedly different.

- Example:

- A mid-sized U.S. company was developing a novel gene therapy and was required to submit a completely different set of data to the FDA and EMA, including different formats to the FDA and EMA. While the product was approved in the U.S., the European regulator required additional long-term safety data, resulting in an 18-month delay in marketing.

- Follow-On Strategy:

- Adoption of ICH Guidelines: The International Council for Harmonization (ICH) is working toward aligning its regulatory processes on a global basis; however, companies must be proactive and engage with regulators early on in their development timeline.

- Using Project Orbis (FDA, EMA, and Health Canada): Collaborative efforts facilitate simultaneous approvals across multiple regions.

2. Data Integrity and Digital Transformation

With increased digital transformation, there is an increased opportunity for regulators to inspect these data integrity factors. Additionally, electronic data capture and eSource, decentralized clinical trials (DCTs), and AI/ML analytics are flowing quickly through the same level of oversight.

- Example:

- To quote a specific example from the FDA 2024 report, “The sponsor of a recent oncology study, for example, was cited for deep data manipulation (when patient-reported outcomes were collected on mobile apps but later were retrospectively edited) following a Phase III oncology trial. The integrity of the trial was jeopardized when the mobile apps were given back to patients at the end of the trial.”

- Follow-On Strategy:

- Investing in GxP-compliant digital platforms for data capture and analysis.

- Adopting Blockchain technology or applications for transferring clinical data into transparent channels to ensure immutability as best practice.

- Continue to train regulatory and clinical teams on ALCOA+ (Attributable, Legible, Contemporaneous, Original, and Accurate).

Download the full article-

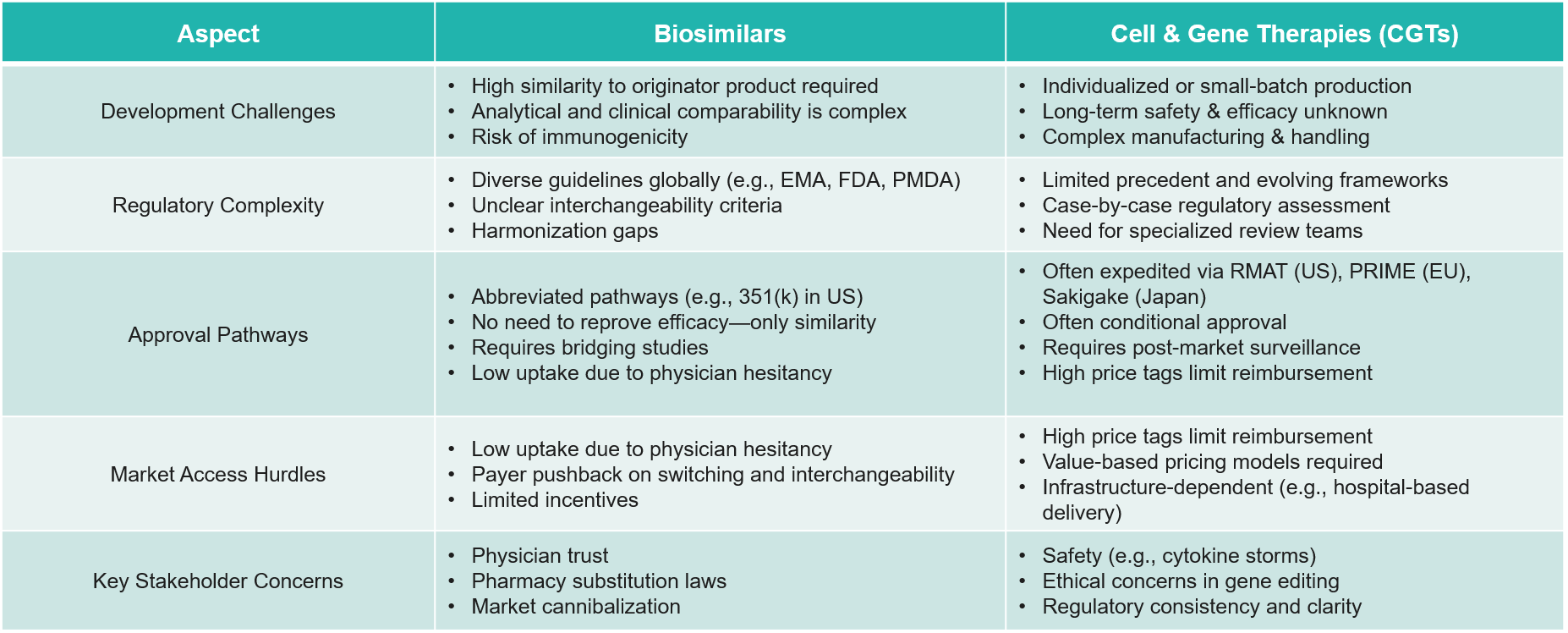

3. Increased Scrutiny and Complexity: Raising the Bar for Safety and Quality

Global regulators are tightening control across all aspects of the pharmaceutical value chain, expanding the scope and depth evident in complex therapies, such as cell and gene therapies (CGTs). This has prompted regulators to broaden the traditional control structures governing the transaction of medicines, as these are patient-specific, living products.

- Example:

- In the United States, the FDA has rapidly grown its Office of Tissues and Advanced Therapies (OTAT), which administers CGT applications, substantially hiring to support the increased volume of applications as well as placing more stringent chemistry, manufacturing, and Controls (CMC) requirements on the aCGT for consistency and safety.

- Follow-On Strategy:

- Companies need to invest in specialized regulatory expertise and adjustable manufacturing models as regulators ramp up their expectations for compliance.

4. Sustainability and ESG: The New Regulatory Frontier

Regulatory authorities are starting to include Environmental, Social, and Governance (ESG) metrics as a part of compliance frameworks. Sustainability in manufacturing, equitable access to medicines, and ethical sourcing are priorities in becoming regulatory compliant.

- Example:

- The EU’s Green Deal and Pharmaceutical Strategy for Europe direct pharma manufacturers to reduce their environmental footprint, particularly through antimicrobial discharge and carbon emissions.

- Follow-On Strategy:

- Companies such as GSK and Novartis are committing to net-zero and restructuring manufacturing sites to comply with sustainable standards.

- Regulatory filings now assess the risk of environmental elements (ERAs) and require ESG impact disclosures.

5. Geopolitical Disruption and Regulatory Instability

Tariffs, Brexit, sanctions, and regional conflicts (ex, Ukraine or the Middle East) have interrupted regulatory timelines, supply chains, and access to active pharmaceutical ingredients (APIs).

Also read- Trump’s Pharma Tariffs: Risks, Impact & Strategy

- Example:

- During Brexit, life-saving products were delayed by all the newly imposed customs and regulatory barriers between the UK and the EU. The UK’s MHRA had to quickly become an independent regulatory agency after going through the EMA approval process.

- Follow-On Strategy:

- Building redundant supply chains and localized regulatory approaches to minimize reliance/single-point of failure in a region.

- Adding regulatory scenario planning as a part of the enterprise risk management process.

6. Real-World Evidence (RWE) and Post-Market Surveillance

Regulators are relying more and more on RWE to support clinical trials or pre-trial data, but inconsistencies in data quality and interpretation present challenges.

- Example:

- AstraZeneca’s Tagrisso (osimertinib) received an expanded indication in 2023, which was based on RWE from electronic health records (EHRs). However, global standards for RWE led to various approvals across global regions.

- Follow-On Strategy:

- Standardization of RWE Collection: Using common data models (e.g., OMOP, Sentinel).

- Engagement with ISPOR & FDA’s RWE Program to harmonize & align methodologies.

7. Biosimilar and CGT Regulations: Complex but Critical

The increase in biosimilar and CGT submissions has inundated regulatory bodies. Not having the same guidelines across markets, the challenges in forming coherent strategies are compounded further.

- Example:

- Cell therapy developers are struggling to standardize manufacturing processes for their autologous treatments, which has resulted in variations in end products and regulatory delays.

- Follow-On Strategy:

- Companies will need to create frameworks for early engagements with regulatory agencies, standardize CMC processes, and prepare to negotiate variable timelines for market access.

8. Accelerated Pathways vs. Robust Oversight

Governments are encouraging swifter access to potentially lifesaving therapies through expedited regulatory pathways such as Breakthrough Therapy Designation (BTD), Priority Review, or Conditional Approvals. Despite the greater access, these pathways come with increased concerns related to post-marketing safety or real-world effectiveness.

- Example:

- A number of COVID-19 vaccines were developed and approved using Emergency Use Authorizations (EUA). While the rapid approvals saved lives, there were problems regarding the rapid scaling of developments, limited long-term data, and associated public distrust, especially in the EU market.

- Follow-On Strategy:

- Manufacturers are establishing post-marketing safety surveillance systems through their Real-World Evidence (RWE) analytics and utilizing them to demonstrate lifecycle regulatory compliance.

- They are entering into partnerships with research institutions and digital health ecosystems to collect and report on real-time patient outcomes.

Future Outlook: What Pharma Needs to Prepare For

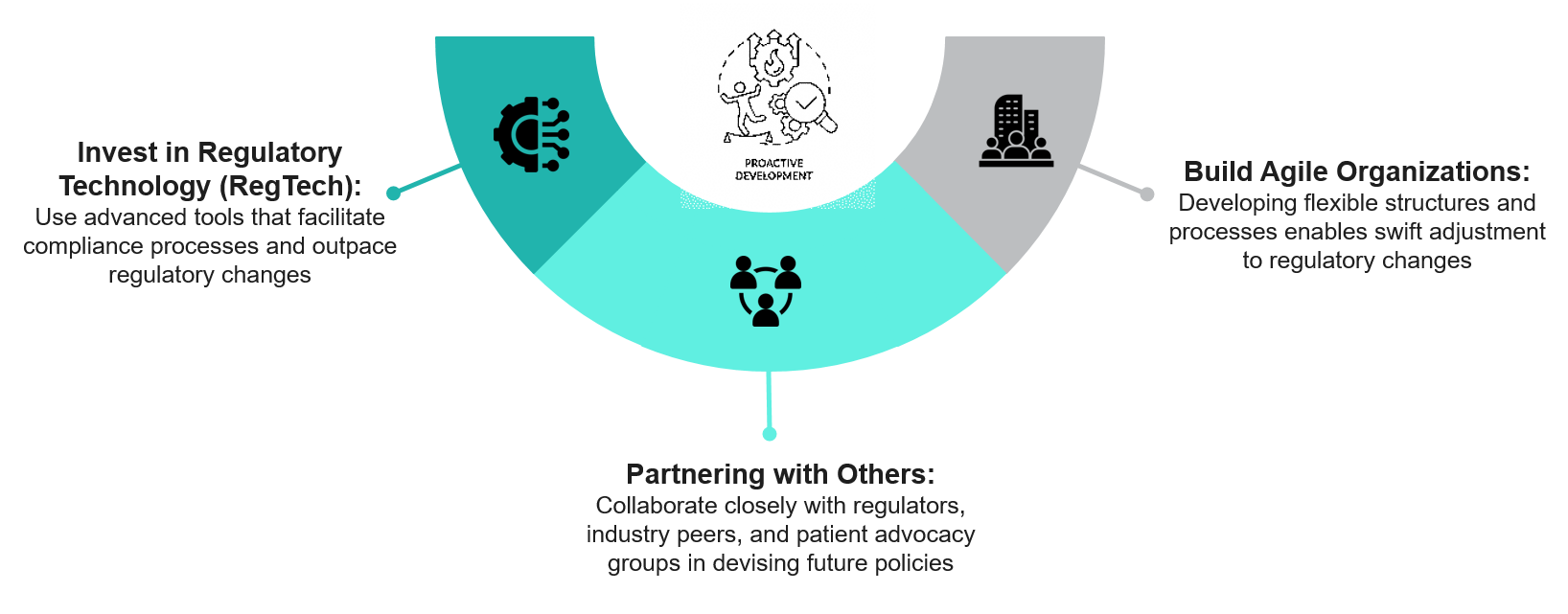

In the days ahead, we expect to see challenges regarding pharmacovigilance and regulations (such as compliance obligations) in the pharmaceutical industry. Companies will need to be agile and active moving forward, as that is not only changing the configuration of realizable pharmaceutical behaviors but also operational behaviors, considering the new imminent global health challenges like pandemics, an aging population, and the rise of chronic diseases, etc.

Given these requirements, pharmaceutical companies should take active means:

Conclusion

Pharmaceutical regulation is more than regulatory compliance; it involves forward thinking, proactive thinking, and collaborative thinking. In today’s global regulatory landscape, organizations need new thinking as they face regulatory challenges in 2025 and beyond, which will require them to think of regulation not as an obstacle, but as an opportunity pathway to innovation, trust, and value. Companies that align their regulatory strategy with R&D, market access, and sustainability will not only accelerate their time to market but also improve their reputations, mitigate risks, and create lasting change.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.