Carbon Farming Trends: Potential Challenges and Growing Opportunities for the Agritech Industry

The agricultural industry faces the dual challenge of combating climate change impacts and maintaining food security amid all the focus and effort directed towards achieving net-zero emissions. Since farmland ecosystems cover around 12% of the land worldwide, including carbon sinks and sources, they significantly contribute to nearly 30% of greenhouse gas emissions. These figures make the agriculture sector central to climate action and policymaking.

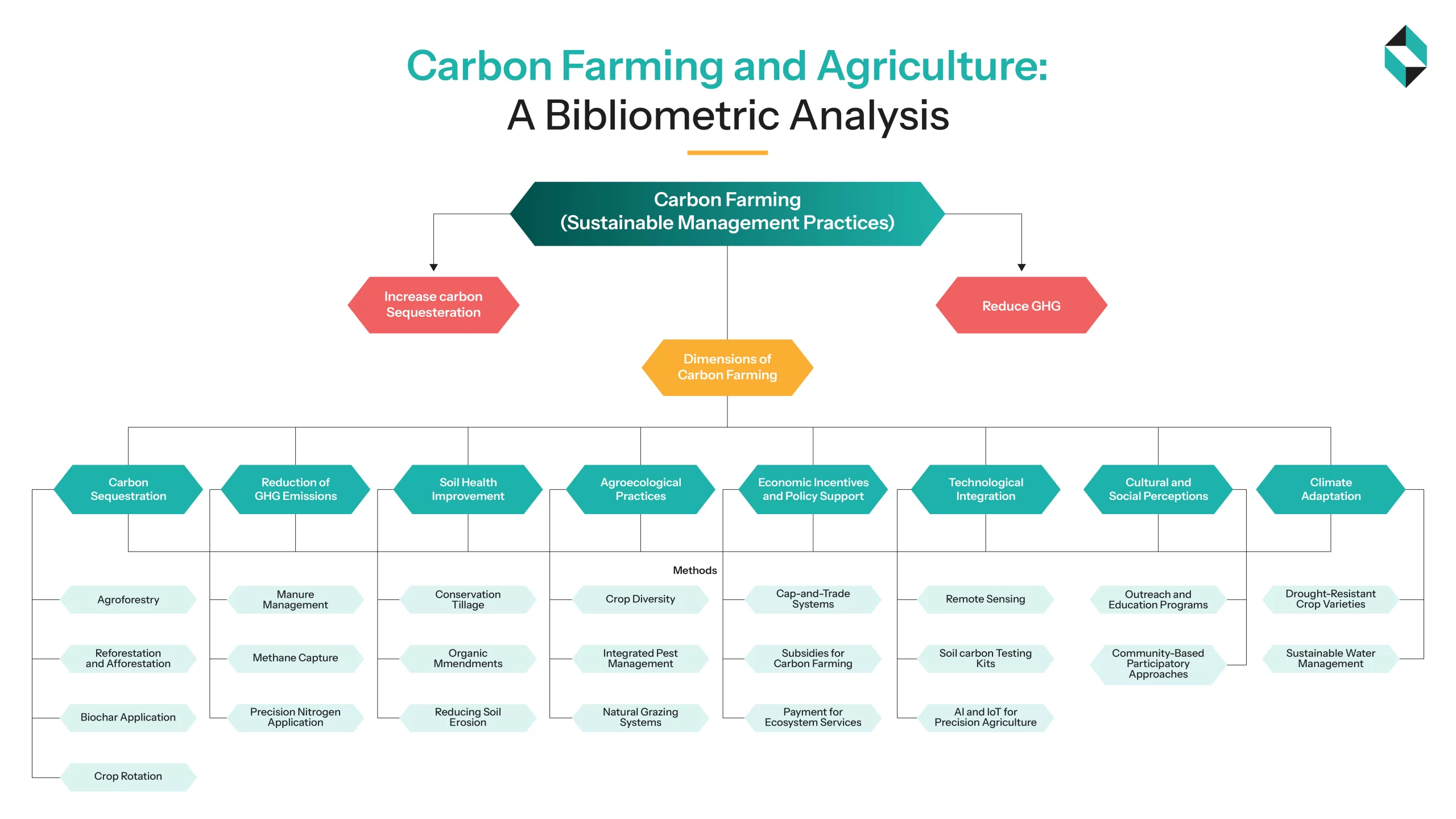

Carbon farming has emerged as a transformative solution for Agritech players to enhance carbon storage and sequestration in soils and plants, while reducing GHG emissions from soils and improving operational efficiency. As businesses and governments work to meet decarbonization goals, farming for climate has shifted from a regulatory mandate to an asset promising financial growth. From conservation tillage to biochar and regenerative agriculture, carbon farming offers tangible benefits for the sector’s long-term sustainability. For Agritech innovators, the convergence of market demand, policy, and technology is opening new revenue streams in the carbon removal economy, placing carbon farming at the forefront of the fight against climate change. Let us get into the pragmatic details of it in the blog.

Carbon Farming Market Landscape: Growth Drivers, Regulations, and Revenue Potential

The accelerating trend of carbon farming is supported by increasing demand for carbon removal credits (CRC), supportive regulations, and technological progression. In this regard, the EU’s Carbon Removals and Carbon Farming Certification Regulation (CRCF) serves as a remarkable turning point. The first-ever EU-wide voluntary framework centers on certifying carbon removals, fostering investor confidence, and boosting transparency and reliability.

Organizations can acquire the benefits of cost-efficient sustainable farming practices, such as better crop management, agroforestry, and improved pasture management, potentially resulting in more than 5 billion tons of carbon sequestration annually by 2050. To promote carbon farming as part of climate change eradication financing, the global Agri-food system would require around 260 billion US dollars in investments every year by 2030 to pave the way for sustainable agriculture.

Europe is leading with approximately €1.8 million in funding through the carbon farming CE project and other supporting initiatives from Horizon Europe and the LIFE Program. EU policy frameworks such as the Common Agricultural Policy and the Soil Deal for Europe are actively aligning carbon farming with wider climate and sustainability objectives.

F&B companies, ESG investors, and financial sector firms are harnessing carbon credits to transform their supply chains into valuable carbon sequestration. Through funding practices such as rewetting peatlands, agroforestry, and optimizing fertilizer use, businesses earn dual returns, such as progressing on ESG mandates and creating tangible environmental assets. Additionally, verified soil carbon increases are monetizable due to advancements in satellite-based MRV (Monitoring, Reporting, Verification) systems, thereby significantly slashing the measurement expenses.

Overall, with carbon farming being central to EU carbon strategies, Agritech companies are playing a crucial role in driving measurable, profitable, and scalable implementation across supply chains.

| Program/Policy | Objective | Funding/Scope |

| CRCF Regulation | Certify carbon removals | EU-wide certification |

| Horizon Europe (Cluster 6) | R&D for sustainable land use | Multi-billion R&D funding |

| LIFE Program | Pilot carbon farming projects | 700 farms, six countries |

| CAP | Climate mitigation & carbon sequestration | Environmental subsidies |

Trends Writing The New Era of Carbon Farming

Startups and agribusinesses are redefining agriculture and unleashing the new era of carbon sequestration through satellite technology, AI, and data-driven decision tools. Some prominent trends transforming agribusiness are:

- AI and Remote Sensing: Tools such as Farmonaut and DeepSeek utilize satellite imagery to regulate soil organic carbon (SOC) and validate sequestration. It is forecasted that most of the carbon credit transactions are expected to require satellite MRV in the coming years.

- Soil Health Technologies: Microbial insights, advanced soil analytics, and biotech tools are changing the way companies understand and enhance soil carbon. Further, conservation tillage, cover cropping, and biochar application are contributing towards enhancing carbon retention and enhancing operational efficiency.

- Regenerative Agriculture: Regenerative techniques, such as rotational grazing, agroforestry, and no-till farming, are gaining popularity due to their additional advantages of improved biodiversity, crop resilience, and water retention.

- Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) and Crop Innovation: Gene-editing tools help in developing cover crops and perennials with improved carbon uptake capabilities.

- Corporate Carbon Insetting: Companies across the globe use carbon farming tactics in their supply chains, utilizing insetting frameworks to decrease indirect GHG, i.e., Scope 3 emissions. However, a lack of standardization raises greenwashing concerns in this area.

Opportunities: Why Carbon Farming is Gaining Traction?

- New Revenue Opportunities: Sustainability efforts can be capitalized and diversified by generating verified carbon credits. With high-integrity CRCs fetching premium prices, especially those rated “BB” or higher, agritech players can monetize practices such as afforestation, agroforestry, and cover cropping.

- Brand and ESG Incentives: Companies including carbon farming in their value chains attain benefits through better alignment with customer demands for sustainable products. Verified emissions reductions, regeneratively farmed labels, and biodiversity scores improve customer trust and brand equity, particularly in F&B and CPG sectors, where climate impact is a major differentiator. A market-differentiating premium brand with enhanced brand image is a key benefit of integrating carbon farming trends.

- Policy and Funding Support: Governments encourage carbon farming through frameworks like the EU CRCF Regulation and funding from CAP, LIFE, and Horizon Europe. These programs help businesses like yours in reducing risk and providing cost-sharing for implementation. The USDA and Australia’s Emissions Reduction Fund also offer direct incentives for carbon-positive practices. Further, the EU’s Green Deal and Farm to Fork Strategy, Australia’s Emissions Reduction Fund, and Asia’s diverse approaches, such as agroforestry, depict a shared dedication to integrating carbon farming into climate strategies, promoting sustainable agriculture.

- Strategic Entry Points for Agritech: Agri-tech firms can capitalize on the climate accountability aspect by providing MRV platforms, precision farming equipment, and AI-based planning tools tailored for carbon farming.

Challenges Blocking Smooth Adoption and Scalability of Carbon Farming

From technical obstacles to regulatory and financial complexities, numerous challenges hinder the commercialization and scalability of carbon farming, including:

- Measurement and Verification Barriers: Accurate measurement of soil carbon remains a persistent hurdle. While satellite and AI-based methods improve scalability, accuracy constraints remain. Laboratory testing is precise but labor-intensive and quite costly, making it not feasible for small or medium farms where inaccurate estimations often lead to reduced earnings, harming market reputation. Without robust tech, projects tend to fail. Our R&D consulting at Stellarix, backed with actionable intelligence and data-driven insights help you in maximizing credit yield and eradicating verification barriers.

- Economic Trade-Offs: Several high-potential carbon farming practices, such as afforestation of marginal cropland or rewetting peatlands, need systemic changes and involve high opportunity costs. Without substantial financial incentives, adoption remains slow among organizations. Payments for ecosystem services (PES) and outcome-based rewards are necessary to mend this gap.

- Policy and Market Fragmentation: Inconsistent standards, complex application processes, and limited awareness hinder participation. The vagueness around terms like “carbon farming” and “insetting” poses the risk of greenwashing, thereby affecting the trust factor in the market. Specialized and expert knowledge is needed for navigating the complexities of the carbon market, wherein we help our clients to better strategize their projects and ensure predictable ROI.

- Technology Accessibility: Technologies for MRV, SOC modeling, and drones are not yet equally accessible across regions, creating disparities in adoption and undermining the possibility of global scaling.

Also Read: Artificial Intelligence in Farming

Final Words

As the agri-tech sector becomes increasingly crucial to decarbonization strategies amid climate change concerns, carbon farming offers a scientifically supported and economically feasible way to cut sector emissions. Supported by strong MRV systems, regulatory frameworks like the EU CRCF Regulation, and market mechanisms such as high-quality carbon removal credits, carbon farming is evolving from adoption to a core component of climate-friendly agriculture.

Stellarix’s agritech consulting experts are helping industry leaders turn sustainability into a market edge by enabling:

- New Revenue Streams: Quantification and monetization of high-integrity carbon removal credits

- Navigation of Regulatory Landscapes: Ensuring compliance with complex frameworks and leveraging funding from supporting policies such as CAP and the EU CRCF Regulation.

- Implementation of Scalable MRV Infrastructure: Using remote sensing and AI for cost optimization and increasing credibility

- Integrated Strategies Implementation: Strategic pathways combining soil health technologies, regenerative practices, and data analytics to build brand equity and business resilience

Looking to turn strategic insights into tangible carbon-farming impact? Let’s connect and build the roadmap together.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.