LNG Energy: Bridging the Gaps in Green Fuels Adoption

As energy transitions accelerate, LNG’s adaptability will be pivotal in both immediate decarbonization and future integration of sustainable fuels. – Pinkesh Shah, Energy, Chemicals, and Materials Business Leader, Stellarix

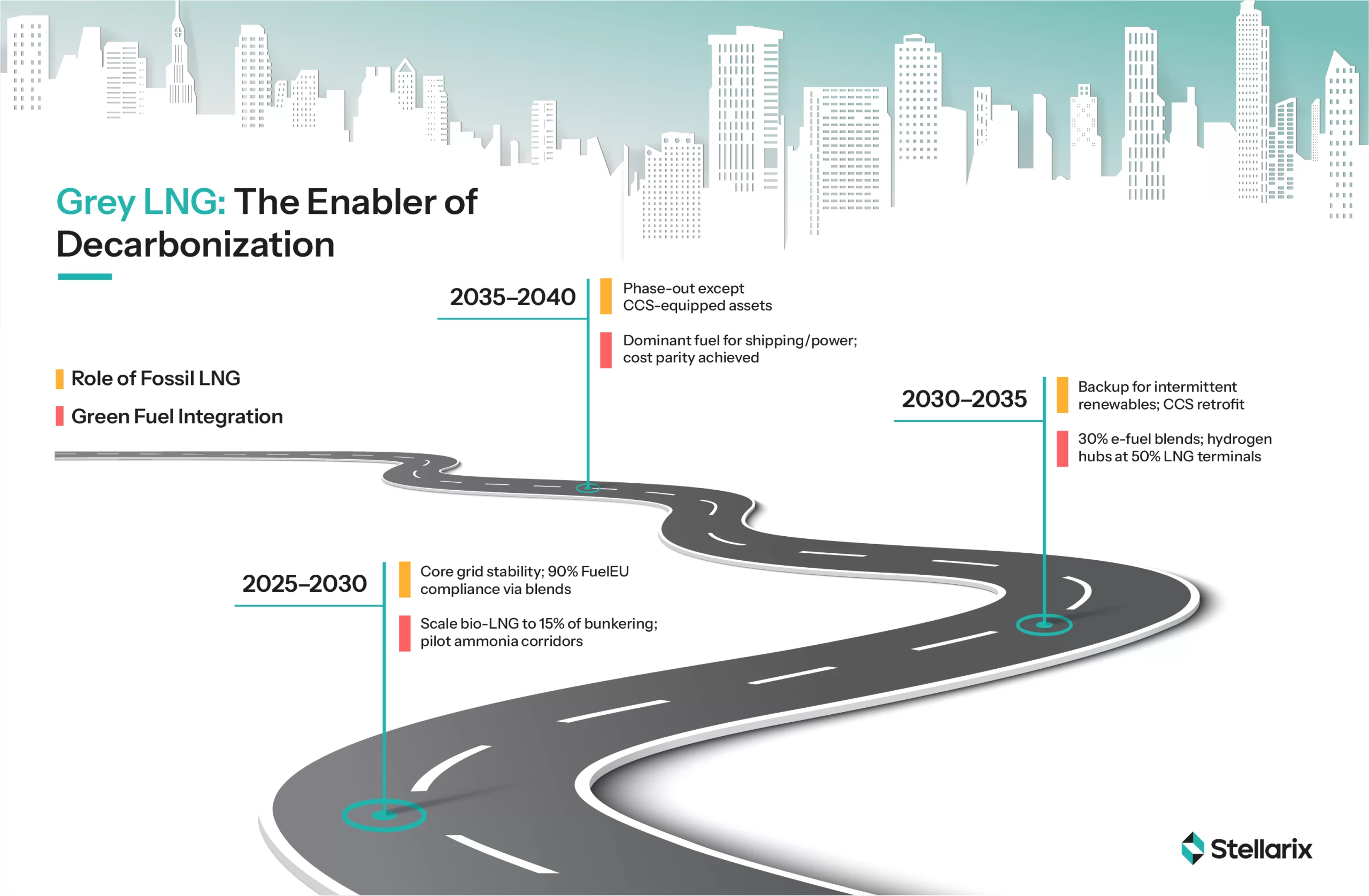

In the last one and a half years, the energy industry has turned its focus back to petroleum-based liquefied natural gas. The accelerating transition of the global energy sector towards sustainability underscores some major challenges with alternative fuels, including ethanol, methanol, diesel, bio-LNG, and HFOs. Grey LNG has emerged as a “bridge fuel” between emerging green fuels and traditional fossil fuels. It leverages its established advantages to balance the technological, economic, and infrastructural challenges associated with its green counterparts. For instance, the recent extension of 45V by the US Senate has brought the fossil industry back into focus. Also, exploration & industry-wide expansion of Shale gas and LNG are expected to dominate the market for at least the next 5 years, as prices favor these fuels.

This article examines the current edge of fossil LNG energy, recent market shifts, and the strategic role it will play in accelerating industrial and maritime decarbonization.

The Promise of Green Fuels and Gaps – How LNG is Filling the Gap?

Diesel and Heavy Fuel Oil (HFO)

HFO is a highly disfavoured fuel option for its high sulfur content, stringent emissions regulations, and reputational drawbacks. Also, switching to HFO offers limited decarbonization benefits as compared to other renewable fuels. Diesel, on the other hand, is cleaner than HFO but faces several headwinds, including rising costs, regulatory restrictions, and carbon inefficiency.

Bio-LNG

Despite being chemically identical to fossil LNG, bio-LNG lags behind its non-renewable counterpart. Feedstock scarcity, fragmented logistics, and methane leakage are some of the most notable factors in this category. Agricultural residues run nearly half of the bio-LNG market; however, they take a back seat to broader biofuels, which leads to frequent shortfalls and delays. Limited production scalability and methane leakage during production counter the carbon credits earned by this biofuel. Lastly, supply chain disruptions and rising regulatory complexities push it back. For instance, the “greened” LNG, i.e., fossil gas + certificates, costs 40% less as compared to onsite bio-LNG, inclining the scales of economics more in its favor despite perpetuating dependence on fossils.

| Country | LNG Growth (2025) | Key Sectors | Green Fuel Barriers |

| India | 8% regas capacity increase | Fertilizers, power | Bio-LNG <1% market share |

| Vietnam | 9GW solar backup capacity | Industrial power | No green ammonia infrastructure |

| China | 60% bunkering growth (ECA) | Shipping compliance | Methanol at 5% penetration |

| Brazil | 12% import surge | Offshore energy | Ethanol is limited to road transport |

Hydrogen-Derivatives

Hydrogen-derived alternative fuels like ammonia and methanol require more than 50kWh/kg of hydrogen, making them 300% more expensive than LNG. Moreover, hydrogen derivatives require storage temperatures as low as -253°C while LNG remains stable at a higher temperature of -162°C, implying lesser energy losses.

Ethanol and Methanol

Biomethanol promises emissions benefits; however, global supply restrictions and high costs limit its applications and adoption across industries. Fossil-based methanol equals diesel in life-cycle emissions. Its storage, bunkering, and production infrastructure lags way behind LNG. Ethanol, on the other hand, mostly blends into gasoline and has limited scalability for power, shipping, and heavy industry.

How Fossil-based LNG Energy is Filling these Gaps?

Foundation for Expansion

Compared to green fuels, LNG infrastructure witnessed robust expansion over the last two years. In 2024, its liquefaction capacity rose to 494.4 million tonnes per annum. The global LNG trade stood at 411.24 million tonnes, and further capacity additions are planned by the end of this decade. For example, in India, LNG regasification capacity is slated to grow by 80% by the end of this year. As of 2023, over 355 LNG-powered vessels were in operation globally, while approximately 400 more are on the go.

Most green fuels remain niche as compared to mainstream LNG. The global LNG exports were valued at ~$396 billion in 2024, dwarfing their bio counterpart niche volume by a considerable margin. By 2023, bio-LNG was available at 70 ports worldwide, while ammonia and methanol infrastructure is limited and demands expensive retrofits. They are currently available at a handful of ports.

Cost and Regulatory Considerations

The most commendable feature of grey LNG is that it offers immediate GHG reductions as compared to diesel or gas oil. Statistically, the lifecycle reductions promised by LNG go up to 23%. According to FuelEU Maritime, in the case of LNG, the compliance with emissions requirements for new vessels is 2.5-3.5 times less costly than ethanol and methanol energy pathways. It presents a critical investment window when twinned with LNG’s widespread infrastructure and mature supply chains, which offer price stability.

On the contrary, cost remains a pressing challenge for green fuels. Methanol and ammonia cost twice or thrice as much as LNG for the same amount of delivered energy. Most of this cost comes from expensive renewable hydrogen inputs. For instance, if ammonia needs to match LNG’s emissions profile, it requires at least 50% renewable input, which increases the costs compared to Grey LNG.

Reliability and Dependability

The supply line of LNG remains solid, strengthened by high fungibility and stable prices. It is a reliable backup for intermittent renewables, which brings it on top in the context of supporting grid stability, specifically in rapidly growing Asian nations like China, India, and Vietnam.

Au contraire, ammonia and green methanol face several restrictions concerning risk handling, storage, and unharmonized safety standards. Although green methanol deliveries are secure through private arrangements, open market trading remains a challenge, wherein the unreliable supply aggravates complexities in scalability.

Strategic Flexibility and Adoption

As of now, petroleum-derived LNG is offering the most flexible pathway for decarbonization. Adopters could begin with LNG and blend it in bio-LNG incrementally as the economies and scale allow. It will enable a structured, low-risk transition to zero emissions without locking into unproven fuel options. Major global energy market intermediaries, such as BP, Shell, and TotalEnergies, are transitioning from simple transactions to complex frameworks of supply chains and diversified contracts, thereby taking control of the entire LPG value chain. They are aggregating LNG volumes from both conventional and sustainable sources.

Most of these companies are integrating bio-LNG to hedge against climate-policy risks, but its adoption is still challenged by scale and cost limitations. Therefore, to optimize their product portfolios, top companies are seeking options to swap and blend supplies flexibly, while maintaining both fossil-based and bio-LNG in their offerings to provide customers with readily available and affordable options.

Green fuels, on the other hand, carry the risk of “standard assets” as their infrastructure investments may not be compatible in the future, especially if widespread adoption is delayed by cost or supply disruptions. Operators also risk high exposure to volatile compliance costs and unpredictable green fuel supply.

New Business Models Paradox

As decarbonization, market fragmentation, and digitalization drive the shift to innovative business models, they are also reinforcing the strategic significance of petroleum-based LNG. However, this paradox reflects certain pragmatic tweaks from the traditional approach. For instance, companies adopting energy-as-a-service (EaaS) models or virtual power plants (VPPs) require reliable backup systems to mitigate the intermittency of renewable energy sources. Fossil-based LNG is proving to be a reliable option in that context. Real-time applications include the growth of solar and wind farms in Southeast Asia, especially in Vietnam, where LNG imports are enabling a surge in solar power of over 9GW and improved grid stability.

Capitalizing on Identified Setbacks Driven Opportunities

Hybrid Infrastructure Development

Companies could initiate by co-locating green fuel production at LNG terminals. The underutilized LNG regasification sites can be turned into “energy hubs” to produce bio-LNG/ammonia using pre-existing loading infrastructure. Also, retrofitting LNG vessels for future green fuels could work extensively in their favor. They could design new LNG carriers with dual-fuel engines that become compatible with methanol or ammonia by the end of this decade. Why? Because it reduces standard asset risk while aligning with IMO’s 2040 fossil phase-out targets.

Novel Transition & Blending Pathways

Leveraging LNG’s existing bunkering network to implement phased regulations could help capitalize on these gaps. Companies could also offer carbon credits for fossil-LNG adopters who invest in certified e-fuel projects.

Technology Leapfrogging

Deployment of modular electrolyzers at LNG power plants could be pivotal in leveraging curtained renewable energy. It could essentially help in cutting hydrogen costs up to $1.8 – $5 kg in the next five years. Similarly, using LNG regasification’s cryogenic energy for carbon capture from adjacent industries will enable low-cost carbon sinks for e-fuel production.

Business Model Innovation

Traders provide cargo exchanges where fossil-LNG buyers pay a premium for future green ammonia deliveries. It will fund the upscaling of green fuel while maintaining supply reliability. Also, energy-as-a-service with LNG backstops could help pave the way to grid-stability solutions for rapidly growing markets.

How are Different Market Drivers Aligning their Focus on LNG?

| Company | Fossil LNG Focus | Green Fuel Integration | Strategic Outcome |

| Shell | 42% global LNG trade share | 10-20% bio-LNG blending | FuelEU Maritime compliance without new vessels |

| Titan | Mediterranean bunkering leader | 2,200 tons bio-LNG for Hapag-Lloyd | Partial decarbonization at existing terminals |

| CMA CGM | 87 LNG dual-fuel ships (2025) | Ammonia-ready vessel designs | Fleet flexibility with 2030 retrofit options |

| Cheniere Energy | $45B U.S. export facilities | Carbon-neutral LNG certificates | 20-year Asian contracts with green premium pricing |

The Final Word

The infrastructure inertia, economic practicality, and scale of LNG cannot be questioned. All cross-comparisons with green fuels reinforce its role as the indispensable transition fuel despite the growing decarbonization pressures. What needs to be noted is that this dominance isn’t structural but transient, implying it could be a catalyst to turning green fuels complexities into opportunities. The industry needs to strategize better to ensure a smooth and sustainable path to decarbonization.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.