Reimagining the Future of Cardiac Valves in the Horizon 1

The convergence of Biotechnology, materials science, AI in designing, implantation planning, monitoring, decentralization, 3D Bioprinting, and regenerative medicine is reshaping the structural heart landscape.

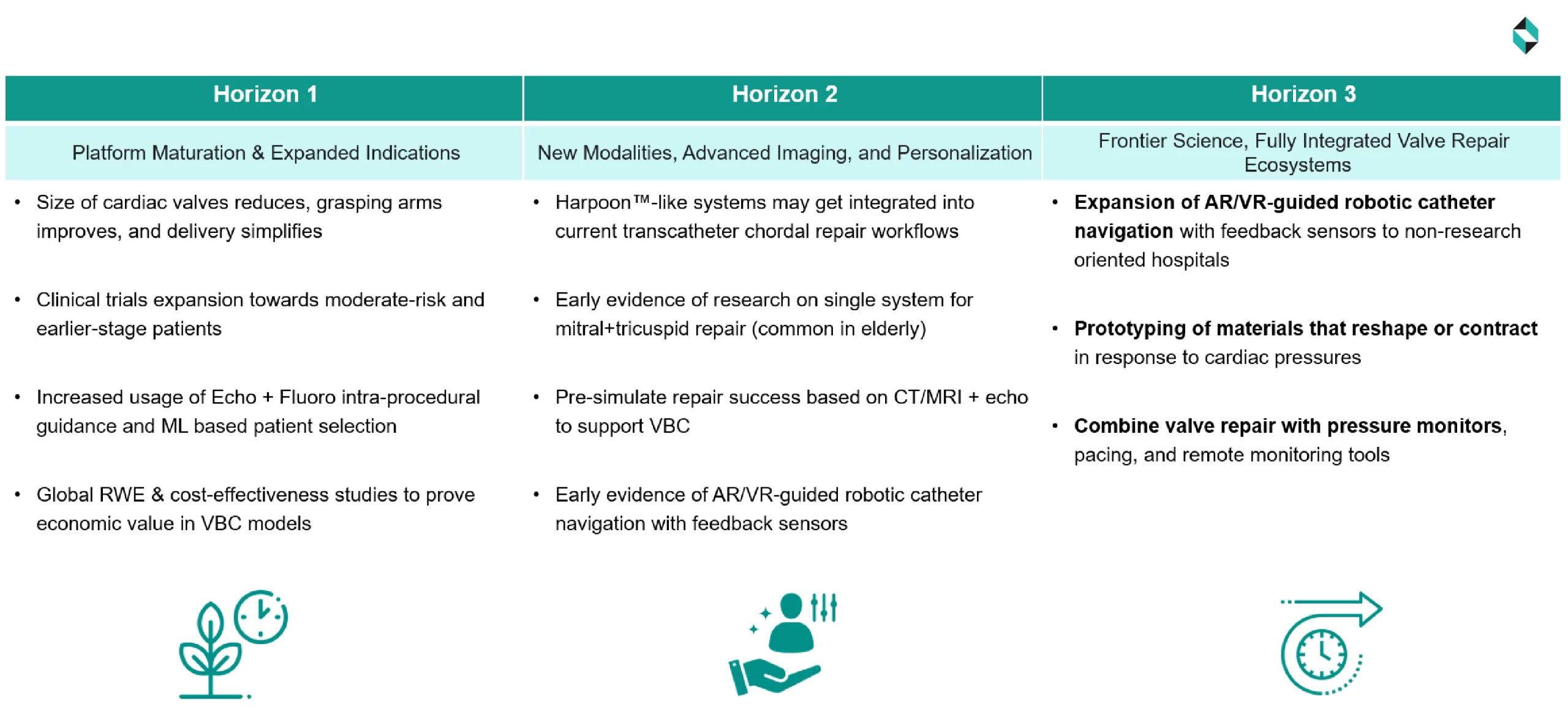

Technological development and the adoption of structural heart devices over the next 10-12 years are divided into three horizons.

This article discusses the first near-term horizons and the impact of the developments on various stakeholders.

Based on research papers published, IP filings, and industry expert consensus, we expect the mainstreaming of incremental innovations over the next 3–5 years. While in the near term, the rate of innovation is expected to remain steady, we anticipate several impactful developments. These are not radical shifts, but powerful ripples that drive measurable value.

Expected Near-Term Innovations

We expect the following major incremental or architectural innovations in the near term:

1. Miniaturized Delivery + Enhanced Grasping Mechanics

New devices will feature smaller profiles and smoother leaflet landing mechanisms. For example, the MitraClip XTR extends its clipping arms by 5 mm compared to the NTR, improving engagement with flail leaflets and achieving a procedural success rate of over 93% in complex cases.

2. Expanded Clinical Trial Populations

Trials like REPAIR MR are now enrolling moderate-risk groups (STS scores 4–8%) with early-stage (NYHA Class II–III) mitral regurgitation. This indicates that a shift from exclusive high-risk cohorts to lower-risk cohorts is expected.

3. Fusion Imaging + AI-Driven Patient Selection

The FDA-approved EchoNavigator real-time echo, Fluoroscopy fusion system, and other similar innovations will reduce radiation exposure to patients and enhance procedure guidance in diverse structural interventions.

4. Global Real-World Evidence & Value-Based Care

Large observational registries (e.g., STS/ACC TVT, EuroSCORE) are now available with economic end-point information with multi-year TAVR data. The models developed from these data are expected to result in 15–20% fewer cumulative care costs, fewer hospital stays, and higher Quality-Adjusted Life Years (0.3–0.5 QALYs) for patients.

Occurrence Probability

Many initiatives expected in Horizon 1 (e.g., smaller sheaths, trial expansions, fusion imaging, real-world evidence) are already underway or have received FDA approval. Thus, the high occurrence probability level (70–85%) of these trends can be safely predicted.

However, realistically, the following hypes are least or not expected in the next 1 – 5 years:

- A completely new drug-eluting or adaptive smart material, as they require 10+ years of durability testing, and no disruptive visibility is observed as of now

- Enhanced versions of current devices are expected; radical redesigns in the valves have the least probability of occurrence

- Less likely to observe complete ecosystem overhauls; mostly device-centric, one-time care events

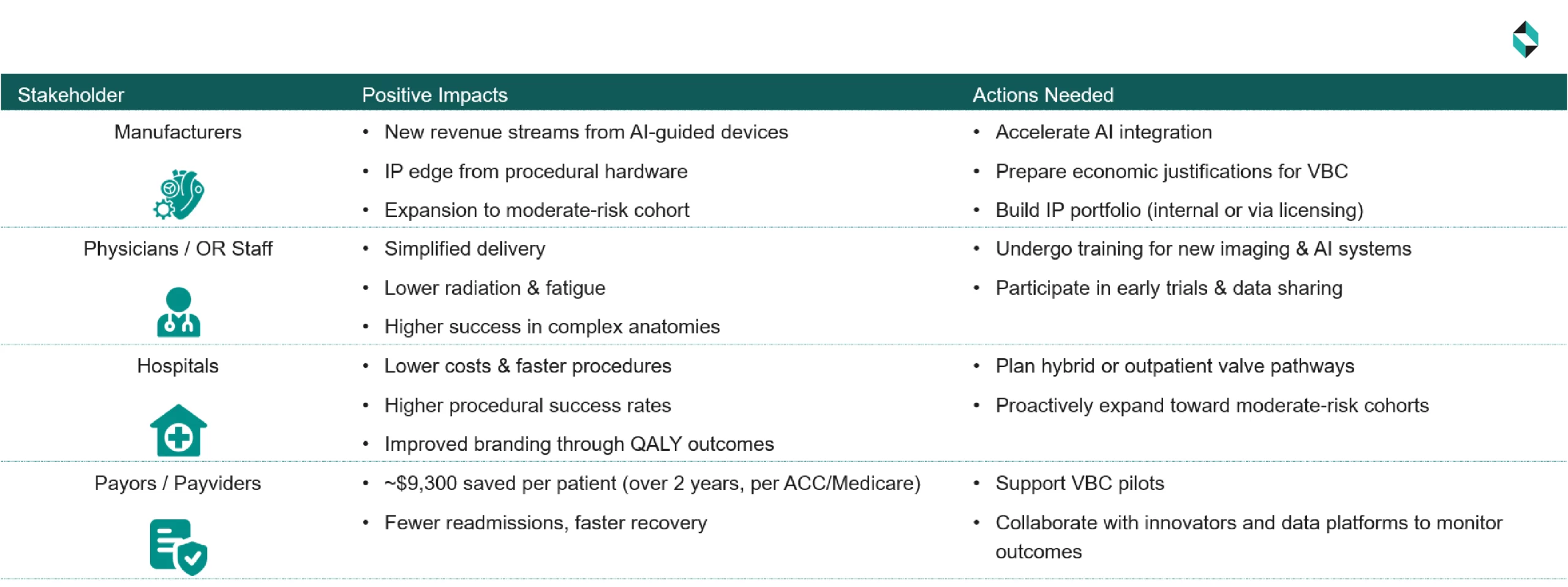

Stakeholder Impact

Assuming all trends realized in the next 1 – 5 years, by connecting the dots, the combined effect on the various stakeholders would be as follows:

- For Manufacturers:

- Miniaturized delivery system, grasping mechanism, and AI or digital twin-based patient selection will bring a new revenue stream and opportunity for IP leadership for the valve & delivery device manufacturers. Real-world data show procedural success rates exceeding 93%, even in complex anatomies

- With the expansion of the moderate-risk groups, it will be essential to offer clear guidelines on the selection of the right patient cohort, to be ethical and avoid unwanted surgery of low/no-risk patients

- To realize the opportunity:

- R&D, strategy, and production teams should expedite the AI-guided releases to capture the market share

- Finance and marketing teams should be ready with pricing and promotion models to justify the premium pricing under value-based care, and embed economic modeling in real-time data platforms

- IP teams should be ready with a portfolio of IP assets, either through self-development or licensing

- To realize the opportunity:

- For Physicians & Supporting Staff:

- Physicians will be able to handle the complex anatomies with fewer clips/procedures. In addition, 2D/3D fusion technology and digital twin-based patient selection are expected to reduce the overall procedural fatigue of physicians, and radiation exposure is anticipated to be lowered

- To enable the opportunity, manufacturers and hospital administrators should allocate budgets, efforts, and time for additional training to help physicians maximize the use of the miniaturized delivery system, grasping mechanism, and AI or digital twin-based patient selection

- For Hospitals:

- New miniaturized implants, in addition to fusion imaging and RWE, would increase the throughput, reduce procedure time/cost, and improve procedural success, with lower postop costs. RWE should offer 15–20% lower costs over three years to hospitals, along with higher Quality-Adjusted Life Years (QALYs), resulting in improved hospital branding

- To enable the opportunity, hospitals should be prepared for valve-in-outpatient or hybrid-procedure pathways. A proactive resource planning would be necessary if hospitals wish to expand the procedure to moderate-risk cohorts

- For Payors/ Payviders

- ACC/Medicare analyses show that TAVR reduces follow-up care costs by ~$9,300 per patient over 2 years. Payors are expected to achieve financial benefits from fewer complications, shorter hospital stays, and lower readmission rates

- Payors/ Payviders can proactively collaborate, & access success stories of innovative technologies, hospitals, CMOs, and startups working on miniaturized delivery, enhanced grasping mechanics, fusion imaging, AI-driven patient selection, and global real-world evidence & value-based care

Conclusion

Each horizon will witness the entry of new players into the market, the exit of existing practices and technologies, the expansion of intervention into new patients and markets, and the development of new business models.

The next article in the series will discuss the impact of the shifts in the second horizon, which may reshape the structural valve market, and the implications of these shifts on technology developers, physicians/HCPs, hospital administrators, and payors/payviders.

Let's Take the Conversation Forward

Reach out to Stellarix experts for tailored solutions to streamline your operations and achieve

measurable business excellence.